Healthcare Contract Management Software Market Size & Overview:

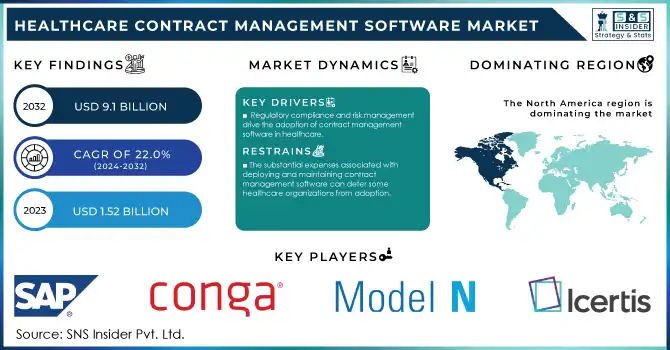

The Healthcare Contract Management Software Market Size was valued at USD 1.85 billion in 2024 and is expected to reach USD 9.1 billion by 2032, growing at a CAGR of 22.0% over the forecast period 2025-2032.

The Healthcare Contract Management Software Market is projected to increase at a remarkable pace, fuelled by growing regulatory complexity, operational efficiency demand among healthcare providers, hospitals, and life sciences companies, rising need for better quality assurance, and unprecedented demand for collaborative data. The U.S. Department of Health and Human Services (HHS) says virtually unprecedented contracts are leaving healthcare providers to manage more than 500 active contracts on average at any given time at one hospital. The spurt in the volume of contracts, along with ever-increasing compliance requirements, has led to the requirement for a solution for the automated management of contracts. CMS has used much stronger language regarding effective contract management as a means of lowering costs and improving care for patients. CMS provided new rules on value-based care contracts in 2024, requiring more rigorous contract oversight and performance tracking by providers. Such a regulatory push has driven the immediate market for contract management software in the healthcare sector.

Get more information on Healthcare Contract Management Software Market - Request Free Sample Report

Healthcare Contract Management Software Market Size and Forecast:

-

Market Size in 2024: USD 1.85 Billion

-

Market Size by 2032: USD 9.1 Billion

-

CAGR: 22.0% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key trends of the Healthcare Contract Management Software Market:

-

Increasing adoption of cloud-based contract management solutions for scalability and remote accessibility.

-

Integration of AI and machine learning to automate contract review, compliance, and risk analysis.

-

Growing use of digital signatures and e-contract technologies to streamline approval workflows.

-

Rising demand for interoperability with ERP, CRM, and healthcare management systems.

-

Enhanced analytics and reporting features to optimize contract performance and financial outcomes.

-

Focus on regulatory compliance and audit readiness, especially for HIPAA and healthcare laws.

-

Expansion of mobile-enabled platforms for on-the-go contract management and approvals.

-

Growing preference for SaaS-based models to reduce IT infrastructure costs.

-

Increasing corporate adoption to manage complex vendor, payer, and provider agreements.

In addition, many healthcare providers are reported to be adopting digital health technologies according to the Office of the National Coordinator for Health Information Technology (ONC), demonstrating a move toward digital transformation in healthcare administration. With the Centers for Disease Control and Prevention (CDC) reporting that 95% of healthcare facilities used new digital tools to keep operations running remotely during the pandemic, including contract management solutions. With healthcare organizations looking to manage the complex regulatory landscape, manage resources more effectively, and increase operational efficiency, demand for robust contract management software is only expected to increase and keep the market poised for growth in the years to come. The additional advantages of software scalability, efficient workflows, remote work adaptability, and cost savings increased the software's attractiveness. The market posted robust growth in the form of increased e-signatures, contract requests, and documents created in its software for companies such as Contract Logix. This contract management software for healthcare seems set to continue growing, with a focus on efficiency, reduction of costs along with the capability to adapt to remote work.

Healthcare Contract Management Software Market Drivers:

-

Healthcare organizations are increasingly transitioning from paper-based to digital processes, necessitating contract management solutions that streamline and automate complex workflows.

-

The need to adhere to regulatory requirements and manage risks effectively is propelling the adoption of contract management software in the healthcare sector.

-

As healthcare agreements become more intricate, there is a heightened demand for software that can efficiently manage and simplify contract lifecycles.

The healthcare industry is experiencing a new age of digital transformation due to the demand for operational efficiency and effective care outcomes for patients. This move away from manual and paper-based systems has greatly driven the adoption of contract management software as organizations now seek out more efficient, automated solutions. A survey done by HealthTech Magazine in 2023 found that 87% of healthcare organizations in developed areas are allocating their resources towards digital tools that emphasize workflow optimization, including contract management systems. With multiple stakeholders such as suppliers and insurers involved with a single contract, contract management software helps healthcare providers manage this complexity. One example could be large hospital networks such as the Mayo Clinic and Cleveland Clinic that have deployed sophisticated contract management software to ensure compliance, mitigate mistakes, and accelerate contract approvals.

Furthermore, digital solutions help address regulatory compliance, a critical requirement in healthcare. By having tools with functionality such as real-time tracking, automated alerts, and audit trails, organizations can effectively comply with complicated regulations such as the Health Insurance Portability and Accountability Act (HIPAA). However, combining contract management software with other healthcare IT systems like electronic health records (EHRs) has improved data visibility and collaboration. Telemedicine is one of those businesses that heavily depend on contracts with technology providers as well as consultants for their business to operate making that trend especially noteworthy. This push toward digitalization underscores the growing reliance on contract management software as a fundamental component of modern healthcare administration.

Healthcare Contract Management Software Market Restraints:

-

The substantial expenses associated with deploying and maintaining contract management software can deter some healthcare organizations from adoption.

-

Data Security and Privacy Concerns: Handling sensitive patient and organizational data raises concerns about security and privacy, potentially hindering the adoption of digital contract management solutions.

-

A lack of awareness and understanding of the benefits of contract management software in certain regions results in continued reliance on traditional methods, slowing market growth.

Healthcare contract management software is typically very expensive to implement and maintain, which presents a major obstacle to adoption, particularly for small and mid-sized healthcare organizations. Software licensing fees, customization to suit specific organizational requirements, integration with the existing systems, and staff training, are just a few of these costs. Alongside this, the ongoing costs of maintenance updates, technical support, and scalability, all contribute to making the financial burden heavier.

Most healthcare providers are budget-constrained and do not see the value of spending a large amount of money on administrative tools, focusing instead on immediate clinical needs. In companies where the necessary technical infrastructure is absent for supporting sophisticated software, this restraint becomes all the more pronounced. However, the lack of resources only complicates this digital transformation process, and naturally, the adoption rate is slowed down. Overcoming this limitation would entail cost-effective, scalable, and user-friendly solutions for smaller healthcare providers.

Healthcare Contract Management Software Market Segmentation Analysis:

By Pricing Model, Subscription-Based Pricing Drives Adoption Due to Flexibility and Cost-Effectiveness

The subscription-based segment held a significant share in 2024 due to its flexibility, cost-effectiveness, and scalability. According to the U.S. Small Business Administration (SBA), healthcare organizations (especially smaller to medium-sized practices) prefer a subscription-based model as it not only helps them to effectively budget for the solution (fixed monthly fee for many software solutions), but also has no large up-front costs. In a recent report, the National Center for Health Statistics (NCHS) found that costs contributed to 72 percent of provider decisions to take technological risk versus return. This concern is mitigated by subscription-based models that allow businesses to have predictable monthly expenses, instead of large capital outlays. Additionally, the Centers for Medicare & Medicaid Services (CMS) has proposed to promote organizational flexibility in IT solutions that will support value-based initiatives, indirectly increasing interest in subscription-based software.

In addition, the Office of the National Coordinator for Health Information Technology (ONC) in 2024 reported that the reliance on subscription-based IT solutions was enabling healthcare organizations to keep up with software updates and security patches 28% of the time, which was vital for ensuring that agility is present in compliance with emerging healthcare regulations. The shift from traditional license-based pricing models towards subscription-based pricing models for healthcare IT solutions mirrors an emerging trend in the broader healthcare technology landscape towards a more agile and flexible technology infrastructure in healthcare. This shift aligns with the industry's need for scalable solutions that can grow with organizational needs and adapt to changing regulatory requirements.

By Deployment, Cloud-Based Solutions Dominate with Enhanced Accessibility, Scalability, and Security

In 2024, cloud-based contract management software accounted for more than a 69% share on account of better accessibility, scalability, and cost-effectiveness. According to the U.S. Department of Health and Human Services (HHS), organizations using cloud-based solutions saved around 30% in IT infrastructure costs. Cloud-based systems can provide better data security and data recovery and, in this regard, NIST mentioned that these cloud-based systems are important for sensitive healthcare information. Cloud Computing Benefits Cloud-based solutions drive collaboration and remote access with 85% of healthcare providers citing these as key advantages, according to the Office of the National Coordinator for Health Information Technology (ONC). In addition, the Federal Risk and Authorization Management Program (FedRAMP) has created an expedited security assessment process for cloud services that correspond easily to the needs of healthcare organizations. Healthcare contract management software is largely cloud-based, showing that the industry is recognizing how the cloud allows for faster scalability, better data accessibility, and less IT management. This trend is going to continue to grow with healthcare organizations looking for more agile and resilient IT infrastructure.

By End Use, Healthcare Providers Lead Market Demand Due to Complex Contract Management Needs

In 2024, healthcare providers accounted for the largest revenue share of 49% due to the complexities and growing requirements for management systems driven by needing to manage multiple contracts in healthcare. U.S. hospitals had an average of 1,200 contracts per facility in 2024, a 15% increase over 2025, according to the American Hospital Association (AHA). Over 25% more healthcare providers had entered into value-based care programs, according to the Centers for Medicare & Medicaid Services (CMS), between 2021 and 2023, creating a need for more advanced contract management tools. The OIG noted that managing contracts properly could have provided relief from compliance headaches to many healthcare providers, especially since in 2023, 30% of the healthcare fraud cases related to contracts. Moreover, the National Center for Health Statistics (NCHS) showed that hospitals that were benefiting from sophisticated contracting management application were experiencing 20% lower administrative costs associated with contracting oversight.

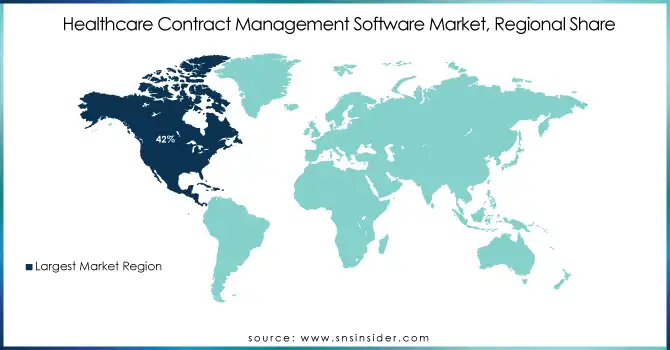

Healthcare Contract Management Software Market Regional Analysis:

North America Dominates Healthcare Contract Management Software Market in 2024

In 2024, North America commands an estimated 40% share of the Healthcare Contract Management Software Market, solidifying its leadership position. The region’s dominance is fueled by advanced healthcare IT infrastructure, widespread adoption of cloud-based solutions, and stringent regulatory compliance requirements. Strong R&D ecosystems, high healthcare spending, and the presence of leading software providers further strengthen its market standing. With hospitals and healthcare organizations increasingly focused on efficiency, cost reduction, and compliance, North America continues to drive innovation and large-scale adoption of contract management software.

-

United States Leads North America’s Healthcare Contract Management Software Market

The U.S. dominates due to its advanced digital healthcare ecosystem, large hospital networks, and early adoption of cloud-based and subscription-based contract management solutions. Government mandates for compliance, rising value-based care programs, and growing complexity of provider-payer contracts are driving the adoption of automated solutions. Leading software vendors and startups operate across the U.S., ensuring a robust innovation pipeline. With contract analytics, risk management, and integration with electronic health records (EHR) as key use cases, the U.S. maintains its leadership in North America’s market in 2024.

Asia Pacific is the Fastest-Growing Region in Healthcare Contract Management Software Market in 2024

The Asia Pacific healthcare contract management software market is projected to grow at a robust CAGR of 23.5% from 2025 to 2032. This growth is fueled by rapid digitization of healthcare services, expansion of hospital networks, and rising adoption of cloud-based and AI-enabled contract management platforms. Government-backed healthcare modernization initiatives, increasing private sector investment, and rising demand for scalable and efficient IT solutions are accelerating deployment. Countries like China, Japan, and India are investing heavily in healthcare IT, making the region a key driver of global market expansion.

-

China Leads Asia Pacific’s Healthcare Contract Management Software Market

China dominates due to its vast healthcare infrastructure, rising number of hospitals, and strong government support for digital health transformation. Cloud-based and subscription-based contract management software adoption is increasing to manage complex provider-payer agreements and compliance requirements. The country’s focus on telehealth, AI analytics, and digital patient management solutions further drives adoption. Large-scale investments in healthcare IT, coupled with an expanding private healthcare sector, enable China to emerge as the leading market for contract management software in Asia Pacific.

Europe Healthcare Contract Management Software Market Insights, 2024

Europe shows steady growth in 2024, driven by increasing digitalization of healthcare operations, stringent regulatory mandates, and the adoption of cloud-based contract management platforms. Rising demand for cost-efficient and agile solutions across hospitals and healthcare providers is boosting market expansion.

-

Germany Leads Europe’s Healthcare Contract Management Software Market

Germany dominates due to its advanced healthcare IT infrastructure, strict compliance regulations, and strong hospital networks. Government mandates and industry regulations drive the adoption of automated, cloud-based contract management systems. Integration with EHRs, data security requirements, and the need for efficient contract oversight make Germany the key market driver in Europe in 2024.

Middle East & Africa and Latin America Healthcare Contract Management Software Market Insights, 2024

The healthcare contract management software market in the Middle East & Africa and Latin America is witnessing steady growth in 2024. In the Middle East, initiatives in Saudi Arabia and the UAE to modernize healthcare IT systems and adopt cloud solutions are driving adoption. In Latin America, Brazil and Mexico lead due to expanding hospital networks, rising value-based care programs, and growing investment in digital health infrastructure. Subscription-based and scalable platforms improve compliance, reduce administrative costs, and enhance operational efficiency across both regions.

Need any customization research on Healthcare Contract Management Software Market - Enquiry Now

Competitive Landscape for the Healthcare Contract Management Software Market:

IBM Corporation

IBM Corporation is a U.S.-based global leader in enterprise technology solutions, specializing in AI-driven and cloud-based healthcare contract management software. With decades of experience in software development and enterprise solutions, IBM designs, engineers, and implements advanced contract lifecycle management tools, offering analytics, compliance monitoring, and automated workflow capabilities. IBM operates globally, managing sales, service, and deployment across healthcare providers, payers, and life sciences organizations. Its role in the healthcare contract management software market is critical, as it provides scalable, secure, and AI-enabled solutions that streamline contract management, reduce administrative burden, and improve regulatory compliance.

-

In 2024, IBM previewed its enhanced Watson Health Contract Management platform, integrating AI-powered contract analytics, automated compliance monitoring, and cloud-based collaboration tools for large healthcare networks.

Oracle Corporation

Oracle Corporation is a global enterprise software leader providing cloud-based contract management solutions for healthcare organizations. The company specializes in automating contract lifecycle management, integrating compliance, and streamlining procurement and provider agreements. Oracle operates through direct and partner channels worldwide, delivering scalable solutions for hospitals, insurers, and health systems. Its role in the market is vital, offering centralized, secure, and efficient contract management platforms that reduce administrative costs and improve operational performance.

-

In 2024, Oracle launched its Oracle Healthcare CLM Cloud, emphasizing AI-driven risk assessment, automated workflow approvals, and seamless integration with electronic health records and procurement systems.

SAP SE

SAP SE is a Germany-based enterprise software provider offering robust healthcare contract management solutions as part of its SAP S/4HANA and SAP Ariba platforms. The company designs cloud and on-premise solutions that automate contract creation, approval, and compliance tracking. SAP operates globally, catering to healthcare providers, payers, and pharmaceutical companies, ensuring contracts meet regulatory standards. Its role in the market is significant, providing end-to-end visibility, risk mitigation, and improved collaboration between stakeholders.

-

In 2024, SAP introduced enhanced SAP Ariba Healthcare Contracting, combining cloud-based contract management with analytics, AI-powered insights, and workflow automation for hospitals and insurers.

Workday, Inc.

Workday, Inc. is a U.S.-based enterprise software company specializing in cloud-based contract management and human capital management solutions for healthcare organizations. The company develops solutions for automating contract creation, approvals, compliance tracking, and reporting. Workday operates globally, serving hospitals, insurers, and healthcare networks, providing scalable platforms that reduce administrative workload and improve compliance oversight. Its role in the market is central, offering unified, cloud-based solutions that streamline contract lifecycle processes and enable data-driven decision-making.

-

In 2024, Workday released an upgraded Healthcare Contract Management module, featuring AI-assisted contract reviews, automated compliance checks, and enhanced reporting dashboards for healthcare providers and payers.

Healthcare Contract Management Software Market Key Players:

-

IBM Corporation

-

Oracle Corporation

-

SAP SE

-

Workday, Inc.

-

Apttus Corporation (Conga)

-

Icertis, Inc.

-

Coupa Software Inc.

-

Agiloft, Inc.

-

Determine, Inc. (Corcentric)

-

Zycus, Inc.

-

Syneos Health

-

Veeva Systems Inc.

-

Medidata Solutions, Inc. (Dassault Systèmes)

-

ContractWorks (Apto Solutions)

-

SirionLabs

-

CobbleStone Software

-

DocuSign, Inc.

-

Exari (part of Coupa)

-

LinkSquares, Inc.

-

SpringCM (DocuSign CLM)

Healthcare Contract Management Software Market Report Scope:

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.85 Billion |

| Market Size by 2032 | USD 9.1 Billion |

| CAGR | CAGR of 22.0% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software {Contract Lifecycle Management Software, Contract Document Management Software}, Services {Support and Maintenance Services, Implementation and Integration Services, Training and Education Services}) • By Deployment Model (Cloud-based, On-Premises) • By Pricing Model (Subscription Based, Others) • By End Use (Healthcare Providers, Hospitals, Physicians, Payers, Medical Device Manufacturers, Pharma, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Icertis, SAP SE, Conga, Model N, Inc., CobbleStone Software, Symplr, Apttus (Thoma Bravo), ContractWorks, DocuSign, Exari (a part of Coupa Software) |