Hand Tools Market Report Scope & Overview:

To get more information on Hand Tools Market - Request Free Sample Report

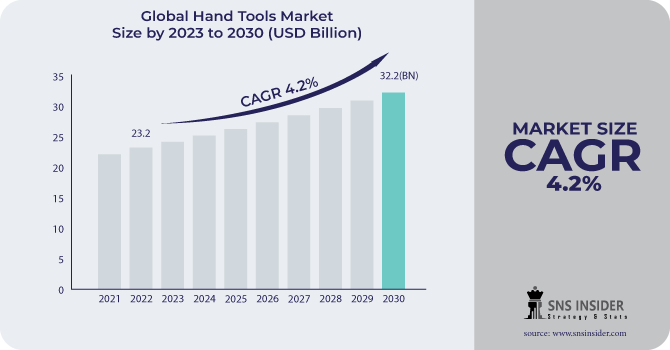

The Hand Tools Market Size was estimated at USD 24.69 billion in 2023 and is expected to arrive at USD 34.33 billion by 2032 with a growing CAGR of 3.73% over the forecast period 2024-2032. The Hand Tools Market report provides unique insights into regional demand and consumption trends, highlighting shifts in professional and DIY tool usage. It examines manufacturing utilization rates, revealing efficiency patterns across key regions. The study also covers maintenance costs and replacement cycles, offering cost-benefit insights for end-users. Additionally, it explores smart tool adoption trends, showing a surge in connected hand tools. The report further presents export/import data, mapping global trade dynamics. Emerging trends include the rise of ergonomic and AI-integrated hand tools, reshaping industry innovation

The U.S. hand tools market is projected to grow from USD 7.88 billion in 2023 to USD 10.61 billion by 2032, reflecting a CAGR of 3.35%. This steady growth is driven by increasing demand across the construction, automotive repair, and home improvement sectors. Technological advancements and a rise in DIY activities further support market expansion.

Market Dynamics

Drivers

-

The growing construction and automotive industries drive demand for durable, ergonomic, and advanced hand tools, boosting market growth.

The hand tools market is experiencing steady growth, driven by increasing demand from the construction and automotive industries. Increasing infrastructural growth along with urbanization and renovation of residential and commercial projects is estimated to boost demand for high-quality hand tools used in construction and repair activities. Likewise, the growing automotive segment, comprising vehicle production as well as maintenance and aftermarket services, drives the need for niche hand tools. The mechanics and technicians use durable and ergonomic tools for precise and efficient work. We have also made evolutionary steps in the design of tools, including lighter materials and the ergonomics of grip, which will make it more comfortable to use and therefore more productive. The market is also showing a potential trend of smart and multi-functional hand tools with sensors for efficient usability and accuracy. Market players have lucrative headroom in hand, particularly in emerging economies with growing construction and automotive sectors. The global Industrialization is growing, which will significantly increase the number of consumers of hand tools, therefore increasing the competition among the manufacturers and impacting the growth of the industry.

Restraint

-

Intense market competition leads to price wars, reducing profit margins and pressuring manufacturers to balance affordability with quality.

The hand tools market is highly competitive, with numerous manufacturers vying for market share across different regions. This very high competition can create situations where prices are driven down, resulting in aggressive price competition and price wars, which alone can affect profit margins heavily. When new brands come into the market, they often drive down prices to get a seat at the table, and Keller has talked about having established brands wanting to cut prices to stay competitive. This is compounded by the presence of low-cost manufacturers, especially from emerging economies, which increases price pressure. In price-sensitive markets, consumers often choose the lower-priced item of a comparable quality product over brands, creating a ripple effect that drives manufacturers to discount or offer low-priced alternatives. Competitive pricing may benefit consumers, however, it makes it difficult for companies to make profits, invest in innovations, and guarantee quality. Companies apply value-added features, brand excellence, and advanced materials to defy these challenges and be able to maintain a premium price. Strategic alliances and a potent distribution network are vital not only to remain competitive but also to garner market share in highly competitive environments.

Opportunities

-

The rise of e-commerce enables hand tool manufacturers to expand their reach, boost sales, and enhance customer engagement through digital platforms.

The rapid growth of e-commerce and digital sales channels has transformed the hand tools market by providing manufacturers with expanded distribution opportunities. This has opened up new opportunities for businesses to sell their tools directly to consumers through online platforms such as Amazon, eBay, and specialized tool retailers, allowing them to target DIY enthusiasts, professionals, and industrial buyers. Brands can access emerging markets without a physical footprint, as e-commerce breaks down geographical barriers. Moreover, digital marketing, customer feedback, and focused advertisements boost brand recognition and buyer interaction. They also push sales by offering subscription-based models, bundled deals, and online-exclusive products. The online platforms also provide doorstep delivery of the products, competitive pricing, and a comparative study on product features , which are encouraging consumers to go from qualitative physical stores to buying products online. Additionally, the incorporation of AR and virtual assistance in online shopping improves the customer experience, displaying accurate details of the product and assisting customers to make informed and accurate purchase decisions. The manufacturers must have to take their optimal position on the net to gain what has been emerging, digital sales channels.

Challenges

-

Evolving consumer preferences drive demand for ergonomic, multifunctional, eco-friendly, and smart hand tools, requiring continuous innovation and adaptation.

Changing consumer preferences in the hand tools market are driven by evolving industry demands, technological advancements, and shifting user expectations. These days, consumers demand ergonomic, durable, and versatile tools that boost efficiency and facilitate ease of use in cleaning. Purchasing decisions have been increasingly affected by the popularity of the DIY movement, the need for sustainability, and integration with smart technology. Businesses, in some cases, are requiring high-performance, precision tools tailored towards specialized industrial applications. Moreover, the shift towards online shopping has created demand for digital marketing strategies and direct-to-consumer sales models. So manufacturers keep innovating with eco-friendly materials, lightweight designs, and smart product features like sensor-enabled hand tools. Neglecting to keep pace with these evolving preferences can result in decreased market relevance and customer loss. Consequently, businesses in the hand tools sector need to keep pace with trends, prioritize R&D, and broaden their product portfolios to cater to the evolving demands of contemporary consumers and professionals.

Segmentation Analysis

By Product Type

The Spanners segment dominated with a market share of over 32% in 2023, due to their widespread use across multiple industries, including automotive, construction, manufacturing, and maintenance. They are important to carry out tightening and loosening of nuts and bolts such as they are needed to be used in repair and assembly jobs. Spanners are very famous because of their usability in construction sites and factories, which makes them also grow as an expected market demand. Also Read: Their adoption is being driven by increased industrialization and infrastructure development around the world. Moreover, they are also used in automotive repairs, machinery maintenance, and household applications, which in turn facilitates the growth of the market. From ergonomic designs to corrosion-resistant materials, innovations never stop, making it the most sought-after tool now and in the future.

By Application

The Industrial segment dominated with a market share of over 64% in 2023, owing to its extensive use across various industries such as construction, manufacturing, and automotive repair. Such industries depend on hand tools for tasks that demand precision, durability, and efficiency. Technological developments, such as better ergonomic designs and advanced materials, as well as the rising demand for high-performance tools to perform heavy-duty operations, are also driving the dominance of this segment. The growing industrialization, infrastructure growth, and rising automotive & aerospace industries also further boost the adoption. The demand for specialized and high-quality hand tools in industrial applications is also on the rise due to the focus on workplace safety and productivity, supporting long-term growth in this market.

By Sales Channel

The online sales segment dominated with a market share of over 68% in 2023, making it the dominant segment in the industry. The advent of e-commerce platforms has transformed the purchase of hand tools for consumers by increasing product availability, competitive pricing, as well as convenience. This trend has been reinforced by large online marketplaces like Amazon, Home Depot, and other specialty tool retailers that have tons of product variety, customer reviews from customers, and delivery directly to your doorstep. Moreover, with the use of online platforms, they can reach a global audience, which is driving growth as well. The rise in digital transactions, combined with regular discounts and promotional offers, has contributed to making online purchases a preferred choice of both professionals and DIY enthusiasts, thereby dominating the market.

Key Regional Analysis

The North America region dominated with a market share of over 42% in 2023, due to significant demand for the material from key industries, including construction, automotive, and manufacturing. Major manufacturers that innovate and expand their portfolios care a great deal about the industrial basis of the region, rotating throughout the market segments. A growing trend of DIY activities and home improvement projects further fuels market growth. Emerging tools with integrated advanced technology are also contributing to the growth of the hand tools market in this region by improving efficiency and durability. An increase in infrastructure development and renovations further supports market growth. In addition, stringent safety regulations and high-quality standards promote the utilization of high-end hand tools. North America continues to dominate the global hand tools market, backed by a robust distribution network and growing investments in research & development.

Asia-Pacific is experiencing the fastest growth in the hand tools market due to rapid industrialization and urbanization across major economies like China and India. The growing construction and manufacturing sectors in the region are demanding hand tools for commercial and industrial applications, everything from homes to factories. Moreover, growing disposable incomes and increasing e-commerce channels are also assisting the market for DIY activities and home improvement projects are gaining traction, which was another major factor driving market growth. Another factor contributing to the increased demand is the government initiatives supporting infrastructure development and small-scale industries. Asia-Pacific continues to remain a predominant region with scope to grow business for hand tool companies due to improved tool technology and the presence of multiple local and international manufacturers.

.png)

Need any customization research on Hand Tools Market - Enquiry Now

Key players in the Hand Tools Market

-

Akar Tools Limited (Wrenches, Spanners, Screwdrivers)

-

Apex Tool Group (Pliers, Sockets, Ratchets, Wrenches)

-

Channel lock Inc.(Pliers, Wrenches, Screwdrivers)

-

JCBL India (Automotive Hand Tools, Wrenches, Pliers)

-

Emerson Electric Co. (Pipe Wrenches, Torque Wrenches, Measuring Tools)

-

Klein Tools Inc. (Pliers, Screwdrivers, Electrical Hand Tools)

-

Snap-On Incorporated (Ratchets, Wrenches, Sockets, Pliers)

-

Stanley Black & Decker (Hand Saws, Hammers, Measuring Tools, Wrenches)

-

Techtronic Industries Co. Ltd. (Hand Saws, Screwdrivers, Pliers)

-

Wera Tools (Screwdrivers, Wrenches, Ratchets, Bits)

-

Makita Corporation (Hand Planers, Saws, Screwdrivers)

-

Bosch Power Tools (Measuring Tools, Saws, Wrenches)

-

Hilti Corporation (Measuring Tools, Chisels, Fastening Tools)

-

Irwin Tools (Clamps, Chisels, Pliers, Screwdrivers)

-

Facom (Stanley Black & Decker) (Precision Hand Tools, Ratchets, Sockets)

-

Bahco (SNA Europe) (Adjustable Wrenches, Hand Saws, Pliers)

-

Wiha Tools (Insulated Screwdrivers, Wrenches, Pliers)

-

GEDORE Tools (Torque Wrenches, Pliers, Spanners)

-

Matco Tools (Automotive Hand Tools, Wrenches, Sockets)

-

Tajima Tool Corporation (Measuring Tapes, Utility Knives, Hammers)

Suppliers for (hand tools, power tools, and storage solutions) Hand Tools Market

-

Stanley Black & Decker

-

Snap-on Incorporated

-

Apex Tool Group

-

Techtronic Industries

-

Emerson Electric Co.

-

Makita Corporation

-

Channellock, Inc.

-

Klein Tools

-

Hilti Corporation

-

Bosch Power Tools

Recent Development

In June 2024: Bosch Power Tools launched new cordless tools, including an 18V deep cut band saw and a PROFACTOR 18V impact wrench. Engineered for precision and efficiency, these tools incorporate brushless motors, ergonomic designs, and advanced features such as tool-free blade changes and adjustable torque settings, making them ideal for demanding applications.

| Report Attributes | Details |

| Market Size in 2023 | USD 24.69 Billion |

| Market Size by 2032 | USD 34.33 Billion |

| CAGR | CAGR of 3.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Spanners, Vices/Clamps, Pliers/Pincers, Household Tools, Grease Guns, Wrenches, Hammers/Sledge Hammers, Chisel/Gauges, Metal Working Tools, Screwdrivers, Others) • By Application (Industrial, Professional) • By Sales Channel (Retail, Online) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Akar Tools Limited, Apex Tool Group, Channellock Inc., JCBL India, Emerson Electric Co., Klein Tools Inc., Snap-On Incorporated, Stanley Black & Decker, Techtronic Industries Co. Ltd., Wera Tools, Makita Corporation, Bosch Power Tools, Hilti Corporation, Irwin Tools, Facom (Stanley Black & Decker), Bahco (SNA Europe), Wiha Tools, GEDORE Tools, Matco Tools, Tajima Tool Corporation. |