High Altitude Pseudo Satellite Market Report Scope And Overview:

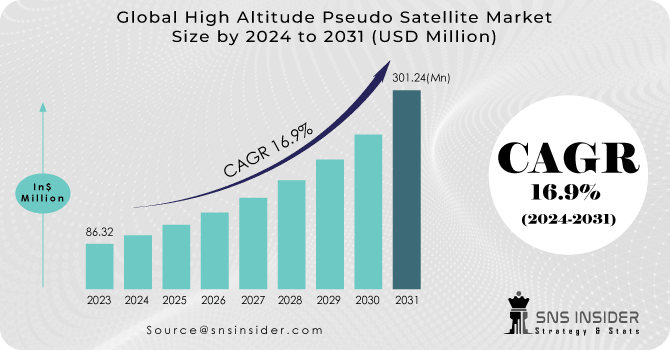

The High Altitude Pseudo Satellite Market size was valued at USD 86.32 Million in 2023 and is expected to grow to USD 301.24 Million by 2031 and grow at a CAGR of 16.9% over the forecast period of 2024-2031.

High-altitude pseudo satellites are potential substitutes for conventional satellites, and once launched, these aerial platforms generally hover at stratospheric altitudes, which ranges between 10 miles and 30 miles above sea level. The high-altitude pseudo satellites are geostationary. Therefore, their effectiveness in the provision of services is local. The high-altitude pseudo satellites incorporate the best aspects of terrestrial and satellite-based communication systems. The best aspects of land and satellite communication systems are incorporated into the HAPS. By efficiently delivering voice, video and broadband services at much lower cost than the performance margins of conventional geostationary satellites, they eliminate both satellite capacity and performance limitations. Therefore, in order to satisfy the demand for High-Capacity Wireless Services, they are being increasingly used by telecommunication service providers.

Get More Information on High Altitude Pseudo Satellite Market - Request Sample Report

Market Dynamics

Key Drivers:

-

Advancements in incorporated photovoltaic technology

To reduce dependence on fossil fuels, gas, and oil, the use of renewable energy has become essential. In order to address the increasing issue of climate change, there is a global need for comparatively cheap and readily available energy sources. In addition, HAPS uses the energy stored in photovoltaic cells to drive its electric propulsion units, and simultaneously replenishes the charge of the solar arrays mounted on the wing’s airframe, and stabilizers. The monitoring systems that regulate and monitor the use and temperature of each of the onboard cells in combination are also installed on these aerial platforms.

-

Network flexibility and providing an excellent option for emergency communications

Restraints:

-

Cost-effective broadband services

Opportunities:

-

High need for surveillance required on border

A HAPS shall provide increased network flexibility and configurability, allowing for the temporary provision of basic and supplementary capacity requirements while at the same time giving a wide range of options in terms of emergency communications. Organisations in the field of rescue are thus adopting them more and more frequently. Moreover, market growth is boosted by advances in technology.

-

Growing adoption by the agencies during rescue operations is another factor that propels the marketplace growth.

-

The need for high speed, secure communication networks in rural areas is growing.

Challenges:

-

Endurance limitations of HAPS

Although HAPS are more cost effective to manufacture and operate, the durability of these platforms is limiting their effectiveness. An electric propulsion system shall be installed for HAPS platforms, such as unmanned aerial vehicles UAVs, in order to increase the durability of the platform. This has led to significant investments in R&D towards developing powerful battery systems and high charging density solar panels with a view to enhancing the endurance of HAPS platforms, thus making them more viable for deployment.

-

The cancellation of ongoing projects is envisioned to impede the growth of the market

IMPACT OF RUSSIA UKRAINE WAR:

The conflict could lead to broader geopolitical tensions that may affect international cooperation and partnerships in the development and deployment of HAPS systems. Collaborative projects involving countries or companies affected by the conflict could face challenges or delays. If either Russia or Ukraine is a significant supplier of components or materials for HAPS production, there could be disruptions in the supply chain. This could lead to delays or shortages in manufacturing, affecting the deployment of HAPS systems. The Geopolitical tensions may result in changes to export controls, trade regulations, or airspace restrictions, impacting the regulatory environment for HAPS operations. This could affect the ability to deploy or operate HAPS systems in certain regions or under certain conditions. Economic uncertainties resulting from the conflict could impact investment in HAPS research, development, and deployment. Companies and governments may prioritize other areas of spending, leading to reduced funding for HAPS projects or programs. Heightened geopolitical tensions could raise concerns about the security of HAPS systems, particularly if they are used for communication or surveillance purposes. There may be increased scrutiny or regulations related to the use of HAPS technology in sensitive areas or applications.

The Ukraine conflict is fundamentally a war of attrition, the true measure of Ukraine’s success or failure is measured in the loss of manpower and equipment versus its ability to regenerate forces, replace equipment, and replenish ammunition stockpiles. In all of these regards, Ukraine has been losing the war from the moment it began – some may even look back in hindsight and conclude the war was lost before it even began. The collective West for decades developed a large, for-profit military industrial base. It focused on maximizing profits through the production of high-cost systems built in relatively small quantities, while eliminating extra manufacturing capacity for large-scale production that rarely if ever was necessary to sustain the West’s “small wars” following the collapse of the Soviet Union. Russia, on the other hand, inherited the Soviet Union’s massive military industrial base, maintained certain aspects of it, modernized and expanded others, preparing for large-scale, high-intensity, protracted warfare within or along its borders. To bolster its drone capabilities, Russia has also invested in the development of swarm drone technology. Swarm drones are a group of coordinated UAVs that can operate together, performing complex tasks with enhanced efficiency. With well-aimed drops, the operator of the strike UAV 58 obSpN 1 of the Donetsk Army Corps managed to tear the tank’s protective mesh and drop ammunition directly into the open hatch of the tank’s turret.

MARKET SEGMENTATION:

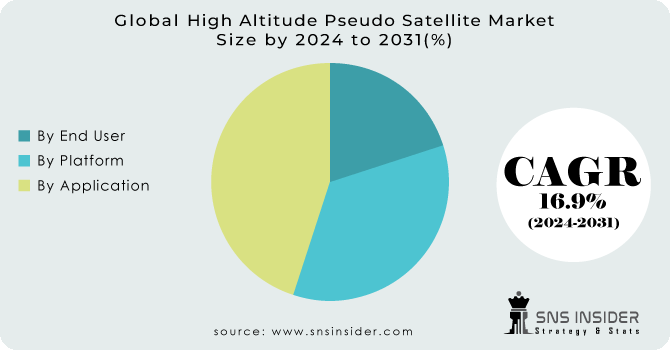

By Platform:

-

Airships

-

Balloons

-

UAVs

In missions, HAPS is using the flexibility of airships with satellite endurance. For example, weather and lack of available on-board energy sources are challenges in the use of Unmanned Balloons for providing these services. Because of their ability to carry and power more cargo, airships have been preferred over other platforms. Airships may cover large areas quickly and effectively, including difficult to reach zones. Low cost, flexibility and ease of deployment are other advantages for airships.

By Application:

-

Communication

-

Earth Observation & Remote Sensing

-

Others (ISR, Monitoring, Search and Rescue, Navigation)

The communication application segment held the largest market share in the high-altitude pseudo satellite market, 2023. "Communications applications, involving the use of HAPS platforms for establishing and enhancing communication links from various points on Earth's surface, are covered by a pseudo satellite segment at altitudes above 500 m." In addition to extending communication coverage in remote or underserved areas, the HAPS can also be used as airborne relay stations and offer additional capacity.

By End User:

-

Government & Defense

-

Commercial

In 2023, the commercial end user segment will have a higher market share in the high-altitude pseudo satellite market. The commercial HAPS provide high speed Internet and cellular connectivity to remote or underserved areas with communication capabilities such as 4G/5G base stations and satellite like transponders, enabling them to communicate. In regions with no terrestrial infrastructure, or in the context of disaster recovery efforts, it is particularly beneficial.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS:

North America region would evolve as a leader in worldwide High-altitude lengthy endurance (Pseudo Satellite) marketplace. It has global leading High altitude long endurance (Pseudo Satellite) capability based on strong and improved advanced infrastructure. Moreover, another factor that contributes to market growth is the presence of major aerospace defence industries in this region. In addition, Europe is expected to be the second highest revenue market in the world. Because of the lack of essential infrastructure to guarantee telecommunication services in rural areas, adoption of HAPS is significantly higher in emerging Asia Pacific countries. HAPS platforms are instrumental in search and rescue (SAR) missions, disaster relief, environmental monitoring, and precision agriculture.

A number of governments in Asia Pacific, for example India, have allowed the HAPS to be tested prior to implementation so as to assess its feasibility in their country. HAPS is also highly efficient in delivering reliable and cost-effective Broadband services, as well as a viable Alternative Infrastructure for the provision of Long-Term Broadband Access to users on fixed or Mobile. For example, for a long period of about 3 to 5 years, the stratosphere balloons can remain in orbit around their intended target area and cover an area.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players:

Some of key players of High Altitude Pseudo Satellite Market are AeroVironment, Inc., Airbus SE, RosAeroSystems, Prismatic (BAE Systems plc), THALES, Ball Corporation, Northrop Grumman Corporation, Hawkeye Systems, Inc., Parrot Drone SAS, Mira Aerospace and other players are listed in a final report.

AeroVironment, Inc-Company Financial Analysis

Recent Developments:

-

July 2023: Mira Aerospace has successfully performed a test flight of its new high altitude pseudo satellite platform HAPS. The ApusDuo UAS successfully reached an altitude of 16,686 m during the ten-and-a-half-hour test flight, which carried 3.6 kg of cargo. The wingspan of the ApsDuo HAPS is 15 m 49.2ft, with a maximum takeoff weight of 95 lb (43 kg).

-

July 2023: BAE Systems plc successfully launched its High-Altitude Pseudo-Satellite (HAPS) Uncrewed Aerial System (UAS) PHASA-35 solar-powered drone into the stratosphere, reaching an altitude of over 66,000 ft 20,000 m. The recent test was sponsored by the US Army's Space and Missile Defense Command Technical Center. PHASA-35 is designed to create an uncrewed aircraft that can stay aloft for a year at a time, circling over a vast area above the weather and air traffic in which it may act as pseudo satellites.

-

In July 2023, PHASA-35 successfully completed a stratospheric flight trial in June 2023, exceeding an altitude of 66,000ft, before landing safely in New Mexico, US.In March 2023, Thales group signed a contract with the European Commission for the EuroHAPS demonstration project worth USD 45.4 million. The contract includes development of three different stratospheric platforms to test a range of capabilities and missions including intelligence, surveillance, and reconnaissance (ISR) as well as communications and electronic intelligence. Light detection and ranging (LIDAR) observation, to detect and classify targets at sea or on land including in vegetation cover, and a meshed broadband communications network will also be trialled.

-

In October 2022, Airbus has signed a contract with Salam, a leading Saudi information & telecommunication company and part of the Mawarid Media & Communications Group (MMCG), to progress the development of private networks, internet of things (IoT) applications, disaster management solutions and other connectivity and high-altitude Earth observation services from the stratosphere to serve the Kingdom of Saudi Arabia.

| Report Attributes | Details |

| Market Size in 2023 | US$ 86.32 Million |

| Market Size by 2031 | US$ 301.24 Million |

| CAGR | CAGR of 16.9 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Airships, Balloons, UAVs) • By Application (Communication, Earth Observation & Remote Sensing, Others (ISR, Monitoring, Search And Rescue, Navigation) • By End User (Government & Defense, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AeroVironment, Inc., Airbus SE, RosAeroSystems, Prismatic (BAE Systems plc), THALES, Ball Corporation, Northrop Grumman Corporation, Hawkeye Systems, Inc., Parrot Drone SAS, Mira Aerospace |

| Key Drivers | • Advancements in incorporated photovoltaic technology • Network flexibility and providing an excellent option for emergency communications |

| Market Opportunities | • High need for surveillance required on border • Growing adoption by the agencies during rescue operations is another factor that propels the marketplace growth. • The need for high speed, secure communication networks in rural areas is growing. |