Growth Hormone Deficiency Market Report Scope & Overview:

Get More Information on Growth Hormone Deficiency Market - Request Sample Report

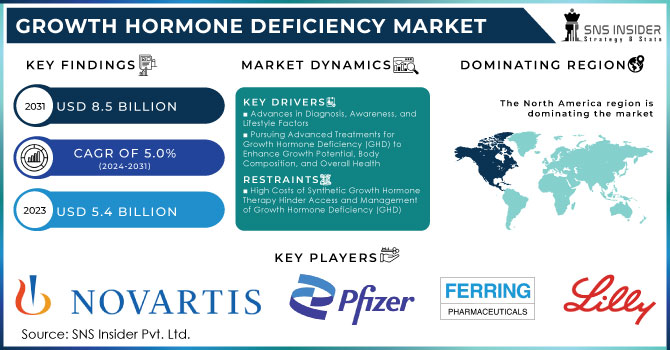

The Growth hormone deficiency market Size was valued at USD 5.4 billion in 2023 and is expected to reach USD 8.5 billion by 2032 and grow at a CAGR of 5.0% over the forecast period 2024-2032.

Growth Hormone Deficiency Market: Expanding Horizons with Advancements and Increased Awareness

Market Growth Driven by Diagnostic Innovations and Rising Awareness

The Growth Hormone Deficiency (GHD) market is on a significant upward trajectory, propelled by advancements in diagnostic techniques, heightened awareness, and an expansion of treatment options. The increasing recognition of GHD’s profound impact on health, combined with ongoing research and development, underscores the market's promising future.

Growth hormone deficiency is prevalent in approximately 2 to 3 individuals per 10,000 people, according to an NCBI article from May 2022. This condition results from structural issues in the pituitary gland, such as pituitary adenomas and craniopharyngiomas, accounting for about 57% of cases. Childhood-onset GHD, often congenital, affects growth throughout a person's life and is associated with comorbidities including obesity, diabetes, hypertension, and cardiovascular diseases. The rising prevalence of these associated conditions is driving demand for effective GHD treatments.

A major factor driving the growth of the GHD market is the increase in cases due to genetic disorders, trauma, and medical therapies. Approximately 1 in 4,000 to 10,000 people is affected by GHD, with conditions arising either in infancy or later in childhood. Early diagnosis and treatment are crucial for achieving normal height and improving overall health outcomes.

Additionally, the aging population is a key driver for growth hormone treatments. Research shows that growth hormone levels decline with age, with over 30% of the elderly experiencing levels below the normal range. By age 55, growth hormone secretion drops significantly from peak levels seen during puberty. The World Health Organization projects that the global population aged 60 and above will increase from 12% to 22% between 2015 and 2050, further boosting the demand for growth hormone therapies.

Market key players are also accelerating growth. For example, in February 2022, OPKO and Pfizer received EU marketing approval for their Once-Weekly NGENLA (somatrogon) Injection, reflecting progress in treatment options. Early detection and intervention for related endocrine disorders are crucial for better management and prevention of severe complications, driving both market growth and research in this field.

Overall, the GHD market is expanding due to increasing prevalence, heightened awareness, and advancements in treatment and diagnostics.

Market Dynamics

Drivers

-

Advances in Diagnosis, Awareness, and Lifestyle Factors

The Growth Hormone Deficiency (GHD) market is experiencing notable growth due to several key drivers. Despite GHD being relatively rare, with only about 1 in 4,000 to 10,000 children and 1 in 10,000 adults diagnosed, its profound impact emphasizes the need for early and accurate diagnosis and effective treatment.

A major driver of the market is enhanced diagnostic capabilities. Traditionally, diagnosing GHD involved labor-intensive stimulation tests, where chemicals were injected to prompt the pituitary gland to release growth hormone. These methods were cumbersome and prone to inaccuracies. However, advancements in imaging technology, particularly magnetic resonance imaging (MRI), have significantly improved diagnostic precision. MRI scans are now essential for detecting pituitary gland abnormalities or tumors that can cause GHD.

Increased awareness of GHD is another critical driver of market growth. Awareness campaigns and educational initiatives have led to better symptom recognition and a greater understanding of the condition among healthcare providers and patients. This heightened awareness has resulted in more cases being identified and treated.

Lifestyle factors also contribute to the rising incidence of GHD. Modern lifestyle changes, such as increased stress, poor sleep patterns, and fluctuating glucose levels, can impact endocrine function and hormone secretion. These factors are believed to contribute to the growing number of GHD diagnoses, further driving demand for effective growth hormone therapies.

Overall, these drivers—enhanced diagnostic methods, increased awareness, and lifestyle factors—are crucial in shaping the GHD market, leading to more accurate diagnoses and improved patient outcomes.

-

Pursuing Advanced Treatments for Growth Hormone Deficiency (GHD) to Enhance Growth Potential, Body Composition, and Overall Health

Restraints

-

High Costs of Synthetic Growth Hormone Therapy Hinder Access and Management of Growth Hormone Deficiency (GHD)

Growth hormone deficiency (GHD) significantly impacts growth, development, body composition, energy levels, and overall well-being, with somatropin therapy proving effective. However, the high cost of synthetic growth hormone therapy remains a major constraint on the GHD market, limiting patient access and optimal management of the condition.

The high costs associated with GHD therapy stem from the complex and costly process of creating synthetic growth hormones. Pharmaceutical companies face substantial R&D expenses and must recoup these investments through sales. Producing recombinant human growth hormone requires specialized facilities, highly purified materials, and rigorous quality control, all contributing to elevated production costs. Consequently, many patients struggle to afford the medication, even with insurance coverage. This financial barrier impedes the wider adoption of effective GHD treatments and highlights the need for more affordable therapeutic options.

Key Market Segmentation

By Brand

-

Norditropin: Manufactured by Novo Nordisk, Norditropin emerged as the dominant player in 2023, commanding the largest market share valued at USD 1.6 billion. This brand is anticipated to maintain its dominance, growing at a significant compound annual growth rate (CAGR) of 4.9% from 2024 to 2032. Norditropin’s market leadership is driven by Novo Nordisk’s strong brand reputation and history of producing high-quality medical products. The product’s efficacy in treating growth hormone deficiency, supported by extensive clinical research, adds to its competitive edge. Norditropin's preloaded pen system, which is premixed and prefilled, offers convenience by eliminating manual mixing, making it a preferred choice among patients.

-

Genotropin: Ranking as the second-largest player, Genotropin held a revenue share of 25% and a market size of USD 1.4 billion in 2023. It is projected to grow to USD 2.1 billion by 2032. Genotropin is a synthetic form of human growth hormone (HGH) used to treat growth hormone deficiencies, including conditions like Turner syndrome and Prader-Willi syndrome. However, it is not recommended for patients with certain severe conditions.

By Application

-

Idiopathic Short Stature (ISS): Dominated the GHD market with a 45% share, the ISS segment generated USD 2.5 billion in revenue in 2023 and is projected to reach USD 3.8 billion by 2032, growing at a CAGR of 4.8%. ISS, characterized by shorter-than-average height without a known cause, is gaining attention due to heightened awareness about its impact on physical and psychological health. Approximately 60-80% of children with short stature globally are classified as ISS, presenting a significant growth opportunity.

-

Pediatric Growth Hormone Deficiency: Holding a 30% market share, this segment generated USD 1.5 billion in revenue in 2023 and is expected to grow at the fastest CAGR of 5.3% from 2024 to 2032. Pediatric GHD, an endocrine disorder causing inadequate growth hormone secretion, can lead to stunted growth and related health issues if untreated. Increased awareness, early diagnosis, and improved diagnostic capabilities drive this segment’s rapid growth.

By End-User

-

Hospital Pharmacies: Led the GHD market, this segment commanded a substantial 48% share and generated USD 2.7 billion in revenue in 2023. It is projected to grow at a CAGR of 4.8% from 2024 to 2032. Hospital pharmacies play a crucial role as recombinant growth hormone medications are prescription drugs requiring physician approval. Many hospitals require patients to obtain prescribed medications directly from in-house pharmacies to ensure proper medication management and adherence to healthcare standards.

-

Specialty Pharmacies: Holding the second-largest share, this segment contributed 35% to the end-user market, generating USD 1.7 billion in revenue in 2023. It is expected to grow at the fastest CAGR of 5.3% during the forecast period. Specialty pharmacies focus on medications for complex or chronic conditions requiring specialized handling and care. They provide additional services such as patient education and adherence programs, enhancing patient outcomes and contributing to market growth.

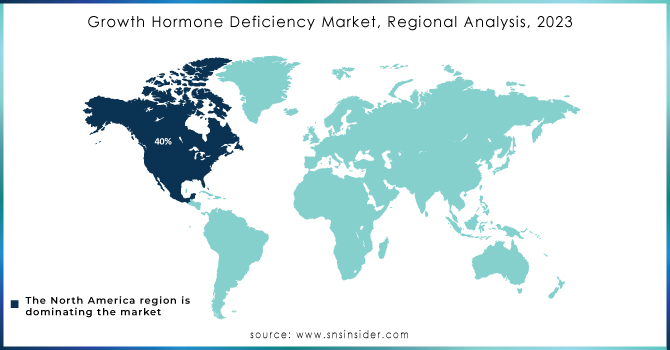

REGIONAL ANALYSIS:

North America: Dominated the GHD market, North America held a 40% market share, contributing USD 2.2 billion in revenue in 2023. The region is expected to grow to USD 3.3 billion by 2032. North America's dominance is driven by high healthcare expenditure, strong demand for growth hormone therapies, advanced research and development, and the presence of major pharmaceutical companies like Pfizer Inc. and Eli Lilly and Company. Comprehensive healthcare systems, favorable reimbursement policies, and high awareness levels further bolster the market in this region.

Europe: Holding the second-largest share of the GHD market with 27%, Europe generated USD 2.1 billion in revenue in 2023, projected to rise significantly by 2032. Growth in Europe is fueled by increasing incidences of GHD, rising healthcare expenditure, and government investments in healthcare. The European Medicines Agency reported a prevalence rate of 4.7 per 10,000 people in 2023, underscoring the region's need for effective GHD treatments.

Asia-Pacific: The fastest-growing market, Asia-Pacific expanded at a CAGR of 5.3% from 2024 to 2032. Contributing USD 0.9 billion in 2023 and projected to reach USD 1.4 billion, this region benefits from increasing healthcare investments, a large patient base, and rising awareness of growth hormone therapies. Economic growth and improved access to advanced medical treatments are key drivers of market expansion in Asia-Pacific

Need any customization research on Growth Hormone Deficiency Market - Enquiry Now

KEY PLAYERS:

Eli Lilly and Company, ROCHE (Genentech, Inc.), Ferring B.V, Pfizer Inc., Novo Nordisk A/S, Teva Pharmaceutical Industries Ltd, Novartis AG, Merck Kga, Anhui Anke Biotechnology Group Co., Ltd, EMD Serono Inc, and others.

Recent Developments

-

Novo Nordisk expanded its clinical trials for Norditropin, focusing on its effectiveness in treating idiopathic short stature (ISS). The company reported promising preliminary results indicating improved growth outcomes in pediatric patients.

-

June 2023: Pfizer announced the launch of a new formulation of its growth hormone therapy, Genotropin, designed to improve patient adherence. The new formulation includes an advanced delivery system that simplifies administration and minimizes discomfort.

-

May 2022: Eli Lilly received FDA approval for its new growth hormone therapy, Zomacton, which features a novel, extended-release mechanism. This new treatment aims to provide more stable hormone levels with fewer injections required, enhancing patient convenience.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.4 Billion |

| Market Size by 2032 | US$ 8.5 Billion |

| CAGR | CAGR of 5.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Brand (Norditropin, Genotropin, Humatrope, Saizen, Omnitrope & Others) • By Application (Growth Hormone Deficiency, Turner Syndrome, Idiopathic Short Stature, Prader–Willi Syndrome, Small for Gestational Age & Others) • By End-User (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy & Specialty Pharmacy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Eli Lilly and Company, ROCHE (Genentech, Inc.), Ferring B.V, Pfizer Inc., Novo Nordisk A/S, Teva Pharmaceutical Industries Ltd, Novartis AG, Merck Kga, Anhui Anke Biotechnology Group Co., Ltd, EMD Serono Inc, and others. |

| Key Drivers | • Growing awareness about growth hormone deficiency (GHD) and its treatments are the key drivers of this market. • The increasing prevalence of GHD is a key factor rationale for the growth in market size. |

| RESTRAINTS | • The side effects of synthetic growth hormone therapy are restraining the market. • High Price of Growth Hormone Replacement Therapy (GHD) is Restraining the overall market. |