Radiopharmaceuticals Market Size Forecast:

Get more information on Radiopharmaceuticals Market - Request Sample Report

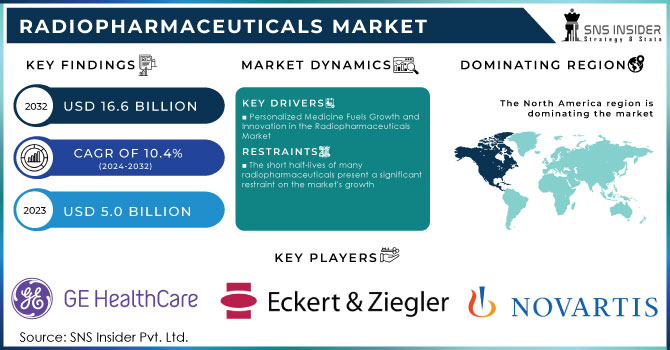

The Radiopharmaceuticals Market Size was valued at USD 5.0 billion in 2023 and is expected to reach USD 16.6 billion by 2032 and grow at a CAGR of 10.4% over the forecast period 2024-2032.

Radiopharmaceuticals Market Growth Factors:

All nuclear medicine sectors have experienced tremendous growth in the radiopharmaceutical industry. This is due to its crucial use in diagnosis and treatment for many conditions. Radiopharmaceuticals are drugs that enable clear visualization of the body's internal functions and aid in the early detection and therapy of diseases such as cancer, cardiovascular diseases, or neurological disorders. Neurological disorders lead the rankings for the cause of disability-adjusted life years, and a 2020 study in The Lancet identifies them as the second leading cause of death in the world, contributing to about 9 million deaths annually. However, for such conditions affecting millions around the globe, services and support are abysmally low, especially in low- and middle-income countries.

The market for radiopharmaceuticals has been growing at a robust rate globally. The principal drivers behind the growth are technological progress in healthcare, growth in the elderly population, and increasing cases of chronic diseases. These factors are further strengthened by the growth in the personalized medicine concept in which radiopharmaceuticals assume the central theme of tailoring the treatment modalities towards individual patients for higher therapeutic benefits. These products have lately seen a growing demand, mainly because cancer, as well as cardiovascular disease rates, are on the increase. Research and development in the sector have led to the development of new radiopharmaceuticals that are not only diagnostic but also improve therapeutic effectiveness.

Challenges include difficult regulatory requirements that may delay approvals and commercialization of new radiopharmaceuticals. Handling and disposal of radioactive materials are also something of a logistical and cost burden, and it takes high initial capital investment to produce radiopharmaceuticals due to the comprehensive requirements for facilities. Still, considering everything, the radiopharmaceutical market remains a definite source of good business opportunities, focused on the development of new diagnostically useful as well as therapeutically important radiopharmaceuticals. Firms that navigate complex regulatory hurdles successfully and invest sufficiently in R&D are likely to find themselves best placed for success. Interactions among pharmaceutical firms, healthcare providers, and research institutions will probably be catalysts for further breakthroughs. Radiopharmaceuticals are sure to catch the wave, riding the wave as the global healthcare landscape continues moving toward the early detection of diseases and customized treatment modalities.

| Product Name | Approval Date | Indication |

|---|---|---|

|

Posluma (flotufolastat F 18) |

May 25, 2023 |

Used with PET imaging for certain patients with prostate cancer |

|

Locametz (gallium Ga 68 gozetotide) |

March 23, 2023 |

Diagnostic imaging agent for identifying PSMA-positive lesions in prostate cancer |

|

Vynfinit (ganetespib) |

July 20, 2023 |

Treatment of advanced solid tumors (under accelerated approval) |

|

Lantheus (piflufolastat F 18) |

December 8, 2023 |

Imaging for prostate cancer detection and localization |

|

Adcetris (brentuximab vedotin) |

March 29, 2023 |

For specific types of lymphoma, including PTCL and HL |

|

Emapalumab (emapalumab-lzsg) |

April 18, 2024 |

Treatment for primary hemophagocytic lymphohistiocytosis |

Radiopharmaceuticals Market Dynamics

Drivers

-

Personalized Medicine Fuels Growth and Innovation in the Radiopharmaceuticals Market

Personalized medicine is one of the most significant growth drivers for the radiopharmaceutical market. It constitutes a new approach wherein therapy is tailored to the specific health and disease profile of an individual, thus becoming a vital shift in the sector of healthcare. Personalized medicine in the radiopharmaceuticals sector brings much scope for designing very targeted diagnostic and therapeutic solutions. Advanced imaging technologies were developed, and radiopharmaceuticals were produced to target binding with disease-specific biomarkers. This has led healthcare professionals to be able to carry out accurate diagnoses and closely monitor diseases such as cancer, cardiovascular diseases, and neurodegenerative disorders.

Moreover, the concept of personalized medicine is driving the development of radiopharmaceutical therapies intended to combat targeted diseases while trying to eliminate side effects. The potential of linking patients to appropriate radiopharmaceuticals that match their genetic makeup or the nature of their disease further enhances the efficacy and safety of the treatment. This has generated high research and development activities aimed at providing new, class-specific radiopharmaceuticals for enhancing demand in the market.

For example, increasing recognition of the role that radiopharmaceuticals play in delivering accurate diagnoses and targeted therapies raises greater acceptance and adoption in the healthcare industry. As personalized medicine continues to blossom, thus, it puts the market for radiopharmaceuticals on a growth trajectory; indeed, disease management transforms and advances patient-centered care.

Restraints

-

The short half-lives of many radiopharmaceuticals present a significant restraint on the market's growth

Radiopharmaceuticals Market Segmentation Analysis

By Radioisotope

Dominant Segment: Technetium-99m

Technetium-99m dominated radiopharmaceutical in this sector in 2023 because it is one of the most frequently used in diagnostic imaging, especially in nuclear medicine. Its half-life favors it over other radiopharmaceuticals as it is not expensive, coupled with its ability to take up images of high quality; it therefore finds acceptance from healthcare providers.

Fastest Growing Segment: Gallium-68

The radioisotope category is found to grow with the most rapidly increasing segment, being Gallium-68, and increasingly applied in PET imaging. The rising prevalence of cancer and the growing demand for precision diagnostics are the two key drivers for the adoption of Gallium-68, which has been proven to be highly specific in targeting certain types of tumors.

By Application

Dominating Segment: Cancer

The application segment by cancer was the dominating segment with a 32.5% share in 2023 due to rising incidence rates of cancer around the world. Applications in oncology based on radiopharmaceuticals have increased exponentially both as a method of diagnosis and as therapy. It has now become a critical area for growth in the market.

Fastest Growing Area: Cardiology

The fastest growth is being witnessed in the cardiology segment due to the rising prevalence of cardiovascular diseases and the greater importance of their early diagnosis and cure. Innovations of radiopharmaceuticals for the imaging of cardiac diseases, such as PET and SPECT, are contributing hugely to this growth.

By Type

Dominating segment: Diagnostic

The diagnostics segment held the largest share with 54.7% in the radiopharmaceutical market in 2023, which is primarily because of the enormous demand for imaging techniques that give precise and accurate diagnoses of several medical conditions. Further, the use of radiopharmaceuticals in imaging modalities such as PET and SPECT reinstalls their tremendous position in patient management.

Faster Expanding Segment: Therapeutic

The therapeutic segment is growing the fastest, supported by improvements in targeted radiotherapy and new radiopharmaceuticals for cancer and other diseases. This is the only driving force behind this segment's growth as more attention is being directed towards personalized medicine and better outcomes from treatment.

By End User

Dominant Segment: Hospitals and Clinics

Hospitals and clinics represented the largest end-user category with a 34.9% share in 2023 on account of wide-scale healthcare provision and high-resolution diagnostic facilities. In addition, nuclear medicine is increasingly becoming part of routine clinical practice, which further aids the hospital and clinic segment to take the lead.

Growth Rate: Medical Imaging Centers

These are the fastest-growing end-users, mainly because of the increasing demand for specialized imaging services and the increasing focus on outpatient care. The medical imaging center often avails state-of-the-art imaging technologies and is increasingly considered indispensable for radiopharmaceutical diagnostic procedures.

Radiopharmaceuticals Market Regional Insights

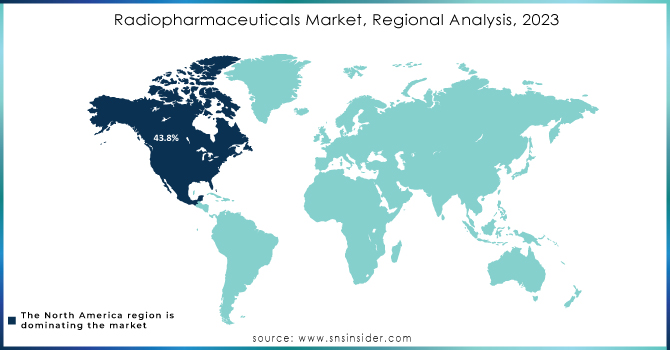

In 2023, the North American region held a major share of 43.8% of the radiopharmaceutical market because of the rising number of patients suffering from chronic diseases. The region's improved healthcare structure encourages the development of radiopharmaceuticals, which in turn is driving this market. Government policies and the ease of providing reimbursement facilities encourage investments in the pharmaceutical business. Additionally, the high utilization of advanced healthcare and diagnostic facilities has strengthened the market across North America.

Looking forward, the Asia Pacific market is likely to move up at a considerable growth rate, which will be backed by increased government spending on healthcare, increased research and development, and increased prevalence of chronic disorders. Escalating rates of CVD due to shifting lifestyles and modernization are further pushing the demand for imaging technologies, such as nuclear imaging equipment. The enhanced research and development concerning innovative diagnostic products, including PET/SPECT systems, continue to support the growth of the market.

Need any customization research on Radiopharmaceuticals Market - Enquiry Now

Key Radiopharmaceuticals Companies

-

GE Healthcare

-

Jubilant Pharmova Limited

-

SOFIE

-

Isotopia Molecular Imaging

-

Bracco

-

NorthStar Medical Radioisotopes

-

Novartis AG

-

Eczacibasi

-

Fusion Pharmaceuticals Inc.

-

Nihon Medi-Physics Co. Ltd

-

The State Atomic Energy Corporation ROSATOM

-

South African Nuclear Energy Corporation (Necsa)

-

Cardinal Health

-

Actinium Pharmaceuticals, Inc.

-

Telix Pharmaceuticals Limited

-

Lantheus

-

Clarity Pharmaceuticals

-

Bayer AG

-

ITM Isotope Technologies Munich SE

-

Eli Lilly and Company and others.

Recent developments

-

In Sept 2024, GE HealthCare announced that the FDA has approved Flyrcado (flurpiridaz F 18) injection, a PET radiotracer designed to enhance the diagnosis of coronary artery disease. This innovative radiotracer is expected to significantly improve the accuracy and effectiveness of cardiac imaging, aiding healthcare professionals in identifying and assessing coronary artery conditions more effectively

-

Bracco Japan will be announced in April 2024 within the Bracco Group, aiming to develop its presence in the Japanese market by offering a comprehensive range of products and services in the area of diagnostic imaging.

-

In April 2024, Curium, a global leader in nuclear medicine, confirmed its agreement to acquire Eczacibasi Monrol Nuclear Product Co. (Monrol) from Eczacibasi Holding and Bozlu Group. Acquisition expected to create synergies through complementary geographical coverage, enhanced capabilities in lutetium-177 (Lu-177), improved PET and SPECT nuclear medicine infrastructure, and facilitation of the advancement of innovative radionuclides and radiopharmaceuticals for both diagnostic and therapeutic applications.

-

Also in April 2024, Telix said that it had completed its acquisition of ARTMS Inc., a company specializing in radioisotope production technology. In the transaction, Telix acquires ARTMS's advanced cyclotron-based isotope production platform, manufacturing facility, and stock of ultra-pure rare metals needed in the production of consumable targets. The acquisition is expected to help Telix advance vertical integration, which would significantly increase supply chain and regulatory control for key isotope production.

-

In April 2024, Clarity Pharmaceuticals announced that it had executed a clinical supply agreement with NorthStar Medical Radioisotopes, LLC, for the manufacture of the 67Cu-SAR-bisPSMA drug product in the Phase I/II and Phase III clinical trials.

-

Lantheus Holdings, Inc. said in February 2024 that it has entered into a collaboration agreement with the National Institute on Aging (NIA) for a study called the Consortium for Clarity in ADRD Research Through Imaging, or CLARiTI. Under the terms of the agreement, the consortium is authorized to use Lantheus's clinical-stage F18-labeled Positron Emission Tomography, MK-6240, in investigating Alzheimer's disease and other related dementias.

-

In January 2024, Novartis reported results from the Phase III NETTER-2 study, which showed that the addition of Lutathera (lutetium Lu 177 dotatate) to long-acting release (LAR) octreotide reduced by 72% the risk of disease progression or death as first-line therapy among those whose advanced well-differentiated grade 2/3 gastroenteropancreatic neuroendocrine tumors (GEP-NETs) express the somatostatin receptor compared with patients treated with high-dose octreotide LAR alone.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.0 Billion |

| Market Size by 2032 | US$ 16.6 Billion |

| CAGR | CAGR of 10.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Radioisotope (Iodine I, Gallium 68, Technetium 99m, Fluorine 18, Others) • By Application (Cancer, Cardiology, Others) • By Type (Diagnostic, Therapeutic) • By End User (Hospitals and clinics, Medical Imaging centers, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | GE Healthcare, Eckert & Ziegler, PRECIRIX, Curium Pharma, Jubilant Pharmova Limited, SOFIE, Isotopia Molecular Imaging, Bracco, NorthStar Medical Radioisotopes, Novartis AG, Eczacibasi, Fusion Pharmaceuticals Inc., Nihon Medi-Physics Co. Ltd, The State Atomic Energy Corporation ROSATOM, South African Nuclear Energy Corporation (Necsa), Cardinal Health and Others |

|

Market Drivers |

• Personalized Medicine Fuels Growth and Innovation in the Radiopharmaceuticals Market |

|

Market Restraints |

• The short half-lives of many radiopharmaceuticals present a significant restraint on the market's growth |