Polypropylene Market Size & Overview:

The Polypropylene Market size was USD 90.16 Billion in 2024 and is expected to reach USD 139.15 Billion by 2032 and grow at a CAGR of 5.57% over the forecast period of 2025-2032.

Polypropylene market analysis covers key insights into production capacity and utilization, feedstock price fluctuations, and regulatory impacts shaping the polypropylene industry. It examines sustainability metrics, including recycling rates and biodegradable polypropylene developments, alongside demand for polypropylene market trends across sectors, such as automotive, packaging, and medical. Additionally, the report explores technological advancements in high-performance polypropylene grades and innovations in manufacturing processes, offering a detailed outlook on market growth and emerging opportunities.

To get more information on Polypropylene Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2024: USD 90.16 Billion

-

Market Size by 2032: USD 139.15 Billion

-

CAGR: 5.57% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Polypropylene Market Trends

-

Rising demand from packaging industry due to polypropylene’s lightweight, high strength, and cost-effectiveness, especially in food and beverage packaging.

-

Increasing automotive sector adoption driven by the push for lightweight materials to improve fuel efficiency and reduce emissions.

-

Growth in medical and healthcare applications, as polypropylene is widely used in disposable syringes, medical containers, and PPE due to its chemical resistance and sterility.

-

Expanding use in construction and infrastructure for piping systems, insulation, and sheets owing to its durability and weather resistance.

-

Strong demand for recyclable and sustainable polypropylene amid tightening regulations and rising consumer awareness about environmental sustainability.

-

Rising capacity expansions and investments by major players to meet growing global demand and secure supply chains.

-

Increasing technological advancements in catalyst systems and polymerization processes to enhance performance and cost efficiency.

Polypropylene Market Growth Drivers

-

Growing Demand from Packaging Industry Fuels Market Growth

Growing demand from the packaging sector is primarily driving the polypropylene market growth. Polypropylene is one of the most prominent lightweight, highly durable, cost-efficient, and recyclable polymer types popularly used in flexible and rigid packaging applications. Polypropylene is widely used for films, containers, pouches, and packaging wraps in the food & beverage, pharmaceutical, and consumer goods industries for better product protection and longer shelf-year life.

In addition, the growth in e-commerce and online retailing has increased demand for durable and lightweight packaging materials, which also contributes to the increase in the usage of polypropylene. Moreover, sustainability initiatives and government regulations that encourage recyclable packaging solutions have prompted manufacturers to choose polypropylene rather than other plastic materials. The market is further set to grow to meet the consumer trend toward greener and more efficient content packaging solutions, with continued development of bio-based and recyclable polypropylene grades.

Polypropylene Market Restraints

-

Environmental Concerns and Stringent Regulations Restrain Market Growth

Due to rising concerns regarding the environment and strict regulations imposed on plastic utilization and disposal. The stringent single-use plastics ban by governments globally impacts polypropene demand through its use in packaging as governments of different regions are imposing regulations and tariffs against the usage of single-use plastics and are promoting sustainable alternatives. Furthermore, issues with effective recycling of polypropylene and diminished carbon footprint create greater limitations on the market growth. Manufacturers are only able to take on the additional cost of complying with changing regulatory frameworks for so long before being forced to devote resources that should instead be directed toward revenue-focused activities and scalability to enforcing compliance, reducing margins and profit potential in the long run.

Polypropylene Market Opportunities

-

Growing Demand for Sustainable and Recyclable Polypropylene Creates Market Opportunities

The polypropylene market has enormous opportunities in sustainability, recyclability, and circular economy practices. There is increasing environmental awareness, and in addition to rising single-use plastic regulations, industries are looking to bio-based and recycled polypropylene to decrease their carbon footprints. Improved chemical and mechanical recycling technologies have also made it possible to recycle increasingly diverse forms of polypropylene waste, making it a popular option in packaging, automotive, and consumer goods.

Besides, lightweight polypropylene composites are being utilized in the automotive sector to increase mileage and meet emission standards. Nowadays there is a continual initiative towards eco-friendly packaging by using recyclable polypropylene films and containers, which supports eco-friendly packaging and drives the packaging industry.

Polypropylene Market Challenges:

-

Recycling and Waste Management Issues May Create a Challenge for Market Expansion

Polypropylene (PP) is a durable material that has many applications, especially in packaging, automotive, and consumer goods, but despite this, it is still relatively low in recycling compared to other polymers due to contamination and the recycling infrastructure. Mixed plastics, additives, and dyes raise difficulties in producing high-quality recycled PP and hinder its application in premium products. The high price of recycling and the lack of government incentives in some places also prevent sustainable waste management. Therefore, with an increasing number of stringent environmental regulations, firms should use advanced recycling technologies to overcome the challenges while complying with sustainability objectives.

Polypropylene Market Segment Analysis

By Product

Copolymer segment held the largest polypropylene market share, around 65%, in 2024 owing to its higher impact resistance, better flexibility, and higher durability compared to homopolymer polypropylene. Used in a variety of products from automotive parts to packaging, from medical devices to forms in consumer goods, copolymer polypropylene especially blocks and random copolymers for their toughness and ability to withstand extremes of temperature has long been a common material in human life. Copolymer polypropylene is witnessing a rise in demand in the automotive industry due to the need for lightweight and high-performance materials, and due to an expanding application scope in flexible and rigid packaging. Furthermore, being resistant to chemicals and moisture, it is often preferred in many industrial and household applications thereby ensuring its continued domination in the market.

By End-Use

Packaging held the largest share in the polypropylene market around 32% in 2024 owing to its lightweight nature, low cost, and exceptional moisture and chemical barrier properties. This includes food and beverage packaging, pharmaceuticals, and personal care and industrial packaging, both flexible and rigid (usually related to polypropylene). Due to its capability of extending product life, holding freshness and durability, it becomes the most desirable in the packaging sector.

The increasing need for sustainable and recyclable packaging solutions has also boosted the consumption of polypropylene as it can be easily recycled and aid in reducing overall packaging waste. Besides, the increasing consumer inclination towards packaged commodities, along with, the shift towards e-commerce due to the ongoing pandemic has had a positive impact on sales of polypropylene material used for packing too.

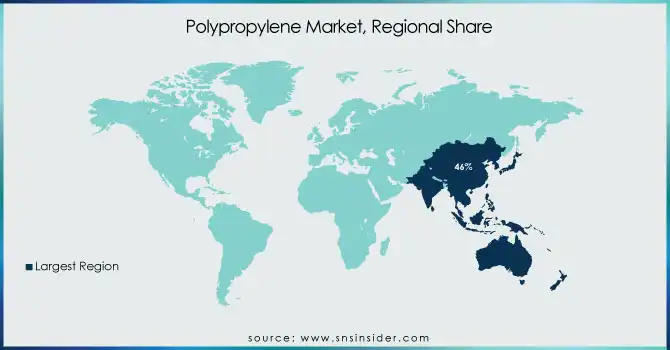

Polypropylene Market Regional Analysis

Asia Pacific Polypropylene Market Insights

Asia Pacific held the largest market share around 46% in 2024. The growing manufacturing sector and consumer base, coupled with high demand from the packaging sector and notable growth of key end-use industries such as automotive, construction, and consumer goods. It is a key area for global polypropylene makers, with cheap feedstock availability, competitive production costs and government initiatives to support industrial output. There is growing demand for polypropylene in the food packaging, medical and infrastructure sector in countries, such as China, India, and Southeast Asian countries.

Moreover, higher disposable income and urbanization along with increasing middle-class population are also boosting the consumption of polypropylene ones, which further entrench supremacy of Asia Pacific over the global market. Asia Pacific also has large scale investments in petrochemical plants, which secure a massive supply of polypropylene at a very low cost. Additionally, the rapid growth of the e-commerce and retail industries in the region has further escalated the demand for robust and lightweight packaging products.

North America Polypropylene Market Insights

North America held a significant market share in the market. It is owing to its industrial base, high manufacturing capabilities, and large-scale demand in major applications including automotive, packaging, and healthcare. The region boasts matured nature of the petrochemicals industry, securing a steady entity of raw materials. Moreover, the rising focus on sustainable plastic alternatives, coupled with escalating investments in recycling technologies, are propelling the need for polypropylene in sustainable applications. With a well-established presence of major market players and regular implementation of new technologies in polymers, North America is gaining its foothold in the global market.

Europe Polypropylene Market Insights

The Europe Polypropylene Market is witnessing steady growth in 2025, driven by strong demand from the automotive, packaging, and construction industries. Key countries such as Germany, France, and Italy are leading in polypropylene consumption due to their robust manufacturing base and stringent EU regulations promoting the use of recyclable and lightweight materials. The region’s focus on circular economy practices has encouraged the development of advanced recycling technologies and certified circular polypropylene grades. Additionally, government-backed sustainability initiatives and R&D collaborations between petrochemical firms and research institutions are boosting innovation, thereby strengthening Europe’s position as a hub for high-performance and eco-friendly polypropylene solutions.

Latin America (LATAM) Polypropylene Market Insights

The LATAM Polypropylene Market is gradually expanding in 2025, supported by rising industrialization, growing consumer goods production, and increasing investments in packaging and automotive manufacturing. Countries like Brazil, Mexico, and Argentina are emerging as key demand centers, driven by expanding middle-class consumption and the development of domestic petrochemical infrastructure. The region is also witnessing a growing emphasis on sustainable polymer production, with local players exploring chemical recycling technologies and bio-based polypropylene options. Furthermore, supportive government policies for industrial development and free trade agreements are attracting global polymer producers to establish local production capacities, fueling consistent market growth.

Middle East & Africa (MEA) Polypropylene Market Insights

The MEA Polypropylene Market is gaining significant traction in 2025, fueled by abundant raw material availability, strategic petrochemical investments, and rising construction and automotive activities. Leading markets like Saudi Arabia, the UAE, and South Africa are witnessing capacity expansions by regional giants to serve both domestic demand and export markets. Government-led industrial diversification programs, such as Saudi Vision 2030, are driving new downstream petrochemical projects focused on polypropylene production. Additionally, increasing foreign direct investments, coupled with growing demand for cost-effective plastic packaging and durable construction materials, are accelerating polypropylene adoption across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Polypropylene Market Competitive Landscape

Braskem

Braskem is a leading global petrochemical company and one of the largest producers of polypropylene in the Americas. The company is focusing on sustainability and circular economy initiatives by developing innovative recycling technologies and expanding its portfolio of eco-friendly polymers.

-

In 2022, Braskem unveiled its first line of certified circular polypropylene, produced from mixed plastic waste, underscoring its commitment to sustainability and the circular economy.

Borealis

Borealis is a prominent provider of advanced polyolefins solutions, specializing in innovative polypropylene and polyethylene products. The company serves diverse industries including packaging, automotive, and healthcare, with a strong emphasis on product innovation and sustainable materials.

-

In 2021, Borealis launched a new polypropylene grade for the healthcare sector, designed to offer improved performance in medical applications, thereby strengthening its position in the healthcare market.

Key Polypropylene Companies:

-

LyondellBasell Industries Holdings B.V. (Purell, Moplen)

-

SABIC (Eltex, Vestolen)

-

ExxonMobil Corporation (Achieve, Exxtral)

-

Borealis AG (Borclear, Bormed)

-

Braskem (I’m Green, Inspire)

-

TotalEnergies (Lumicene, TotalE)

-

Reliance Industries Limited (Repol, Relene)

-

INEOS Group (Eltex, Repsol)

-

Formosa Plastics Corporation (Formolene, Homopolymer PP)

-

Sinopec (Yansab PP, SECCO)

-

LG Chem (LUPOY, Lupolen)

-

Mitsui Chemicals, Inc. (Beaulon, TPX)

-

Sumitomo Chemical (Tafmer, TPV)

-

Indian Oil Corporation Limited (Proppylene, Marlex)

-

China National Petroleum Corporation (CNPC PP, PetroChina PP)

-

Haldia Petrochemicals Limited (Haldia PP, Raffia)

-

Hyosung Corporation (Hyosung PP, Topilene)

-

Braskem Idesa (Green PE, Polipropileno)

-

Chevron Phillips Chemical (Marlex, K-Resin)

-

Repsol (Repol, Impact PP)

| Report Attributes | Details |

|---|---|

|

Market Size in 2024 |

USD 90.16 Billion |

|

Market Size by 2032 |

USD 139.15 Billion |

|

CAGR |

CAGR of 5.57% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Homopolymer, Copolymer) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

|

Company Profiles |

LyondellBasell Industries Holdings B.V., SABIC, ExxonMobil Corporation, Borealis AG, Braskem, TotalEnergies, Reliance Industries Limited, INEOS Group, Formosa Plastics Corporation, Sinopec, LG Chem, Mitsui Chemicals, Inc., Sumitomo Chemical, Indian Oil Corporation Limited, China National Petroleum Corporation, Haldia Petrochemicals Limited, Hyosung Corporation, Braskem Idesa, Chevron Phillips Chemical, Repsol |