Germanium Market Report Scope & Overview:

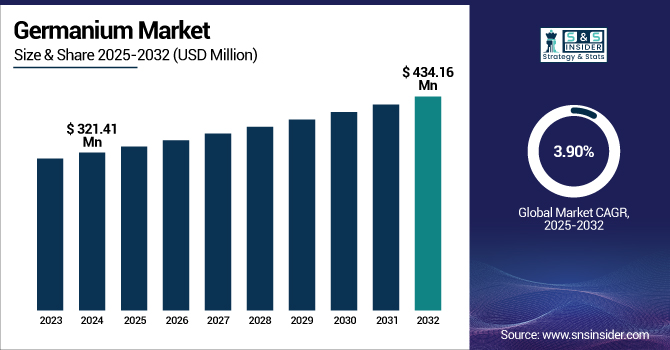

The Germanium Market size was valued at USD 321.41 million in 2024 and is expected to reach USD 434.16 million by 2032 and grow at a CAGR of 3.90% over the forecast period 2025-2032.

To Get more information on Germanium Market - Request Free Sample Report

The global market for germanium is expected to growing steadily with increasing demand in the applications of fiber optics, infrared optics, and solar cell. As defense, telecommunications, and renewable energy technology continues to advance, the strategic importance of germanium continues to increase the supply chain dynamics, including recycling activity and geopolitics, further shaping the future of the market.

According to the U.S. Geological Survey, China is the dominant global supplier of germanium, responsible for approximately 60% of the total worldwide germanium production and supply.

The U.S. germanium market size was USD 50.97 million in 2024 and is expected to reach USD 69.77 million by 2032, growing at a CAGR of 4.07% over the forecast period of 2025–2032.

The U.S. germanium industry is experiencing strong growth due to technological progress and increasing strategic importance. More government support and industry focus are helping to build a more resilient supply chain driven by the innovation and self-sufficiency, the demand is projected to continue to rise steadily over the period of forecast.

According to a research, the U.S. produced about 20% of the global germanium supply, primarily through recycling and as a byproduct of zinc refining.

Market Dynamics:

Key Drivers:

-

Rising Adoption of Germanium in Defense and Space Technologies Significantly Contributes to the Germanium Market Growth.

Due to its distinct optical and semiconductor characteristics, it is significantly important for infrared imaging systems, night vision instruments, and satellite communication systems. The demand for germanium is growing in the face of defense modernization and space exploration by governments globally, further propelling market.expansion. As an increasing number of geopolitical disputes and national security issues surface, investments in defense technologies are growing and strengthening demand for germanium-based devices, driving growth of the market.

Restraints:

-

Limited Global Sources and High Dependency on By-Product Extraction Restrict Market Growth.

Germanium is not extracted from ores, but is instead obtained as a byproduct from the processing of base metal ores, such as zinc, and germanium is also produced as a byproduct of a burning coal-ore smelter. This reliance makes supply volatility more likely, particularly in the event that production of base metal starts to slow or be more regionally concentrated. Moreover, the high degree of supply in the hands of a small number of countries, especially China, creates geopolitical risks and export bans. Such supply limitations are not only the cause for an unstable price, but would also deter the defrayal of substantial investments in industries that depend on a reliable source of germanium.

Opportunities:

-

Emerging Use of Germanium in Next-Generation Semiconductors and Photonic Devices Offers Lucrative Market Expansion Opportunities.

Germanium has recently attracted attention as a material for high-speed electronics, integrated photonics, and quantum computing owing to its high carrier mobility and compatibility with silicon. As industry continues to seek out materials capable of being pushed to their limits in performance, the ability of germanium to enhance data transmission and the efficiency of data processing proves invaluable. Research challenges and industry investment in the monolithic integrative germanium-on-silicon suggest, there is a strong and growing need for this technology in the longer term. If commercialized, this new technology may lead to other applications that were previously not believed to be possible and that would truly rejuvenate the germanium industry.

Challenges:

-

Recycling and Reclamation Challenges Due to Technical Complexities Pose a Major Obstacle to Market Efficiency.

Germanium recycling is a difficult and inefficient process, which presents a serious barrier to its sustainable market development. It is used in trace amounts in many products, and is often incorporated into devices so that it is technically and economically challenging to extract or recover. Recycling rates are still low due to the absence of an adapted infra-structure and cost-effective recovery technologies. Moreover, inconsistent regulations among regions make it more difficult for recycling business. These problems account for the wastefulness and rely on primary materials. Improvement of recycling procedures and infrastructure is crucial for securing a sustainable and long-term supply of germanium.

Segmentation Analysis:

By Type

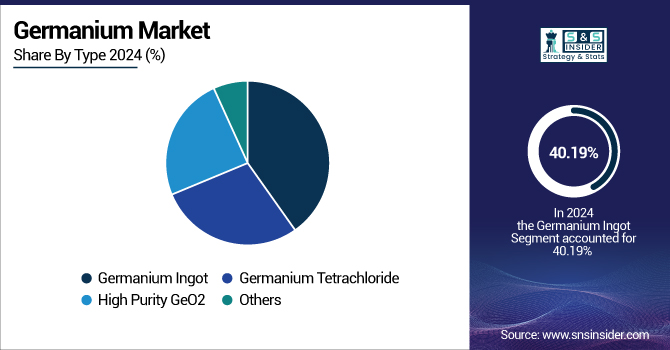

The germanium Ingot segment dominates the market with a commanding 40.19% revenue share in 2024 due to its extensive use in infrared optics, fiber optics, and semiconductor uses. Major players, such as Yunnan Lincang Xinyuan Germanium Industry Co. and Umicore have increased their manufacturing capacity to cater to growing demand from aerospace and defense industries. For instance, Yunnan Germanium Technology Co. just released a new refining technology to increase the purity of the ingot. All of these developments are facilitating broader applications in high-precision electronic devices, solidifying the cornerstone position of this segment in the global market and asserting its status as the revenue leader.

The high purity GeO₂ segment is expected to register the fastest CAGR of 5.40% during the forecast period, 2025-2032, as it plays a major role in fiber optics and solar panel production. Germanium market companies, such as 5N Plus and Photonic Sense GmbH, have developed elaborative purification strategies to meet the high demands for optical-grade applications. For instance, 5N Plus recently extended its purification capabilities, adding facilities which now, are suitable for telecoms or photovoltaics industry standards. The demand for high-speed internet and renewable energy products is growing globally, which means higher demand for ultra-pure germanium dioxide. This renders the segment a high growth influencer in the evolving application landscape of the market.

By Application

The fiber optics segment held the highest germanium market share worth 37.04% in terms of revenue in 2024 as it plays a decisive role in telecommunications, broadband internet, and data transmission. Germanium-doped fiber strengthens the signal and reduces attenuation, which makes it vital for long-distance communications. Rising requirement for ultra-fast internet connections, cloud computing, and 5G networks is adding to the demand for advanced optical fibers. This growing reliance on fiber optic technology and continued advancement in optical communication systems are expected to make the fiber optics sector the fastest-growing revenue generating segment in the germanium industry.

The electronics & solar segment is expected to be the fastest growing segment in the germanium market, with an estimated CAGR of 5.51% during 2025-2032. The segment’s growth is driven by the growing demand for high-performance germanium-based semiconductors and solar energy solutions. Germanium's distinctive properties, including high electron mobility, make it a perfect material for next-generation semiconductor devices and high-efficiency solar cells. As the world proceeds toward renewable energy and digital technology, more germanium is expected to be applied in electronic and solar technology.

Regional Analysis:

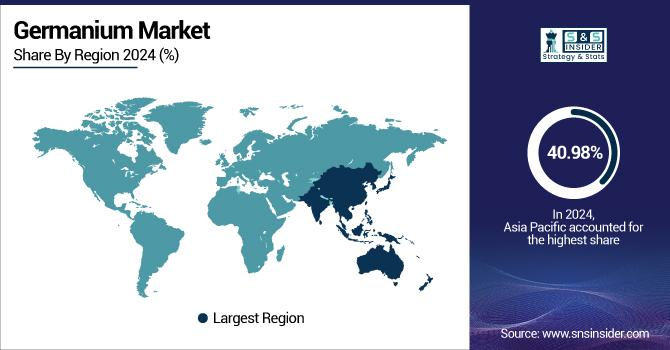

Asia Pacific dominated the germanium market with a 40.98% revenue share in 2024 due to robust manufacturing facilities and growing demand from electronics, fibre optics, and solar sectors. The nations of China, Japan, and South Korea are investing heavily in semiconductor research and development and renewable energy. Local firms have increased germanium refining and product development, particularly for high-purity ingots and optical-grade GeO₂. This regional supremacy is complemented by government support in tech infrastructure and exports, underlining Asia Pacific's pivotal position in fulfilling global germanium supply and application demand.

China is the market leader in Asia Pacific region with its large production capacity, providing most of the germanium supply globally. Its robust industrial base, government incentives, and demand from electronics, fiber optics, and solar industries further establish its leadership position.

The North American germanium market is estimated to grow at the fastest CAGR of 5.02% during 2025-2032 due to increasing spending in defense, aerospace, and solar power infrastructures, which depend heavily on germanium. The uptake of germanium-based infrared optics and solar cells is growing in the region, especially in the U.S. Companies are concentrating on increasing production capacity and exploring new applications in semiconductors and space-grade elements.

The U.S. dominates the North American market due to its strong technological infrastructure and growing investments in renewable energy and defense applications. Government efforts to secure critical materials and increase domestic production reinforce its dominance in the regional market even further.

Th Europe market is growing slowly, supported by the development of fiber optics, infrared imaging, and clean energy. With the aerospace, defense, and semiconductor sectors driving demand, the region focuses on higher material purity and utilization.

Germany has presence in European market with its high-end industry in the optics, semiconductors, and renewable products. Key players, such as Umicore, 5N Plus are contributing towards the high purity germanium industry size owing to the technological advancements and strong R&D facilities offered in the nation.

In the Middle East & Africa, South Africa leads the germanium market owing to mining activities and increasing demand from electronics and renewable sources of energy industry. The largest market in Latin America is seen in Brazil, spurred by investments in solar energy, telecommunications and technology infrastructure, which increases demand for germanium in high-end applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Major germanium market companies are Yunnan Chihong Zinc & Germanium Co., Ltd., Umicore, Teck Resources Limited, JSC Germanium, PPM Pure Metals GmbH, Indium Corporation, China Germanium Co., Ltd., AXT, Inc., 5N Plus, and Noah Chemicals.

Recent Development:

-

April 2024, 5N Plus introduced a new range of high-purity germanium products, including ingots and dioxide, catering to the semiconductor and solar industries. This initiative supports the company's strategy to diversify its product offerings and meet market needs.

-

December 2024, Noah Chemicals launched a series of germanium-based compounds for use in semiconductor and solar applications. These products aim to enhance the performance and efficiency of electronic devices and solar cells.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 321.41 Million |

| Market Size by 2032 | USD 434.16 Million |

| CAGR | CAGR of 3.90% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Germanium Ingot, Germanium Tetrachloride, High Purity GeO2, Others) •By Application (PET, Electronics & Solar, Fiber Optics, IR Optics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Yunnan Chihong Zinc & Germanium Co., Ltd., Umicore, Teck Resources Limited, JSC Germanium, PPM Pure Metals GmbH, Indium Corporation, China Germanium Co., Ltd., AXT, Inc., 5N Plus, Noah Chemicals |