GPU Mining Colocation Market Report Scope & Overview:

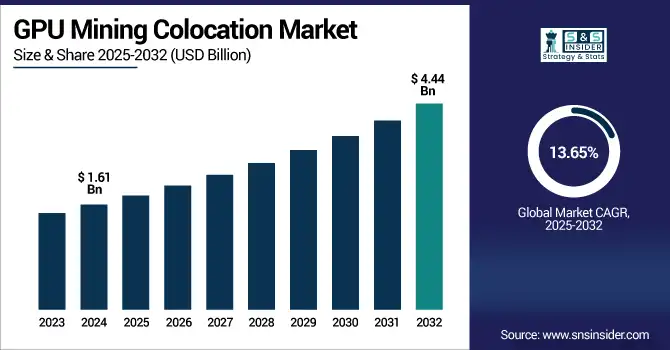

GPU Mining Colocation Market size was valued at USD 1.61 billion in 2024 and is expected to reach USD 4.44 billion by 2032, growing at a CAGR of 13.65% over 2025-2032.

To Get more information on GPU-Mining-Colocation-Market - Request Free Sample Report

The GPU Mining Colocation Market growth is expanding rapidly due to rising demand for high-performance computing in cryptocurrency mining. Colocation provides scalable infrastructure, efficient cooling, and stable energy without significant capital investment, as mining becomes power-intensive. The increased number of retail investors willing to participate in crypto, coupled with a growing interest from institutional investors, are driving demand for professional setups. Energy-efficient GPU hardware innovations and a growing preference toward managed and hybrid colocation models to increase efficiencies and lower expenses are helping to accelerate market growth making colocation a more appealing option for miners.

-

Bit Digital, for example, had deployed 50,044 miners by June 30, 2024, with a total hash rate of 4.3 EH/s (2.6 EH/s active), powered by approximately 86% carbon-free energy.

-

The U.S. Department of Energy also emphasizes that server utilization boosts GPU/server efficiency by ~50% when usage increases from 20% to 30%, highlighting the cost-performance optimization achievable through advanced colocation strategies.

The U.S. GPU Mining Colocation Market size was valued at USD 0.44 billion in 2024 and is expected to reach USD 1.20 billion by 2032, growing at a CAGR of 13.41% from 2025-2032.

The U.S. GPU Mining Colocation Market is growing due to rising crypto adoption, access to affordable renewable energy, and increasing demand for secure, scalable infrastructure. Institutional investments and advanced GPU technology further drive the shift toward professional colocation services.

Market Dynamics:

Drivers:

-

Rising Demand for Scalable, High-Density Infrastructure is Accelerating Adoption of GPU Mining Colocation Across Crypto and AI-Driven Workloads

The increase of GPU-intensive workloads such as crypto mining and generative AI has generated urgent demand for colocations that can scale near term. Many modern GPUs require high power density and high cooling thresholds ill-suited to legacy on-prem configurations. It is even more important for ensuring continuous mining, which is why these facilities have a robust physical infrastructure, 24/7 electricity supply, and backup cooling solutions. As such, it allows for miners to scale quickly at a lower cost of capital with greater operational efficiency. With an in-depth cost-benefit and performance advantages, the colocation segment is growing at a faster pace due to robust retail and institutional mining operations.

-

Hut 8’s Vega data center, a 162,000 ft² liquid-cooled facility powered by 205 MW, supports approximately 15 EH/s of compute representing nearly 2% of global Bitcoin hashpower.

-

Similarly, Bit Digital signed two GPU-cloud deals in Q1 2025 deploying 616 NVIDIA H200 GPUs, generating an estimated USD 20.9 million in annualized revenue under long-term contracts.

Restraints:

-

High Capital and Operational Expenditure in Colocation Setups Continue to Deter Small-Scale or Independent GPU Miners from Entry

Colocation delivers performance and efficiency, but high upfront and ongoing costs represent a major barrier to entry. Colocating GPU rigs will incur upfront costs for shipping, installation of hardware, monthly rental of rack space in a data center, and repair. This is compounded by rising crypto prices, which affect miner ROI. For small or solo miners, however, these economic factors often outweigh the benefits. Additionally in some colocation markets the absence of flexible pricing models or volume discounts limits their availability, forcing the ecosystem to be populated by well-capitalized actors.

-

For instance, Bit Digital’s accounts payable rose by USD 1.1 million in 2024, largely due to maintenance costs associated with mining, cloud, and colocation operations.

-

Base rate of USD 102 per kW per month with a 10-kW minimum, while even a small 1.4-kW Antminer S9 unit can cost around USD 143/month plus a USD 31.55 setup fee. Providers, such as AceHost and others often set minimum thresholds or long-term contracts, further excluding smaller operators from access to professional colocation services.

Opportunities

-

Increased Adoption of Blockchain Technologies Beyond Cryptocurrencies is Expanding the Use Case for GPU-Based Colocation Services

With the expansion of blockchain into finance, healthcare, logistics and entertainment, parallel processing power on GPU are in demand. GPU mining colocation centers started with a crypto-only focus but have since shifted to evolve into high-performance compute hubs for smart contracts, tokenization, and decentralized apps. This will allow providers to not only penetrate enterprise clients, but also generate revenue streams outside of the ever-changing crypto markets. In the meantime, this growing demand of scalable and efficient infrastructure in hybrid blockchain environments boosts the long-term need for co-located GPUs. Such diversification enables providers to leverage larger trends, such as digital transformation and enterprise-grade blockchain.

-

VanEck estimates that by redeploying just 20% of current bitcoin miner capacity for AI and HPC workloads, companies could unlock an estimated USD 37.6 billion in net present value by 2027.

-

Additionally, BCG projects that global data center power demand will grow approximately 16% annually from 2023 to 2028, driven primarily by enterprise and AI workloads indicating sustained infrastructure demand for compute-intensive blockchain applications.

Challenges

-

Hardware Obsolescence and Rapid Innovation Cycles Challenge Colocation ROI and Asset Lifecycle Planning for GPU Miners

The rapid pace of development in the GPU industry, as large improvements in performance happen every 12-18 months, makes colocating older hardware increasingly noncompetitive. Miners with older GPUs suffer from reduced efficiency and profitability, and long-term colocation contracts may not be conducive with fast hardware turnover. This discrepancy also creates ROI risk, which may result in expensive premature upgrades or renegotiations. Colocation providers put up or die. Without that flexibility, both miners and server vendors become stuck with stranded investments and at risk of falling behind the game when it comes to the dynamic GPU compute space.

Segmentation Analysis:

By Service Type

Managed Colocation led the GPU Mining Colocation Market share in 2024 with a 47%, due to its multi-faceted provision of services such as infrastructure, maintenance and security. This market share segment caters to the miners who want minimal operational disturbance and need to concentrate on mining, leaving the technical mechanics, uptime and power redundancy to the colocation provider for a steady performance in a high-stake crypto mining atmosphere.

Hybrid Colocation is expected to grow at a CAGR of 15.70% over 2025-2032 owing to the fact that it combines both self-managed and provider-managed resources. Providing miners with advanced configurations and operational control along with professional infrastructure support to achieve cost effectiveness and scalability while optimizing performance for complex or multi-coin mining projects

By Mining Type

Altcoin Mining held the dominant revenue share of 52% in 2024 as miners continued to diversify away from Bitcoin and toward other GPU-compatible altcoins. The altcoins mentioned above present much lower entry barriers, a higher transaction throughput and algorithmic convenience of GPU rigs which is why they are very appealing to both inexperienced and experienced miners wanting to optimize profits in a volatile crypto climate.

Ethereum Mining is projected to grow at the fastest CAGR of 17.33% over 2025-2032 due to Ethereum forks and Layer-2 projects not utilizing the proof-of-stake consensus yet continuing to use a GPU-compatible proof-of-work algorithms. The growth of decentralized applications and the recovery of an Ethereum network keep the demand for Ethereum-oriented mining, especially in GPU-friendly colocation centers.

By End-User

Mining Farms dominated the market with a 53% revenue share in 2024 owing to their extensive scales, optimized supply of GPUs, and financial backing. They capitalize on economies of scale and resource access to less expensive power sources to provide better efficiency and more uptime, making colocation a cheaper means for creating a space where they can maximize output while minimizing overhead.

Enterprises are expected to grow at the fastest CAGR of 15.29% over 2025-2032 as more enterprises begin to experiment with blockchain infrastructure and decentralized compute strategies. As institutional interest in digital assets and Web3 infrastructure intensifies, enterprises need a dependable, secure, and scalable GPU colocation to host internal blockchain nodes, smart contract platforms, and private mining farms.

By Facility Size

The Medium segment led with a 46% revenue share in 2024, driven by mid-size mining operations seeking a balance between cost and compute capacity. These setups are large enough to benefit from colocation efficiencies but small enough to remain agile in shifting market conditions. They represent the backbone of the sector, with stable investment and consistent mining throughput.

Large segment is anticipated to grow at a CAGR of 15.03% over 2025-2032 due to the rising installations of this ultra-large setup for GPU farms and AI focused colocation centers. Colocation providers have begun to ramp up high-density power and cooling in many of their large-scale data centers, which are well suited for these types of setups. This segment is also supported by partnerships with industry players and government initiatives for large-scale compute centers.

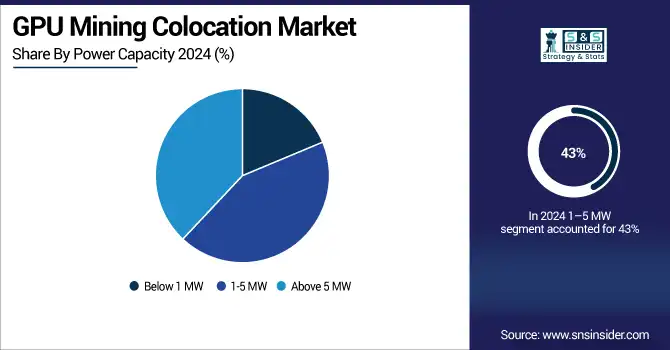

By Power Capacity

The 1–5 MW segment dominated in 2024 with a 43% revenue share, due to its compatibility with the majority of mid-to-large mining needs. This power range strikes a balance between the scalability required for decentralized mining farms and dedicated blockchain infrastructure projects and the cost that does not raise unnecessary regulatory attention or the permitting challenges associated with larger installations.

Above 5 MW segment is projected to grow at a CAGR of 14.83% during 2025-2032 due to increasing deployment of ultra-large GPU farms and AI-focused colocation centers. These setups require high-density power and cooling, which large-scale colocation facilities are increasingly equipped to provide. Strategic partnerships and government support for industrial-scale compute centers also support this segment’s expansion.

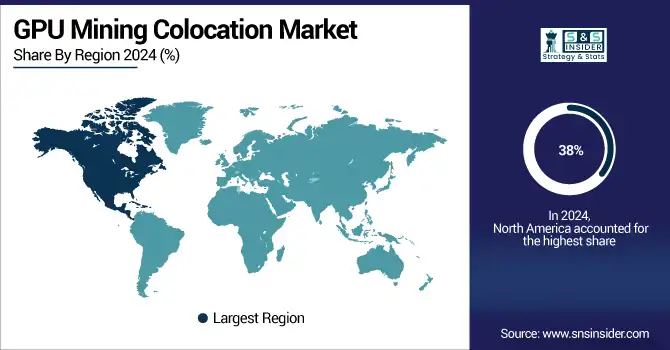

Regional Analysis

North America dominated the GPU Mining Colocation Market in 2024 with a 38% revenue share, owing to the abundance of renewable energy at low costs, well-developed digital infrastructure and, a clear regulatory framework across major countries such as the U.S. and Canada. North America is also led in high-performance, energy-efficient, GPU mining operations, thanks to a burgeoning number of established colocation providers and institutional miners.

The U.S. is dominating the GPU Mining Colocation Market due to its abundant renewable energy, strong infrastructure, and favorable regulatory environment.

Asia Pacific is projected to grow at the fastest CAGR of 15.41% during 2025-2032, owing to the rising investments in digital assets in the region, and the growing data center capacity in countries, such as Kazakhstan, Malaysia, and India, where electricity costs are also comparatively low. Growing government interest in blockchain and AI use cases contributes to demand for scalable GPU infrastructure across the fast-digitalizing economies in the region.

China is dominating the GPU Mining Colocation Market in Asia Pacific due to its large-scale mining infrastructure, affordable electricity, and established hardware supply chains.

Europe holds a strong position in the GPU Mining Colocation Market owing to its digital infrastructure, increasing energy-efficient mining of GPUs, and demand for Blockchain technologies across a wide range of sectors under supportive regulation and sustainability.

Germany is dominating the GPU Mining Colocation Market in Europe due to its advanced data center ecosystem, reliable power grid, and strong industrial mining presence.

GPU mining colocation market trends indicate strong growth in Latin America and the Middle East & Africa, fueled by low-cost energy, enhanced digital infrastructure, and rising interest in crypto mining as a driver of economic and technological advancement.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

GPU mining colocation market companies are CoreWeave, ZoomHash, MegaVolt Mining, Infinity Data Center / Webservio, AceHost, Whitelabel IT Solutions, Coolhousing, Colocation America, Core Scientific, Hut 8 Mining, Hive Digital Technologies, Bit Digital, Iris Energy, HostRunway, ColocationPLUS, CloudKleyer, Veloxty, Bit Capital Group (BitCap), TensorDock, OneMiners, and others.

Recent Developments:

-

2025: CoreWeave became the first hyperscaler to deploy NVIDIA GB300 NVL72 GPUs globally, collaborating with Dell, Switch, and Vertiv. The deployment earned a Platinum GPU Cloud ClusterMAX rating for advanced AI infrastructure performance.

-

2024: CoreWeave partnered with MERLIN Edged to launch an innovative, zero‑water AI data center in Barcelona. This sustainable facility supports large-scale GPU workloads while enhancing Europe's AI infrastructure with eco-efficient cooling technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.61 Billion |

| Market Size by 2032 | USD 4.44 Billion |

| CAGR | CAGR of 13.65% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Managed Colocation, Unmanaged Colocation, Hybrid Colocation) • By Mining Type (Bitcoin Mining, Ethereum Mining, Altcoin Mining, Others) • By End-User (Individual Miners, Mining Farms, Enterprises) • By Facility Size (Small, Medium, Large) • By Power Capacity (Below 1 MW, 1–5 MW, Above 5 MW) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | CoreWeave, ZoomHash, MegaVolt Mining, Infinity Data Center / Webservio, AceHost, Whitelabel IT Solutions, Coolhousing, Colocation America, Core Scientific, Hut 8 Mining, Hive Digital Technologies, Bit Digital, Iris Energy, HostRunway, ColocationPLUS, CloudKleyer, Veloxty, Bit Capital Group (BitCap), TensorDock, OneMiners |