Chromatography Resin Market Analysis & Overview:

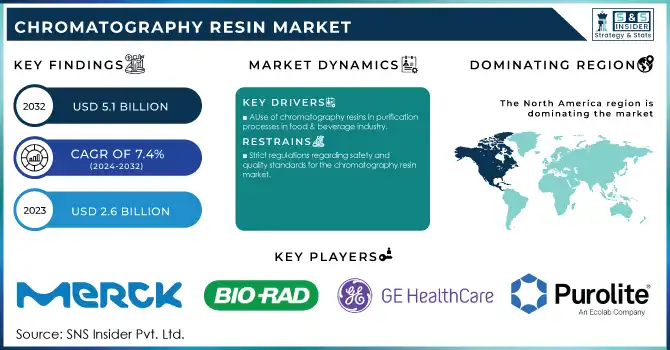

The Chromatography Resin Market Size was USD 2.6 billion in 2023 and is expected to reach USD 5.1 billion by 2032 and grow at a CAGR of 7.4% over the forecast period of 2024-2032.

Get More Information on Chromatography Resin Market - Request Sample Report

The high production of biologics and monoclonal antibodies, which play a vital role in treating various chronic and life-threatening diseases, including cancer, autoimmune disorders, and rare genetic diseases, drives demand in the biopharmaceutical industry for chromatography resins. The purification processes needed to guarantee the safety, efficacy, and quality of these biological drugs rely heavily on chromatography resins. Government incentives and funding to support biopharmaceutical research and manufacturing also increase this demand. In this context, the U.S. FDA approved more than 30 biologic drugs in 2023, highlighting the increasing dependence of contemporary medicine on biopharmaceuticals. Moreover, the rise of advanced therapies (e.g., cell and gene therapies) has increased demand for highly specific and efficient separation technologies, making chromatography resins an unrivaled and critical part of biopharmaceutical manufacturing streams.

The European Medicines Agency (EMA) emphasized that biologics accounted for nearly 20% of all new drug approvals in 2023, underscoring their expanding significance. These statistics indicate robust growth in biopharmaceuticals, driving the adoption of chromatography resins for the stringent purification processes required to meet regulatory standards and therapeutic demands.

The increasing focus on research & development in academic and clinical settings is expected to surge the demand for chromatography resins, as a major percentage of life sciences research is dependent on these analytical and preparative materials. This is propelling research and development (R&D), as governments and private institutions spend more on genomics, proteomics, and drug discovery. Universities and research institutes are forming partnerships with industrial users to manufacture affinity chromatography resin targets for specific applications ranging from protein purification to metabolomics.

Moreover, recently, government grants and funding programs, such as Horizon Europe, announced USD 95.5 billion to drive innovation and research in the European Union fuelling this trend. In addition, the increasing focus on precision medicine and high-throughput screening technologies in clinical research is pushing the market for advanced chromatography solutions for growing needs, fueling the growth of the overall market.

Chromatography Resin Market Dynamics

Drivers

-

Use of chromatography resins in purification processes in food & beverage industry.

-

High-performance liquid chromatography dominates the pharmaceutical industry.

High-performance liquid chromatography (HPLC) is a widely used analytical technique in the pharmaceutical industry, as it offers unmatched precision, versatility, and reliability in the separation, identification, and quantification of compounds. HPLC plays a critical role in drug development, quality control, and regulatory compliance, delivering accurate results essential to guarantee pharmaceutical product safety and efficacy. It is indispensable for making biologics, generics, and specialty drugs because of its ability to analyze complex mixtures and detect impurities at trace levels. Regulatory bodies, including the U.S. FDA, require advanced chromatographic methods (e.g., HPLC) for pharmaceutical quality evaluation, reinforcing its prevalence. Moreover, the emergence of HPLC innovations, such as ultra-high-performance liquid chromatography (UHPLC) systems, has further improved analysis speed and resolution to satisfy the increased demand for high-throughput and cost-effective solutions in the pharmaceutical field. For the global pharmaceutical industry, the need for HPLC and increasing adoption of HPLC will continue, given the importance of product quality and adherence to international standards.

In 2023, the FDA conducted over 1,400 inspections of pharmaceutical manufacturing facilities globally, emphasizing the need for robust quality control systems, including HPLC. Additionally, the European Medicines Agency (EMA) reported that chromatographic techniques were used in 90% of drug quality assessments during the same year.

Restraint

-

Strict regulations regarding safety and quality standards for the chromatography resin market

-

The High Cost of Manufacturing MAb Therapies in the chromatography resin market.

Chromatography resin market faces a major restraint due to high manufacturing cost involved with the monoclonal antibody (MAb) therapies as they play a vital role in the purification process but are also significant contributors towards the overall expense. MAb manufacturing is complex and resource-intensive, with several separation and purification steps, designed to yield the aims of high-grade chromatography, and is expensive because of the complex design and manufacture of resins. For example, affinity resins are often used in MAb purification, representing up to 50% of the total downstream processing costs. More so, production and scalability issues in the manufacturer process, as well as the requirement for bulk resins in mass production, make it costly. MAb therapies are less accessible, especially in developing economies, as they are often cost-prohibitive, with these costs transferred to the patient and the healthcare system.

Chromatography Resin Market Segmentation Analysis

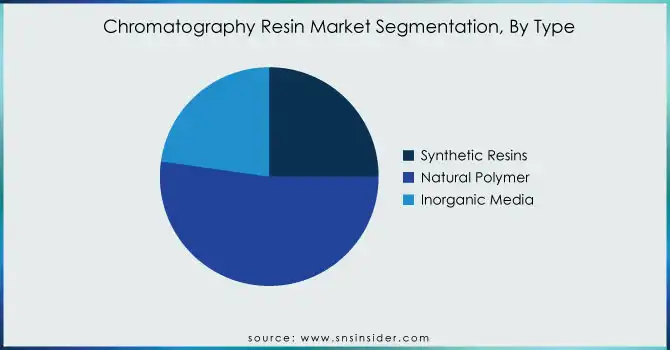

By Type

The natural segment held the largest market share around 52.23% in 2023. This is due to its biocompatibility, higher efficiency, and the fact that it is well-accepted by multiple industries. These resins, for example, agarose and dextran-based resins, are derived from renewable biomass and may offer excellent chemical stability, low nonspecific adsorption and high binding capacity, all of this makes them suitable for critical applications such as the purification of proteins and the immobilization of enzymes for biopharmaceuticals. Their ubiquitous dominance derives from their well-established capabilities of preserving the structural folding of delicate biomolecules while guiding large-scale modules. Furthermore, the growing demand for sustainable and environmentally friendly materials is contributing to the expanding use of natural resins.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Technique

The Ion Exchange sub-segment by technique, capturing a dominant 43.0% market share in the chromatography resin market in 2023, is a powerhouse for both pharmaceuticals and food & beverage. Major drug companies and CROs increasingly rely on ion exchange in their drug discovery processes, as it excels at purifying and separating key components. Similarly, the food & beverage industry finds ion exchange to be a versatile and innovative tool, contributing significantly to overall sector growth. Synthetic resins are the stars of the ion exchange show. Their popularity surges due to boosting production across various industries like food & beverage, chemicals, pharmaceuticals, and water treatment are all beneficiaries.

By Application

In 2023, the pharmaceutical and biotechnology segment accounted for the largest market share of approximately 24%. These sectors significantly utilize chromatography technologies across crucial stages namely, drug discovery, development, and manufacturing. Chromatography resins are essential in purifying biologics such as monoclonal antibodies, vaccines, and recombinant proteins, making sure that these products are safe, effective, and compliant. The rise in chronic diseases along with the increase in demand for individualized medicine and biologic therapies has led investors into these industries.

Chromatography Resin Market Regional Outlook

North America held the largest market share around 33.23% in 2023. It is driven by the high pharmaceutical and biotechnology industry in addition to high investments in R&D and regulatory framework. The prominent distributors for chromatographic columns used in the bioprocessing market are US based, as it contributes to hold a major carcass in the global market with many world-leading pharmaceutical companies and biotechnology firms. The U.S. Food and Drug Administration (FDA) imposes stringent quality control and safety standards, which for biopharmaceutical products means high-quality chromatography resins must be used for production. Additionally, to encourage drug discovery and innovation, North America also invests billions of dollars per year by organizations such as the National Institutes of Health (NIH) making a big contribution to life sciences research in the region. Additionally, the region's solid infrastructure for biopharmaceutical manufacturing, alongside increasing attention to personalized medicine and biologics, has established North America as the leader in the chromatography resin market. Additionally, the investment in cutting-edge technologies and innovation in the region has made it a major hub for the development and adoption of advanced chromatography solutions.

Key Players

-

Merck KGaA (Sepharose, Eshmuno)

-

Bio-Rad Laboratories, Inc. (Nuvia, Bio-Scale)

-

WIPRO GE HEALTHCARE PVT LTD (MabSelect, MabSelect SuRe)

-

Purolite (Chromalite, ProSep)

-

GRACE (Matrix, Discovery)

-

Mitsubishi Chemical Holdings Corporation (Kromasil, HICresin)

-

Danaher (Cytiva, ÄKTA)

-

Tosoh Corporation (Tosoh Biosep, TSKgel)

-

GE Healthcare (MabSelect, Sepharose)

-

Avantor Performance Materials Inc. (VWR, J.T. Baker)

-

Agilent Technologies (Bond Elut, Zorbax)

-

Lonza Group (Xuri, CliniMACS)

-

Thermo Fisher Scientific (Pierce, Dionex)

-

Repligen Corporation (Profinia, KrosFlo)

-

Sartorius AG (Stedim, Sartobind)

-

3M (3M™ Emphaze, 3M™ Polisher)

-

Eppendorf AG (Eppendorf Chromatography, Eporite)

-

Shimadzu Corporation (Prominence, Shim-pack)

-

Fisher Scientific (Thermo Scientific, Fisher BioReagents)

-

Kraton Polymers (Kraton G, Kraton D)

Recent Development:

-

In 2023: Merck KGaA expanded its Life Science division by launching new chromatography resins under its Sepharose and Eshmuno brands. These resins were specifically developed for the purification of biologics, with a focus on improving process efficiency and reducing costs for large-scale manufacturing.

-

In 2023: Bio-Rad launched new Nuvia chromatography resins designed to optimize protein purification processes in biopharmaceutical production. These resins are tailored to meet the growing demand for high-throughput drug discovery, especially in monoclonal antibody production.

-

In 2023: WIPRO GE Healthcare introduced the MabSelect SuRe chromatography resin, an upgraded version of its widely used MabSelect resin. The innovation enhances binding capacity and stability for more efficient purification of monoclonal antibodies, making it an essential tool for biologics manufacturing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.6 Billion |

| Market Size by 2032 | US$ 5.1 Billion |

| CAGR | CAGR of 7.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By type (Synthetic Resins, Natural Polymer, Inorganic Media) • By technique (Ion Exchange, Cation, Anion, Affinity, Size Exclusion, Hydrophobic Interaction, Mixed Mode, Others) • By application (Pharmaceutical & Biotechnology, Production, Academics & Research, Food & Beverage, Water & Environmental Analysis, Others) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Purolite Corporation, Tosoh Corporation, Repligen Corporation, Pall Corporation, R. Grace & Co, Merck KGaA, Mitsubishi Chemical Corporation, GE Healthcare, Thermo Fisher Scientific Inc, Bio-Rad Laboratories Inc., Avantor Performance Materials Inc, and other players. |

| Drivers | • Use of chromatography resins in purification processes in food & beverage industry.

• High-performance liquid chromatography dominates the pharmaceutical industry. |

| Restraints | • Strict regulations regarding safety and quality standards for the chromatography resin market

• The High Cost of Manufacturing MAb Therapies in the chromatography resin market. |