Gesture Control Market Analysis & Overview:

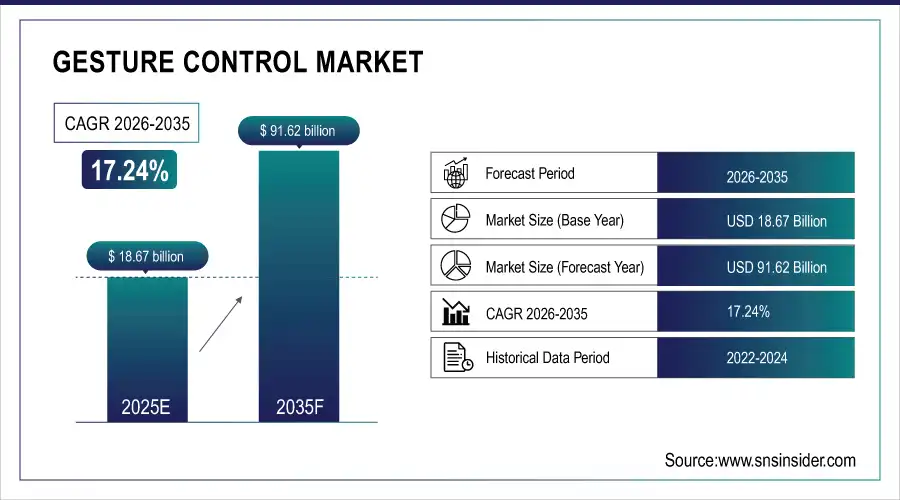

The Gesture Control Market was valued at USD 18.67 billion in 2025 and is expected to reach USD 91.62 billion by 2035, growing at a CAGR of 17.24% from 2026-2035.

The Gesture Control Market growth is driven by the increasing demand for touchless interfaces, rising adoption of smart consumer electronics, and growing emphasis on hygiene post-pandemic. The market is witnessing strong traction in automotive, gaming, healthcare, and industrial automation sectors due to enhanced user experience and intuitive interaction. Advancements in sensor technology, AI, and computer vision are enabling more accurate and responsive gesture-based systems.

Gesture Control Market Size and Forecast

-

Market Size in 2025: USD 18.67 Billion

-

Market Size by 2035: USD 91.62 Billion

-

CAGR: 17.24% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On Gesture Control Market - Request Free Sample Report

Gesture Control Market Trends

-

Rising demand for touchless interfaces in consumer electronics, automotive, and industrial applications is driving the gesture control market.

-

Growing adoption in smart TVs, gaming consoles, AR/VR devices, and infotainment systems is boosting market growth.

-

Expansion of automotive safety and infotainment systems is fueling deployment.

-

Increasing focus on hygiene, accessibility, and user-friendly interaction is shaping adoption trends.

-

Advancements in AI, computer vision, and sensor technologies are enhancing accuracy and responsiveness.

-

Rising investments in smart home, wearable devices, and robotics are supporting market expansion.

-

Collaborations between technology providers, device manufacturers, and software developers are accelerating innovation and global adoption.

U.S. Gesture Control Market was valued at USD 5.60 billion in 2025 and is expected to reach USD 26.95 billion by 2035, growing at a CAGR of 17.01% from 2026-2035. The U.S. Gesture Control Market trend is driven by increasing demand for touchless interfaces, AI-powered sensor advancements, and growing use in smart homes, automotive, and healthcare applications.

Gesture Control Market Growth Drivers:

-

Surge in Demand for Touchless Interaction Leads to Accelerated Adoption of Gesture Control in Smart Devices

The rapid growth in smart devices and consumer electronics is fueling demand for gesture-based interfaces that offer contactless, intuitive control. Consumers increasingly seek seamless interaction with devices such as smart TVs, laptops, wearables, and smartphones, especially in a post-pandemic era where hygiene and convenience are prioritized. Gesture recognition enhances user experience by reducing physical contact and improving accessibility, particularly for gaming, infotainment, and AR/VR applications. Technological improvements in 3D depth-sensing cameras, AI, and embedded sensors are making gesture interfaces more accurate and responsive, leading to higher user acceptance. As a result, gesture control is becoming a standard feature in next-gen consumer devices.

Gesture Control Market Restraints:

-

High Integration Costs and Hardware Complexity Limit Adoption in Cost-Sensitive and Mid-Range Markets

Despite its advantages, gesture control technology often requires complex hardware setups like infrared sensors, 3D depth cameras, and motion-tracking systems, which can significantly raise development and product costs. These high initial investments deter small and medium-sized manufacturers, especially in cost-sensitive markets. Moreover, ensuring precision and minimal latency in gesture detection demands advanced processors and software optimization, adding to overall design complexity. Integration challenges with legacy systems and limited interoperability across devices also restrict wider adoption. This cost and complexity barrier may slow down the penetration of gesture control in mid-range electronics and industrial applications, thereby restraining its broader market growth potential.

Gesture Control Market Opportunities:

-

Advancements in AR/VR and Automotive Systems Create New Avenues for Gesture-Based Interfaces

The expanding applications of gesture control in AR/VR environments and automotive systems offer significant growth opportunities. In augmented and virtual reality, gesture-based interfaces allow users to interact naturally within immersive environments, improving gaming, design, and training experiences. Meanwhile, automotive manufacturers are integrating gesture recognition into infotainment systems, navigation controls, and safety features, enabling drivers to operate functions without taking their hands off the wheel. As connected vehicles and autonomous driving technologies evolve, gesture interfaces enhance user interaction and safety. Additionally, this integration aligns with growing consumer demand for futuristic and intuitive controls, opening new use cases across sectors such as retail, education, and healthcare.

Gesture Control Market Challenges:

-

Inconsistent Accuracy and Lack of Standardization Hinder Seamless User Experience Across Applications

A major challenge for the gesture control market lies in achieving high accuracy and consistent performance across varied environments and use cases. Lighting conditions, hand shapes, movement speed, and background interference can significantly affect recognition reliability. In real-world scenarios—like automotive or public kiosks—such inconsistencies can lead to poor user experiences or even safety concerns. Moreover, the lack of standardized protocols and design frameworks hinders cross-platform integration and slows innovation. Developers must invest heavily in training gesture algorithms to handle real-time variations, which increases development timelines and costs. Overcoming these challenges is critical for building user trust and ensuring mass-market scalability.

Gesture Control Market Segmentation Analysis:

By Input Devices:

In 2025, the vision-based segment dominated the gesture control market and accounted for a significant revenue share. Vision-based systems lead due to their widespread adoption in consumer electronics and automotive applications, driven by advancements in 3D cameras and AI-powered image processing. Their ability to capture natural hand movements without physical contact makes them ideal for immersive AR/VR and infotainment systems. This dominance is expected to persist with steady integration into smart environments.

In August 2024, Sony Group Corporation launched its Bravia 9 series 4K mini‑LED smart TVs that support hand‑gesture control leveraging vision-based gesture interaction for intuitive viewing experiences.

The electric field-based segment is expected to register the fastest CAGR in the gesture control market during the forecast period. Electric field-based gesture systems are gaining traction due to their low power consumption, compact sensor design, and high responsiveness in close-range applications. Their suitability for wearable and IoT devices is accelerating adoption in health tech and smart home automation. Rising demand for miniaturized and touchless human–machine interfaces is driving their rapid market expansion.

By Dimension:

In 2025, the 2-dimensional segment dominated the market gesture control market and accounted for a significant revenue share. due to their cost-effectiveness, ease of integration, and wide usage in consumer electronics like smartphones, tablets, and laptops. These systems use basic optical sensors and image processing, making them suitable for mainstream applications. Their continued relevance in budget-friendly devices supports sustained revenue contribution over the forecast period.

3D segment is expected to register the fastest CAGR in the gesture control market during the forecast period. 3D gesture control is rapidly advancing, driven by demand for immersive, real-time interaction in automotive displays, AR/VR, and gaming. Enhanced depth sensing, improved spatial accuracy, and increasing availability of compact 3D sensors are accelerating adoption. As industries shift toward intuitive human-machine interfaces, 3D solutions are positioned for rapid growth and broader market penetration.

By Application:

In 2025, the consumer electronics segment dominated the market gesture control market and accounted for a significant revenue share. Consumer electronics led the market owing to the widespread integration of gesture control in smartphones, smart TVs, laptops, and wearable devices. Increasing demand for intuitive and touchless user interfaces, coupled with advancements in embedded sensors and AI vision, continues to drive adoption. Frequent product upgrades and tech-savvy consumers further reinforce this segment’s dominance.

The automotive segment is expected to register the fastest CAGR in the gesture control market during the forecast period. Gesture control adoption in the automotive sector is accelerating due to the growing popularity of smart dashboards, driver-assistance systems, and in-vehicle infotainment. Automakers are increasingly deploying 3D gesture technologies to enhance driver safety and reduce distractions. The trend toward autonomous and connected vehicles will further amplify the demand for touchless interaction solutions.

By Technology:

In 2025, the touchless gesture recognition segment dominated the market gesture control market and accounted for a significant revenue share. Touchless gesture recognition is led due to rising demand for hygienic, contact-free interfaces across healthcare, consumer electronics, and automotive sectors. Advancements in AI, computer vision, and sensor technology have made these systems more responsive and accurate. The pandemic accelerated the shift toward touchless interaction, solidifying its adoption across both personal and professional environments.

Touch-based gesture recognition segment is expected to register the fastest CAGR in the gesture control market during the forecast period. Touch-based gesture systems are gaining momentum in wearables, gaming consoles, and industrial control panels due to their high accuracy and low hardware complexity. The integration of capacitive and resistive sensors enables precise input tracking. Their affordability and ease of deployment in consumer devices are expected to drive rapid adoption in emerging markets.

Gesture Control Market Regional Outlook:

North America Gesture Control Market Insights

In 2025, North America region dominated the market gesture control market and accounted for a significant revenue share. due to early adoption of advanced technologies, high penetration of smart devices, and strong presence of leading tech innovators. Widespread use of gesture control in automotive infotainment, gaming consoles, and healthcare devices drives growth. Continued R&D investment and consumer demand for intuitive interfaces reinforce regional dominance through the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Gesture Control Market Insights

The Asia-Pacific region is expected to register the fastest CAGR in the gesture control market during the forecast period, driven by expanding consumer electronics manufacturing, rising disposable incomes, and increasing demand for smart home and automotive technologies. Government-backed digital initiatives and growing AR/VR adoption in education and retail further support gesture control deployment. Countries like China, Japan, and South Korea are key accelerators for the region’s robust market expansion.

Europe Gesture Control Market Insights

Europe is experiencing steady growth in gesture control adoption due to increasing integration in automotive systems, healthcare equipment, and industrial automation. Rising demand for touchless interfaces in public infrastructure and smart homes, combined with favorable regulatory support, is expected to drive consistent market expansion across the region.

Germany dominates the European gesture control market, fueled by its strong automotive industry, early adoption of Industry 4.0 technologies, and advanced healthcare infrastructure. With leading OEMs integrating gesture control in vehicles and manufacturing, the country is set to maintain leadership through ongoing innovation and high-tech investments.

Middle East & Africa and Latin America Gesture Control Market Insights

The Middle East & Africa and Latin America Gesture Control Market is witnessing steady growth due to rising adoption of smart devices, automotive infotainment systems, and gaming applications. Increasing investment in advanced consumer electronics, growing demand for touchless interfaces in healthcare and automotive sectors, and expanding awareness of gesture-based technologies are driving market expansion. Additionally, technological advancements, supportive government initiatives, and rising smartphone penetration are contributing to market growth across these regions.

Gesture Control Market Competitive Landscape:

Apple Inc.

Apple Inc. continues to lead in gesture-based human‑computer interaction, integrating advanced sensors and AI into its devices. By leveraging watchOS, iPadOS, and iOS, Apple enables intuitive control through touchless, pinch, wrist, and gaze-based gestures. These features enhance accessibility, improve one‑handed usability, and streamline user interactions across Apple Watch, iPhone, and iPad. Apple’s continuous innovation blends hardware, software, and AI to redefine user experience in personal devices.

-

2023: Apple introduced a double‑tap gesture on Apple Watch Series 9 & Ultra 2 for one‑hand control via pinch detection.

-

2024: Apple announced eye‑tracking navigation for iPad and iPhone, allowing control of UI elements using gaze and dwell gestures.

-

2025: Apple previewed watchOS 26 with a wrist flick gesture to dismiss notifications and enhance touchless control.

Elliptic Labs

Elliptic Labs develops AI-powered, touchless gesture sensing technologies for laptops, peripherals, and mobile devices. Its solutions enable intuitive user interactions, device pairing, and control without physical touch, leveraging ultrasonic and AI-based sensing. The company focuses on enhancing device accessibility, user experience, and seamless integration of gesture-based interfaces, targeting consumer electronics, laptops, and IoT devices.

-

2025: Elliptic Labs unveiled its AI Virtual Tap-to-Pair gesture sensor at CES 2025, enabling seamless device pairing through tap-based gestures.

Key Players

Some of the Gesture Control Market Companies

-

Apple Inc.

-

Microsoft Corporation

-

Alphabet Inc. (Google)

-

Samsung Electronics Co., Ltd.

-

Intel Corporation

-

Qualcomm Technologies, Inc.

-

Microchip Technology Inc.

-

Infineon Technologies AG

-

GestureTek Systems Inc.

-

PointGrab Ltd.

-

Elliptic Labs

-

Oblong Industries

-

EyeSight Technologies

-

Leap Motion Inc.

-

Cognitec Systems GmbH

-

XYZ Interactive Technologies

-

uSens Inc.

-

Jabil Inc.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2025 |

USD 18.67 Billion |

|

Market Size by 2035 |

USD 91.62 Billion |

|

CAGR |

CAGR of 17.24% From 2026 to 2035 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

Historical Data |

2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Input Devices (Wearable-based, Vision-based, Infrared-based, Electric field-based, Ultrasonic-based) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

|

Company Profiles |

Apple Inc., Microsoft Corporation, Alphabet Inc. (Google), Sony Corporation, Samsung Electronics Co., Ltd., Intel Corporation, Qualcomm Technologies, Inc., Microchip Technology Inc., Infineon Technologies AG, Texas Instruments Inc., GestureTek Systems Inc., PointGrab Ltd., Elliptic Labs, Oblong Industries, EyeSight Technologies, Leap Motion Inc., Cognitec Systems GmbH, XYZ Interactive Technologies, uSens Inc., Jabil Inc. and others in the report |