Transcatheter Embolization and Occlusion Devices Market Report Scope & Overview:

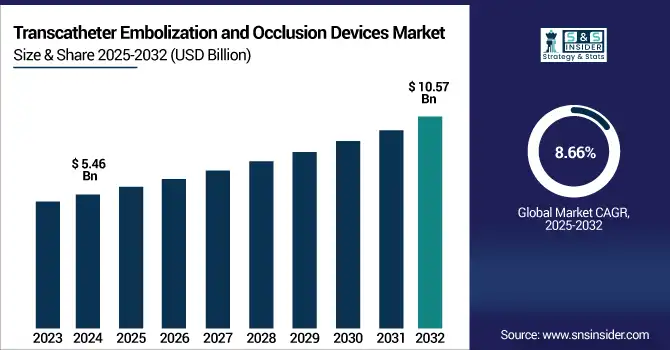

The transcatheter embolization and occlusion devices market size was valued at USD 5.46 billion in 2024 and is expected to reach USD 10.57 billion by 2032, growing at a CAGR of 8.66% over the forecast period of 2025-2032.

To Get more information on Transcatheter Embolization and Occlusion Devices Market - Request Free Sample Report

The global transcatheter embolization and occlusion devices market is expected to grow steadily, mainly attributed to the increasing cases of cancer, vascular disorders, and neurovascular diseases across the globe. Moreover, the upsurge in demand for minimally invasive techniques, progress in developing novel embolic agents, and increasing availability of interventional radiology infrastructure are additional factors in boosting the transcatheter embolization and occlusion devices market growth. Continued demand in the market is anticipated with increasing adoption in emerging economies and increasing application in oncology and neurology. Long-term market growth outlook is supported by favorable reimbursement policies and clinical success of embolization procedures.

The U.S. transcatheter embolization and occlusion devices market size was valued at USD 1.58 billion in 2024 and is expected to reach USD 2.98 billion by 2032, growing at a CAGR of 8.28% over the forecast period of 2025-2032.

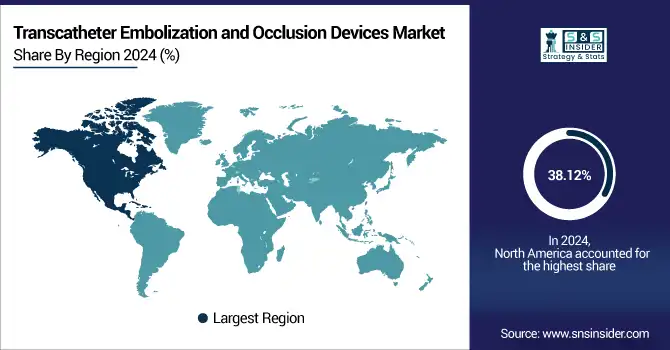

North America, comprising the U.S. and Canada, will remain the largest market for transcatheter embolization and occlusion devices over the estimated period. The growth can be attributed to advanced healthcare infrastructure in the region, the growing preference for minimally invasive procedures, and the adoption of many novel embolization technologies, particularly in the U.S. Thyrocare has its leadership in the region backed by high procedural volume for neurovascular, oncology, and peripheral interventions.

Market Dynamics:

Drivers

-

Market Growth is Driven by the Rapidly Increasing Prevalence of Cancer and Vascular Diseases

The rising burden of cancer, particularly hepatocellular carcinoma, renal tumors, and gynecological malignancies, represents one of the key drivers for the increasing transcatheter embolization demand. Transarterial Chemoembolization (TACE) and Transarterial Radioembolization (TARE) have ever since defined as the standard treatment modalities for inoperable tumors, especially in the liver. At the same time, vascular anomalies, such as aneurysms, arteriovenous malformations (AVMs), and chronic hemorrhages, are becoming a major economic burden, requiring embolic agents for safe, minimally invasive treatment. With the global increase in cancer and vascular diseases, there is a growing demand for localized and targeted occlusion devices.

Pre-operative Planning and Real-time Guidance for Embolization Procedures with AI-assisted Imaging Innovation (via CBCT and Fusion Imaging) Leading to an Increase in Precision and Clinical Outcomes

-

The Market is Driven by Technological Advancements in Embolic Materials

Advancements in embolic device technology enable higher success rates, improved safety profiles, and more targeted treatments. These consist of detachable coils, hydrogel-coated coils, non-adhesive liquid embolics, including Onyx and calibrated microspheres, which permit selective embolization of edematous vessels. This has allowed a wider range of conditions to be addressed with an overall lower risk of non-target embolization, improved imaging visibility, and more reproducible particle distribution. These advancements improve clinical outcomes but also promote embolization in an expanded array of medical indications, such as oncology, urology, and neurology, which in turn propels the growth of the market.

JUNE 2025 — Embolization, Inc., a medical device company, recently achieved FDA 510(k) clearance for its Nitinol-Enhanced device (NED). The NED is intended for use in peripheral vasculature for arterial and venous embolization and represents an important addition to the company's portfolio of vascular embolization solutions.

Restraint

-

High Cost of Devices and Procedures is Restraining the Market from Growing

High costs of the devices and procedures are one of the major restraining factors during the forecast period in the transcatheter embolization and occlusion devices market. Embolic material such as detachable coils, microspheres, liquid embolics (e.g., Onyx, NBCA), and advanced microcatheters is extremely costly. Moreover, these approaches usually involve complex imaging equipment, specialized interventional radiologists, and operating room facilities, which can substantially elevate the cost of care.

In developing or underfunded healthcare systems, this becomes an enormous obstacle as hospitals and clinics lacking the infrastructure or backing from government reimbursement are unlikely to be able to adopt these therapies at scale. Consequently, access to embolization therapies is often limited in LMIC markets due to prohibitive costs, which in turn limits the overall market enablement potential.

Segmentation Analysis:

By Device Type

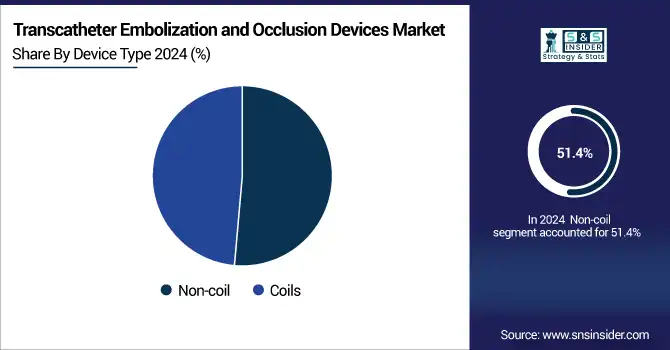

The non-coil segment dominated the transcatheter embolization and occlusion devices market share with 51.4% in 2024, as it has wide applicability compared to other products, contributing the major market share in treating complicated vascular abnormalities and tumors, having clinically proven benefits. Novel devices (liquid embolics, vascular plugs, microspheres) pave the way for increased precision, reduced risk of migration, and greater versatility across anatomies. The proven efficiency in their targeted tumor embolization and for liver cancer treatment (TACE—Transarterial Chemoembolization) has impelled their considerable uptake. Moreover, their position has been consolidated with growing usage in peripheral interventions and progressive delivery systems for different non-coil technologies.

The coils segment is anticipated to grow steadily during the forecast period, owing to increasing volumes of neurovascular procedures and design refinements in coils over the period. Coils have been the gold standard for treating cerebral aneurysms and arteriovenous malformations (AVMs) for decades, whilst there remains a long history supporting the safety and efficacy of coils. For instance, hydrogel-coated coils, detachable coils are the innovations wherein functional use is considered to increase the procedural outcome and also expand their applicability in newer therapeutic areas, fuelling the growth of the market in developed and emerging markets.

By Application

The oncology segment dominated the transcatheter embolization and occlusion devices market with a 61.20% market share due to the high standard application of embolization procedures in the treatment of cancer, especially for unresectable tumors. Methods such as transarterial chemoembolization (TACE) and transarterial radioembolization (TARE) are widely reported for liver cancer and solid tumor sites to regionally occlude the blood supply to the tumor site. The increasing global incidence of cancer, with a rise in hepatocellular carcinoma, alignment of awareness regarding embolization, and innovation in transcatheter targeted embolic agents constitute major contributing factors for the growing adoption of embolization as a standard procedure in oncology care.

The neurology segment is anticipated to grow at the fastest rate during the forecast period, owing to the increasing prevalence of cerebral aneurysms, strokes, and arteriovenous malformations (AVMs). Coils and liquid embolics for neurovascular embolization procedures are becoming increasingly popular due to their safety, specificity, and good results with relatively minimally invasive procedures. Technological innovations in neuro-interventional devices, expanding access to specialized care, and increased clinical training in endovascular neurology are rapidly stimulating the use of embolization for both developed and emerging markets.

By End Use

The hospitals segment dominated the transcatheter embolization and occlusion devices market in 2024 with a 64.3% market share due to the availability of advanced imaging systems and specialist interventional radiology units, and trained medical personnel. As the centers at which the most complex embolization procedures are performed, hospitals often receive patients with the most severe cases, such as tumors, aneurysms, or trauma-related vascular injuries. As hospitals can accommodate higher patient volume, have access to multidisciplinary care teams, and offer intensive post-procedural care, they represent the leading market preference for these procedures.

The ambulatory surgical centers (ASCs) segment is projected to register the fastest CAGR during the forecast period, due to the increasing need for cost-effective adult soft tissue surgical procedures with minimum trauma and faster recovery times. Ambulatory Surgery Centers (ASCs) provide a more convenient setting for some of the embolization cases (peripheral vascular/oncological cases) compared to hospital admission. Catheter-based technology advancements, patient-friendly workflows, and broader insurance coverage for outpatient procedures are accelerating the transition to ASCs. The phenomenon is well visible in the developed regions where healthcare providers are moving towards efficient and rapid access models to lower the costs of inpatient treatment.

Regional Analysis:

North America dominated the transcatheter embolization and occlusion devices market with a 38.12% market share in 2024, due to the advanced healthcare infrastructure, broad accessibility of interventional radiology services, and a high incidence of vascular and oncologic conditions. This supremacy in the region is supported by the presence of global players in the medical device industry, favorable reimbursement policies, and high adoption rates for these minimally invasive technologies. Furthermore, the demand for embolization devices among hospitals and specialty centers is supported by the ascendance of awareness, procedural volumes, and favorable clinical guidelines.

The transcatheter embolization and occlusion devices market trends in Asia Pacific are anticipated to grow fastest with a 9.25% CAGR owing to increasing healthcare expenditures, a rise in cancer and vascular diseases, and higher availability of advanced medical technologies. The rising healthcare infrastructure, growing penetration of insurance, and increasing public awareness about interventional procedures are driving market growth in Countries such as China, India, Japan, etc. In addition, training professionals in health care and government initiatives to promote minimally invasive care is enhancing the growth of the regional market.

The transcatheter embolization and occlusion devices market analysis in Europe is growing due to the increasing volume of minimally invasive procedures in the field of oncology, vascular care, and neurology. It is boosted by developed healthcare systems, an ageing population, and an increasing number of chronic diseases such as cancer and peripheral artery disease. Moreover, positive regulatory assistance, rising clinical trials in interventional radiology, and leading medical device companies provide an impetus for widespread utilization of the technology in hospitals and specialty clinics across Europe.

The transcatheter embolization and occlusion devices market in Latin America and the Middle East & Africa (MEA) is anticipated to witness moderate growth over the forecast period, owing to improving healthcare infrastructure and rising awareness of interventional radiology procedures. Although these regions have constraints such as accessibility to advanced medical apparatus and expertise, the growing governmental investments, escalating disease burden, and slow acceptance of minimally invasive therapies have kept the markets expanding steadily for them. Moreover, the participation of the private sector and medical tourism in some of the cities is promoting the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Boston Scientific Corporation, Medtronic, Inc., Stryker Corporation, Abbott Laboratories, Cook Medical, Terumo Corporation, DePuy Synthes (J&J), Cordis Corporation, St. Jude Medical, Sirtex Medical, and other players.

Recent Developments

-

In April 2022, Boston Scientific announced that it had received FDA510(k) clearance for its EMBOLD Fibered Detachable Coil for use in occlusion or embolization of blood vessels within the peripheral vasculature to restrict or block blood flow. With the University of Alabama at Birmingham performing the first clinical procedure earlier this week, the device has achieved an important milestone in peripheral embolization therapy.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.46 Billion |

| Market Size by 2032 | USD 10.57 Billion |

| CAGR | CAGR of 8.66% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Non-coil, Coils) • By Application (Oncology, Peripheral Vascular Disease, Neurology, Urology, Other Applications) • By End Use (Hospitals, Ambulatory Surgical Centers, Other End Use) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Boston Scientific Corporation, Medtronic, Inc., Stryker Corporation, Abbott Laboratories, Cook Medical, Terumo Corporation, DePuy Synthes (J&J), Cordis Corporation, St. Jude Medical, Sirtex Medical, and other players. |