Care Management Solutions Market Size Analysis:

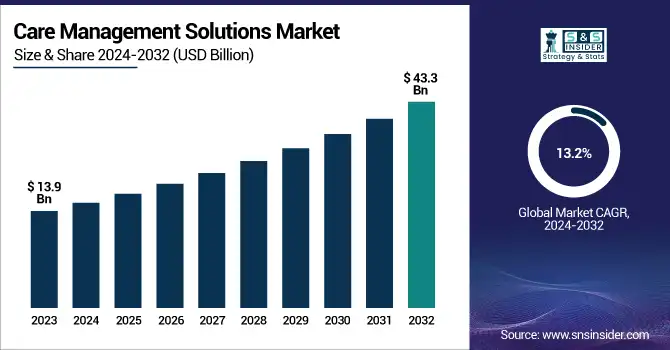

The Care Management Solutions Market size was valued at USD 13.9 Billion in 2023 and is expected to reach USD 43.3 Billion by 2032, growing at a CAGR of 13.2% over the forecast period 2024-2032.

Get more information on Care Management Solutions Market - Request Sample Report

The care management solutions market report offers a comprehensive analysis of key statistics and emerging trends, as well as data-driven industry growth and transformation. The report notes adoption rates, stressing that care management solutions are becoming more widely used by healthcare providers, payers, and ACOs. It further delves into HIPPA and GDPR compliance as well as changing value-based care models and regulatory compliance and certifications. The report provides a global analysis of healthcare expenditure on care management solutions by healthcare government, healthcare insurers and private healthcare providers. Assessments of the potential promise of future trends such as care coordination enabled by AI and automation, the use of predictive analytics, and progress toward interoperability are summarized. Furthermore, user demographics and role-based utilization 2023 are explored, offering insights into physician, insurer, and patient engagement, aiding stakeholders in strategic planning and market positioning.

Care Management Solutions Market Dynamics

Drivers

-

Favorable government initiatives and regulations promoting patient-centric care are driving the growth of care management solutions among the end users.

Government initiative and regulations focusing on patient centric care is driving the adoption of a care management solution. The "Martha's Rule" implemented in the UK in 2024 allows patients and their families to insist upon an urgent review of their treatment by specialist teams. There have been 573 emergency medicine requests since it was introduced, 286 of which led to a critical care staff review and 57 of which has seen an escalation-to-care decision that could reduce mortality

Additionally, the establishment of 160 Community Diagnostic Centres (CDCs) across England has expedited access to essential tests like X-rays and scans. Around 87% of patients reported satisfaction in these centers, proving them to be effective in providing timely and patient-centered services. These initiatives are prime examples of how these government policies are making healthcare delivery more patient-centric and in turn leading to a much faster adoption of patient engagement and PT care management solutions. The philosophy behind integrated people-centered health services is to organize the health system around people rather than around diseases, an idea the World Health Organization (WHO) is advocating worldwide. This approach promotes equitable access to appropriate high-quality health services and seeks to ensure that care is coordinated across the continuum of care and that it is person-centered.

Restraint:

-

Interoperability issues between different healthcare systems can hinder the effectiveness of care management solutions, leading to fragmented care.

However, interoperability challenges still remain and keep hindering the overall effectiveness of care management solutions. Among U.S. hospitals in 2024, the Office of the National Coordinator for Health Information Technology (ONC) reported that only 55% were able to electronically discover, send, receive and incorporate information from other providers about a patient. This can result in missing patient records and possible medical mistakes. Moreover, the lack of standard data formats and communication protocols also compounds these problems preventing seamless data exchange between the various health IT systems. This lack of standardization hinders efficient care coordination and can result in suboptimal patient outcomes. Meeting these interoperability challenges is essential to increasing the utility of care management tools and patient care.

Opportunity:

-

The integration of artificial intelligence and machine learning into care management solutions presents vast opportunities for enhancing efficiency and personalization in patient care.

Integrating artificial intelligence (AI) and machine learning (ML) into care management solutions can create opportunities for better patient care with more accurate diagnoses, tailored treatment plans, and proper resource allocation. Machine learning algorithms have proven to be better than humans in interpreting the images that are used to detect certain medical conditions, including cancers and heart disease at an early stage. For example, the UK National Health Service (NHS) is about to begin the largest trial in the world of AI in breast cancer diagnosis, using around 700,000 mammograms. The goal of this trial is to evaluate how effectively AI can identify breast cancer, which may aid in speeding up diagnosis and ensure radiologists make the most of their time.

AI and ML process huge amounts of patient data to customize treatment plans in individualized care. Cera, a healthcare startup from the UK, uses AI to improve outcomes and reduce the risk of further deterioration for older people that does not require hospitalization and falls of those older people. Cera, which employs 10,000 staff to deliver 2 million appointments a month, claims to save the NHS £1 million a day by using machine learning to proactively manage patients. AI also improves patient engagement and monitoring. For instance, PainChek uses AI to analyze small alterations in facial expressions, allowing caregivers to determine the pain score for non-verbal patients, especially those with dementia. This tech will help to provide timely pain management interventions, improving the comfort and quality of provided care to the patient. This represents a significant opportunity for progressing healthcare delivery, as care management solutions incorporating AI and ML can enable patient care that is more efficient, personalized, and proactive, respectively.

Challenge:

-

Data security and privacy concerns are significant challenges, as care management solutions handle sensitive patient information, necessitating robust cybersecurity measures.

The rise of cyberattacks in the healthcare sector has prompted strict regulatory proposals. The U.S. Senate in 2024 proposed legislation requiring the Department of Health and Human Services to adopt new cybersecurity practices, including greater reliance on multifactor authentication and regular auditing. The decision came after large-scale attacks hit entities such as Ascension Health Alliance and Cedars-Sinai Medical Center, disrupting operations. Smaller healthcare providers, in particular, have limited resources to respond to these evolving security demands. Data transfer is hampered by fragmented healthcare systems. According to a new report from the Office of the National Coordinator for Health Information Technology, published in May 2024, only 55% of U.S. hospitals are able to electronically search, send, receive, and integrate patient information from outside providers. This fragmentation causes incomplete patient records and creates the potential for medical error. Moreover, heterogeneous data standards between different Electronic Health Record (EHR) systems make it harder to share patient-level data, and this leads to misinterpretation and latency effects in patient care. Addressing these challenges is crucial for the effective implementation of care management solutions, ensuring both the security of patient data and the seamless integration of healthcare information across platforms.

Care Management Solutions Market Segmentation Analysis

By Component

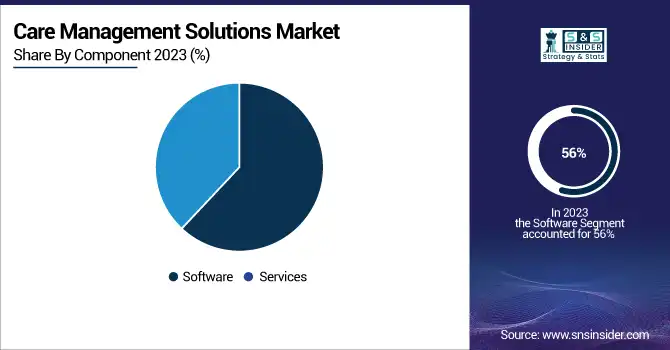

In 2023, the software segment held the largest revenue share of 56% in the market. The dominance of this segment is owing to the enterprises shifting toward electronic health records (EHRs) and rising demand for an integrated healthcare IT solution. 96% of all non-federal acute care hospitals have adopted certified EHR technology in 2023, according to the Office of the National Coordinator for Health Information Technology (ONC). In addition, software segment dominance is attributed to the ease in care coordination, patient engagement, and clinical decision-making.

According to the U.S. Department of Health and Human Services, providers using comprehensive care management software experienced a 15% reduction in hospital readmissions and a 20% increase in patient satisfaction scores over 2022. Also, in 2023, National Institutes of Health (NIH) funded a few research project assignments to total funding of over USD 100 million towards developing novel care management software approaches to improve chronic disease management using technology. Such investments highlight the government's resolve towards improving the healthcare delivery mechanism using software.

By Mode of Delivery

Web-based solutions dominated the market in 2023 and accounted for the largest revenue share of 38%. That leadership position is substantially the result of web-based platforms being flexible, available, and inexpensive. A national preparedness strategy, opened 2022, stated that in 2022, health care organizations using web-based care management solutions had lower administrative costs by 25% and had 30% more efficient care coordination from the U.S. Multimedia Audio with a Background.

In 2023, the National Institute of Standards and Technology (NIST) released guidelines for secure web-based healthcare applications to further the advancement of these types of solutions throughout the healthcare enterprise. The FCC also set aside USD 250 million in 2023 for broadband expansion in rural areas to make such web-based healthcare more widely available. The low cost of deployment and reduced initial investment, along with government-backed support for technology solutions have played a major role in the stalled acceptance & growth of web-based solutions in the care management market, coupled with increasing trends of remote patient monitoring.

By Application

In 2023, the Disease Management segment accounted for significant share of revenue. The increase in the number of chronic diseases and the associated demand for effective long-term care solutions is the primary reason for this position. The U.S. Department of Health and Human Services created "Healthy People 2030" which clarifies disease management plays an intrinsic role in addressing population health. In 2023, the National Institutes of Health (NIH) budgeted USD 1.5 billion for research into new methods of managing disease, encompassing the creation of predictive analytics utilizing AI for chronic diseases. Moreover, the Agency for Healthcare Research and Quality (AHRQ) stated that the implementation of comprehensive evidence-based disease management programs by healthcare providers resulted in a 20% reduction in emergency department visits and a 15% reduction in hospitalizations among patients with chronic conditions in 2022. These statistics highlight the critical role of disease management applications in modern healthcare delivery and explain their significant market share.

By End Use

In 2023, healthcare providers have dominated the market with a 55% revenue share. The reason for this dominance is that hospitals, clinics and healthcare facilities, in general, are increasingly adopting integrated care models and moving towards value-based care. According to the Centers for Medicare & Medicaid Services (CMS), reported that 61% of healthcare providers participated in value-based care programs in 2022, compared with 54% in 2021. Thus, the increasing requirement for care management solutions by healthcare providers is stemming from this trend. According to the U.S. Department of Health and Human Services in 2023, hospitals implementing advanced Care management solutions experienced a 12% lower cost across the healthcare continuum and a 18% increase in overall patient outcomes. Furthermore, ONC announced that 89% of healthcare providers utilized care coordination and patient engagement tools in care management solutions. Such statistics highlight the need for care management solutions to improve healthcare delivery which helps to compute the larger share of the market accounted for by healthcare providers.

Regional Insights

In 2023, North America held a leading position in the care management solutions market with a market share of 45%. The position of leadership is due to an extensive healthcare infrastructure, high adoption of digital health technologies, and supportive government initiatives in the region. The largest market share within the region was held by the United States, due to new software development, and improved awareness about care management solutions. Accordingly, the increasing implementation of patient care solutions for cost containment and quality improvement continues to drive the market over the coming years. The underlying reasons for this growth are positive consumer attitudes towards telehealth, regulatory reforms to better reimburse these services, and the growing burden of chronic diseases. Regional key players such as Allscripts Healthcare Solutions, Inc. & Cognizant are constantly innovating and expanding their portfolios.

Asia-Pacific will register the highest CAGR over the forecast period. This growth is driven by rising health spending, rising awareness of digital health solutions, and government initiatives to enhance the accessibility of healthcare services in countries like China and India. The growth rate for healthcare spending across the Asia-Pacific region also, as projected by the World Health Organization (WHO), is much faster than that of other regions, an annual 7.5% up to the year 2025, thereby continuing to create high potential for care management solution providers.

Need any customization research on Care Management Solutions Market - Enquire Now

Care Management Solutions Market Key Players

Key Service Providers/Manufacturers

-

Philips Healthcare (Philips Engage, Wellcentive)

-

Cerner Corporation (HealtheIntent, Population Health Management)

-

Allscripts Healthcare Solutions (Care Director, FollowMyHealth)

-

Epic Systems Corporation (Healthy Planet, MyChart Care Companion)

-

IBM Watson Health (Phytel Outreach, IBM Micromedex)

-

Salesforce Health Cloud (Health Cloud, Einstein Analytics for Healthcare)

-

Optum (UnitedHealth Group) (Optum Care Coordination, Optum One)

-

Medecision (Aerial, Risk Management)

-

eClinicalWorks (CCMR, Healow)

-

Health Catalyst (Care Management Suite, Population Health Analytics)

Key Users

-

UnitedHealth Group

-

Humana Inc.

-

Anthem, Inc. (Elevance Health)

-

Cigna Corporation

-

Kaiser Permanente

-

CVS Health (Aetna)

-

Mayo Clinic

-

Cleveland Clinic

-

Ascension Health

-

Blue Cross Blue Shield Association

Recent Developments in the Care Management Solutions Market

-

In Marc 2024, The U.S. Department of Health and Human Services announced a USD ss500 million initiative to expand the uptake of AI-based care management solutions at rural healthcare facilities to ensure that under-served areas get access to quality care.

-

In February 2024 HealthSnap, a vendor of Chronic Care Management and Remote Patient Monitoring solutions, announced USD 25 million in Series B funding, notably continuing to showcase the valuable place of investment in the sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.9 Billion |

| Market Size by 2032 | USD 43.3 Billion |

| CAGR | CAGR of 13.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Application (Disease Management, Case Management, Utilization Management, Others) • By Mode of Delivery (Web-based, Cloud-based, On-premise) • By End Use (Healthcare Providers, Healthcare Payers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Philips Healthcare, Cerner Corporation, Allscripts Healthcare Solutions, Epic Systems Corporation, IBM Watson Health, Salesforce Health Cloud, Optum (UnitedHealth Group), Medecision, eClinicalWorks, Health Catalyst |