FLAME RETARDANTS MARKET REPORT SCOPE & OVERVIEW:

Get More Information on Flame Retardants Market - Request Sample Report

The Flame Retardants Market was valued at USD 8.32 Billion in 2023 and is expected to reach USD 14.29 Billion by 2032, growing at a CAGR of 6.17% over the forecast period 2024-2032.

Import and export activities of flame retardants are dynamic and are augmented by regional demand variations and regulatory standards. This is expected to drive consumption in electronics, construction, and automotive markets as safety becomes more of a necessity within the industries. The cost of raw materials, changes in environmental regulations, and the effects of geopolitical factors on supply chains all influence pricing trends. The distribution is often more complex as there are various levels of the supply chain that the raw material suppliers will be sending to the end-user Manufacturers, Distributors, etc. Recent disruptions and sustainability concerns are leading manufacturers to seek alternate, sustainable flame-retardant options, impacting overall supply chain strategy.

Flame Retardants Market Dynamics

KEY DRIVERS:

-

Rising Demand for Flame Retardants Driven by Growing Electric Vehicle Electronics and 5G Technology Adoption

One of the most important factors that are accelerating the flame retardants market is the growing electrical and electronics industry. With increasing global demand for consumer electronics, electric vehicles, and other smart devices, manufacturers have to find reliable flame-retardant materials to ensure the safety and robust quality of such products. Specifically, the increasing number of EVs which utilize a diverse array of plastics for components and wiring is growing demand for flame retardants to reduce fire risks in batteries and electrical systems. Her advancement to study polymers and plastics in electronics led to the introduction of flame-retardants for circuit boards and cables to meet safety requirements. Fire-retardants, with opportunities in the electronics industry growing with strides towards 5G, IoT, and wearables. Global electric vehicle registrations grew 35% approximately 14 million vehicles in 2023, driving flame retardant demand, particularly in lithium-ion batteries and electrical systems. However, the demand for these batteries with flame retardants is anticipated to grow at an annual rate of 6.2% over the coming years. The growing demand for non-halogenated flame retardants owing to the increasing penetration of 5G, IoT, and wearable devices in which they find applications such as smartphones, circuit boards, and cables is also expected to propel the market growth.

-

Shift Towards Eco-Friendly Flame Retardants Driven by Consumer Demand and Sustainability Focus in Industries

Recognizing the adverse impact of conventional flame retardants, especially those containing bromine and chlorine, there is a movement to develop and implement safer, more sustainable materials. More manufacturers are searching for flame retardants that are flame retardant but nontoxic and not harmful to the environment. This change is driven by increased regulation and rising consumer demand for environmentally friendly products. This has made phosphorous- and nitrogen-based and intumescent flame retardants attractive and safer options over conventional chemicals. With the core focus of industry moving towards sustainability, the demand for such advanced sustainable flame retardants is foreseen to increase, sliding the market up. Phosphorus-based flame retardants now represent 20% of the total flame-retardant consumption in Europe, having increased from around 15% in the early 2000s reflecting the increased demand for more environmentally friendly flame retardants. Furthermore, around 30% of all of the new flame retardants developed are non-toxic, environmentally friendly flame retardants, up from 10% over the previous decade. Such a trend is fueled by greater acceptance of intumescent and phosphorus-nitrogen flame retardants, providing 5-10% yearly growth in automotive and electronics categories.

RESTRAIN:

-

Challenges in the Flame-Retardant Market Due to Health Concerns Regulatory Barriers and Slow Adoption of Safer Alternatives

The regulatory and health concerns related to various flame-retardant chemicals are some of the key restraining factors for the flame-retardant market. Although effective, the toxicity and environmental persistence of conventional brominated and chlorinated flame retardants have aroused concerns about health hazards. As a result, there have been strict guidelines in place, in some cases, bans in certain areas of the world, mainly in Europe and North America. They will have to spend on research and development to develop safer ecologically preferable substitutes, which is often a daunting and time-consuming task for manufacturers. In some regions, there has been a lack of awareness of newer, safer flame-retardant technologies creating yet another challenge. Some may be resistant to change due to inertia or lack of regulatory pressure, despite a growing interest in sustainable and non-toxic flame retardants. This delays the switch over to less harmful substitutes and slows the development of the market.

Flame Retardants Market Segments

BY TYPE

Aluminum Trihydrate (ATH) accounted for a major portion of the flame retardants market, 28.3%, in 2023. ATH is widely utilized as a filler in plastics, rubber, and coatings, especially in the construction and automotive sectors. Because of its dual properties as a flame retardant and a smoke suppressant, it has become a favorite. Moreover, ATH is non-toxic and eco-friendly and is considered a safer alternative to a few other flame retardants, thus, driving its use. It has entrenched itself only because of its high demand in industries where fire safety and sustainability are key.

Phosphorous-based flame retardants are projected to have the fastest CAGR growth rate through 2024 - 2032 on account of rising environmental concerns and increasing restrictions on brominated and chlorinated flame retardants. Also, phosphorous flame retardants can provide effective thermal stability and fire resistance without releasing toxic gases that are part of the combustion products of conventional flame retardants, which makes phosphorous flame retardants a superior and more sustainable option. Phosphorous flame retardant is in great demand in electronics, automotive (including electric vehicles), and construction which are poised for explosive growth and output within the short-incoming future to be characterized by sustainable and higher-efficient materials. This is primarily driven by their versatility and their ability to meet stringent fire safety standards while also being less harmful to health and the environment.

BY APPLICATION

The polyolefins segment dominated the flame retardants market with 24.8% of the total market share in 2023 and will achieve the fastest CAGR over 2024-2032. This has been mainly due to their widespread industrial applications in the automotive, construction, and consumer electronic industries. Polyethylene and polypropylene are two of the most common polyolefin materials used to create lightweight, durable, cost-effective items. This property of these materials has attributed to their versatile usage, not only as a construction material but in diverse applications which is expected to be a significant segment in the flame retardants market due to the growing demand for fire-resistant materials. The trend towards electric vehicles, coupled with the increased development of smart electronics and energy-efficient buildings, will drive further adoption of flame-retarded polyolefins. Commonly used in components wires, cables, and battery housing all of which require fire safety in the automotive sector these materials are increasingly used for their outstanding performance. Driven by the increasing trend towards sustainability, together with the advent of environmentally safe flame retardants that are functionally compatible with polyolefins, their market share is also growing at a rapid rate, making them a modern manufacturing necessity.

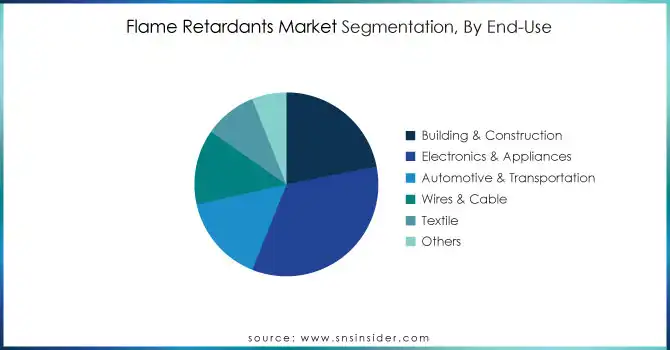

BY END USE

In 2023, Electronics & Appliances held a 34.2% share of the flame retardants market, due to a higher number of uses of flame-retardant materials in cases such as consumer electronics, household appliances, and IT devices. With smartphones, laptops, televisions, and various electronic devices and systems being used more and more everywhere, the demand for fire-resistant components has expanded significantly. Flame retardants are vital for pole safety, since the plastics and polymers typically used in construction have a low ignition threshold, especially with any type of electrical component, including wiring, circuit boards, and casings. Rapid growth in high-tech electronics amid rising focus on fire safety regulations is another factor accountable for the substantial growth of this segment.

Building & Construction is anticipated to become the fastest-growing application during the projection years from 2024-2032, owing to the rising focus on fire safety in residential and commercial buildings. The demand for flame-retardant materials in construction applications is driven by stringent building codes along with fire safety regulations. Examples of these are insulation, coatings, and cladding materials required to make buildings energy-efficient which have become a hallmark of modern architecture, and where the efficacy of flame retardants is crucial. With global urbanization, the demand for fire-safe infrastructure and the fire-safe building and construction sector will grow; hence, flame retardants have the potential to become a major influential market within the next decade.

Flame Retardants Market Regional Analysis

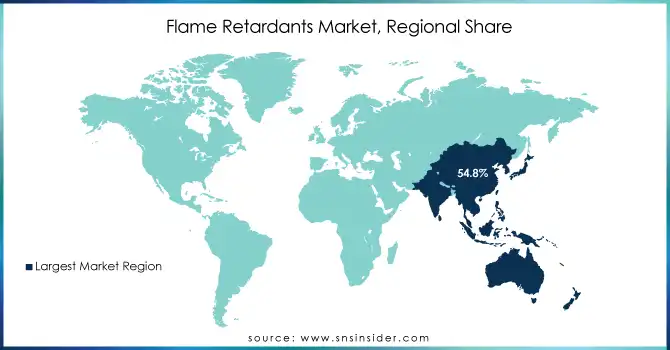

In 2023, Asia Pacific dominated the flame retardants market accounting for 54.8% of the total market share, and it is anticipated to have the fastest CAGR from 2024 to 2032. Factors such as a strong manufacturing base, rapid industrialization, and large demand are being experienced from end-use industries like construction, automotive, and electronics which is fuelling the dominance of the region. This expansion is being driven by countries such as China, India, and Japan, which fuel their economic growth with increased urbanization, large infrastructure projects, and a growing electronics and automotive industry. As an illustration, China, the top consumer and producer of flame retardants, is experiencing significant growth in the electronics and automotive industries, which are the largest end-users of flame-retardant materials. This also plays into the increase in flame-retardant materials due to the country’s rapid transition to electric vehicles, which need fire-safe materials for batteries, wiring, insulation, and more. Furthermore, the Indian construction sector is thriving expeditiously and with an increasing need for fire-safe materials in commercial and residential structures.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key players

Some of the major players in the Flame Retardants Market are:

-

ICL Group (Aluminum Hydroxide, Phosphorus-based Flame Retardants)

-

LANXESS (Exolit OP, Aflammit)

-

Albemarle Corporation (Saytex, GreenCrest)

-

BASF SE (Melapur, Polybond)

-

Jiangsu Yoke Technology Co. Ltd (Brominated Flame Retardants, Phosphorus-based Retardants)

-

Dupont (Zytel, Nomex)

-

Daikin (Fluon, Aflammit)

-

Dow (FIRETEX, FRX)

-

Huntsman International LLC (Melapur, Flamex)

-

Clariant (Exolit, Halogen-Free Flame Retardants)

-

Italmatch Chemicals SpA (Antiblaze, Flamex)

-

DIC Corporation (Flame Retardant Masterbatches, Exolit)

-

RTP Company (Flame Retardant Compounds, Custom Polymers)

-

J.M. Huber Corporation (Hybond, CCB)

-

Kemipex (Phosphorus-based Flame Retardants, Boron Compounds)

-

Tor Minerals International Inc. (Torlon, Alumina Trihydrate)

-

MPI Chemie BV (Thermo-stabilizers, Flame Retardant Agents)

-

Sanwa Chemical Co. Ltd (Halogenated Flame Retardants, Antimony Compounds)

-

Shandong Brother Sci. & Tech. Co. Ltd (Brominated Compounds, Antimony Oxide)

-

Thor (Halogen-Free Flame Retardants, Phosphorus-based Solutions)

Some of the Raw Material Suppliers for Flame Retardants companies:

-

Albemarle

-

Lanxess

-

Dow

-

Solvay

-

BASF

-

SABIC

-

Momentive

-

Honeywell

-

BASF

-

Clariant

RECENT TRENDS

-

In July 2024, ICL launched VeriQuel R100, a sustainable phosphorus-based flame retardant for polyurethane insulation, investing over USD 2 million in R&D.

-

In March 2024, Azelis expanded its partnership with LANXESS to include polymer additives and phosphorus flame retardants in the US, enhancing its product offerings in the region.

-

In April 2024, DuPont launched the Tyvek 400 SFR coverall, a single-use, flame-resistant garment designed to protect against flash fires and hazardous particulates. The coverall is made from Tyvek nonwoven fabric treated for flame resistance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.32 Billion |

| Market Size by 2032 | US$ 14.29 Billion |

| CAGR | CAGR of 6.17% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Aluminum Trihydrate, Antimony Oxide, Brominated, Chlorinated, Phosphorous, Nitrogen, Others) • By Application (Epoxy, Unsaturated Polyester, Polyolefins, Polyvinyl chloride, Polyurethane, Polystyrene, Others) • By End Use (Building & Construction, Electronics & Appliances, Automotive & Transportation, Wires & Cable, Textile, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ICL Group, LANXESS, Albemarle Corporation, BASF SE, Jiangsu Yoke Technology Co. Ltd, Dupont, Daikin, Dow, Huntsman International LLC, Clariant, Italmatch Chemicals SpA, DIC Corporation, RTP Company, M. Huber Corporation, Kemipex, Tor Minerals International Inc., MPI Chemie BV, Sanwa Chemical Co. Ltd, Shandong Brother Sci. & Tech. Co. Ltd, Thor, and Others |

| Key Drivers | • Rising Demand for Flame Retardants Driven by Growing Electric Vehicle Electronics and 5G Technology Adoption • Shift Towards Eco-Friendly Flame Retardants Driven by Consumer Demand and Sustainability Focus in Industries |

| Restraints | • Challenges in the Flame-Retardant Market Due to Health Concerns Regulatory Barriers and Slow Adoption of Safer Alternatives |