5G Chipset Market Size:

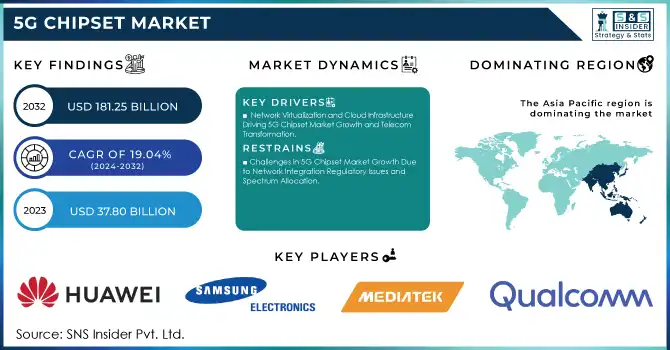

The 5G Chipset Market Size was valued at USD 37.80 Billion in 2023 and is expected to reach USD 181.25 Billion by 2032 and grow at a CAGR of 19.04% over the forecast period 2024-2032.

Get more information on 5G Chipset Market - Request Sample Report

Demand for faster, more reliable, and efficient communication networks is skyrocketing 5G chipset market is expanding well with profitability. 5G technology is witnessing a wave of innovation among the services and applications it is being integrated into as it offers higher speeds, low latency, and wider bandwidth than earlier generations of mobile networks. Consequently, there has been a consistent increase in the adoption of 5G-capable devices such as smartphones, tablets, wearables, and connected cars, driving the need for high-performance chips that can handle these high-performance applications. Moreover, industries such as IT & Telecoms, manufacturing, and health care are adopting 5G to improve operational efficiencies, real-time data transmission, and raising the Internet of Things (IoT). Global 5G connections neared 2 billion by Q1 2024, having added 185 million connections in the quarter. Global shipments of 5G-enabled smartphones are estimated to reach 50% by the end of 2024. By the year 2025, the globally connected car count is expected to be more than 400 million, while V2X communication has become possible with the technology of 5G. With increased health monitoring and data processing capabilities, the market for 5G-enabled wearables is predicted to pass the 200 million units mark in 2025.

Additionally, an increasing number of new applications such as augmented reality (AR), virtual reality (VR), smart cities, and autonomous vehicles are also aiding the growth of this market. The technologies require high-speed data processing and low latency, which can only be achieved with 5g chipsets. As telecommunications providers and industries continue to invest in infrastructure for deploying 5G networks, the market for advanced chipsets will surely expand as well. Rapidly evolving consumer use cases and ongoing worldwide rollout of 5G infrastructure will likely keep the 5G chipset market on its growth spurt for years to come. Global investment in smart city technologies could be as high as USD 2.7 trillion by 2025, requiring 5G networks to process 5G data in real-time. In 2030, there will be 30 million autonomous vehicles on the road, and it is 5G that will take care of V2V and V2I communication. At a global level, as of 2023, there are 25.6 million 5G IoT connections on the planet and this number is expected to continue rising, especially as 5G solely device-enabled devices increase.

5G Chipset Market Dynamics:

KEY DRIVERS:

-

Network Virtualization and Cloud Infrastructure Driving 5G Chipset Market Growth and Telecom Transformation

Demand for network virtualization and cloud-based infrastructure will be one of the important markets driving the growth of the 5G chipset market. As 5G comes into play, telecom companies are more and more transitioning toward virtualized and would reasonably be able to cloud local arrange engineering. This shift allows networks to be built in a more scalable, flexible, and cost-effective manner, with 5G chipsets playing a significant role in enabling this transition. Cloud tech enables operators to support larger volumes of data traffic and deliver a better-performing network without the investment in new hardware. Moreover, network slicing where a physical network is partitioned into multiple virtual networks for different needs depends on 5G chipsets to control the dynamic allocation of data channels, optimizing resource use for specific services. This change in the network infrastructure is fueling the need for these types of advanced chipsets, for them to be able to support these technologies. A 5G-enabled edge cloud infrastructure and network slicing will be required to handle the onset of 5G global data traffic which is expected to surpass 60 exabytes per month by 2025. It is expected that 60% of the infrastructure will be moved to cloud environments, which will provide scalability and also reduce hardware expenses, by 2025 for the telecom companies. Telecom operators will spend more than USD 2 billion on network function virtualization (NFV) technologies by 2024, helping to fast-track the migration to cloud-native architecture.

-

Rapid 5G Expansion in Developing Economies Driving Demand for Low-Cost Chipsets and Devices

With more 5G networks being deployed across the world, especially in developing economies, the technology is rolling out faster than anticipated to help close the digital divide. Coupled with that, these regions are laying large amounts of investments in constructing 5G infrastructure to grow economic growth and enhance connectivity and emerging industries. The ramp-up of 5G in these markets will create strong demand for low-cost 5G chipsets capable of serving a wide array of devices from smartphones to industrial IoT systems. Moreover, as mobile operators and service providers from such areas roll out affordable 5G plans, there will be significant growth in the shipment of 5G-enabled devices, thus escalating the demand for chipsets. There are numerous reasons to believe that the 5G expansion effort towards emerging economies will expedite the rollout of 5G infrastructure to reach new heights in the chipset market. Connections Global 5G connections grew to 2 billion in Q1 2024, with 185 million new connections added in that quarter. In SA, MTN launched the MTN Icon 5G smartphone (opens in new tab) available at just 2,499 rand (~USD 138), making it easy for more users to experience 5G. In addition, Ericson won a contract to supply 5G equipment to Vodafone Idea in India for USD 3.6 billion Africa will hit the milestone of more than 150 million 5G subscriptions by 2027, compared to fewer than 4 million in 2023. In 2024, more than 50 mobile operators in high-growth markets initiated 5G trials and services.

RESTRAIN:

-

Challenges in 5G Chipset Market Growth Due to Network Integration Regulatory Issues and Spectrum Allocation

The complexity of network integration and interoperability is one of the major challenges that are hindering the growth of the 5G chipset market. Even as 5G networks are rolled out around the world, it is not trivial to match new 5G chipsets to existing infrastructure. Telecom operators need to ensure that 5G devices and networks work with existing systems and can transfer between different frequency bands and across regional transportation. That is a huge leap in technology with a great deal of testing needed to ensure that devices can perform consistently and reliably across diverse network landscapes. The other 5G chipsets supporting issues are regulatory and spectrum allocation. The distribution of the 5G spectrum in each country is regulated and each government has different policies over time, causing a delay in the development of 5G networks. Governments around the world need to find ways to deal with these regulatory barriers and provide spectrum availability, which will influence the opportunity of 5G networks and hence the availability and uptake of 5G chipsets internationally.

5G Chipset Market Segmentation:

BY TYPE

Radio Frequency Integrated Circuits (RFICs) led in 2023, with a total market share of 41.5%, due to their role as the backbone of 5G communication systems by providing continuous signal processing across multiple frequency bands. RFICs have led to an increase in RFIC demand due to the need to deploy 5G infrastructure including macro base stations, small cells, etc, and densify existing networks, with the use of RFICs necessary for both uplink and downlink. This trend combined with the transition to high-frequency bands such as millimeter wave (mmWave) means that RFICs must address moving forward increasingly complex RF challenges, including signal loss and interference. The RFICs also facilitate MIMO (Multiple-Input Multiple-Output), which provides faster transmission speed and efficient spectral usage. This versatility in supporting various devices from smartphones to industrial IoT applications cements their place as the dominant players in the market.

Modems are projected to register the highest CAGR from 2024 to 2032 attributed to their key function in supporting 5G connectivity among consumers and enterprise devices. As the global race towards adoption heats up, there will be a significant rise in demand for devices that support embedded 5G modems smartphones, tablets, laptops, and wearables. In addition, the modem technology development like mmWave supporting and Sub-6 GHz frequency and dynamic spectrum sharing is extending their boundary and usage. The 5G modems enable high-speed, low-latency connectivity that is critical for emerging applications such as augmented reality (AR), virtual reality (VR), autonomous vehicles, and industrial IoT. The modem sector buried the record and is the fastest-growing category in the market increasingly driven by the lower cost of 5G devices, paired with the deployment of 5G networks in developing economies.

BY DEPLOYMENT TYPE

Smartphones and tablets dominated the 2023 market share with 43.2%. Consumer demands for higher internet speeds, better streaming, and an upgrade to mobile gaming have played a large role in the transition from 4G to 5G. For example, many of the most popular smartphone makers released 5G-compatible devices, including low-cost offerings aimed at emerging markets. We adopt these devices, thanks to their ubiquitousness and the speed of 5G network rollout. The telecom operators have also aggressively marketed 5G-capable handsets by bundling them with competitive 5G data tariffs, forcing their dominance on the market. There were other tablet beneficiaries from this type of development, especially in the educational, enterprise, and entertainment sectors, where mobility and new levels of connectivity made a lot of sense.

Connected devices which include IoT devices, wearables, smart home devices, and industrial IoT applications, will continue to experience the fastest CAGR growth based on increasing IoT ecosystem and reliance on 5G. With ultra-low latency, massive device connectivity, and reliable communication delivering new use cases for connected devices in areas such as healthcare, manufacturing, and transportation, 5G networks is enabling these capabilities at scale. The growth of things such as 5G-enabled wearables improve real-time health monitoring, and smart home devices are also aided by 5G with better integration for advanced automation. The use of the 5G technology in Industrial IoT, especially for manufacturing and logistics, is advancing smart factories, predictive maintenance, and real-time supply chain tracking. Rapid growth in the number of 5G-enabled IoT devices deployed in both consumer and enterprise sectors is helping propel their fast-growing adoption rate, making connected devices a major market growth driver in the following years.

BY PROCESSING NODE

In 2023, 7 nm processing node accounted for 57.5% of the market share as it is the standard for advanced semiconductor manufacturing. The sub-6GHz band is the perfect mix of speed, power consumption, and price, and is the most common frequency in 5G chipsets, and for phones, tablets, and IoT devices. This makes it a popular choice among OEMs for handling high frequencies, enabling complex tasks, including those driven by AI, and supporting high-speed connectivity with 5G. 7nm li technology also reached mass production maturity which also guarantees cost efficiency and high yields and 7nm li 2WD also further strengthens market dominance. The 7 nm process has become the most advanced technology used to manufacture 5G chipsets, as major leading semiconductor houses such as TSMC and Samsung have optimized their 7 nm processes.

The 10 nm processing node is projected to witness the strongest CAGR over the forecast period from 2024-2032, as its use in particular 5G applications will continue to increase, as end-users are looking for cost-effective solutions, requiring the utmost performance. With 5G rolling out into emerging markets and consumer demand for low-power, lower-cost devices on the rise, 10 nm chipsets offer a sweet spot in delivering enough performance for the company's true mainstream devices at a more economical production cost. Moreover, the original 10 nm is starting to support more energy-efficient designs too, which could be of real interest to IoT and connected devices with strict power efficiency requirements. Also, with the semiconductor industry tightening its manufacturing processes, the 10 nm node is becoming popular for mid-range 5G devices which will make sure that we will see fast adoption and growth of this node in the following years.

BY OPERATING FREQUENCY

In 2023, the Sub-6 GHz frequency band occupied a substantial share of 53.6%, as it is generally used in the first stage of 5G network construction. The frequency range strikes a balance in coverage and performance, making it suitable for wide deployment in urban, suburban, and rural areas. The frequency is widely used by telecom operators who are seeking to provide wider 5G coverage, thanks to its provision of more reliable connectivity over longer ranges and through obstacles such as buildings. Furthermore, the Sub-6 GHz frequency band is largely compatible with 5G devices like smartphones, tablets, and IoT devices, which supports its prevalence. In addition to this, Governments and regulatory bodies have also dedicated Sub-6 GHz spectrum on higher priorities, and hence expect fast deployment around the world.

The 24–39 GHz frequency band, under the millimeter wave (mmWave) spectrum, is expected to have the fastest growth rate (CAGR) from 2024 to 2032 because it provides ultra-high data rates with lower latency. This spectrum band is getting widely adopted for high-capacity use cases including its usage in enhanced mobile broadband, fixed wireless access, and industrial automation. As telecom infrastructure matures, operators are turning to 24 – 39 GHz to serve high-bandwidth applications in dense urban areas, large stadiums, and smart-city deployments. Additionally, the emergence of advanced antenna technologies (e.g., Massive MIMO, beamforming) is addressing issues of limited range and dependence on line-of-sight conditions, further unlocking mmWave deployments. With the increase in penetration of mmWave-enabled devices and the increasing investments in 5G infrastructure worldwide.

BY VERTICAL

In 2023, IT & Telecom led the market share with 38.6% as 5G acts as a catalyst to adopt new technology. The big stakeholders in deploying and utilizing 5G networks to improve communication services, data transfer speed, and network reliability are telecom operators and IT companies. 5G-enabled devices are being deployed in droves and the sector has poured heavily on the associated infrastructure, including base stations and small cells, along with cloud-native and containerized architectures. In addition, the IT & Telecom sector gains from the immediate requirement for improved network capabilities needed to enable applications like cloud computing, video conferencing, and remote work, which experienced a sharp rise after COVID-19. IT & Telecom firmly held a strong place in the market, as they require 5G connectivity for smooth functioning.

The Manufacturing industry is projected to dominate the CAGR for 2024 to 2032 owing to the rise in the deployment of 5G-driven smart manufacturing tools. With 5G connectivity that enables time-sensitive applications such as real-time monitoring, predictive maintenance, and automation, factories can streamline operations, improve efficiency, and lower costs. As Industry 4.0 ramped up, manufacturers are using 5G for industrial IoT (IIoT) solutions, robotics & augmented reality (AR) for assembly & quality control. In addition, the high speed and high reliability of 5G networks are an ideal environment for enabling innovative technologies like digital twins and autonomous systems in manufacturing. Due to the quest for global competitiveness, investors are channeling funds into 5G for industrial automation through better-functioning manufacturing, which is projected as a high-growth vertical in the future.

5G Chipset Market Regional Analysis

Asia Pacific contributed to 43.3% of the total share of the 5G chipset market in 2023, which can be attributed to its high 5G adoption along with superior manufacturing skills in the region. Nations like China, South Korea, and Japan are at the forefront of the development of 5G networks. China Mobile, China Telecom, and China Unicom combined deployed hundreds of thousands of 5G base stations, establishing China as the largest 5G market in the world. With major telecom companies such as SK Telecom and KT Corporation pioneering 5G-based applications, including gaming and VR, South Korea became the first nation to offer nationwide 5G services in October 2023. Japan, too, has pumped money into 5G in readiness for mass-scale events such as the Olympics, where NTT Docomo and KDDI are boosting 5G usage across consumer and industrial markets. On top of that, Asia Pacific is already leading in global semiconductor manufacturing as TSMC and Samsung secure their dominance in the 5G chipset market.

North America is anticipated to grow at the highest CAGR through 2024 – 2032. Particularly the US is using the 5G to push new developments in autonomous vehicles, smart cities, and industrial automation. Verizon, AT&T, and T-Mobile are pouring money into 5G rollouts, with T-Mobile's low-band spectrum blanketing enormous swathes of the country. It is also unlocking advances in mmWave deployment for urban high-speed mobility. Additionally, we've seen rapid growth of 5G in industries like healthcare, with companies such as Qualcomm and Intel enabling remote surgeries and telemedicine. Investments in 5G for rural digitization and smart agriculture in Canada are also adding to the expansion. This development makes North America a hot spot for the 5G chipset market.

Need any customization research on 5G Chipset Market - Enquiry Now

Key players

Some of the major players in the 5G Chipset Market are:

-

Qualcomm Technologies, Inc. (Snapdragon X70 5G Modem-RF System, Snapdragon 8 Elite)

-

MediaTek Inc. (Dimensity 9000, Dimensity 1200)

-

Samsung Electronics Co., Ltd. (Exynos 2200, Exynos 2100)

-

Huawei Technologies Co., Ltd. (Kirin 9000, Balong 5000)

-

Intel Corporation (XMM 8160 5G modem, Atom P5900)

-

Broadcom Inc. (BCM43752, BCM4389)

-

NXP Semiconductors N.V. (Layerscape Access LA1200, QorIQ LS1046A)

-

Qorvo, Inc. (QM19000, QPF4006)

-

Skyworks Solutions, Inc. (Sky5® RF Front-End Solutions, SKY66423-11)

-

Analog Devices, Inc. (ADRV9026, AD9375)

-

Marvell Technology Group Ltd. (OCTEON Fusion, Prestera DX)

-

Unisoc Communications, Inc. (T7520, T7510)

-

ZTE Corporation (ZX297520, ZX297510)

-

Apple Inc. (Custom 5G modem in development)

-

NVIDIA Corporation (Mellanox ConnectX-6 Dx, BlueField-2 DPU)

-

Infineon Technologies AG (BGT60TR13C, BGT24MTR11)

-

Texas Instruments Incorporated (AWR6843AOP, DRA829V)

-

Xilinx, Inc. (Zynq UltraScale+ RFSoC, Versal AI Core)

-

Renesas Electronics Corporation (R-Car M3, RZ/G2M)

-

Anokiwave, Inc. (AWMF-0156, AWMF-0123)

Some of the Raw Material Suppliers for 5G Chipset Companies:

-

BASF SE

-

LG Chem Ltd.

-

Indium Corporation

-

KYOCERA Corporation

-

DuPont de Nemours, Inc.

-

Rogers Corporation

-

Soitec

-

GlobalFoundries Inc.

-

Samsung Electronics Co., Ltd.

RECENT TRENDS

-

In July 2024, Qualcomm launched the Snapdragon 4s Gen 2 chip, aiming to bring gigabit 5G to smartphones under USD 99, targeting 2.8 billion users globally. Xiaomi will debut the chip in a smartphone expected by the end of 2025.

-

In December 2024, MediaTek launched the Dimensity 8400, the first all-big core chip designed for premium smartphones, offering enhanced performance for high-end devices. The new chip is set to elevate the mobile experience with improved processing power and efficiency.

-

In September 2024, Qualcomm announced a new agreement with Apple to supply chips for its devices, marking a significant collaboration between the two companies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 37.80 Billion |

| Market Size by 2032 | USD 181.25 Billion |

| CAGR | CAGR of 19.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Modems, RFICs, Millimeter Wave Integrated Circuit (mmWave IC), Cellular Integrated Circuit (Cellular IC), Others) • By Deployment Type (Smartphone/Tablets, Connected Vehicles, Connected Devices, Broadband Access Gateway Devices, Others) • By Processing Node (7 nm, 10 nm, Others) • By Operating Frequency (Sub-6 GHz, 24-39 GHz, above 39 GHz) • By Vertical (Manufacturing, Energy & Utilities, Media & Entertainment, IT & Telecom, Transportation & Logistics, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qualcomm Technologies, Inc., MediaTek Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Intel Corporation, Broadcom Inc., NXP Semiconductors N.V., Qorvo, Inc., Skyworks Solutions, Inc., Analog Devices, Inc., Marvell Technology Group Ltd., Unisoc Communications, Inc., ZTE Corporation, Apple Inc., NVIDIA Corporation, Infineon Technologies AG, Texas Instruments Incorporated, Xilinx, Inc., Renesas Electronics Corporation, Anokiwave, Inc. |

| Key Drivers | • Network Virtualization and Cloud Infrastructure Driving 5G Chipset Market Growth and Telecom Transformation • Rapid 5G Expansion in Developing Economies Driving Demand for Low-Cost Chipsets and Devices |

| Restraints | • Challenges in 5G Chipset Market Growth Due to Network Integration Regulatory Issues and Spectrum Allocation |