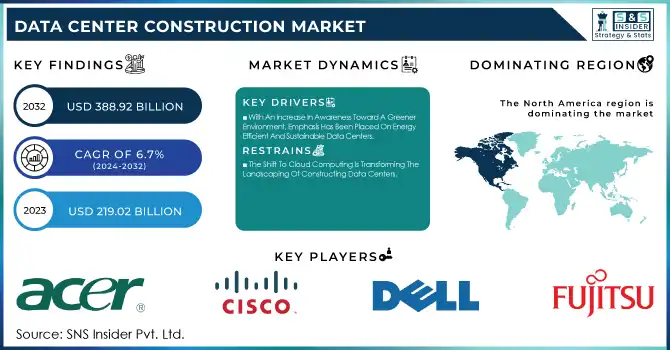

DATA CENTER CONSTRUCTION MARKET SIZE:

To get more information on Data Center Construction Market - Request Free Sample Report

The Data Center Construction Market Size was valued at USD 219.02 Billion in 2023 and is expected to reach USD 388.92 Billion by 2032 and grow at a CAGR of 6.7% over the forecast period 2024-2032.

The Data Center Construction Market has experienced tremendous growth in recent years, benefiting from a confluence of factors that reflect the growing demand for data processing, storage, and management capacity. Organizations of all sizes are embracing digital transformation, and the imperative for robust, scalable, and efficient data centers is more pronounced today than ever before.

The dramatic growth experienced by the data center construction market is attributable to the exponential rise in data generation coupled with an increasing demand for strong data processing and storage. According to the latest study, the world today generates approximately 463 exabytes of data every day, which further posits the insatiable appetite for data-handling infrastructure. This upward trend of data production is therefore catalyzed by the high proliferation of IoT devices, social media, streaming services, and enterprise applications. To this effect, with such high levels of data production, businesses require rugged data center solutions to help them handle, store, and process this information effectively. Notably, 90% of the data created in this world was in the last two years. This shows a trend of data-centric operation across every industry.

MARKET DYNAMICS

KEY DRIVERS:

-

With An Increase In Awareness Toward A Greener Environment, Emphasis Has Been Placed On Energy-Efficient And Sustainable Data Centers.

Data centers are huge consumers of energy, constituting 1-2% of the total electricity consumption around the globe. In this regard, sustainability is now being taken at the forefront of various organizations through renewable sources and energy-efficient technologies. For instance, the ratio of renewable energy-based data centers has risen highly in recent periods. This focus on sustainability not only meets the regulation and societal expectations but also enhances the reputation of the corporation along with operational efficiencies that further push investment in the construction of data centers.

The renewable energy landscape is moving at a lightning pace, with a strong effect on the sustainability of the data center construction market. In 2023, the renewable capacity stood at 3,800 GW globally, with solar and wind energy accounting for 80% of new installations, and investment in renewable energy technologies surged to almost USD 500 billion in 2022. Being energy-efficient is of greater importance nowadays; renewable sources are increasingly being integrated into data centers; over 40% of new data centers are designed to run on renewable energy; and that indicates a clear shift toward greener operations in the sector.

-

The Shift To Cloud Computing Is Transforming The Landscaping Of Constructing Data Centers.

Cloud migration has rapidly become the main mode by which most organizations are gaining flexibility, scalability, and cost efficiency. Consequently, hyperscale data centers are springing up to house the gigantic infrastructure needed to host their scale. This rapid growth requires intensive investment in new buildings of data centers, which will be capable of housing applications and services of the cloud, thus propelling the construction sector forward.

A boom in demand for cloud computing services can be observed from the rising construction of data centers. So robust infrastructure plays an important role in the digital economy. This landscape shows the evolution of hyperscale data centers, which have been rapidly increasing in its growth.

RESTRAIN:

-

The Impact of Compliance on Data Center Construction

Data centers are required to adhere to very strict rules regarding energy consumption and emissions as well as land use. Adherence to these regulations may add even more complexity to the construction project, not to mention increasing the cost, due in particular to the rising demand to make them greener and more earth-friendly.

Data centers are expected to consume 1,000 TWh by the year 2024 as this power estimation shows a sharp upsurge in energy demand due to increasingly stringent regulations pinning the facilities down for greater accountability. It consumes about 460 TWh today. That's 2% of all electricity consumed globally. Data centers in Ireland are expected to consume 32% of the country's electricity by 2026, increasing the stakes for adhering to energy efficiency regulations and leading by example through sustainable practices. This landscape significantly impacts construction costs and operational decisions within the data center sector.

KEY MARKET SEGMENTS

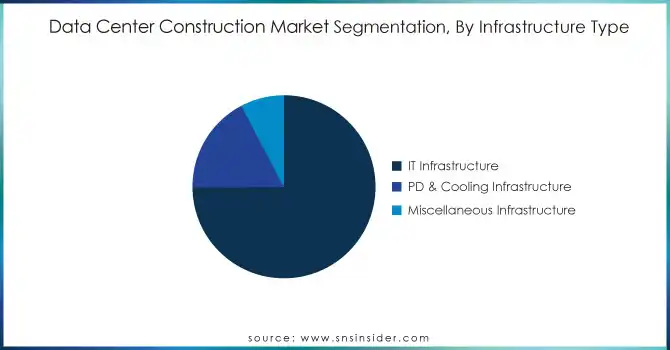

BY INFRASTRUCTURE TYPE

In 2023, the IT Infrastructure segment dominated with revenue share of 78%, This reflects its critical role in enabling organizations to leverage technology for better efficiency and innovation. Notable players, such as Cisco, Dell Technologies, and HPE, have significantly contributed to this space through their high-performance networking solutions and integrated systems focused on increased performance and scale. As of 2023, not more than 38 % of data centers meet local regulations, mainly attributed to building codes and environmental audits. Such compliance requirements may delay construction up to 25% and consequently cause project rollout delays and increase costs.

The PD and Cooling Infrastructure segment is poised for significant growth, with an impressive CAGR of 9.64% projected during the forecast period. Such development is being driven by the increase in demand for energy-efficient cooling solutions with the rapid growth and transformation of data centers.

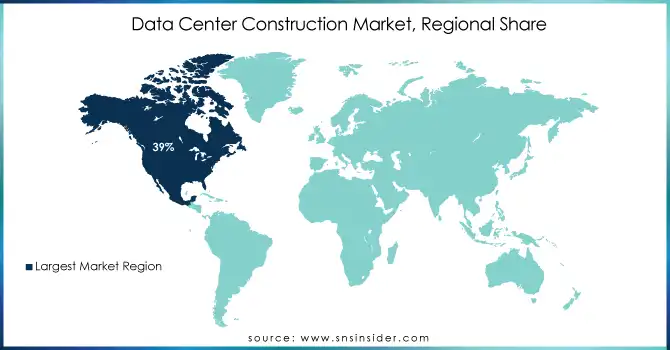

REGIONAL ANALYSIS

In 2023, North America emerged as the dominant region in the global data center construction market, capturing over 39% of the market share attributed to the fact that the region has been termed the technology and innovation hub, constantly fueling the need for advanced data infrastructure. market, bringing it to the forefront of technological advancements and infrastructural excellence. The domination is further sustained by the presence of such giants as Amazon and Microsoft, driving investments in the highly emerging spheres of cloud computing and AI technologies. By 2024, the region will spend more than USD 35 billion on building data centers.

In 2023, the Asia Pacific region emerged as the fastest-growing segment in the data center construction market, with an estimated CAGR of 8.30% from 2024 to 2032. This robust growth is mainly driven by various aspects, including rapidly data-centred expansion amid the increasing proliferation of smartphones, IoT devices, and digital applications. As of 2024, the Asia Pacific continues to power its expansion in the data centers construction market , with China remaining the region's leader, hosting 448 data centers. Japan is the next contender, with 218 data centers, a reflection of considerable investments endeavored in boosting data infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Data Center Construction Market are:

-

Acer Inc. (Acer Server Systems, Acer Storage Solutions)

-

Cisco Systems, Inc. (Cisco Data Center Network Switches, Cisco Data Center Interconnect Solutions)

-

Dell Inc. (Dell EMC PowerEdge Servers, Dell EMC Storage Solutions)

-

Fujitsu (Fujitsu PRIMERGY Servers, Fujitsu Storage Solutions)

-

Hewlett Packard Enterprise Development LP (HPE Synergy, HPE Apollo Servers)

-

Huawei Technologies Co., Ltd. (Huawei FusionServer, Huawei OceanStor Storage)

-

IBM (IBM Power Systems, IBM Storage Solutions)

-

Lenovo (Lenovo ThinkSystem Servers, Lenovo Storage Solutions)

-

Oracle (Oracle Exadata Database Machine, Oracle ZFS Storage)

-

INSPUR Co., Ltd. (INSPUR Servers, INSPUR Storage Solutions)

-

Ascenty (Ascenty Data Center Facilities, Ascenty Colocation Services)

-

ABB (ABB Data Center Power Distribution, ABB Data Center Cooling Solutions)

-

Hitachi, Ltd. (Hitachi Data Systems, Hitachi Storage Solutions)

-

Equinix, Inc. (Equinix Data Center Facilities, Equinix Colocation Services)

-

Gensler (Data Center Design and Architecture Services, Data Center Construction Management)

-

Schneider Electric (Schneider Electric Data Center Infrastructure, Schneider Electric Data Center Cooling Solutions)

-

HostDime Global Corp. (HostDime Data Center Facilities, HostDime Colocation Services)

-

IPXON Networks (IPXON Data Center Facilities, IPXON Colocation Services)

-

KIO (KIO Data Center Facilities, KIO Colocation Services)

-

Vertiv Group Corp. (Vertiv Liebert Data Center Infrastructure, Vertiv Geist Data Center Cooling Solutions)

RECENT TRENDS

-

In January 2024, Fujitsu said it had completed its third hyperscale data center in the Kansai region of Japan, designed to fuel the ever-increasing demand for cloud and AI infrastructure in the country. The facility is expected to help expand the company's strategy to boost Japan's digital transformation through energy efficiency and sustainability from renewable sources.

-

In October 2024, IBM inaugurated a new quantum data center in Ehningen, Germany, marking one of the major investments in Europe's quantum computing infrastructure. The facility forms part of IBM's commitment to scaling up its focus on quantum computing in the region, as it enables businesses and research institutions across Europe to access IBM's advanced quantum systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 219.02 Billion |

| Market Size by 2032 | US$ 388.92 Billion |

| CAGR | CAGR of 6.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Infrastructure Type (IT Infrastructure (Networking Equipment, Server. Storage), PD & Cooling Infrastructure (Power Distribution, Cooling) Miscellaneous Infrastructure) • By Tier Type (Tier 1, Tier 2, Tier 3, Tier 4) • By Vertical Type (IT & Telecom, BFSI, Government & Defense, Healthcare, Energy, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acer Inc., Cisco Systems, Inc., Dell Inc., Fujitsu, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., IBM, Lenovo, Oracle, INSPUR Co., Ltd., Ascenty, ABB, Hitachi, Ltd., Equinix, Inc., Gensler, Schneider Electric, HostDime Global Corp., IPXON Networks, KIO, Vertiv Group Corp. |

| Key Drivers | • Driving Sustainability: The Shift Toward Energy-Efficient Data Centers • Cloud Computing Revolution: Fueling the Growth of Hyperscale Data Centers |

| Restraints | • Navigating Regulatory Challenges: The Impact of Compliance on Data Center Construction |