Digital Farming Market Size & Overview:

Get more information on Digital Farming Market - Request Sample Report

The Digital Farming Market size was valued at USD 23.9 Billion in 2023 and is expected to grow to USD 74.70 Billion by 2032 and grow at a CAGR of 13.5% over the forecast period of 2024-2032.

The digital farming market has been growing significantly due to the government introducing several measures to increase agricultural productivity through technology. In 2023, the adoption of digital technologies for farming was noted globally as governments prioritized food security, optimization of resources, and sustainability of the environment. For example, the U.S. Department of Agriculture revealed that 25% of U.S. farms were using precision agriculture by the end of 2023. In Europe, the European Commission stated that there was a growth of 30 % in the implementation of digital farming under the Common Agricultural Policy (CAP). Governments are facing challenges such as water shortage, changes in climate, and an increased demand for food and are thus driving the uptake of technology in farming, such as sensors, IoT, data analytics. The government’s push in the digital transformation of farming is likely to continue in many countries, which will influence the efficiency of operations and sustainability. For the maximization of farmers’ yield, digital farming uses advanced technologies like artificial intelligence (AI), big data analytics, and the Internet of Things (IoT), as well as gadgets like drones, smart crop sensors, and automatic systems

The Government of India has made several efforts to implement digital agriculture. Important digital agriculture initiative includes the development of a Digital Agriculture Mission worth Rs 2,817 crores. The mission’s aim is to enable farmers through the creation of a Digital Public Infrastructure that offers services such as soil health profiling, digital crop estimation, digital yield modeling, and credit access. The National e-Governance Plan in Agriculture was also another scheme that was revised to include the use of new and emerging technologies in digital agriculture. Also, the government has been offering funding to various agri-tech companies and enabling the use of artificial intelligence in agriculture.

Market Dynamics

Drivers

-

Remote sensing, communication, and telematics technologies are being more widely used, which will promote market growth.

-

Increasing the use of automation in poultry and livestock farming.

Farmers can map soil qualities, classify crop species, detect crop conditions, monitor weeds and agricultural diseases, and track yield using remote sensing technologies. The market is anticipated to expand as a result of the quick advancements in sensing technologies including GIS, GPS, sensors, and cameras. Farmers can obtain useful information about the weather, crop health, and production thanks to sensing devices. Similar to this, producers can now access information about their farms from a distance and help optimize the production process at every stage thanks to the development of cloud computing and data analytics. To manage farm data, market participants are investing in cloud infrastructure construction.

Restrains

-

The market's growth may be constrained by autonomous farm equipment's high initial cost.

Automated agricultural equipment is substantially more expensive than conventional farming equipment. Examples include automated harvesters, weeding robots, tillers, and irrigation systems supported by robots. Similar to how high maintenance costs for modern cars limit the use of smart digital agricultural techniques by small farms. The cost of maintaining these vehicles' cameras, sensors, software, and hardware restrains market expansion. It is important for farmers to invest in automated and technologically advanced vehicles in order to boost agricultural output and profitability, but it is challenging for them to make a larger initial investment. Farmers in nations like India, Brazil, and China have challenges due to the high initial cost of smart farming technologies.

Because of the complexity of the technology employed in smart agriculture solutions, operational costs rise. With changing weather patterns and crop varieties, grid management, software, and remote sensing must be updated on a regular basis. The high cost of drones equipped with tools, image sensors, high-resolution cameras, and software is expected to limit industry expansion.

Opportunities

-

IoT and AI technology adoption is increasing, which will lead to several opportunities for market expansion.

-

Less availability of labor the farmers are shifting towards digital farming.

Artificial intelligence and machine learning are being quickly incorporated into farming equipment and field practices. With its ability to improve productivity and aid in learning, understanding, and responding to various situations, cognitive computing is gaining popularity across the industry. The solutions as a service allow the farmers to keep up with cutting-edge technology, including chatbots and other conversational platforms.

Segment analysis

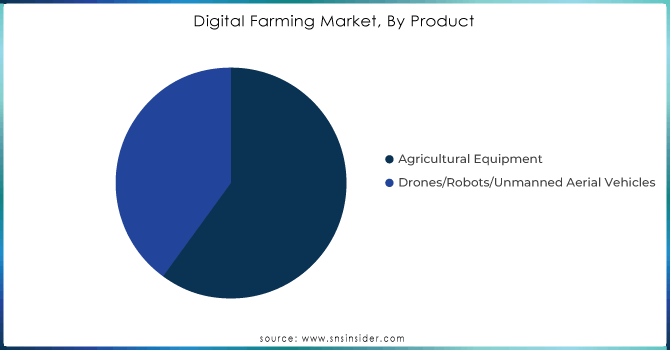

By Product

In 2023, Agricultural Equipment was the dominant segment in the digital farming market and held about 55% of the digital farming market share. This was mainly because with current farming practices that require new technology, both traditional and smart agriculture machinery are playing increasingly growing vital role. For instance, tractors, harvesters and planting equipment are integrated with global positioning systems, sensors and automation technologies are indispensable for large-scale and precision farming. The United States Department of Agriculture reported that the share of large farms using digital-enabled agricultural equipment was about 70% at the end of 2023. In different countries such as the European Union and India also, governments supported plans that supplied and invested in smart farming machinery greatly, strengthening the demand of agricultural equipment integrated with digital technologies.

The Drones/Robots/Unmanned Aerial Vehicles segment is also expected to register the highest growth at more than 15% between 2024 and 2032. Drones are used mainly in precision farming to monitor crops and spray pesticides and also map fields. The dominance of UAVs in precision farming and also because UAVs can collect data using aerial monitoring and surveillance in real time. For example, subsidies in China powered the adoption of UAVs; the Chinese Ministry of Agriculture reported that between 15 and 20 million UAVs were being sold annually in the country in 2023. The Federal Aviation Administration also reported that there were more than 35,000 drones that were registered for agricultural use in the United States in 2023.

Need any customization research/data on Digital Farming Market - Enquiry Now

By Technology

The on the basis of technology, digital farming market is dominated by Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP). The rising need for automated and advanced equipment to improve farming efficiency is fueling the adoption of AI/ML technologies in agricultural machinery. These technologies allow for real-time data analysis to optimize farming activities, such as weather forecasting, soil health analysis, crop health monitoring, and pests and weed detection. AI solutions are being increasingly incorporated into smart farming systems to enhance precision and reduce input costs. Moreover, various government initiatives are aiding this adoption. For example, to support the implementation of AI in farming, India’s Digital Agriculture Mission offers grants for agri-tech startups to develop AI-supported tools. With such developments, AI/ML/NLP technologies are expected to define the digital farming market during the forecast period.

The Internet of Things segment is growing with significant growth rate, the demand for IoT technology is becoming prevalent as an increasing number of farms install sensors, drones, robots, and computer imaging systems fitted with analytics capabilities. These devices also continue to support IoT solutions by providing farmers with actionable insights to manage their resources better in real time. In particular, IoT solutions for precision irrigation, smart crop monitoring, and livestock management continue to be deployed in the market. IoT has significant support from the USDA, which funds these technologies’ development for resource management and monitoring. Such developments and increasing needs for data-driven farming are expected to cause IoT technology to record significant growth during the forecast period.

By Application

Among the several application segments, yield monitoring and mapping held the largest share in 2023, accounting for around 30% of the overall digital farming market. This segment’s growth is primarily driven by the need for data-driven decisions that increase crop performance and optimize input effectiveness. In addition, enhanced utilization of yield monitoring strategies is significantly stimulated by government measures to encourage precision farming. For example, according to the U.S. Department of Agriculture, many farmers inn U.S. actively using of precision farming practices were using yield monitoring technologies by 2023. These data collection and analysis systems allow farmers to monitor crop development and asses where more or fewer resources should be provided. Consequently, this increases the input yield relation and makes production more efficient.

The smart crop monitoring segment growing with significant CAGR. Its progress is mostly growing with increasing crop performance and health through continuous data collection. Additionally, Government initiatives promoting precision agriculture have significantly contributed to this trend. For instance, in the EU countries, wise crop monitoring is stimulated through various projects that have received funding under the European Commission’s Horizon Europe program. In the U.S., the USDA's National Institute of Food and Agriculture (NIFA) reported a 20% increase in funding for research on smart crop monitoring systems, emphasizing the importance of early detection of crop stress and disease. By utilizing remote sensing and machine learning algorithms, farmers can optimize resource usage, leading to reduced input costs and improved yields.

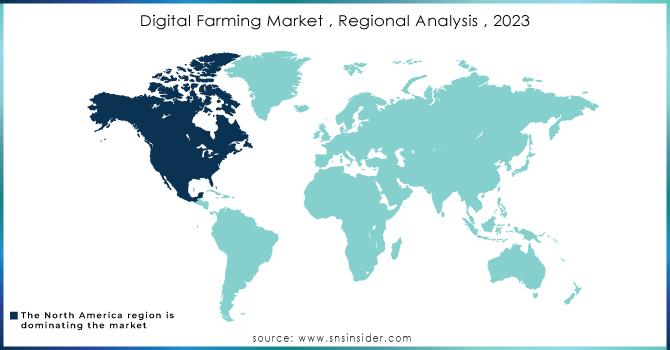

Regional Analysis

North America was the leading region in the digital farming market in 2023, accounting for approximately 34% of the total market share. This can be attributed to a high adoption level of the digital farming technology in addition to the strong government support for technological advancements in the agricultural. The USDA reported that at least one digital technology in farming was used in nearly 75% of large-scale farms in the U.S. through the appeals put in place as of the end of 2023, because of the program such as the Precision Agriculture Loan Program. The Canadian government budget for 2023 implied more than $1 billion on smart farming as a pilot project with the aim of enhancing yields and sustainability. The digital infrastructure in the region is urged on by the government policies that are encouraging for the technology, which includes the adoption of the Internet of Things technology, Artificial Intelligence, and drones. Perhaps the technology use was highly accepted in the region due to an effort to address specific challenges to farming in the region, for example, water management, and complications with the labour force.

Asia Pacific region is growing with the significant growth rate, with the significantly growing implementation of digital farming technologies in APAC region. A growing support from the government of various countries, want to increase farm productivity, especially in Japan and India. As a part of the digital goal, the Indian government has initiated multiple projects that leverage next-generation technologies like blockchains, cloud, drones, remote sensing, GIS, and robots.

Key Players

-

Bayer AG (FieldView, Xarvio Digital Farming Solutions)

-

Syngenta Group (Cropwise, AgriEdge)

-

Deere & Company (John Deere) (John Deere Operations Center, JDLink)

-

CNH Industrial (Case IH & New Holland) (AFS Connect (Case IH), PLM Intelligence (New Holland))

-

AGCO Corporation (Fuse Connected Services, Precision Planting)

-

Trimble Inc. (Trimble Ag Software, GFX-750 Display System)

-

Kubota Corporation (Kubota Farm Solutions, K-Monitor)

-

Raven Industries (Slingshot, VSN Visual Guidance)

-

Taranis (Taranis Precision Scouting, Taranis SmartScout)

-

Tavant Technologies (AI-powered Agritech Solutions, IoT-based Farm Management Tools)

-

Hexagon Agriculture (HxGN AgrOn, AgrOn Machine Control)

-

Corteva Agriscience (Granular Farm Management, Encirca)

-

Topcon Agriculture (Topcon X35 Console, Horizon Software)

-

Climate Corporation (Subsidiary of Bayer) (Climate FieldView, Climate Insights)

-

Farmers Edge (FarmCommand, Smart VR)

-

Yara International (Atfarm, N-Sensor)

-

Prospera Technologies (Crop Monitoring Platform, Agronomy Analytics)

-

CropX (CropX Farm Management System, Soil Sensor Technology)

-

Sentera (FieldAgent Platform, NDVI Sensors)

-

Valmont Industries (Valley Irrigation, BaseStation Controller)

and others in final Report.

Latest News and Developments

-

In December 2023, Sonata Software announced the formation of a partnership with Bayer, one of the world’s leading corporations in consumer health, pharmaceuticals, agrochemicals, seeds and biotechnology. These corporations, supported by the Microsoft Azure Data Manager for Agriculture, will seek to facilitate a frictionless field activity data acquisition and integration, associated with a range of agricultural equipment manufacturers, when developing the new AgPowered services.

-

In November 2023, the Syngenta Group integrated its Cropwise digital platform with the agricultural brands of CNH Industrial. Moore claims that this step connects diverse precision farming systems, offering a reliable and following data source, used to make decisions by farmers and advisors, which, in turn, increase business insights. According to Surne, seven different brands, including the Cropwise platform, are linked to the strategic data in agriculture.

-

John Deere, one of the leading players in the market for agricultural equipment, initiated the launching of the first fully autonomous tractor in the U.S., aimed to change farming operations. The USDA suggests that this innovation will advance labor efficiency at large-scale farms by up to 30%. The tractor uses AI-driving software in soil analysis, real-time crop monitoring and resource management.

-

In May 2022, the Kubota Corporation partnered with a start-up Parcel THRIVE, Inc. to develop a platform to foster and speed up the production value chain optimization, increasing production for the crops, such as vegetables, fruits, nuts, and other. R-CISC reports that the solution allowed to improve face-herding cattle.

| Report Attributes | Details |

| Market Size in 2023 | USD 23.9 Bn |

| Market Size by 2032 | USD 74.70 Bn |

| CAGR | CAGR of 13.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Infrastructure (Sensing & Monitoring, Communication Technology, Cloud & Data Processing, Telematics/Positioning, End-Use Components) • By Technology (AI/ML/NLP, IoT, Blockchain, Big Data & Analytics) • By Product (Agricultural Equipment, Drones/Robots/Unmanned Aerial Vehicles) • By Application (Yield Monitoring and Mapping, Smart Crop Monitoring, Soil & Fertilizer Management, Smart Irrigation Monitoring System, Weather Forecasting, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Monsanto Company, Topcon Corporation, Deere & Company, AGCO Corporation, Kubota Corporation, Hexagon AB, CNH Industrial N.V., Bayer Crop Science Limited, Agreena, CLAAS KGaA mbH, Trimble, Agleader, IBM Corporation, AgEagle Aerial Systems |

| Key Drivers | • Remote sensing, communication, and telematics technologies are being more widely used, which will promote market growth. • Increasing the use of automation in poultry and livestock farming. |

| Market Opportunities | • IoT and AI technology adoption is increasing, which will lead to several opportunities for market expansion. • Less availability of labor the farmers are shifting towards digital farming. |