GPU As A Service Market Report Scope & Overview:

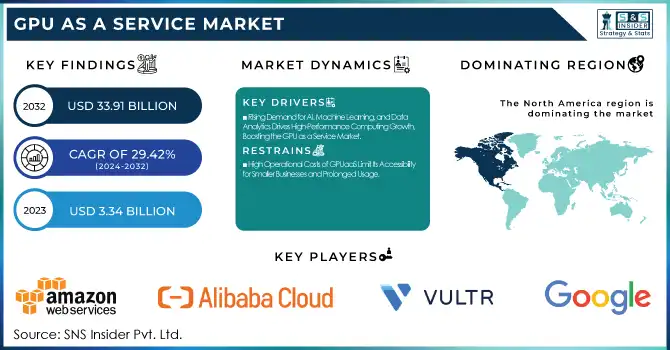

The GPU As A Service Market was valued at USD 5.59 billion in 2025E and is expected to reach USD 44.00 billion by 2033, growing at a CAGR of 29.42% from 2026-2033. This report includes key insights into adoption rates, highlighting increasing demand across industries such as AI and machine learning. It covers customer segmentation, with a focus on businesses seeking high-performance computing. Pricing trends reflect competitive models, while technological advancements in cloud infrastructure drive growth. Investment trends show a surge in funding, supporting innovation in GPU as a Service solutions, which are revolutionizing sectors like healthcare, automotive, and entertainment.

To get more information on GPU As A Service Market - Request Free Sample Report

GPU As A Service Market Size and Forecast:

-

Market Size in 2025E: USD 5.59 Billion

-

Market Size by 2033: USD 44.00 Billion

-

CAGR: 29.42% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

GPU As A Service Market Highlights:

-

Rising demand for AI and data analytics is driving the need for high-performance computing

-

High-performance GPUs enable faster computations and improved operational efficiency

-

GPUaaS provides cost-effective access to powerful GPU resources without large upfront hardware investments

-

High operational costs of cloud-based GPU usage can limit accessibility for smaller businesses

-

Growing adoption of edge computing is increasing demand for GPUaaS to process real-time data efficiently

-

GPUaaS offers scalable and agile computing solutions, reducing reliance on centralized data centers and lowering latency

GPU As A Service Market Drivers:

-

Rising Demand for AI, Machine Learning, and Data Analytics Drives High-Performance Computing Growth, Boosting the GPU as a Service Market

The fast growth of AI, machine learning, data analytics, and scientific computing is driving the demand for stronger computational capabilities to support intricate calculations. As companies more and more depend on these technologies to extract insights and improve operations, demand for high-performance computing keeps on increasing. GPUs, which possess the capabilities of parallel processing, play a pivotal role in driving these applications, far shortening processing time and enhancing efficiency. As companies look for economical alternatives to tap into the needed computational power, GPUaaS has emerged as an important solution, allowing organizations to harness the power of GPUs on-demand, without large upfront investment in physical equipment. This increasing dependence on HPC is a major driver for the GPUaaS market.

GPU As A Service Market Restraints:

-

High Operational Costs of GPUaaS Limit Its Accessibility for Smaller Businesses and Prolonged Usage

Although GPU as a Service (GPUaaS) eliminates the need for businesses to invest in expensive hardware, the operational costs associated with cloud-based GPU services can still be substantial. These costs are particularly high for prolonged or intensive computational workloads, as the pricing models for GPU-powered cloud services typically depend on usage time and resource consumption. For organizations that require continuous or large-scale GPU resources, these costs can quickly accumulate, creating a financial burden. This can limit the accessibility of GPUaaS for smaller businesses or startups that have limited budgets for IT infrastructure, potentially reducing the broader adoption of this service despite its flexibility and scalability.

GPU As A Service Market Opportunities:

-

Increased Adoption of Edge Computing Creates Growing Demand for GPU as a Service in Real-Time Data Processing

As edge computing gains ground, the requirement for high-performance computing to carry out computations closer to the point of data creation is on the rise. The transformation creates huge demand for resources based on GPU, which will support complex computing in real time, particularly across use cases such as autonomous driving, IoT endpoints, and intelligent cities. By making available mighty GPU resources on demand, GPU as a Service presents enterprises with an agile and scalable model for utilizing edge computing. With the capability to deploy high-performance GPUs on the edge, the need for centralized data centers is eliminated, enhancing efficiency and decreasing latency. As more industries embrace edge computing to enable quicker data processing, demand for GPUaaS will increase, opening the market's full potential.

GPU As A Service Market Segment Analysis:

By Enterprise Type

Large Enterprises dominate the GPU as a Service market due to their substantial computing requirements for complex tasks like AI, machine learning, and big data analytics. These organizations can afford the high operational costs associated with GPUaaS and have the infrastructure to support large-scale, GPU-powered cloud services. Their need for robust computational power and the ability to leverage advanced technologies drives their dominant revenue share in the market.

Small and Medium-sized Enterprises (SMEs) are expected to grow at the fastest CAGR due to the increasing accessibility of cloud-based solutions. SMEs are adopting GPU as a Service to access high-performance computing resources without significant upfront costs, enabling them to scale their operations. As GPUaaS offers a cost-effective, on-demand model, SMEs can compete with larger enterprises in areas like AI, data analysis, and innovation.

By Deployment Model

The Public GPU Cloud segment dominated the GPU as a Service market due to its scalability, cost-effectiveness, and broad accessibility. Public cloud providers offer flexible pricing models, allowing businesses to pay only for the resources they use, which appeals to large enterprises and SMEs. The ability to scale computing power as needed, coupled with minimal capital investment, makes public GPU cloud services the preferred choice for organizations across various industries.

The Hybrid GPU Cloud segment is expected to grow at the fastest CAGR due to the increasing demand for a balance between public and private cloud benefits. Organizations seek hybrid models to combine the scalability of public cloud with the security and control of private cloud environments. This flexibility enables businesses to optimize costs and ensure better data management and compliance, driving the segment’s rapid growth.

By Application

The IT & Telecommunication segment dominated the GPU as a Service market due to the increasing demand for high-performance computing in networking, data centers, and telecommunications. Service providers in this sector require GPU-powered solutions for processing large datasets, supporting AI-driven applications, and managing complex network infrastructures. As telecom companies expand their 5G networks and implement AI-driven systems, GPUaaS has become an essential tool for enhancing operational efficiency.

The Healthcare segment is expected to grow at the fastest CAGR due to the increasing adoption of AI, machine learning, and big data analytics for medical research, diagnostics, and treatment planning. Healthcare organizations leverage GPU-powered cloud services for faster data processing, improved accuracy in diagnostic imaging, and the analysis of large patient datasets. As innovation in healthcare technologies expands, GPUaaS adoption accelerates, fueling rapid growth in the sector.

By Enterprise Type

Pay-per-use segment dominated the GPU as a Service market with the highest revenue share of about 69% in 2025 and is expected to grow at the fastest CAGR of about 30.20% from 2026-2033. The Pay-per-use model is popular due to its flexibility and cost-efficiency, allowing businesses to access high-performance GPU resources without significant upfront investments. This pricing structure aligns with the needs of companies that require scalable solutions for fluctuating workloads, especially small and medium-sized enterprises (SMEs) that have limited capital. The growth is driven by increasing demand for on-demand computing in AI, data analytics, and real-time processing applications. The ability to scale resources dynamically based on real-time requirements, coupled with the shift toward cloud adoption, is propelling the growth of this segment.

GPU As A Service Market Regional Analysis:

North America GPU As A Service Market Trends:

North America dominated the GPU as a Service market with a 37% revenue share in 2025 due to the region's strong presence in advanced technological sectors like AI, machine learning, and data analytics. The high adoption of cloud computing and strong infrastructure investments, especially in industries such as IT, telecommunications, and healthcare, further contributed to this dominance. Leading tech companies in the U.S. and Canada drive innovation in GPU-powered services, making North America a key market player.

Asia-Pacific GPU As A Service Market Trends:

Asia Pacific is expected to grow at the fastest CAGR of about 31.16% from 2026-2033 due to rapid technological advancements and increasing digital transformation in industries like healthcare, automotive, and manufacturing. The region’s growing adoption of AI, IoT, and 5G technologies, along with rising demand for high-performance computing, drives the need for GPUaaS. Additionally, government initiatives supporting technology innovation are contributing to the fast-paced growth in this region.

Europe GPU As A Service Market Trends:

Europe held a significant share of the GPUaaS market in 2025, driven by strong investments in AI, machine learning, and cloud computing infrastructure across countries like Germany, the UK, and France. The region’s focus on digital transformation in sectors such as automotive, finance, and healthcare, combined with robust government policies supporting technology adoption, contributes to steady market growth. Europe is expected to witness moderate growth as enterprises increasingly adopt GPU-powered services for high-performance computing needs.

Latin America GPU As A Service Market Trends:

Latin America is witnessing growing adoption of GPUaaS, particularly in sectors such as finance, healthcare, and manufacturing. Expansion of cloud infrastructure, rising interest in AI and high-performance computing, and increasing IT investments across countries like Brazil and Mexico are driving market growth. The region is expected to see consistent growth over the forecast period as enterprises leverage GPU-powered solutions to enhance computational efficiency.

Middle East & Africa (MEA) GPU As A Service Market Trends:

The MEA region is gradually emerging in the GPUaaS market, with growth fueled by increasing cloud adoption and AI integration in industries like oil & gas, finance, and government services. Investments in IT infrastructure, smart city initiatives, and data center expansion are driving demand for GPU-based services. The market is expected to grow steadily, supported by regional governments promoting technology-driven economic development.

Get Customized Report as per Your Business Requirement - Enquiry Now

GPU As A Service Market Key Players:

-

Alibaba Cloud (Elastic GPU, ECS GPU-optimized instances)

-

Vultr (GPU Compute Instances, Cloud GPU)

-

Linode LLC. (Linode GPU, GPU-Optimized Plans)

-

Amazon Web Services, Inc. (Elastic GPU, EC2 P3 Instances)

-

Google (Google Cloud GPU, Tensor Processing Units)

-

IBM Corporation (IBM Cloud GPU, Virtual Servers with GPU)

-

OVH SAS (GPU Cloud Instances, GPU Dedicated Servers)

-

Lambda Labs (Lambda GPU Cloud, Lambda GPU Workstations)

-

Hewlett Packard Enterprise Development LP (HPE GreenLake with GPU, HPE Cloud GPU Servers)

-

CoreWeave (GPU Cloud, Virtual GPUs)

-

Arm Holding PLC (Arm-based GPUs, Arm Compute Instances)

-

Fujitsu Ltd (Fujitsu Cloud GPU, Cloud Service with GPU)

-

HCL Technologies (HCL Cloud GPU, GPU-Optimized Virtual Machines)

-

Intel Corporation (Intel GPU Cloud Service, Xe Graphics Cloud Service)

-

Microsoft Corporation (Azure N-Series, GPU Virtual Machines)

-

NVIDIA Corporation (NVIDIA DGX, NVIDIA A100 GPU Cloud Instances)

-

Oracle Corporation (Oracle Cloud GPU, Virtual Machine GPU)

-

Qualcomm Technologies, Inc. (Snapdragon GPUs, Cloud AI Solutions)

-

Tencent Cloud (Tencent Cloud GPU, GPU Cloud Instances)

-

Huawei Cloud (Huawei Cloud GPU, Cloud GPU Servers)

-

Baidu AI Cloud (Baidu Cloud GPU, Cloud Computing with GPU)

-

Packet (Packet GPU, High-Performance GPU Instances)

-

DigitalOcean (DigitalOcean GPU, Cloud GPU Instances)

-

Rackspace (Rackspace GPU Cloud, GPU-Optimized Servers)

-

Scaleway (Scaleway GPU, Cloud GPU Instances)

-

Hetzner Online (Hetzner GPU Cloud, GPU Servers)

GPU As A Service Market Competitive Landscape:

-

In October 2024, Vultr introduced its GPU Stack and Container Registry, providing easy access to NVIDIA's NGC catalog of pre-trained large language models. This launch aims to accelerate AI and GPU-driven applications.

-

In January 2025, Qualcomm's Snapdragon X Series pushed the boundaries of the PC category with enhanced GPU performance, mini desktop designs, and NPU-powered AI capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 5.59 Billion |

| Market Size by 2033 | USD 44.00 Billion |

| CAGR | CAGR of 29.42% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Pricing Model (Pay-per-use, Subscription-based Plans) • By Deployment Model (Private GPU Cloud, Public GPU Cloud, Hybrid GPU Cloud) • By Enterprise Type (Small and Medium-sized Enterprises, Large Enterprises) • By Application (Healthcare, BFSI, Manufacturing, IT & Telecommunication, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alibaba Cloud, Vultr, Linode LLC., Amazon Web Services, Inc., Google, IBM Corporation, OVH SAS, Lambda Labs, Hewlett Packard Enterprise Development LP, CoreWeave, Arm Holding PLC, Fujitsu Ltd, HCL Technologies, Intel Corporation, Microsoft Corporation, NVIDIA Corporation, Oracle Corporation, Qualcomm Technologies, Inc., Tencent Cloud, Huawei Cloud, Baidu AI Cloud, Packet, DigitalOcean, Rackspace, Scaleway, Hetzner Online |