Gas Leak Detector Market Report Scope & Overview:

Get More Information on Gas Leak Detector Market - Request Sample Report

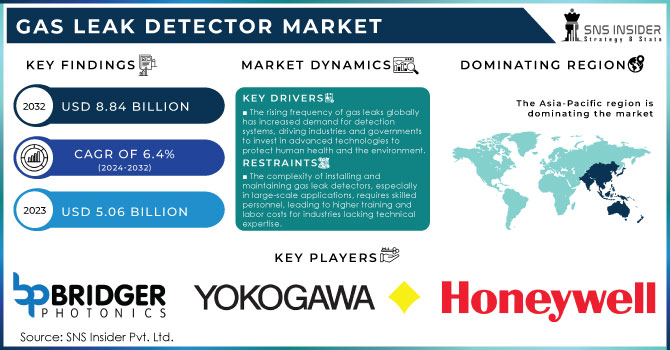

The Gas Leak Detector Market Size was valued at USD 5.06 Billion in 2023 and is now anticipated to grow USD 8.84 Billion by 2032, displaying a compound annual growth rate (CAGR) of 6.4% during the forecast Period 2024-2032.

The Gas Leak Detector Market has seen significant growth, driven by heightened industrial safety standards and technological advancements. As industries like oil and gas, chemicals, and manufacturing expand, the need for advanced gas leak detection systems has surged to prevent costly and dangerous incidents. The integration of smart technologies, including IoT-enabled detectors and real-time monitoring systems, has enhanced detection accuracy and operational efficiency, further stimulating market growth. The market has also benefited from regulatory pressures and increased safety awareness, pushing organizations to adopt more sophisticated detection solutions. Additionally, the expansion of residential and commercial applications for gas leak detectors, spurred by rising concerns about gas safety and energy efficiency, has contributed to market expansion.

Volatility has been one of the key issues in the changing global fuel-based economy due to the daily fluctuation of oil & gas commodity prices. As a result, users need a viable solution to help in reduced profit earnings in times of uncertainty. Specifically, the industry utilizes the Internet of Things and plenty of data which is generated by devices that are connected to perform multiple critical roles such as automated predictive maintenance, real-time monitoring, as well as failure analysis. For example, communication, which is an essential element in the digitalization world of IIoT is vital because it assists the users in capturing the primary parameter such as pressure, moisture, as well as temperature which aids in the development of operational strategies. Connected detectors are also critical due to the near-infrared spectroscopy which is smart because it is essential in detecting methane. This is important because this vital gas leak can easily be monitored in residential homes or commercial premises which forms the foundation of a driver of the demand for the gas leak detector market.

In March 2024: Emerson released the Rosemount 9195 Wedge Flow Meter, a fully integrated solution consisting of a wedge primary sensor element, supporting components, and a selectable Rosemount pressure transmitter. The new meter’s unique flexible design is ideal for measuring process fluids with a wide range of demanding characteristics in various heavy industry applications, including metals and mining, oil and gas, renewable fuels, chemicals and petrochemicals, pulp and paper, and others.

Market Dynamics

Drivers

The gas leak detector market is driven by stringent safety regulations and standards, as governments and regulatory bodies enforce compliance in industries like oil & gas, chemicals, and manufacturing to minimize accidents and ensure workplace safety.

One of the main drivers for the gas leak detector market is the increasing enforcement of safety regulations and standards. In industries where minor gas leakage can result in severe consequences, including oil & gas, chemicals, and manufacturing, governments and regulatory bodies across the globe are issuing strict rules to protect and safeguard the workplace. Such regulations require the installation or regular maintenance of advanced gas leak detection systems to protect workers and the environment from hazardous gas leaks. For example, within the oil & gas industry, handling of various volatile gases is performed regularly. Even slight leakage of such gas types can lead to fatal accidents, fire, or explosions. Furthermore, in manufacturing, special regulations related to chemical control require industries to install gas leak detection systems to avoid gas exposure and its consequences. The enforcement of safety regulations is beneficial to the gas leak detector market in many ways. It improves the safety features of gas leak detection devices. Manufacturers have to react to stricter requirements to be approved for the installation. The systems become more automated, reliable, and sensitive. On the other hand, because every target industry will have to comply with such regulations, it drives market development. The described trend is expected to continue as an increasing number of industries are focusing on safety and the planet.

The rising frequency of gas leaks globally has increased demand for detection systems, driving industries and governments to invest in advanced technologies to protect human health and the environment.

The increasing number of gas leaks around the world, industries and governments have begun to pour additional resources into reliable detection systems. Gas leaks caused by age-related degradation of infrastructure, industrial accidents, or natural disasters present a high risk both to human health and the environment. There is always a danger of explosion, fire, or exposure to a potentially toxic gas, and even if none of these occurs, the undue pressure and other, less extreme adverse effects can still prove dangerous. As a reflection of the known risks of gas leaks staying undetected, detection technology is becoming increasingly sophisticated on the back of massive investment. These new systems provide increased accuracy, detection speed, and integration into the systems that ensure personnel safety. The trend is representative of the broader commitment to safety, minimal environmental footprint, and even public health.

Restraints

The complexity of installing and maintaining gas leak detectors, especially in large-scale applications, requires skilled personnel, leading to higher training and labor costs for industries lacking technical expertise.

One of the critical challenges of gas leak detectors is connected with installation and maintenance. It is becoming particularly relevant in the case of large industrial plants in which the technology which is used is quite sophisticated. In other words, the technology requires the calibration of devices and certain levels of repair and updating on a regular basis to be truly efficient. When a great number of devices are paired for the creation of a certain network, the level of difficulty is multiplying. Thus, such systems require a workforce with specific qualifications and training that can ensure appropriate handling and repair. However, it may not always be easy since not all factories can afford dedicated teams to service their detectors and other technologies, and they must either pay the increased cost of their work or hire specific technical organizations to solve potential malfunctions.

Key Market Segmentation

By Sensor Type

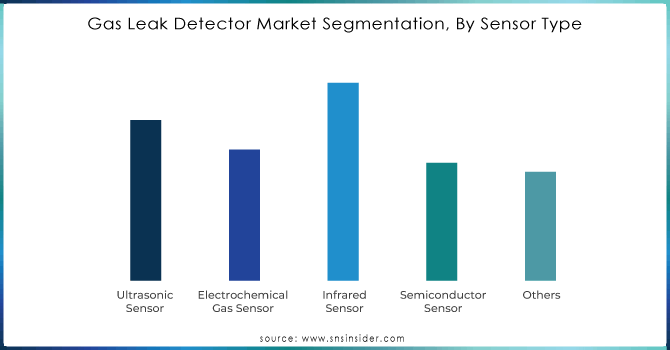

The infrared sensors are dominated the market with a share of 27.63% in 2023. The infrared rays are used in infrared gas detection technologies for resolving and detecting the presence of flammable gases like hydrocarbons. Moreover, the infrared gas detectors are maintenance free, are resistant to poisoning and contamination, and should help in growth of the market. They are used to detect the presence of other poisonous gases, such as methane and carbon dioxide, as well of organic chemicals, such as butane, benzene, and others.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End Use

The industrial sector is dominated the market, with a share of 22.45% in 2023. Rapidly growing urbanization in emerging countries such as China and India are also one of the factors behind the growth in this sector. Additionally, there are stringent rules & regulations related to the safety of employees, which is why gas detectors are widely used in the sector. The amount of oxygen and carbon dioxide in mines is also measured, by using gas detectors in the mines. An increase in the incidence of mine deaths because of a lack of oxygen is resulting in the rise of demand for Gas Detectors.

Regional Analysis

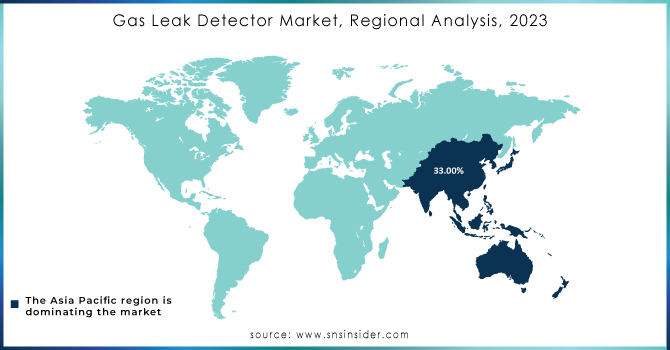

Asia-Pacific is dominated the market with a share of 33% in 2023, because there is an increase in popularity of Portable gas detectors in Asia due to their easy use features and flexibility. The gas leak detector can be easily installed and can be moved, so it is beneficial for use in big industrial facilities. The technological advancement in the sensor is also one of the major driving factors for the development of more reliable and accurate gas detectors.

North America shows huge growth in terms of CAGR. The U.S. and Canada have highly stringent safety regulations regarding the use of gas in industries and residential applications. Many of our industries and laboratories use gases for various processes and R&D work. This is also increasing the growth of gas leak detection systems. The gas detection system ensures the safety of workers as well as consumers and surroundings. The increasing awareness about the risk’s accidents and other health risks like carbon monoxide poisoning has also contributed to the increase in gas leak detector market share.

Key Players

The major key players are MSA - The Safety Company, Honeywell International Inc., Drägerwerk AG & Co. KgaA, Testo SE & Co. KGaA, PSI Software AG, Yokogawa Electric Corporation, BRIDGER PHOTONICS, Siemens, Xylem Inc., New Cosmos Electric Co. Ltd (Japan), and others.

Recent Development

In February 2024: ABB acquired SEAM Group, which was associated with energized asset management and advisory services. The services of SEAM Group were focused on the provision for the commercial and industrial buildings sectors. The acquisition helped ABB to improve its Electrification Services division. With the acquisition, the company got an ample amount of additional expertise in preventive, predictive, and corrective maintenance, renewables asset management advisory services, and electrical safety.

In January 2024: Emerson presented Branson Series GMX-Micro, which was a new line of ultrasonic metal welders with numerous new features in their computerized operating system, including multiple power levels and models, different advanced control modes, and improved connectivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.06 Billion |

| Market Size by 2032 | US$ 8.84 Billion |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Ultrasonic Sensor, Electrochemical Gas Sensor, Infrared Sensor, Semiconductor Sensor, Others) • By End Use (Industrial, Petrochemical, Automotive, Building Automation & domestic appliances, Environmental, Medical) • By Application (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | MSA - The Safety Company, Honeywell International Inc., Drägerwerk AG & Co. KgaA, Testo SE & Co. KGaA, PSI Software AG, Yokogawa Electric Corporation, BRIDGER PHOTONICS, Siemens, Xylem Inc., New Cosmos Electric Co. Ltd (Japan) |

| Key Drivers | • The gas leak detector market is driven by stringent safety regulations and standards, as governments and regulatory bodies enforce compliance in industries like oil & gas, chemicals, and manufacturing to minimize accidents and ensure workplace safety. • The rising frequency of gas leaks globally has increased demand for detection systems, driving industries and governments to invest in advanced technologies to protect human health and the environment. |

| Challenges | •The complexity of installing and maintaining gas leak detectors, especially in large-scale applications, requires skilled personnel, leading to higher training and labor costs for industries lacking technical expertise. |