AI Annotation Market Report Scope & Overview:

AI Annotation Market was valued at USD 2.39 billion in 2025E and is expected to reach USD 28.31 billion by 2033, growing at a CAGR of 17.46% from 2026-2033.

The AI annotation market is experiencing strong growth due to the rapid expansion of AI and machine learning applications across industries such as autonomous vehicles, healthcare, retail, and finance. Increasing demand for high-quality labeled data to train advanced algorithms, coupled with the rise of computer vision and NLP technologies, is driving adoption. Additionally, growing use of automated and semi-supervised annotation tools, along with outsourcing trends and scalable cloud-based platforms, further accelerate market growth globally.

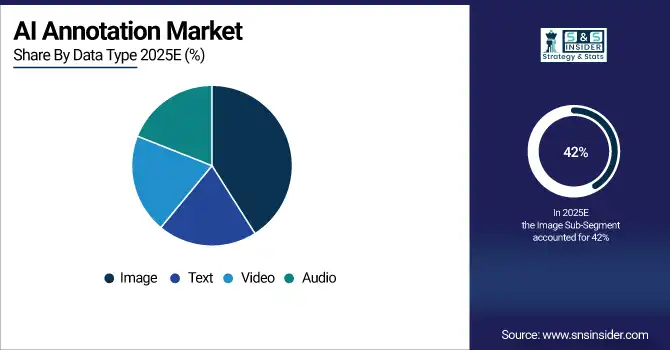

Data modality and growth: Image and video annotation remains the dominant modality (~40%+), with rapid expansion in multimodal and sensor-fusion labeling to support perception stacks in AI systems.

AI Annotation Market Size and Forecast

-

AI Annotation Market Size in 2025E: USD 2.39 Billion

-

AI Annotation Market Size by 2033: USD 28.31 Billion

-

CAGR: 17.46% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On AI Annotation Market - Request Free Sample Report

AI Annotation Market Trends

-

Expansion of AI applications in healthcare, autonomous vehicles, and retail analytics.

-

Increasing use of cloud-based annotation platforms for scalability and collaboration.

-

Integration of AI-assisted tools to enhance accuracy and reduce manual annotation costs.

-

Surge in outsourcing annotation services to specialized third-party providers.

-

Emphasis on data security, privacy, and compliance in AI data labeling workflows.

-

Advancements in NLP and computer vision driving multi-modal data annotation growth.

-

Growing investments in annotation platforms supporting synthetic and augmented datasets.

-

Continuous innovation toward domain-specific annotation tools for industry-tailored AI solutions.

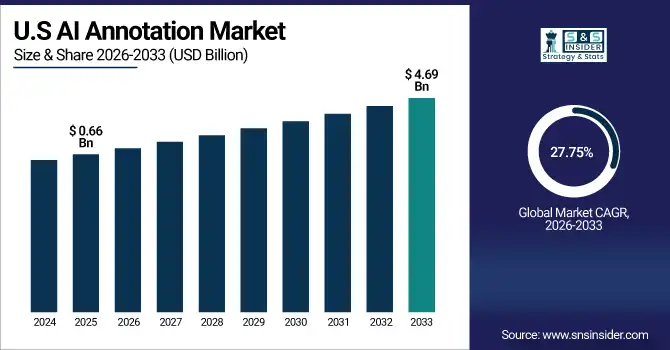

U.S. AI Annotation Market was valued at USD 0.66 billion in 2025E and is expected to reach USD 4.69 billion by 2033, growing at a CAGR of 27.75% from 2026-2033.

The U.S. AI annotation market is growing rapidly due to increasing adoption of AI and machine learning across sectors such as healthcare, autonomous vehicles, and retail. Rising demand for high-quality labeled datasets, advancements in automated annotation tools, and strong investments from tech companies are fueling sustained market expansion.

In 2024, NVIDIA’s DRIVE Sim + AI-assisted labeling cut annotation time by 70%; Scale AI reported USD1.2B in AV-related contracts. By 2025, over 85% of top-10 automakers use AI-augmented annotation, with labeled dataset volumes growing 40% YoY.

AI Annotation Market Growth Drivers:

- Growth of Autonomous Vehicles and Advanced Driver Assistance Systems (ADAS)

The rapid development of autonomous vehicles and ADAS technologies is significantly driving demand for data annotation. These systems rely on precisely labeled image and video datasets to train computer vision algorithms for lane detection, pedestrian recognition, object tracking, and traffic sign identification. Accurate annotation ensures safer navigation, improved decision-making, and enhanced vehicle perception, supporting automakers and AI developers in advancing reliable, real-world autonomous driving solutions. As R&D accelerates, the need for large-scale, high-quality labeled data continues to grow.

The global autonomous vehicle data annotation, rises with over 70% of AV developers prioritizing high-accuracy labeling for safety-critical perception tasks.

- Increasing Use of AI in Retail, E-Commerce, and Finance

AI adoption across retail, e-commerce, and financial sectors is creating a strong demand for accurate text and image annotation. Chatbots, recommendation engines, and fraud detection systems rely on labeled datasets to understand customer behavior, personalize shopping experiences, and identify anomalies. Annotated data helps AI models process visual and textual information more efficiently, improving operational accuracy, automation, and decision-making. As digital transformation accelerates, businesses increasingly invest in advanced annotation tools to enhance customer engagement and operational intelligence.

In 2024, 79% of retailers used annotated data for recommendation engines (↑18% YoY); fraud detection models with high-quality labeled data reduced false positives by 32%. By 2025, AI-powered chatbots handling 85% of customer queries rely on 10M+ labeled intents.

AI Annotation Market Restraints:

-

Quality Inconsistencies and Human Error

Human-based annotation processes often lead to variations in labeling quality due to fatigue, subjective interpretation, or lack of domain expertise. These inconsistencies can introduce bias and reduce the reliability of annotated datasets, ultimately affecting model training and accuracy. Maintaining consistent labeling across large, complex datasets requires extensive quality control, double verification, and standardized workflows, which increase operational costs and slow project timelines. As AI applications expand, ensuring uniform annotation precision becomes a critical challenge for scalable, high-performance AI systems.

In 2024, 71% of AI projects faced labeling inconsistencies from human annotators; 58% incurred ≥20% higher QA costs. By 2025, 67% of firms plan hybrid (human-in-the-loop + AI-assisted) workflows to cut errors by 35% and improve annotation consistency.

-

Lack of Standardization Across Annotation Tools and Platforms

The AI annotation industry lacks consistent standards for data formats, labeling guidelines, and workflow protocols. This absence of standardization makes it difficult to integrate data from multiple platforms, hindering interoperability and efficiency in AI development pipelines. Organizations often face challenges when transferring annotated data between tools or scaling projects globally. Inconsistent annotation quality and non-uniform labeling frameworks also reduce model generalizability, highlighting the need for standardized annotation practices and industry-wide data interoperability frameworks.

In 2024, 78% of AI teams reported integration delays due to annotation inconsistencies; 64% cited quality variance across vendors—driving 52% to prioritize standardization initiatives by 2025.

AI Annotation Market Opportunities:

-

Growing Collaboration Between Tech Companies and Data Providers

Strategic partnerships between technology companies and data providers are creating new growth avenues for the AI annotation market. These collaborations focus on data sharing, API integration, and outsourcing of annotation services to enhance scalability and accuracy in AI model development. By combining domain expertise with high-quality labeled datasets, companies can accelerate product innovation, reduce time-to-market, and expand globally. Such alliances also enable the development of specialized annotation tools and industry-specific solutions, driving efficiency and improving data pipeline management across multiple AI-driven sectors.

In 2024–25, 65% of AI firms formed annotation partnerships; such alliances cut model dev time by 30% and boosted labeling accuracy by 25%.

-

Expansion of AI Applications in Retail and E-Commerce

The rapid adoption of AI technologies in retail and e-commerce is fueling demand for large-scale, accurately annotated datasets. Applications such as visual search, automated product tagging, inventory management, and personalized recommendations rely heavily on precise image, text, and video labeling. As businesses aim to enhance customer experience and operational efficiency, annotation platforms are becoming critical to AI model training. The increasing use of AI for demand forecasting, customer sentiment analysis, and omnichannel retail strategies presents significant growth opportunities for annotation service providers.

In 2024–25, retail AI adoption hit 72–85%, demand for annotated data surged 38% YoY, and AI-driven personalization boosted AOV by 12–18%.

AI Annotation Market Segment Highlights

-

By Data Type: In 2025, Image led the market with 42% share, while Video is the fastest-growing segment with the highest CAGR (2026–2033).

-

By Annotation Type: In 2025, Manual Annotation led the market with 55% share, while Automatic Annotation is the fastest-growing segment with the highest CAGR (2026–2033).

-

By Buyer Type Outlook: In 2025, OEMs & Large Enterprises led the market with 44% share, while SaaS Companies & Platform Owners is the fastest-growing segment with the highest CAGR (2026–2033).

-

By Application / Use Case: In 2025, Autonomous Vehicles & Mobility led the market with 28% share, while Medical Imaging and Healthcare is the fastest-growing segment with the highest CAGR (2026–2033).

AI Annotation Market Segment Analysis

By Data Type, Image segment led in 2025; Video segment expected fastest growth 2026–2033

The Image segment dominated the AI Annotation Market in 2025 because of its critical role in computer vision applications such as facial recognition, autonomous driving, and medical imaging. High demand for accurately labeled image datasets to train AI models in various industries reinforced its dominance across multiple use cases.

The Video segment is expected to grow fastest from 2026–2033 due to the rising need for real-time object detection, surveillance, and autonomous navigation. Increasing adoption of AI in autonomous vehicles, retail analytics, and smart city infrastructure drives demand for continuous, frame-by-frame video annotation for better contextual understanding.

By Annotation Type, Manual Annotation segment led in 2025; Automatic Annotation segment expected fastest growth 2026–2033

Manual Annotation dominated the AI Annotation Market in 2025 because it ensures superior accuracy, context awareness, and quality control for complex datasets. Human annotators are essential for refining training data in applications requiring nuanced understanding, such as medical imaging, autonomous driving, and natural language processing.

Automatic Annotation is expected to grow fastest from 2026–2033 due to advancements in AI-assisted labeling tools that significantly reduce time and costs. Automation technologies, including machine learning and pre-trained models, enhance scalability and efficiency, driving widespread adoption for large-scale image, video, and text datasets.

By Buyer Type Outlook, OEMs & Large Enterprises segment led in 2025; SaaS Companies & Platform Owners segment expected fastest growth 2026–2033

OEMs & Large Enterprises dominated the AI Annotation Market in 2025 because they have extensive AI development projects, large data requirements, and higher budgets for data labeling. Their focus on autonomous systems, advanced analytics, and enterprise-scale AI deployment fuels consistent investment in high-quality annotation services.

SaaS Companies & Platform Owners are expected to grow fastest from 2026–2033 as they increasingly integrate AI annotation capabilities into cloud-based platforms. The growing demand for scalable, automated, and on-demand annotation services supports their rapid expansion across industries like retail, finance, and healthcare.

By Application / Use Case, Autonomous Vehicles & Mobility segment led in 2025; Medical Imaging & Healthcare segment expected fastest growth 2026–2033

Autonomous Vehicles & Mobility dominated the AI Annotation Market in 2025 because image and sensor data labeling is vital for object detection, navigation, and safety applications. High investments by automotive OEMs and tech companies in training perception models strengthened demand for accurate annotation in this domain.

Medical Imaging and Healthcare are expected to grow fastest from 2026–2033 due to increasing use of AI for diagnostics, disease detection, and image-based clinical analysis. The growing need for precisely labeled medical datasets, combined with rising healthcare digitization and AI integration, drives significant growth in this segment.

AI Annotation Market Regional Analysis

North America AI Annotation Market Insights

North America dominated the AI Annotation Market with a 32% share in 2025 due to the strong presence of leading AI companies, high investment in automation technologies, and early adoption of advanced machine learning models across industries. Robust infrastructure, skilled workforce, and widespread use of annotated data in autonomous systems and healthcare further drive growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S.-based labeling hubs and regional delivery centers supported rapid turnaround for large-scale driving-data projects, reflecting the centralized presence of AI-labeling firms in North America

Asia Pacific AI Annotation Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 30.12% from 2026–2033, driven by the rapid expansion of AI-based startups, growing data labeling outsourcing industry, and increasing government support for AI innovation. Rising digital transformation, cost-efficient workforce availability, and strong demand from automotive, retail, and healthcare sectors propel regional growth.

The Chinese AI startup ecosystem alone has attracted tens of billions of dollars in investment and continues to push advances in NLP, computer vision, and robotics, with government and corporate partnerships accelerating deployment in healthcare, finance, and manufacturing

Europe AI Annotation Market Insights

Europe held a significant share in the AI Annotation Market in 2025, supported by strong regulatory frameworks for data privacy, widespread adoption of AI across automotive, healthcare, and manufacturing sectors, and increasing government initiatives promoting ethical AI development. The region’s focus on high-quality labeled data and advanced automation technologies further strengthens its market position.

Middle East & Africa and Latin America AI Annotation Market Insights

The Middle East & Africa and Latin America regions together showed steady growth in the AI Annotation Market in 2025, driven by increasing digital transformation initiatives, expanding AI adoption in retail, security, and automotive sectors, and growing government investments in technology infrastructure. Rising demand for cost-effective data labeling services and improving access to AI-driven solutions further support market expansion in these emerging regions.

AI Annotation Market Competitive Landscape:

Scale AI (Founded 2016)

Scale AI, headquartered in San Francisco, is a leading provider of data annotation and AI training solutions for computer vision, natural language processing, and generative AI. The company partners with top technology, automotive, and defense firms to accelerate AI development through automation and high-quality labeled datasets. Its scalable platform integrates human-in-the-loop capabilities, APIs, and workflow management tools, ensuring data accuracy and security for advanced autonomous, geospatial, and enterprise AI applications worldwide.

-

June 13 2025: Meta invested in Scale, valuing the company over US USD29 billion; Scale’s founder moved to Meta while remaining on Scale’s board, marking a strategic evolution of Scale’s enterprise partnership path

Appen (Founded 1996)

Appen, based in Sydney, Australia, is a global leader in providing high-quality training data for artificial intelligence and machine learning models. With a network of over 1 million contributors across 170 countries, Appen specializes in text, speech, image, and video annotation. Its diverse data solutions support industries including automotive, retail, finance, and tech. The company emphasizes ethical AI development, multilingual data, and scalable annotation infrastructure to enhance AI accuracy, fairness, and real-world adaptability.

-

December 18 2024: Appen blogged their review of 2024 and outlook for 2025, noting milestones and shift to supporting generative and agentic AI.

iMerit (Founded 2012)

iMerit, headquartered in Kolkata, India, delivers high-quality data annotation and enrichment services for AI and machine learning applications. The company supports industries such as autonomous vehicles, geospatial intelligence, medical imaging, and natural language processing. iMerit combines human expertise with advanced platforms to ensure accuracy, scalability, and compliance. Employing over 5,500 data specialists globally, iMerit emphasizes ethical employment and inclusivity while helping enterprises build reliable AI solutions that improve automation, safety, and decision-making.

-

March 12 2024: iMerit won the “Best Use of Machine Learning” award at India’s IDEA Awards 2024 for its Ango Hub annotation-automation platform

CloudFactory (Founded 2010)

CloudFactory, based in the United Kingdom, offers cloud-based managed workforce solutions for AI data annotation and automation projects. The company blends human intelligence with technology to deliver accurate labeled data for autonomous vehicles, robotics, and healthcare AI. Operating globally, CloudFactory provides scalable, secure, and ethical workforce management, integrating quality control and workflow automation. Its mission-driven approach connects skilled workers in developing nations to digital jobs, empowering communities while supporting enterprise-level AI innovation.

-

December 18 2024: Published a recap “How Businesses Adopted AI in 2024”, highlighting annotation, automation, and workforce strategy for data pipelines.

AI Annotation Market Key Players

Some of the AI Annotation Market Companies are:

-

Scale AI

-

Appen

-

iMerit

-

Cloud Factory

-

TELUS International

-

Lionbridge AI

-

Super Annotate

-

Label box

-

task Us

-

Surge AI

-

Sama (Sama source)

-

Payment

-

Data loop AI

-

Toloka

-

Understand.ai

-

Twine AI

-

Zuru Tech

-

DataAnnotate (or Data Annotate)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.39 Billion |

| Market Size by 2033 | USD 28.31 Billion |

| CAGR | CAGR of 17.46% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Data Type (Text, Image, Video, Audio) • By Annotation Type (Manual Annotation, Semi-Supervised Annotation, Automatic Annotation) • By Buyer Type Outlook (OEMs & Large Enterprises, SMEs, NGOs & Public Sector, SaaS Companies & Platform Owners) • By Application / Use Case (Autonomous Vehicles & Mobility, Geospatial & Remote Sensing, Medical Imaging and Healthcare, Retail & E-Commerce, NLP, Enterprise Search, and Finance, Defense & Security) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Scale AI, Appen, iMerit, CloudFactory, Shaip, TELUS International, Lionbridge AI, SuperAnnotate, Labelbox, TaskUs, Surge AI, Sama (Samasource), Cogito Tech, Playment, Dataloop AI, Toloka, Understand.ai, Twine AI, Zuru Tech, DataAnnotate |