Cloud Infrastructure Services Market Report Scope & Overview:

Get More Information on Cloud Infrastructure Services Market - Request Sample Report

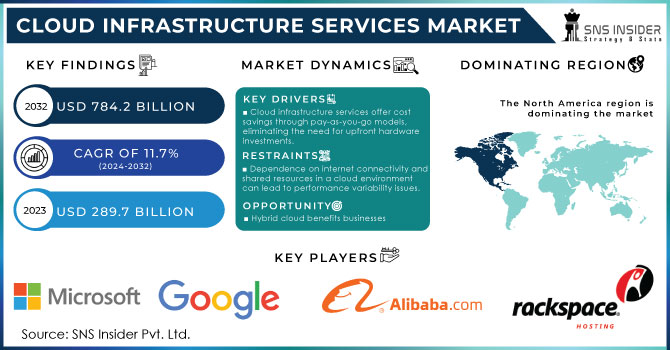

Cloud Infrastructure Services Market size was valued at USD 289.7 Bn in 2023 and is expected to reach USD 784.2 Bn by 2032 and grow at a CAGR of 11.7 % over the forecast period 2024-2032.

The Cloud Infrastructure Service Market is significantly driven by the growing adoption of cloud computing across diverse industries. The growing need to reduce operational costs and IT infrastructure maintenance also drives organizations to adopt cloud services. The increase in global data volumes and the adoption of cloud technologies for improved security of data, integrity, and service delivery drives the market growth. Virtual transformation is embraced by using businesses and greater agility, scalability, and price optimization. Access and usage of computing assets on-call are enabled by using cloud infrastructure offerings for corporations, without the need for upfront investments in physical infrastructure. This flexible and scalable technique is allowed, allowing fast provisioning and de-provisioning of assets based on dynamic necessities, and permitting fast responses to market adjustments and fluctuating workloads.

The virtualization of infrastructure across a network or the internet is known as cloud infrastructure. Software as a service, platform as a service, infrastructure as a service, cloud business process as a service, content delivery network /application delivery network, and colocation hosting are examples of delivery methods used by cloud infrastructure. The Cloud Infrastructure Service Market benefits from urbanization and digitalization, the mainstreaming of edge computing, and increased investment. The various factors that help to drive the market include cost-effectiveness, scalability, flexibility, and security, leading to accelerated Time-to-Market (TTM) and rapid application development.

Drivers

-

Cloud infrastructure services are cost-effective through pay-as-you-go models, Reducing the need for initial hardware investments.

-

Cloud services allow companies to scale their infrastructure up or down primarily based on demand, offering flexibility and agility.

-

The growing volume of data is driving the demand for cloud storage and analytics capabilities.

-

The Increasing adoption of cloud services as businesses shift to remote work models.

Cloud infrastructure services function on a pay-as-you-go basis, meaning businesses are charged solely for the resources utilized, eliminating the necessity of initial hardware investments. This method drastically reduces initial capital costs and grants companies the ability to adjust resource allocation as required. The absence of physical hardware purchases and maintenance further drives cost savings and enhances resource allocation efficiency. The pay-as-you-cross model offers extended flexibility and flexibility to evolving enterprise needs and avoids rigid infrastructure commitments. In essence, it fosters a greater inexpensive and efficient approach to IT infrastructure Management.

The digital revolution is helping to drive cloud infrastructure services. Businesses are prioritizing digital transformation, and cloud services are becoming important tools for this shift. Approximately 88.5% of enterprises are already or planning to shift towards Digital transformation, according to an IDG survey. Cloud services offer several advantages, on-demand resources, cost-efficiency, and a platform for rapid development. These benefits make the cloud perfect for businesses across industries to pursue digital initiatives. As the initiatives of digital transformation continue to rise, the cloud infrastructure services market is set to grow even bigger, providing the essential technological foundation for businesses in today's digital world.

Restrain

-

Concern related to data breaches and cyber threats is a major problem for considering cloud adoption.

-

Dependence on internet connectivity and shared sources in a cloud environment can lead to performance variability issues.

-

Some businesses may lack the internal expertise to manage and secure their cloud infrastructure effectively, this results in security risks and inefficiencies.

Market segmentation

By Service

-

Compute Service

-

Storage Service

-

Disaster Recovery and Backup Service

-

Networking Service

-

Desktop Service

-

Managed Hosting

Based on services market is divided into computing, storage, disaster recovery, networking, desktop, and managed hosting services. Organizations of all sizes and industries are adopting these services to boost efficiency, reduce server space costs, and ensure data accessibility. The disaster recovery and backup services are projected to have the highest growth rate during the forecast period, the storage services held the largest market share more than 28%. Cloud infrastructure services have become integral to business operations due to their user-friendly nature, cost-effectiveness, and adaptability.

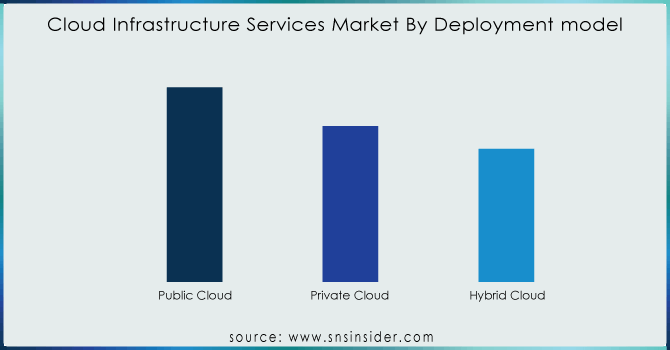

By Deployment model

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

Based on the deployment model the public cloud segment dominated the market and accounted for a revenue share of more than 39% in 2023, projected to maintain the largest market share. Among deployment models, the public cloud is noted for its simplicity, easy deployment, and minimal initial investment. Users benefit from scalability, reliability, flexibility, utility-style costing, and location-independent services, without the burden of infrastructure management responsibilities.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Organization Size

-

Small and Medium-sized Enterprises (SMEs)

-

Large Enterprises

In 2023, the Small and medium-sized enterprises (SMEs) segment dominated the market and held the largest revenue share of more than 55% of the cloud infrastructure services market. These organizations are more and more recognizing the benefits of cloud offerings, together with advanced performance, less complicated scaling, and price savings. SMEs are turning to the cloud for diverse functions, along with storing information, hosting applications, and the usage of collaborative tools. This lets them compete more successfully with large companies. The growing trend of cloud adoption amongst SMEs highlights their knowledge of ways cloud offerings can facilitate their expansion and digital transformation.

The large enterprises segment is projected to grow with a Significant CAGR of 12.01% during the forecast period of 2024-2032. with their complex operations and vast IT needs, are important for the cloud infrastructure services market. These corporations require scalable, stable, and reliable cloud answers to manage their Complex infrastructure requirements. The trend among massive establishments is leaning in the direction of hybrid and multi-cloud strategies. This lets them hold essential data and applications on-website online while leveraging the cloud for flexibility. Additionally, there is a developing demand for specialized solutions catering to industry-specific demands. This reflects the numerous desires of big-scale agencies as they expand their cloud adoption strategies.

By Vertical

-

Banking, Financial Services, and Insurance (BFSI)

-

IT and Telecommunications

-

Government and Public Sector

-

Retail and Consumer Goods

-

Manufacturing

-

Energy and Utilities

-

Media and Entertainment

-

Healthcare and Life Sciences

-

Others

IT and telecommunications sectors dominate the market based on vertical and held the largest revenue share of more than 20% of the cloud infrastructure services market in 2023. This segment uses cloud services to create adaptable and efficient infrastructure. A significant trend within the IT & Telecom industry is the growing adoption of hybrid cloud models. This allows companies to balance security and performance by combining their existing infrastructure with cloud resources. This strategic technique increases flexibility, which is important for the dynamic nature of IT operations and the ever-changing needs of the telecommunications industry.

The retail segment is predicted to grow with a significant annual growth rate in the cloud infrastructure services market. The retail sector includes corporations that sell goods and services at once to purchasers. Retailers are turning to the cloud to enhance the experience of customers, improve supply chain operations, and power their structures of e-commerce. The primary trend in retail is the usage of cloud-based solutions in managing inventory, personalizing advertising campaigns, and turning in a seamless omnichannel experience. Cloud offerings permit shops to scale resources based totally on demand fluctuations, enhance operational efficiency, and stay agile in a swiftly evolving virtual retail environment.

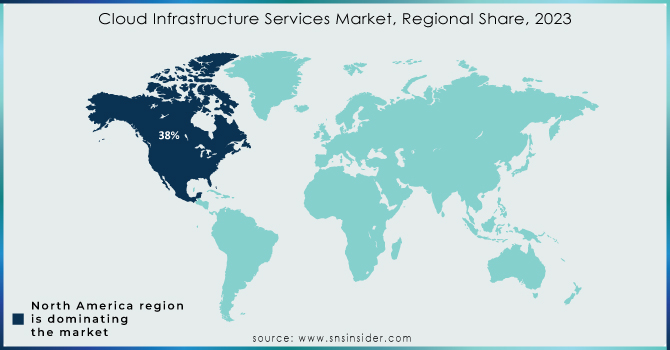

Regional Analysis

North America dominated the global cloud infrastructure services market and held a revenue share of more than 38%, driven by increasing widespread adoption of cloud-based IT services and substantial investments in IT infrastructure research and development. The U.S. dominates this industry, benefiting from key vendors' presence and a growing adoption rate of cloud services to cut data center costs and increase business continuity. Major players such as Google, Amazon, and Microsoft further Helps to drive market growth. Additionally, a focus on innovation, supportive rules, and heavy investments in cloud technologies further solidify their management.

The Asia Pacific (APAC) region is growing with a significant growth Rate with the highest expected compound annual growth rate (CAGR). The region's focus on rapid, cost-effective service delivery and security in cloud operations drives the global cloud infrastructure services market forward. This growth is driven by companies embracing digital transformation, widespread access to the internet, and a developing choice for cloud-based solutions. The APAC region's dynamic tech scene sees businesses increasingly Shifting towards the cloud for its flexibility, scalability, and cost-effectiveness. The ever-growing need for storage and processing of data, with the growing demand for edge computing, similarly fuels the capacity of the Asia-Pacific market.

Europe region is experiencing significant growth through a surge in virtual transformation tasks throughout various industries, various businesses are increasingly adopting cloud solutions that improve their scalability, agility, and cost-effectiveness. Factors such as the Increasing demand for remote work solutions, increasing data generation, and a focus on cybersecurity are accelerating cloud adoption. Additionally, strategic partnerships and expansions by fundamental cloud carrier vendors contribute to the region's significant market growth, solidifying Europe's major key region in the international digital economy.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are AWS, Microsoft, Google, IBM, Alibaba, Salesforce, Rackspace, Fujitsu, Digitalocean, Dell Technologies, Vmware, Hewlett Packard Enterprise (HPE), Red Hat, Oracle, SAP, Cisco Systems, Adobe, and other players mentioned in the final report.

| Report Attributes | Details |

| Market Size in 2023 | US$ 289.7 Bn |

| Market Size by 2032 | US$ 784.2 Bn |

| CAGR | CAGR of 11.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Service (Compute Service, Storage Service, Disaster Recovery and Backup Service, Networking Service, Desktop Service, Managed Hosting) • by Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud) • by Organization Size (Small and Medium-sized Enterprises (SMEs) and Large Enterprises) • by Industry Vertical (Banking, Financial Services, and Insurance (BFSI), IT and Telecommunications, Government and Public Sector, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Media and Entertainment, Healthcare and Life Sciences, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AWS, Microsoft, Google, IBM, Alibaba, Salesforce, Rackspace, Fujitsu, Digitalocean, Dell Technologies, Vmware, Hewlett Packard Enterprise (HPE), Red Hat, Oracle, SAP, Cisco Systems, Adobe |

| Key Drivers | • Cloud infrastructure services are cost-effective through pay-as-you-go models, Reducing the need for initial hardware investments. • Cloud services allow companies to scale their infrastructure up or down primarily based on demand, offering flexibility and agility. |

| Market Challenges | • There is a shortage of skilled professionals with expertise in cloud technologies, leading to challenges in implementation and management. • Migrating legacy systems and applications to the cloud can be complex, requiring careful planning and execution. |

Recent Development:

-

On 9 Apr 2024, IBM announced a new Cloud Multizone Region (MZR) in Montreal, Canada. This MZR will launch in the first half of 2025 and is designed to help businesses meet data sovereignty regulations and leverage technologies like generative AI with a secure cloud platform. This expansion will benefit all of Canada by providing a more robust cloud infrastructure.

-

In May 2023, Dell Technologies expanded its Dell APEX portfolio, offering new options for cloud platforms, public cloud storage software, client devices, and computing. This widens their existing as-a-service and multi-cloud offerings, allowing businesses to better manage and move their applications and data across data centers, public clouds, and client devices. This, in turn, could help businesses run and innovate faster.

-

Hitachi and Google Cloud announced a partnership to Improve their business innovation with generative AI On 29 May 2024. Hitachi will create a new unit to address challenges using Google Cloud's AI tools. This will improve Hitachi's Lumada business and benefit the Hitachi Group. They set up a business unit and an excellence center to expand Google Cloud tech to businesses. Hitachi will also include Google Cloud's AI training in its program. This will give large businesses the resources to improve their AI operations.