Healthcare EDI Market Report Scope & Overview:

Get more information on Healthcare EDI Market - Request Sample Report

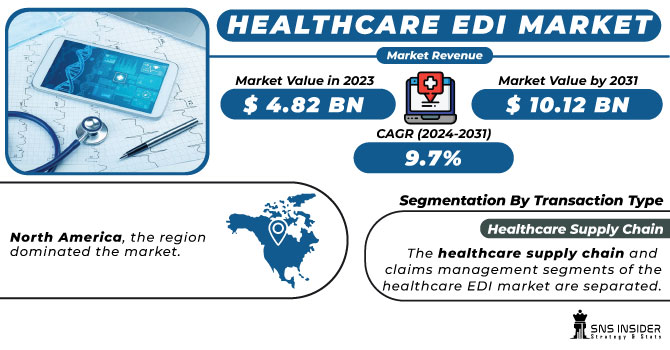

The Healthcare EDI Market Size was valued at USD 4.5 Billion in 2023 and is expected to reach USD 10.2 Billion by 2032, growing at a CAGR of 9.6% over the forecast period 2024-2032.

The Healthcare Electronic Data Interchange (EDI) Market report provides an in-depth analysis of key trends shaping the industry. It covers transaction volume growth highlighting the increasing use of EDI in claims processing, patient records, and supply chain management. An in-depth examination of regulatory compliance trends discusses compliance with HIPAA, GDPR, and other regulations fueling EDI adoption. The report also includes cost savings and efficiency metrics that highlight the decreases in administrative expenditures, billing errors, as well as, reimbursement cycles. Insights into Integration with healthcare IT System insights evaluate the interoperability with EHR, revenue cycle management, and cloud-based platforms.

Market Dynamics

Drivers

-

Cloud-based EDI solutions are revolutionizing healthcare by reducing costs and offering remote access with enhanced security.

Electronic Data Interchange (EDI) solutions hosted on cloud infrastructure are changing the paradigm in healthcare, making cost-effective, safe, and easily accessible alternatives available as modes of data exchange. Cloud-based EDI has no requirement for significant hardware or infrastructure investment upfront, as is the case with conventional on-premise systems. With significantly lower capital expenditure, it becomes an attractive option for healthcare providers looking to maximize their costs. A notable example is TeleTracking's cloud-based software, which manages patient movements and hospital logistics. This system has helped automate processes like tracking patient flow, reducing waiting time, and improving bed turnover in the UK's National Health Service (NHS). The software, which is included with a total cost of about £100 per bed per month including installation and training, is a cost-effective measure to improving operational efficiency. A major benefit of cloud-based EDI is its ability to enable healthcare professionals to access mission-critical data remotely, allowing for rapid decision-making and collaboration from multiple locations. This remote access facility is highly effective in handling patient care, as well as working with other health care professionals.

Restraint

-

High implementation costs remain a barrier, especially for small healthcare providers, eating up significant budgets.

One of the most significant barriers to EDI system adoption in healthcare is the high implementation costs of an EDI system, especially for small and medium-sized providers. There are capital costs for early-stage EDI systems for software licensing, hardware, integration, and training. The U.S. Department of Health and Human Services (HHS) recently found that small healthcare practices may spend as much as 15% of their annual budget on IT infrastructure improvements such as EDI systems. The costs can also limit smaller providers from being able to invest in areas like patient care or facility improvements.

Additionally, maintaining these EDI systems entails continuous costs after initial implementation including updating, securing, and adapting to changes in the health IT regulations, policies, and technologies. A 2024 survey by the Healthcare Information and Management Systems Society (HIMSS) found that 62% of small healthcare providers reported challenges in securing funds for necessary IT upgrades, including EDI systems. Moreover, the lack of in-house IT expertise often forces smaller providers to rely on external consultants, further escalating costs. Increased worries about data breaches and regulations like HIPAA add to those expenses as well as the cost associated with implementing sophisticated security features.

Opportunity

-

The rise of IoT and blockchain integration offers new avenues for secure and efficient data exchange in healthcare EDI.

The integration of IoT and blockchain is changing the EDI in the healthcare landscape by enabling it to be more secure, versatile, and operationally efficient. Devices like medical sensors and wearable health monitors are a form of IoT that help with the real-time collection of patient data, facilitating continuous observation and timely medical interventions. Wearable technology, which is capable of providing real-time information about the health of the patient, is one such example, where the information is transmitted to the EDI systems of the healthcare providers and then analyzed accordingly and initiated response. Blockchain technology offers a natural complement by providing a secure, decentralized way of storing and sharing health information on a common ledger.

The combination of IoT and blockchain presents an ideal solution to transform healthcare data exchange over EDI frameworks, solving issues that have plagued the sector for years. While IoT cubicles procure information actually, blockchain furnishes affirmation of the information and permits the data to be divided just with the approved focuses in a scrambled way accordingly, giving confirmations about the protection of the patient and the trustworthiness of the data. This synergy not only streamlines data exchange processes but also enhances the overall quality of patient care by enabling timely and informed medical decisions.

Challenge

-

Rising data security and privacy concerns continue to challenge the widespread adoption of healthcare EDI systems.

The increasing adoption of Electronic Data Interchange (EDI) systems in healthcare has heightened concerns over data security and patient privacy. Recent events illustrate the risk characteristics of these systems. In September 2024, a hacker leaked data of more than 31 million customers of Star Health, which is India's biggest health insurer, by scraping the information using Telegram chatbots. Similarly, in February 2024, a cyberattack on Change Healthcare, a subsidiary of UnitedHealth Group, affected approximately 190 million individuals, exposing sensitive data such as insurance details and medical diagnoses. These breaches underscore the imperative that security in EDI systems needs to be as tight as ever to safeguard sensitive patient information. To mitigate these risks and make sure that the platform complies with data protection regulations, appropriate protection such as robust encryption, access controls, and periodic security audits should be implemented.

Segment Analysis

By Component

In 2023, the services segment held the highest share of revenue share 59% within the Healthcare EDI market. The increasing complexity of healthcare data management and the growing requirement for industry-specific EDI services underlies this dominance. This fast expansion of the healthcare industry is propelling the need for better EDI services to process more healthcare transactions quickly. The services segment includes consulting, implementation, and maintenance support services all of which aid the healthcare organizations to implement and adopt EDI systems. According to the U.S. Government Accountability Office, in 2021, 96% of hospitals and 78% of office-based physicians were using certified electronic health record (EHR) technology. In addition to this high EHR adoption rate, reliable EDI services are needed to provide interoperability between the different data exchange and healthcare systems.

Furthermore, the increasing transition to value-based care models, fueled by CMS initiatives, is causing care providers and payers to look for expert EDI services that will enable them with better data analytics and reporting. According to the CMS, In 2023, 13.2 million people were enrolled in a Medicare Advantage plan with a value-based payment arrangement, accounting for 48% of all people in Medicare Advantage plans. It highlights the ever-increasing need for EDI services to enable rapid data transmission and insights for value-based care etc.

By Delivery Mode

In 2023, the web and cloud-based EDI segment was leading the market, in terms of revenue, with a 45% share. The large market share is driven by the increasing adoption of cloud technologies within the healthcare industry and the numerous benefits offered by the Web & Cloud EDI solutions. A 97% of hospitals and 80% of office-based physicians used certified health IT, indicating a rapid movement towards digital health, according to the U.S. Department of Health and Human Services. Web and cloud-based EDI solution provides multiple advantages over on-premises EDI such as effective scalability, accessibility, and cost-effectiveness. According to the U.S. Department of Health and Human Services, telehealth utilization remained stable 38 times higher than the pre-pandemic baseline, which required strong cloud-based EDI systems to accommodate increased volumes of digital health transactions.

By End Use

Healthcare payers segment held, the largest revenue share of 37% in 2023. The domination is due to the increasing trend among healthcare payers for streamlining claims processing and minimizing administrative costs. The scale of this healthcare expenditure underlines just how important efficient EDI systems are for providers when it comes to managing claims and reimbursements amongst payers. From automating claims processing to minimizing errors, healthcare payers like insurance companies and government agencies are increasingly going for EDI solutions for better operational efficiency.

This is also boosting the demand among payers for sophisticated electronic data interchange (EDI) solutions as they transition to value-based care models, enabling better analytics and risk assessment. The CMS reported that in 2023, 13.2 million people were enrolled in Medicare Advantage plans with value-based payment arrangements, representing 48% of all Medicare Advantage enrollees. This highlights the increasing need for value-based care of healthcare payers which can exchange and analyze data using EDI systems.

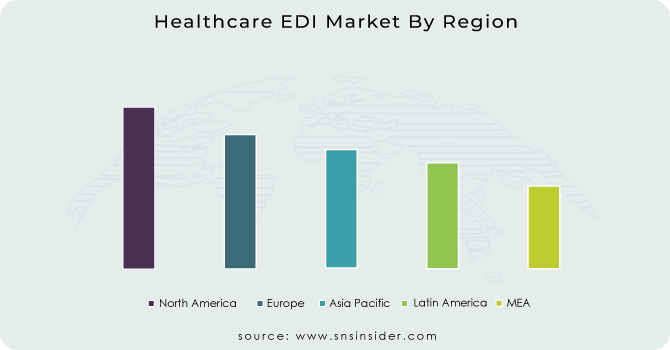

Regional analysis

North America region dominated the market with the largest revenue 40% in 2023. This dominance is due to the advanced healthcare infrastructure, high adoption of healthcare IT solutions, and supportive government initiatives in this region. According to the U.S. Department of Health and Human Services, 97% of hospitals and 80% of office-based physicians used certified health IT in 2021, indicating a high level of digital maturity in the healthcare sector.

During the forecast period, the Asia-Pacific region is anticipated to register the highest CAGR. Some of the factors driving this rapid growth include the growth of healthcare expenditure across countries, growing awareness about the advantages of using EDI systems, and government initiatives towards digital health in countries such as China and India. Healthy China 2030, a strategic plan released by the government, includes the development of a smart healthcare system driven by information technology. The full coverage of electronic health records and the use of big data in healthcare will be achieved by 2030 under the plan. Likewise, India is also establishing its nationwide digital fraternity with the introduction of the National Digital Health Mission in 2020 which will be a major driver of the adoption of EDI solutions for health data.

Need any customization research on Healthcare EDI Market - Enquiry Now

Key Players

Key Service Providers/Manufacturers

-

McKesson Corporation (US): (RelayHealth, McKesson EDI)

-

Optum (US): (Optum Intelligent EDI, Optum Claims Manager)

-

Allscripts Healthcare Solutions Inc. (US): (Allscripts Payerpath, Allscripts eAuth)

-

athenahealth (US): (athenaCollector, athenaEDI)

-

NextGen Healthcare (US): (NextGen Connect, NextGen EDI Solutions)

-

Cognizant Technology Corporation (US): (TriZetto Facets, TriZetto QNXT)

-

SSI Group, LLC (US): (ClickON EDI, ClickON Claims)

-

Cerner Corporation (US): (Cerner EDI Services, Cerner HealtheNet)

-

Comarch SA (Poland): (Comarch EDI, Comarch EDI Medical)

-

Axway Software SA (France): (Axway B2B Integration, Axway Healthcare EDI)

Key Users:

-

Kaiser Permanente

-

Mayo Clinic

-

Cleveland Clinic

-

Johns Hopkins Hospital

-

Cedars-Sinai Medical Center

-

UC Davis Medical Center

-

Partners HealthCare

-

Emory Healthcare

-

Baptist Health

-

Memorial Hermann Health System

Recent developments

-

In November 2023, qBotica Inc. made a strategic investment in Healthomation Inc. to further healthcare automation adoption by embedding Robotic Process Automation (RPA) and EDI efficiencies, thereby improving healthcare automation speed and accuracy.

-

In September 2023, Ontrak Health implemented the Axiom Systems TransSend Core EDI Gateway to automate and simplify EDI exchanges with trading partners, while maintaining compliance requirements.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.5 Billion |

| Market Size by 2032 | USD 10.2 Billion |

| CAGR | CAGR of 9.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Services, Solutions) • By Delivery Mode (Web and Cloud-based EDI, EDI Value Added Network (VAN), Direct (Point-to-Point) EDI, Mobile EDI) • By End-Use (Healthcare Payers, Healthcare Providers, Pharmaceutical & Medical Device Industries, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | McKesson Corporation, Optum, Allscripts Healthcare Solutions Inc., athenahealth, NextGen Healthcare, Cognizant Technology Corporation, SSI Group, LLC, Cerner Corporation, Comarch SA, Axway Software SA |