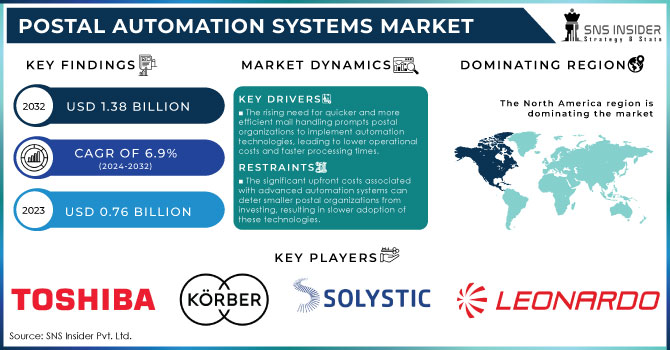

Postal Automation Systems Market Size Analysis:

The Postal Automation Systems Market size was valued at USD 0.76 Billion in 2023 and is expected to reach USD 1.38 Billion by 2032 and grow at a CAGR of 6.9% over the forecast period 2024-2032. The Postal Automation Systems Market has witnessed significant growth in recent years, driven by the increasing demand for efficiency in postal operations and the rising volume of parcels due to e-commerce. Postal automation refers to the use of advanced technology and systems to streamline various postal operations, including sorting, tracking, and delivery.

To Get More Information on Postal Automation Systems Market - Request Sample Report

As e-commerce continues to expand, postal services face pressure to enhance speed and accuracy, making automation essential. Technological advancements, such as the integration of artificial intelligence (AI), machine learning, and Internet of Things (IoT) in postal systems, have fueled market growth. Automated sorting systems can process up to 40,000 parcels per hour, significantly increasing throughput compared to manual sorting methods. Moreover, studies show that implementing automation can reduce operational costs by up to 30%, highlighting the financial benefits of these technologies.

Recent developments in the postal automation sector include the adoption of automated parcel lockers, which allow customers to pick up their packages conveniently, reducing last-mile delivery challenges. With more than 20% of online shoppers preferring parcel lockers for pickup, this trend is transforming the delivery landscape. Additionally, many postal operators are investing in automated sorting systems to handle increasing parcel volumes efficiently. Major players like Siemens and Honeywell have launched innovative sorting solutions that enhance speed and accuracy, further promoting automation adoption. Furthermore, the COVID-19 pandemic has accelerated the shift towards digital solutions in postal services. Research indicates that 50% of postal operators increased their automation budgets in response to changing consumer behaviors during the pandemic. Collaborative partnerships between technology providers and postal operators have emerged, focusing on developing integrated solutions that streamline operations and enhance customer experience.

Postal Automation Systems Market Dynamics

DRIVERS

-

The rising need for quicker and more efficient mail handling prompts postal organizations to implement automation technologies, leading to lower operational costs and faster processing times.

The increasing demand for efficiency in mail processing has become a pivotal factor driving postal organizations to adopt automation technologies. As global e-commerce sales surged to approximately USD 5.2 trillion and are projected to grow by 56% over the next four years, the volume of parcels has significantly increased, necessitating faster processing to meet consumer expectations. Postal organizations are under immense pressure to handle this growing volume efficiently while ensuring timely delivery. Automation technologies, such as automated sorting systems and robotic handling solutions, streamline operations by expediting the sorting and routing of mail and parcels.

Automated sorting machines can process up to 30,000 items per hour, compared to traditional manual sorting methods, which are considerably slower. According to the International Postal Corporation, the adoption of automation technologies has led to a 30% reduction in processing times for many postal organizations, translating to quicker delivery times for customers. Additionally, automation not only enhances speed but also reduces operational costs; studies indicate that organizations can save up to 25% on labor costs through the implementation of automated systems. This combination of increased speed and reduced costs is driving postal organizations to invest in automation technologies, ensuring they remain competitive in a rapidly evolving market. In conclusion, the urgent need for efficiency in mail processing is transforming the landscape of postal services, compelling organizations to embrace automation as a solution to meet rising demands and enhance service quality.

-

Technological advancements, including machine learning, artificial intelligence, and robotics, significantly enhance postal automation systems by increasing sorting accuracy and processing speed.

Technological advancements play a crucial role in revolutionizing the Postal Automation Systems Market, particularly through innovations like machine learning, artificial intelligence (AI), and robotics. These technologies significantly enhance the capabilities of postal automation systems, leading to improvements in sorting accuracy and speed, which are vital for meeting the growing demands of modern postal services. Machine learning algorithms analyze vast amounts of data to identify patterns and optimize sorting processes. By learning from historical data, these systems can predict the most efficient sorting routes, reducing the time required for processing mail. AI further elevates this efficiency by enabling real-time decision-making, allowing systems to adapt to fluctuating volumes and varying types of parcels dynamically.

Robotics also plays a transformative role in postal automation. Automated sorting machines equipped with robotic arms can handle packages of different sizes and weights with high precision. This not only speeds up the sorting process but also minimizes human error, ensuring greater reliability in mail delivery. Moreover, advancements in image recognition technology enhance the ability of these systems to read addresses and barcodes accurately, facilitating quicker identification and routing of parcels. Overall, these technological innovations not only streamline postal operations but also enhance customer satisfaction by ensuring timely and accurate deliveries. As postal organizations increasingly adopt these cutting-edge solutions, they position themselves to effectively compete in the rapidly evolving landscape shaped by e-commerce and changing consumer expectations.

RESTRAIN

-

The significant upfront costs associated with advanced automation systems can deter smaller postal organizations from investing, resulting in slower adoption of these technologies.

The high initial investment required for implementing advanced postal automation systems presents a significant barrier, particularly for smaller postal organizations. These systems often involve substantial upfront costs associated with purchasing cutting-edge equipment, such as automated sorting machines, robotics, and integrated software solutions. For many smaller entities, which may already operate on tight budgets, allocating funds for such extensive capital expenditures can be challenging. This financial strain is further compounded by the need for infrastructure upgrades and staff training to ensure effective utilization of the new systems.

Moreover, the high cost of automation systems can create a disparity between larger postal organizations and their smaller counterparts. Larger companies typically have more resources at their disposal, enabling them to absorb these costs and implement automation solutions more readily. In contrast, smaller organizations may struggle to justify the investment, especially when faced with uncertain returns on investment in a rapidly evolving market. This reluctance to invest can lead to slower adoption rates of automation technologies, hindering smaller postal services' ability to compete effectively in a landscape increasingly dominated by e-commerce and consumer expectations for quick delivery. Consequently, many smaller players may find themselves at a competitive disadvantage, as they are unable to enhance operational efficiency, reduce processing times, and improve service quality, ultimately impacting their market share and sustainability. Thus, addressing the financial barriers associated with automation investments is critical for fostering a more equitable and competitive postal services sector.

Postal Automation Systems Market Segmentation Oveview

By Technology

In 2023, the parcel sorter sector accounted for around 34.08% of the total revenue. The process of sortation involves using devices controlled by software to identify items on conveyer systems and redirect them to the intended destination. The parcel sorting solutions ensure precise outcomes and reduce the volume of lost package inquiries by enhancing traceability.

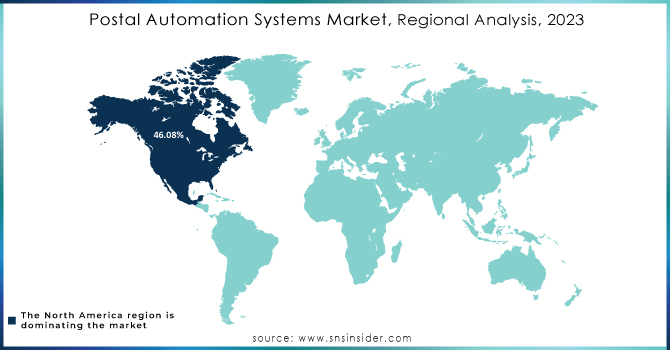

Postal Automation Systems Market Regional Analysis

In 2023, the North American market for postal automation systems dominated with a market share of around 46.08%. The increase is credited to the higher use of new technologies in mail services and the existence of major market participants in the area. Furthermore, the increasing expenses of labor and lack of available workers are pushing businesses to utilize automation, leading to the expansion of the market.

Asia Pacific postal automation systems are projected to experience a significant Compound Annual Growth Rate (CAGR) of around 12.2% during the predicted timeframe. The rapid expansion of the e-commerce sector in nations like Japan, China, and India is driving the need for a highly advanced e-commerce logistics sector.

Do You Need any Customization Research on Postal Automation Systems Market - Inquire Now

Major Players in Postal Automation Systems Market

Some of the major key players of Postal Automation Systems Market

-

Toshiba Infrastructure Systems & Solutions Corporation: (Postal sorting systems, Automated parcel lockers)

-

Körber AG: (Automation software, Sorting systems, Robotics solutions)

-

NEC Philippines, INC.: (Automated mail processing systems, Facial recognition solutions)

-

SOLYSTIC: (Mail sorting solutions, Automated postal handling systems)

-

Pitney Bowes Inc.: (Mailing and shipping solutions, Address verification systems)

-

Vanderlande Industries B.V.: (Automated parcel sorting systems, Baggage handling systems)

-

Fives Group: (Automated sorting systems, Robotics for postal and parcel handling)

-

Leonardo S.p.A.: (Postal automation systems, Smart technologies for logistics)

-

Lockheed Martin Corporation: (Automated sorting and handling systems, Security and surveillance solutions)

-

BEUMER GROUP: (Conveyor and sorting systems, Packaging and palletizing systems)

-

Interroll Group: (Conveyor systems, Sorting solutions)

-

Dematic: (Warehouse automation, Parcel sorting systems)

-

Eurosort: (Sorting and handling systems, Conveyor technology)

-

Fluence Automation, LLC: (Automated sorting solutions, Robotic systems for logistics)

-

Siemens AG: (Postal automation solutions, Digitalization technologies)

-

Honeywell Intelligrated: (Automated material handling systems, Sorting technologies)

-

Bastian Solutions: (Automation solutions, Sorting and storage systems)

-

Swisslog: (Automated storage and retrieval systems, Parcel sorting systems)

-

SICK AG: (Sensor solutions for automation, Object detection systems)

-

Cognex Corporation: (Vision systems for automation, Barcode reading solutions)

RECENT DEVELOPMENTS

-

In June 2022: Fives formed a collaboration with Caja Robotics, a top supplier of robotic and adaptable goods-to-person solutions. The companies would combine knowledge, technical skills, and understanding of customer needs and market trends to enhance their role in warehouse automation.

-

In July of 2022: Pitney Bowes introduced its Designed Delivery platform, featuring fresh regional delivery choices. This system uses the Pitney Bowes modular Global Ecommerce network to create customized services for direct-to-consumer logistics teams. This new product is a crucial point in the development of the Global eCommerce industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.76 Billion |

| Market Size by 2032 | USD 1.38 Billion |

| CAGR | CAGR of 6.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Culler Facer Canceller, Letter Sorter, Flat Sorter, Mixed Mail Sorter, Parcel Sorter, Others) • By Type (Hardware, Software, Services) • By Application (Commercial Postal, Government Postal) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Toshiba Infrastructure Systems & Solutions Corporation, Körber AG, NEC Philippines, INC., SOLYSTIC, Pitney Bowes Inc., Vanderlande Industries B.V., Fives Group, Leonardo S.p.A., Lockheed Martin Corporation, BEUMER GROUP, Interroll Group, Dematic, Eurosort, Fluence Automation, LLC, Siemens AG, Honeywell Intelligrated, Bastian Solutions, Swisslog, SICK AG, Cognex Corporation. |

| Key Drivers | • The rising need for quicker and more efficient mail handling prompts postal organizations to implement automation technologies, leading to lower operational costs and faster processing times. • Technological advancements, including machine learning, artificial intelligence, and robotics, significantly enhance postal automation systems by increasing sorting accuracy and processing speed. |

| RESTRAINTS | • The significant upfront costs associated with advanced automation systems can deter smaller postal organizations from investing, resulting in slower adoption of these technologies. |