Healthcare Business Intelligence (BI) Market Report Scope & Overview:

Get more information on Healthcare Business Intelligence (BI) Market - Request Free Sample Report

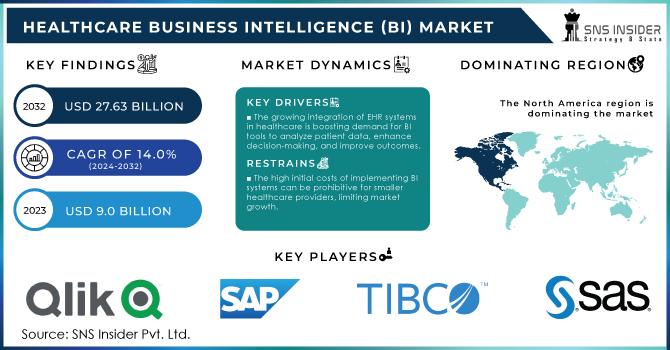

The Healthcare Business Intelligence (BI) Market Size was valued at USD 9.0 Billion in 2023, and is expected to reach USD 27.63 Billion by 2032, and grow at a CAGR of 14.0%.

The Healthcare Business Intelligence (BI) market is expected to grow rapidly as a result of government initiatives aimed at increasing the adoption of Electronic Health Records (EHR) through incentives and the establishment of patient registries. This will lead to a greater demand for healthcare data warehousing. In January 2021, the Government of India outlined its digitization process for healthcare, emphasizing the implementation of EHR to improve patient data management and facilitate coordination among healthcare providers, as well as to enhance healthcare research.

At the national level, efforts are underway to formulate the National Digital Health Blueprint to establish a digital health record system across India. Additionally, major healthcare providers such as Tata Memorial Hospital and Max Hospitals Private Limited have begun implementing electronic medical record (EMR) software, with plans to transition to comprehensive EMRs. These advancements and the increasing adoption of BI practices among healthcare providers are driving market growth. However, the complexity of systems may pose challenges to market expansion in the forecast period.

MARKET DYNAMICS:

Key Drivers:

-

The Increasing Integration of EHR Systems Across Healthcare Facilities Is Driving the Demand for Business Intelligence (BI) Tools that can Analyze Large Volumes of Patient Data, Improve Decision-Making, and Enhance Patient Outcomes.

-

The Shift Towards Value-Based Care and Personalized Medicine has Led to an Increased Focus on Healthcare Analytics. Bi Tools are Crucial in Analyzing Patient Data, Predicting Trends, And Enabling More Effective Management of Resources and Treatments.

Restraints:

-

The Sensitive Nature of Healthcare Data Makes It Vulnerable to Breaches. Strict Regulations Like HIPAA in The United States Impose Significant Compliance Challenges, Restraining the Rapid Adoption of BI Tools.

-

The Initial Investment Required for Implementing Comprehensive BI systems, Including Software, Infrastructure, And Training, can Be Prohibitive for Smaller Healthcare Providers, Limiting the Market's Growth.

Opportunity:

-

The Incorporation of AI and Machine Learning into BI tools Presents Significant Opportunities for Enhanced Predictive Analytics, Automated Data Processing, And Improved Decision-Making in Healthcare.

-

The Growing Healthcare Infrastructure in Emerging Markets Offers Substantial Opportunities for BI Solution Providers to Tap into New Regions, Where the Adoption of Healthcare Technology is Accelerating.

KEY MARKET SEGMENTATION:

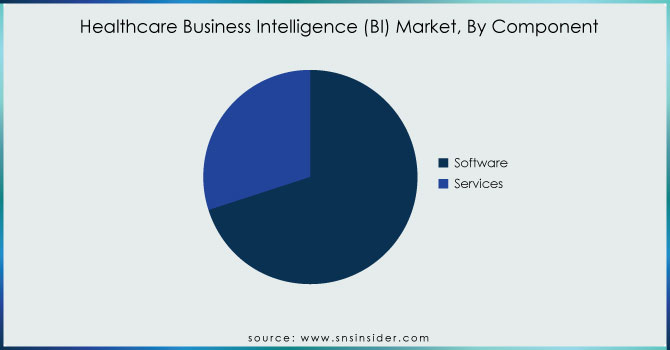

By Component

The market is divided into software and services, with the software segment holding the largest share 70% in 2023. This segment has found wide application in the healthcare sector. Business intelligence software enables administrators to monitor key performance indicators, analyze data, and provide insights for data-driven decision-making. The applications of this software are continuously evolving and have led to improved patient outcomes and real-time data sharing, proving beneficial for the healthcare industry. Additionally, it helps reveal financial trends and insights that aid in decision-making.

The increased adoption of next-generation cloud computing models, specifically Software as a Service (SaaS) applications, has played a critical role in the expansion of the healthcare business intelligence market. SaaS applications provide access to enterprise performance management, supply chain management, revenue cycle administration, and business process management. These applications also offer various security options that medical institutions can use to safeguard patient data, ensuring accuracy and providing real-time updates. The growth of this segment is further supported by the strategies implemented by major players. In June 2021, Salesforce.com, Inc., an enterprise business application platform provider, announced a partnership to deploy advanced workflows into the Amazon Web Services, accelerating digital transformation.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Mode of Delivery

The cloud-based delivery mode segment accounted for a significant share of 48% in 2023 value terms, and it is expected to dominate new technology initiatives over the forecast period. Cloud computing allows all processes in big data to be done because it provides a large amount of storage and processing power. The rapid adoption of cloud BI tools due to the speed and accessibility offered by such devices could enable organizations to adopt various other cloud-based systems too. One major type is classified as Customer Relationship Management (CRM) applications like Salesforce and patient engagement CRM. Another is Analytics Cloud for HR segment companies with a huge workforce, involving larger technology involvement in day-to-day activities and operational data.

The growth is mainly due to the increasing demand for affordable and user-friendly technology, as well as its greater adaptability, which leads to higher adoption rates. Healthcare providers are increasingly using cloud computing for revenue cycle management and to improve patient care, which is driving market growth. The cloud's immense computing power is essential for 99% of big data operations, as it requires extensive storage and processing capabilities. The growing use of telehealth among healthcare providers and the adoption of telecloud in various applications is expected to further expand the market.

By Application

The largest application segment in 2023 was financial analysis, which accounted for 38% of revenue. Financial analysis software has various uses, such as managing spending budgets, controlling cash flow, overseeing claims, and optimizing sales systems to enhance profitability. These factors are driving the market for financial analytics software, enabling efficient management of the revenue cycle, and can be used for risk assessment and claims processing.

Nevertheless, the revenue share in patient care is anticipated to increase rapidly at a CAGR over the forecast period as healthcare organizations prioritize enhanced new methods for high-quality patient and clinical treatment, thereby reducing readmissions while optimizing personnel distribution and running well-controlled expenses on patients. In the life science industry, they need business intelligence tools to provide quality patient care-informed data, which is certainly more valuable.

REGIONAL ANALYSIS:

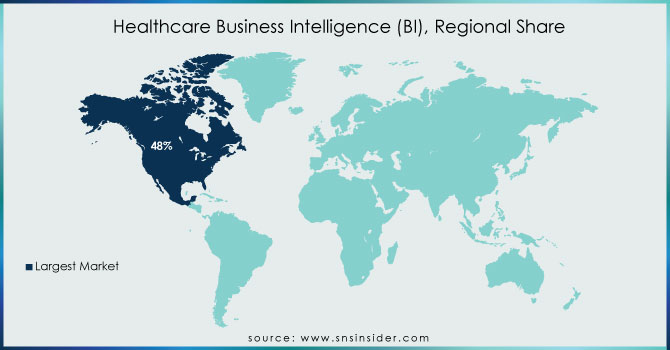

North America led the global market in 2023 with a 48% share, driven by the increasing adoption of healthcare business intelligence (BI) solutions and services to improve patient care. The growing awareness of business intelligence, along with factors such as the shift to cloud computing and ongoing improvements in healthcare and IT infrastructure, also contributed to the market's growth. For instance, a report published in PubMed Central in March 2022 highlighted the use of BI processes to assess ICA wastage during CT scans in the US. This growing implementation of BI in various healthcare sub-segments is expected to drive market expansion in the region.

In North America, data services are being used as robust tools for recovery in the tech sector to address pandemics. In April 2021, IBM launched the Summit supercomputer at Oak Ridge National Laboratory (ORNL) under the United States Department of Energy, which can be utilized for emergency computation and high-level simulation.

Additionally, the 2021 data from The Office of the National Coordinator for Health Information Technology revealed that the majority of office-based physicians and non-federal acute care hospitals in America adopted certified electronic health records (EHR). The increased adoption of EHRs is also anticipated to support market growth. Furthermore, the introduction of new products, such as Med Tech Solutions' MTS Practice Data Analytics visual business intelligence (BI) tools in September 2021, is driving general market growth in North America. Practice Data Analytics offers over 40 standard business intelligence reports based on electronic health record (EHR) data, viewable in highly flexible dashboards, contributing to sustainable market growth in the region.

KEY PLAYERS:

The key market players are Qlik, SAP SE, TIBCO Software, SAS Institute, Tableau Software, Yellowfin International Pty Ltd., IBM Corporation, Oracle Corporation, Microsoft Corporation, Information Builders, and Other Players.

RECENT DEVELOPMENTS

-

In January 2022, PINC AI, a technology and services platform powered by Premier Inc., launched INsights, an advanced self-service healthcare solution that generates custom on-demand analytics.

-

CareCloud Inc., a leading provider of healthcare technology solutions for medical practices and health systems, released PrecisionBI Lite (PBI Lite), a streamlined business intelligence platform. This platform aims to open up new markets for the company and provide quick and robust financial analytics and insights to smaller independent practices.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.0 Billion |

| Market Size by 2032 | US$ 27.63 Billion |

| CAGR | CAGR of 14.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Software, Services) •By Mode of Delivery (On-premise, Cloud-based, Hybrid) •By Application (Financial Analysis, Operational Analysis, Clinical Analysis, Patient Care) •By End-use (Payers, Providers, Healthcare Manufacturers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qlik, SAP SE, TIBCO Software, SAS Institute, Tableau Software, Yellowfin International Pty Ltd., IBM Corporation, Oracle Corporation, Microsoft Corporation, Information Builders and Other Players |

| Key Drivers | •The Increasing Integration of EHR Systems Across Healthcare Facilities Is Driving the Demand for Business Intelligence (BI) Tools that can Analyze Large Volumes of Patient Data, Improve Decision-Making, and Enhance Patient Outcomes. •The Shift Towards Value-Based Care and Personalized Medicine has Led to an Increased Focus on Healthcare Analytics. Bi Tools are Crucial in Analyzing Patient Data, Predicting Trends, And Enabling More Effective Management of Resources and Treatments. |

| RESTRAINTS | •The Sensitive Nature of Healthcare Data Makes It Vulnerable to Breaches. Strict Regulations Like HIPAA in The United States Impose Significant Compliance Challenges, Restraining the Rapid Adoption of BI Tools. •The Initial Investment Required for Implementing Comprehensive BI systems, Including Software, Infrastructure, And Training, can Be Prohibitive for Smaller Healthcare Providers, Limiting the Market's Growth |