Smokeless Tobacco Market Report Scope & Overview:

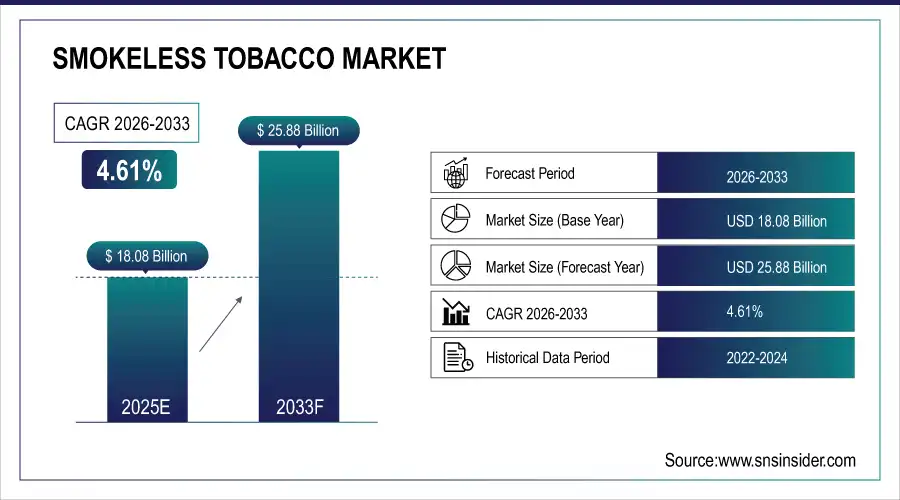

The Smokeless Tobacco Market size was valued at USD 18.08 Billion in 2025E and is projected to reach USD 25.88 Billion by 2033, growing at a CAGR of 4.61% during 2026-2033.

The Smokeless Tobacco Market analysis highlights the increased demand for items such as snus, chew and dissolvable is fueled by new flavors and ways of using the products that make it easy to consume on the run without anyone knowing. Nevertheless, growing regulatory strictness and health concerns still impede market growth.

In 2025, over 60% of smokeless tobacco users cited discretion and ease of use in public or workplace settings as key reasons for choosing snus, pouches, or dissolvable over traditional tobacco products.

Market Size and Forecast:

-

Market Size in 2025E: USD 18.08 Billion

-

Market Size by 2033: USD 25.88 Billion

-

CAGR: 4.61% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Smokeless Tobacco Market - Request Free Sample Report

Smokeless Tobacco Market Trends

-

Growing trend of flavored and segmented smokeless tobacco products targeting youth and improving consumer experience.

-

Growth in switchover from smoking to smokeless products on account of health consciousness and public smoking bans across the globe.

-

Robust expansion of the online and specialty retail segments that provide easy access and broader product selection to smokeless tobacco users.

-

Manufacturers are relying on advanced packaging, moisture retention and portion control technologies that support longer shelf life and usability.

-

Growth in the emerging markets, including India, Bangladesh, and Africa based on cultural acceptability; less stringent regulations.

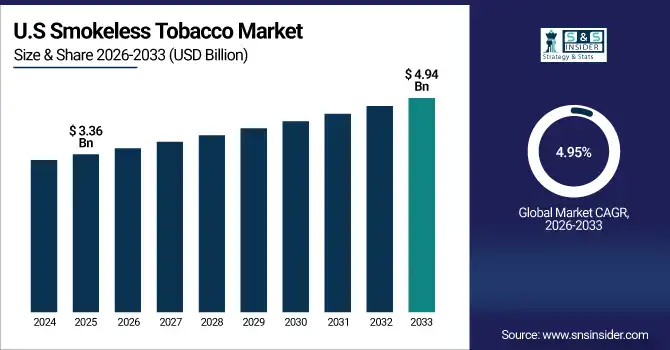

The U.S. Smokeless Tobacco Market size was valued at USD 3.36 Billion in 2025E and is projected to reach USD 4.94 Billion by 2033, growing at a CAGR of 4.95% during 2026-2033. Smokeless Tobacco Market growth is driven by increasing demand for moist snuff and nicotine pouches. As health consciousness and workplace smoking bans continue to rise, consumers are increasingly migrating towards smokeless alternatives. Behind the big brands is an increasing array of flavors and sleeker packaging to entice younger adult users.

Smokeless Tobacco Market Growth Drivers:

-

Rising Shift Toward Smoke-Free Nicotine Alternatives Due to Health Awareness and Smoking Restrictions

Growing health consciousness and tight smoking restrictions in public are leading consumers to choose smokeless tobacco products over cigarettes. Safer, more discreet alternatives such as snus and nicotine pouches have emerged. The expanding menu of flavors, doses and lower- moisture products is also luring spontaneity switchers such as Seds especially among young adults who are seeking a discreet, sleek and socially acceptable nicotine option.

In 2025, over 30% of adult smokers in regions with strict public smoking bans such as the UK, Scandinavia, and parts of the U.S. reported switching to snus or nicotine pouches as a perceived lower-risk alternative.

Smokeless Tobacco Market Restraints:

-

Stringent Government Regulations, Health Concerns, and Increasing Anti-Tobacco Awareness Campaigns Worldwide

The smokeless tobacco industry experiences severe challenges on account of stringent government regulations such as heavy excise duties, banning of advertisements and compulsory health warning. Greater awareness on oral cancer, gum diseases and nicotine addiction has been discouraging new users away from the category as well as reducing repeat purchases. Furthermore, public health organizations and international anti-tobacco movements are implementing smoking cessation programmes which contract product demand and restrict brand-building methodologies in developed as well as emerging markets.

Smokeless Tobacco Market Opportunities:

-

Product Innovation and Expansion into Emerging Markets with High Cultural Acceptance of Smokeless Tobacco

Manufacturers are developing products that include flavored pouches, biodegradable packaging and lowered-nicotine offerings to appeal to a wider range of consumers. Release LIVE Drugs continuous exposure among billions of people in developing markets throughout Asia, Africa and the Middle East, creates enormous growth potential based on cultural acceptance and price competitiveness. In these areas, strategic alliances, local product naming and digital marketing campaigns can markedly increase market access which has very good longer-term prospects for international snuff brands.

In 2025, over 60% of new smokeless tobacco launches featured flavored pouches, reduced nicotine levels, or biodegradable packaging to align with evolving consumer preferences and sustainability expectations in semi-regulated markets.

Smokeless Tobacco Market Segment Analysis

-

By type, Chewing Tobacco led the smokeless tobacco market with a 45.27% share in 2025, while Dissolvable Tobacco registered the fastest growth at a CAGR of 9.50%.

-

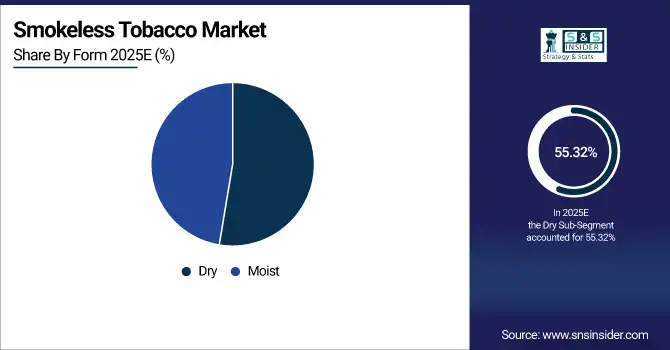

By form, Dry smokeless tobacco dominated the market with 55.32% share in 2025, whereas Moist products recorded the fastest growth with a CAGR of 8.20%.

-

By route, Oral consumption led the market at 60.51% in 2025, while Nasal products experienced the fastest growth with a CAGR of 9.26%.

-

By distribution channel, Supermarkets and Hypermarkets held 50.87% of the market in 2025, while Online Stores registered the fastest growth at a CAGR of 9.12%.

By Type, Chewing Tobacco Leads Market While Dissolvable Tobacco Registers Fastest Growth

Chewing tobacco leads the market due to higher consumption of smokeless tobacco predominated mainly by its strong cultural presence, availability and relatively cheaper cost especially in developing countries. It is still favoured by the purists. While, dissolvable tobacco is registering the highest growth rate on the back of discrete consumption, contemporary image, and flavors varieties and forms innovations. Abandoned one line You can see a "shine" and then an edit which addresses this at the end, but yes smoke-free Either way, favor for more convenient substitutes Making 'smokeless'.

By Form, Dry Dominate While Moist Shows Rapid Growth

By form, Dry segment leads the market as they have much greater shelf-life, are easier to store and produce at a cheaper price than wet ones. These products are notably popular in Asia and Africa, where traditional rural consumption patterns persist. While, Moist segment is growing quickly in popularity due to their increased hold on flavour and the milder taste experience: particularly of interest to those in North America and Europe. Various advantages of premium moist snuff and portioned pouches are gaining popularity, which is expected to push this segment in a positive direction.

By Route, Oral Lead While Nasal Registers Fastest Growth

The oral route is still dominating the market due to its familiarity, rich variety of flavors and cultural acceptance in a number of areas. Products including snus, chewing tobacco and moist snuff are popular for ease of use and satisfaction in nicotine. However nasal tobacco is the fastest growing, popular among niche customers for traditional and secretive tastes. So, product innovation particularly for powdered and dry snuff are also adding to its attractiveness in a few select European and Asian markets.

By Distribution Channel, Supermarkets and Hypermarkets Lead While Online Stores Grow Fastest

Supermarkets and hypermarkets are lead the market and largest smokeless tobacco outlets with wide range of products, promotional offers and consumers trust. These outlets are important as they help in brand presence and product availability more so in the urban and semi-urban areas. Meanwhile, on-line channels are growing fastest, enabled by rising e-commerce penetration and digital marketing and the convenience of home delivery. Smokeless tobacco sales are also being boosted by the growth in age-verified online services.

Smokeless Tobacco Market Regional Analysis:

Asia-pacific Smokeless Tobacco Market Insights

In 2025 Asia-Pacific dominated the Smokeless Tobacco Market and accounted for 41.79% of revenue share, this leadership is due to the consumption and market value as smokeless tobacco is widely popular in countries such as India and Bangladesh. High demand is maintained both in rural and semi-urban areas through cultural beliefs, ready availability and low price. Governments are regulating more strictly and adding warning labels, but it is still heavily used. Quick urbanization and expanding population rise are still driving the development of the market in general.

Get Customized Report as per Your Business Requirement - Enquiry Now

India Smokeless Tobacco Market Insights

India is one of the largest and most dynamic markets for smokeless tobacco worldwide, influenced by long-standing cultural habits and low cost. Gutkha, khaini and zarda are the most consumed products, specially in rural and semi-urban regions. Although government measures including bans on flavoured types and warnings of severe health risks.

North America Smokeless Tobacco Market Insights

North America is expected to witness the fastest growth in the Smokeless Tobacco Market over 2026-2033, with a projected CAGR of 5.14% due to wide product range, deep brand presence, and innovation in nicotine pouches and flavors. There is also a growing interest in reduced harm and smokeless products among consumers. The regulatory environment in the region is still strict and continues to affect product labeling and advertising. Nevertheless, premiumization, flavor news and sports marketing also help keep the category expanding and competitive.

U.S. Smokeless Tobacco Market Insights

The US smokeless tobacco market is mature with high levels of consumer loyalty to both moist snuff and snus products. The big players Altria, particularly in chew, and Reynolds American, for dip tend to dominate, supported by giant distribution networks and marketing campaigns. Growth is further supported by new product developments in portioned pouches and flavored products aimed at younger adults.

Europe Smokeless Tobacco Market Insights

The market for smokeless tobacco in Europe continues to rise, infrastructure including Sweden snus. EU restrictions significantly constrain product diversity and marketing flexibility, but demand for reduced harm products is rising. Its strengthened uptake in Nordic and Eastern Europe supports gradual market growth. Companies are concentrating on compliance and sustainable packaging to conform with regional requirements.

Germany Smokeless Tobacco Market Insights

In Germany smokeless tobacco is rapidly becoming one of Europe’s fastest-growing markets and increasingly is turning up in German convenience stores, fueled by growing acceptance for snus and nicotine pouches. Customers are taking up these products for a less harmful substitute to smoking in the name of convenience and avoiding public scrutiny.

Latin America (LATAM) and Middle East & Africa (MEA) Smokeless Tobacco Market Insights

The Smokeless Tobacco Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to growing slowly, promoted by high cultural acceptance among rural dwellers. Date palm and other forms of chewing tobacco are still widely consumed in countries such as Sudan, Yemen and parts of Brazil. Demand is upheld by cheapness, local production and weak enforcement of tobacco laws. But growing health consciousness and anti-smoking campaigns are finally starting to change the way doses are used.

Smokeless Tobacco Market Competitive Landscape:

Altria Group Inc. is the leading U.S. tobacco company that commands the smokeless tobacco category with Copenhagen and Skoal brands. Founded to obsess over new dairy products, taste and packaging. Aggressive product Innovation, Flavor diversification & Contemporary packaging. Altria is the Destination Altria is further broadening its portfolio with regard to oral nicotine choices as it goes after harm-reduction options, but it can still maintain a stranglehold on the market and remain profitable.

-

In September 2025, Altria entered a non-binding global collaboration memorandum of understanding with South Korea’s KT&G Corporation. This partnership aims to leverage complementary strengths in modern oral nicotine products, non-nicotine products, and traditional tobacco efficiency, supporting long-term growth opportunities.

British American Tobacco plc (BAT) is a major player in the world's smokeless tobacco and oral nicotine market. Its brands such as Velo and Lyft are leading its growth in contemporary, smoke-free categories. BAT’s spending in product development, sustainability and digital marketing enhances its competitive position in dynamic as well as mature markets.

-

In August 2025, BAT acquired an additional PACHA synthetic vape product, expanding its portfolio in the synthetic nicotine segment. This acquisition aligns with BAT's strategy to diversify its product offerings and strengthen its position in the evolving nicotine market.

Philip Morris International Inc PMI continues to shift focus from traditional combustible products and invest more in smoke-free alternatives such as snus and nicotine pouches, which are sold under the ZYN brand. The company is dedicated to the development of evidence-based products that meet regulation standards while striving for a smoke-free future. PMI’s growing distribution and marketing spend is still fueling strong growth for their oral tobacco alternatives.

-

In August 2024, PMI announced a $232 million investment through its Swedish Match affiliate to expand production capacity at its Owensboro, Kentucky facility. This expansion is expected to create 450 direct jobs and support the growing demand for smoke-free products.

Imperial Brands plc manufactures a broad range of smokeless and next-generation products including Skruf and Zone X, offering its solutions on the European and North American markets while advancing its vision through innovation and acquisitions. Its focus on harm reduction, product integrity and consumer satisfaction will continue to establish its leadership in the worldwide smokeless tobacco category.

-

In 2024, Imperial Brands launched its digital media platform for the Maverick brand. In 2025, the brand began a 21-state expansion initiative, aiming to increase its market presence and consumer engagement across the United States.

Smokeless Tobacco Market Key Players:

Some of the Smokeless Tobacco Market Companies are:

-

Altria Group Inc.

-

British American Tobacco plc

-

Philip Morris International Inc.

-

Imperial Brands plc

-

Swedish Match AB

-

Japan Tobacco Inc.

-

KT&G Corporation

-

Turning Point Brands Inc.

-

DS Group

-

Dholakia Tobacco Pvt Ltd.

-

Regie Nationale des Tabacs et des Allumettes

-

Kothari Group Ltd.

-

ITC Limited

-

Black Buffalo Inc.

-

Swisher International Inc.

-

Kretek International Inc.

-

Scandinavian Tobacco Group A/S

-

Mac Baren Tobacco Company A/S

-

Fiedler & Lundgren AB

-

Snus AB

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 18.08 Billion |

| Market Size by 2033 | USD 25.88 Billion |

| CAGR | CAGR of 4.61% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Chewing Tobacco, Dipping Tobacco, Dissolvable Tobacco, Snuff, Others) • By Form (Dry, Moist) • By Route (Oral, Nasal) • By Distribution Channel (Supermarkets and Hypermarkets, Tobacco Stores, Online Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Altria Group Inc., British American Tobacco plc, Philip Morris International Inc., Imperial Brands plc, Swedish Match AB, Japan Tobacco Inc., KT&G Corporation, Turning Point Brands Inc., DS Group, Dholakia Tobacco Pvt Ltd., Regie Nationale des Tabacs et des Allumettes, Kothari Group Ltd., ITC Limited, Black Buffalo Inc., Swisher International Inc., Kretek International Inc., Scandinavian Tobacco Group A/S, Mac Baren Tobacco Company A/S, Fiedler & Lundgren AB, Snus AB |