Green Water Treatment Chemicals Market Size & Overview

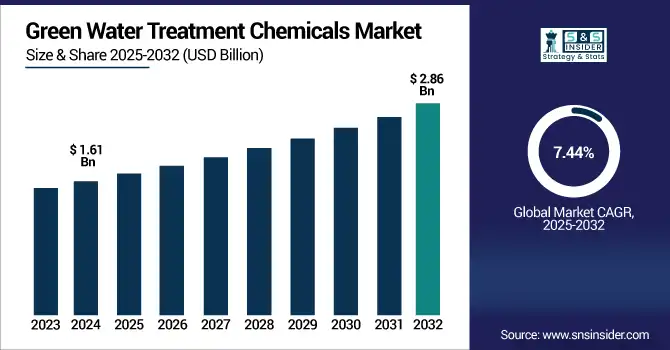

The Green Water Treatment Chemicals Market size was valued at USD 1.61 billion in 2024 and is expected to reach USD 2.86 billion by 2032, growing at a CAGR of 7.44% over the forecast period of 2025-2032.

To Get more information on Green Water Treatment Chemicals Market - Request Free Sample Report

The green water treatment chemicals market is growing due to increasing industrial and municipal water reuse efforts amid freshwater scarcity and stricter environmental regulations. Biodegradable, non-toxic, and sustainable, these chemicals enable safe treatment of reclaimed water through membrane filtration, biological treatment, and disinfection, ensuring compliance with high-quality recycled water standards. Rapid urbanization and industrial growth further drive the demand for effective water reuse solutions. Supportive initiatives, such as the EPA’s WIFIA program approving USD 268 million for Hampton Roads’ SWIFT project serving 1.9 million residents via aquifer recharge, highlight the focus on advanced water reuse systems. Overall, environmentally friendly water treatment technologies are poised to propel market expansion globally.

Green Water Treatment Chemicals Market Drivers

- Stringent Environmental Regulations & Growing Water Reuse Mandates Drives the Market Growth

The growing water scarcity and pollution, stringent water safety, discharge, and reuse standards, especially in the U.S. and Europe, are being implemented by governments around the globe. Industry and municipalities are being forced to greener wastewater solutions due to regulations such as the U.S. EPA's PFAS action plan, Clean Water Act, and National Water Reuse Action Plan (WRAP). Conventional water treatment chemicals, which were used for treating water, were toxic chemicals not biodegradable and are being replaced with green plant-based biodegradable alternatives. Such chemicals are preferred also due to their lower environmental impact, lower toxicity, and can also work well with advanced treatment systems, like membrane filtration and ZLD (Zero Liquid Discharge).

In 2023, the U.S. EPA approved a USD 268 million Water Infrastructure Finance and Innovation Act (WIFIA) Loan to The Hampton Roads Sanitation District for its SWIFT Reuse Project, which uses advanced treatment and a green chemical process to recharge aquifers and reduce pollution

Green Water Treatment Chemicals Market Restraints

- High Costs & Performance Concerns Compared to Conventional Chemicals May Hamper the Market Growth

Sustainable green water treatment chemicals are more expensive due to their relatively high production costs and limited scale. Most green solutions are either still being developed or have only been introduced to the market in this decade, so they remain more expensive than synthetic alternatives, including biosurfactants, natural coagulants, and enzyme-based treatments. Furthermore, many industrial users are still not convinced that these alternatives actually work, particularly for hard-to-treat highly chemical- or metal-laden wastewaters. The other significant restraint is for adoption in low-cost facilities or developing regions. This is a price-performance barrier. Municipal utilities tend to be smaller with limited budgets and may be reluctant to convert without subsidies or demonstrated cost-benefit information.

Green Water Treatment Chemicals Market Opportunities

- Integration of Smart Dosing Systems & Biotech-Based Green Chemicals Creates an Opportunity in the Market

Smart Sensors, AI-based monitoring, and biotechnology-driven innovations are powering next-gen water treatment. Such technologies facilitate the real-time monitoring of water properties and targeted dosing, which would lead to a reduction in both chemical use and waste. Bio-based polymers, enzymatic treatments, and microbial formulations that provide better treatment efficacy with low environmental impact are now being developed by startups and established firms alike. Additionally, digital water management systems also ensure the optimal usage of green chemicals, lowering operation costs and making sustainable treatment affordable. That not only improves their environmental footprint, but also fits with broader trends of digital transformation for infrastructure and utilities, which drive the green water treatment chemicals market trends.

In 2024, Kurita America joined forces with a biotech startup, Solugen, to develop carbon-negative, AI-enabled platforms for water treatment using bio-based and synthetic-free chemical alternatives to support safer industrial discharge and the circular reuse of water.

Green Water Treatment Chemicals Market Segment Highlights

-

By Type

In 2024, Coagulants & Flocculants dominated the green water treatment chemicals market with a 38% share, driven by their essential role in removing suspended solids, turbidity, and organic impurities in municipal and industrial water treatment. Increasing environmental concerns and stricter discharge limits are pushing a shift from synthetic to biodegradable, plant-based alternatives like chitosan, tannin, and starch, which reduce sludge and secondary pollution. Corrosion & Scale Inhibitors also held a significant share, as they prevent mineral scale, metal corrosion, and cavitation damage in water systems. Regulatory and environmental pressures are promoting green, non-toxic, phosphate-free inhibitors, supporting sustainable operations while maintaining performance comparable to conventional chemicals.

-

By Source

In 2024, Plant-Based Sources led the green water treatment chemicals market with a 56% share, driven by the global shift toward natural, renewable, and biodegradable ingredients. Derived from tannin, starch, and chitosan, these plant-based agents offer low toxicity, reduced sludge, and effective pollutant removal, making them ideal for sensitive ecosystems and eco-compliant applications in agriculture, food & beverage, and municipal water treatment. They also support sustainable development and regulatory compliance. Mineral-Based Sources hold a significant share due to their efficiency, stability, and broad applicability. Minerals like zeolites, clays, and natural oxides provide eco-friendly alternatives for coagulation, adsorption, pH adjustment, and heavy metal removal, offering low-cost, low-toxicity solutions suitable for municipal, industrial, and agricultural water treatment.

-

By Application

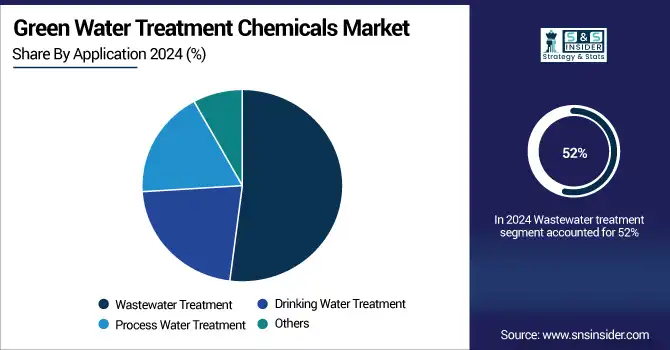

In 2024, Wastewater Treatment dominated the green water treatment chemicals market with a 52% share, driven by the need for sustainable disposal amid rising industrial and municipal wastewater volumes. Global water scarcity and stricter discharge regulations have made efficient, cost-effective wastewater reuse a priority. Biodegradable coagulants, natural flocculants, and non-toxic biocides enable effective pollutant removal without harming ecosystems. Drinking water applications also hold a significant share due to growing public health concerns and environmental impacts of conventional chemicals. Utilities increasingly adopt green, non-toxic, and biodegradable solutions, including plant-based disinfectants, natural coagulants, and mineral-based pH stabilizers, ensuring safe purification while minimizing human health and environmental risks.

-

By End-Use Industry

In 2024, the Municipal segment dominated the green water treatment chemicals market with a 68% share, driven by cities’ commitment to sustainable water treatment. Municipalities are adopting non-toxic, biodegradable chemicals to treat large volumes of drinking and wastewater, responding to stricter regulations, public health concerns, and pollution awareness. Green chemicals ensure effective treatment with minimal sludge and ecotoxicity. Investments in wastewater recycling, decentralized treatment, and water reuse further fuel demand. The Industrial segment also holds a significant share due to rising sustainable water management needs across manufacturing, power, oil & gas, food processing, and chemical industries. Biodegradable scale inhibitors, non-toxic biocides, and plant-based coagulants are increasingly used to meet regulatory and ESG requirements.

Green Water Treatment Chemicals Market Regional Analysis:

North America Green Water Treatment Chemicals Market Insights

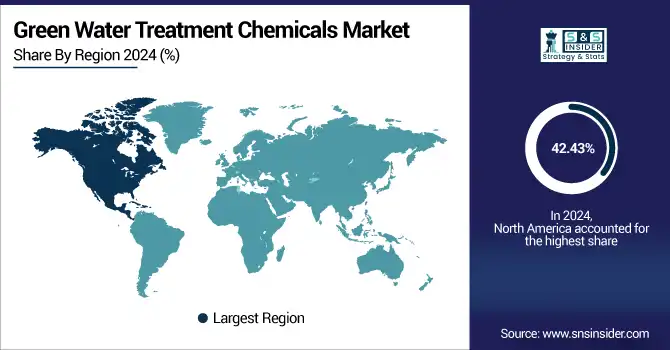

North America green water treatment chemicals market held the largest market share, around 42.43%, in 2024. It is owing to strict environmental regulations, rising awareness of water contamination among consumers, and governmental support for infrastructure development. Regulatory tools, like the Clean Water Act and the Safe Drinking Water Act, and more recent PFAS restrictions, have forced both municipal and industrial facilities to transition to sustainable and non-toxic chemical alternatives. Programs like the EPA’s WIFIA loans have provided big funding boosts to the region for large projects to redevelop ageing water infrastructure. This has attracted key market players, including SNF, Ecolab, and Kurita, to broaden their green chemical offerings.

In 2024, the introduction of the new “GreenFloc” coagulants from SNF, which they state are made from renewable resources and tailored for North American water treatment facilities, embodies the company's environmental focus.

U.S. Green Water Treatment Chemicals Market Insights

The U.S. green water treatment chemicals market size was USD 504 million in 2024 and is expected to reach USD 904 million by 2032 and grow at a CAGR of 7.57% over the forecast period of 2025-2032. The US is spearheading the shift toward green water treatment chemicals through bold federal initiatives coupled with local mandates. In 2024, the EPA made history when it imposed near-zero limits on that class of chemicals in drinking water, essentially requiring water utilities to improve their treatment processes and stop using harmful chemicals altogether. US facilities are beginning to replace these with biodegradable coagulants, scale inhibitors and other bio-based substitutes, supported by fed funding and increasing ESG pledges from the private sector. Such transformations have provided impetus for innovation and rapid uptake of green solutions in all sectors.

Asia Pacific Green Water Treatment Chemicals Market Insights

Asia Pacific green water treatment chemicals market held a significant market share and is the fastest-growing segment in the forecast period. It is due to the speed at which industrialization and urban development has occurred, particularly China and India, and the governments addressing this by enforcing stricter environmental legislation and encouraging green water treatment methods. Increasing water reuse in municipal and industrial settings are driving more interest in biodegradable and plant-derived products. As this demand increases, regional manufacturers, as well as global manufacturers, are ramping up production and partnerships in the area. Asia Pacific countries have also announced billions of investments in water infrastructure, following the example of the US, and plans focus on green technologies to tackle increasing pressures of water stress and pollution.

Europe Green Water Treatment Chemicals Market Insights

Europe held a significant market share in the forecast period. It is because of the strong historical basis for protecting the environment and not polluting water and air. The recently reformed Urban Waste Water Directive from the European Union requires the removal of micropollutants, including pharmaceuticals and PFAS, leading to a wave of demand for advanced, green treatment chemicals. To comply with these new standards, countries such as Germany, the Netherlands, and Sweden are investing in next-generation treatment facilities utilizing plant-based, biodegradable chemicals. The market share in Europe gets a further boost by launching special green products focusing on the regulations; Veolia, BASF are the key players in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Competitive Landscape for Green Water Treatment Chemicals Market:

Kemira Oyj was founded in 1920 and is headquartered in Helsinki, Finland. Kemira specializes in sustainable chemical solutions for water-intensive industries. The company serves municipal water utilities, pulp and paper, oil and gas, and mining sectors. Kemira offers biodegradable coagulants, flocculants, non-toxic biocides, and other green water treatment chemicals. Its solutions focus on improving water quality, reducing environmental impact, and enhancing operational efficiency. With a global presence, Kemira emphasizes innovation in sustainable water treatment technologies and resource-efficient chemical applications.

-

In February 2025, Kemira launched a chlorine-free antimicrobial water treatment solution, approved by the U.S. EPA, targeting large-scale municipal and industrial applications, enhancing water quality while maintaining eco-friendly compliance standards.

Veolia Environnement S.A. was established in 1853 and is headquartered in Aubervilliers, France. Veolia is a global leader in environmental services, providing water, waste, and energy management solutions. Its water treatment segment delivers advanced solutions for potable water, wastewater, and industrial applications. Veolia focuses on sustainable, eco-friendly water treatment technologies, offering filtration systems, green chemicals, and process optimization services. The company serves municipalities and industries worldwide, emphasizing resource efficiency, regulatory compliance, and reducing environmental impact across all water treatment operations.

-

In January 2024, Veolia initiated over 30 PFAS mitigation projects in the U.S., employing advanced filtration and green chemical solutions to ensure safe drinking water and meet stringent regulatory standards.

Green Water Treatment Chemicals Market Key Players

-

Veolia

-

Ecolab

-

Solenis

-

BASF SE

-

Kurita Water Industries

-

SNF Group

-

Clariant

-

Nouryon

-

Kriss Products

-

Weas Engineering

-

Hydrite Chemical Co.

-

AOS Treatment Solutions

-

Green Chem Laboratories

-

Puretec Industrial Water

-

Clean Chemistry

-

Economy Polymers & Chemicals

-

Crucible Chemical Co.

-

SMC Global

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.61 Billion |

| Market Size by 2032 | USD 2.86 Billion |

| CAGR | CAGR of 7.44% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Coagulants & Flocculants, Corrosion & Scale Inhibitors, Biocides & Disinfectants, Chelating Agents, and Others) • By Source (Plant-Based Sources, Animal-Based Sources, and Mineral-Based Sources), • By Application (Wastewater Treatment, Drinking Water Treatment, Process Water Treatment, and Others) • By End-Use Industry (Municipal, and Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Kemira, Veolia, Ecolab, Solenis, BASF SE, Kurita Water Industries, SNF Group, Clariant, Thermax, Nouryon, Kriss Products, Weas Engineering, Hydrite Chemical Co., AOS Treatment Solutions, Green Chem Laboratories, Puretec Industrial Water, Clean Chemistry, Economy Polymers & Chemicals, Crucible Chemical Co., and SMC Global |