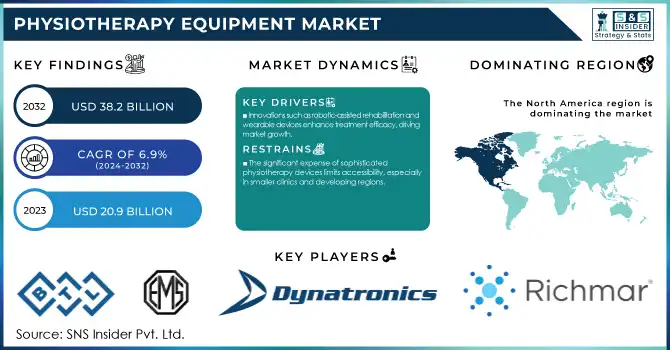

Global Physiotherapy Equipment Market Size & Overview

The Physiotherapy Equipment Market Size was valued at USD 20.9 billion in 2023, is projected to grow at a CAGR of 6.9% to reach USD 38.2 billion by 2032.

To get more information on Physiotherapy Equipment Market - Request Free Sample Report

The growing number of geriatric people, the prevalence of chronic musculoskeletal disorders, and government spending on healthcare infrastructure are all contributing to the strong growth of the global physiotherapy equipment market. The Centers for Disease Control and Prevention (CDC) estimate that 58 million Americans, or 1 in 4 adults, suffer from arthritis, a condition that frequently necessitates physiotherapy treatments. According to the National Center for Biotechnology Information (NCBI), by 2050, there will be 142.7 million people with at least one chronic illness, a 99.5% increase from the 71.5 million in 2020. Advanced rehabilitation solutions are required as multimorbidity cases are predicted to increase by 91.2% over the same period. The data from the World Health Organization (WHO) highlights by 2050, 80% of older people will be living in low- and middle-income countries, amplifying the global demand for physiotherapy equipment to address age-related degenerative disorders.

According to the Bureau of Labor Statistics, “musculoskeletal diseases represented 31% of the total cases of worker injury and sickness in the United States, Private industry employers reported 2.6 million nonfatal workplace injuries and illnesses in 2023, down 8.4% from 2022”. It reflects the need for effective physiotherapy solutions for occupational health. Also, the National Institute of Neurological Disorders and Stroke (NINDS) estimated that 80% of individuals experience low back pain at least once in their lifetime causing a demanding need for physiotherapy services and devices. The increasing population of elderly individuals and higher prevalence of neurological, musculoskeletal, and cardiovascular disorders in developed as well as developing economies like China and India are projected to propel the market growth. Dementia affects over 54 million people around the world, according to a study by the WHO from March 2023 while greater than 59% of those suffering from this condition are residents of low- and middle-income countries. Alzheimer's Disease is a generic term that accounts for about 60–70% of these cases, which would be the remaining brain conditions that possess difficulty of both cognitive and/or speech and motor functions, long-term care is required. Physiotherapy equipment can reduce the level of assistance these patients need.

Physiotherapy Equipment Market Dynamics

Drivers

-

The increasing incidence of conditions like osteoarthritis and back pain necessitates physiotherapy interventions, boosting equipment demand.

The growing prevalence of musculoskeletal disorders is one of the major factors escalating the growth of the physiotherapy equipment market. In a comprehensive survey conducted in 2023 by the Global Health Institute, approximately 22% of adults reported experiencing chronic musculoskeletal pain over the past year, indicating an upward trend in conditions such as arthritis, back pain, and joint degeneration. This growth was especially evident in middle-aged and elderly populations, who now represent a larger proportion of patients seeking therapeutic interventions. Also in 2023, a clinical study published in the Journal of Orthopedic Rehabilitation described a 15% annual increase in patient visits due to musculoskeletal conditions. Additional data from North American healthcare facilities in early 2024 observed a 17% increase in referrals for physiotherapy treatment resulting from musculoskeletal concerns. Statistical evidence of this nature drives another crucial evolution in healthcare needs, and thus clinics and hospitals begin to incorporate new technological advancements in treatment solutions.

The increasing incidence of these diseases has accelerated the use of new physiotherapy devices like robotic-assisted rehabilitation systems and digital therapy devices. Providing effective treatment, decreasing patient recovery time, and improving patient outcomes in response to the growing burden of musculoskeletal conditions, these modern treatments are becoming necessary. In 2024, the growing burden of these disorders further emphasizes the need for novel physiotherapy solutions, driving healthcare providers and researchers alike to be at the forefront of tackling these disorders.

-

Innovations such as robotic-assisted rehabilitation and wearable devices enhance treatment efficacy, driving market growth.

Restraints

-

The significant expense of sophisticated physiotherapy devices limits accessibility, especially in smaller clinics and developing regions.

Advanced physiotherapy devices are still high-cost, which is one of the major challenges restraining the growth of the market. According to the 2023 cost analysis report, the latest statistics reveal that the price of state-of-the-art sophisticated robotic rehabilitation systems and digital therapy devices can cost upwards of several hundred thousand dollars, creating barriers for smaller clinics and rural healthcare facilities. Adding to the challenge is the relative lack of capital investment in emerging markets, which further exacerbates this challenge, as budgets struggle to accommodate these expensive technologies. In early 2024, a survey of physiotherapy centers indicated that nearly 35% cited high equipment costs as a primary factor in delaying upgrades or expansions. As a result, many practitioners are stuck with outdated, inefficient tools with lower patient outcomes. The result is that modern technologies are not adopted in mass, which decelerates innovation and restricts patient access to advanced therapies due to ongoing cost hurdles. Addressing these financial challenges is crucial for ensuring that all patients can benefit from recent advancements in physiotherapy care.

-

A lack of adequately trained physiotherapists hampers the effective utilization of advanced equipment, restricting market expansion.

Physiotherapy Equipment Market Segmentation Analysis

By Application

The musculoskeletal segment led the market due to the high prevalence of conditions like arthritis, ligament injuries, and degenerative joint diseases. According to the National Institute for Occupational Safety and Health (NIOSH), work-related MSDs cost employers about USD 20 billion each year in direct costs and up to USD 100 billion in indirect costs. The rising incidence of chronic pain has shifted the focus towards the need for physiotherapy; in the U.S., government initiatives like Healthy People 2030 are targeting chronic pain by encouraging reducing the number of adults experiencing chronic pain, fuelling demand for physiotherapy equipment for musculoskeletal conditions. According to the American Physical Therapy Association (APTA), 50% of Americans aged 18 and older develop a musculoskeletal injury that lingers for more than three months, highlighting the importance of physiotherapy equipment in long-term rehab and pain management strategies.

By Type

The ultrasound segment dominated the market and held the largest share, as it provides non-invasive therapeutic advantages such as relief from pain, tissue healing, and reduction of inflammation. Ultrasound devices have been approved by the Food and Drug Administration (FDA) for treating a wide range of musculoskeletal problems based at least in part on the impression of efficacy in clinical practice. Therapy ultrasound use increased by 12% in 2023 due to the rapid rise of portable and even handheld devices, according to the National Institutes of Health (NIH). The American Institute of Ultrasound in Medicine (AIUM) states Therapeutic ultrasound is one of the most widely used treatments with more than 70% of outpatient rehabilitation clinics in the United States utilizing it. A study published in the Journal of the American Medical Association (JAMA), when combined with exercise, improved pain and function in patients with chronic low back pain by 23% compared to exercise alone. Ultrasound therapy has received expanded coverage under the Centers for Medicare & Medicaid Services (CMS) and is known to be a cost-effective treatment option for chronic musculoskeletal conditions and enhances the potential to reduce unnecessary surgical procedures.

By End-Use

The hospitals and clinics segment dominated the market and accounted for 43% of revenue share in 2023. This growth is driven by the present infrastructural facilities, skilled personnel, and covered insurance. In the U.S., as per 2022 stats provided by the American Hospital Association (AHA), approximately 6,093 hospitals are making a broad network for physiotherapy. According to a 2023 report from the Medicare Payment Advisory Commission (MedPAC), outpatient therapy services of which physiotherapy is a part represented USD 9 billion in spending by the Medicare program in the year 2022, out of which hospitals and clinics played a considerable role as providers. The Bureau of Labor Statistics has estimated a 21% growth rate for employment of physical therapists between 2020 and 2030, which is much faster than average for all occupations, suggesting an increasing body of professionals in both hospital- and clinic-based settings. According to a survey conducted by the American Physical Therapy Association (APTA), the vast majority of physical therapists, around 60%, operate in either hospital or private practice clinic settings, reaffirming that these facilities are the primary providers of physiotherapy services.

Physiotherapy Equipment Market Regional Outlook

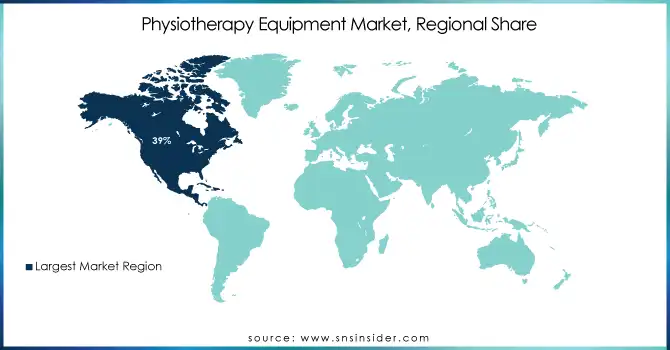

In 2023, the North American region dominated the market with account for 39% of the market due to having the largest healthcare expenditure, numerous advanced rehabilitation centers, and favorable insurance policies. A recent study shows that U.S. health spending grew 7.5 % in 2023 to USD 4.9 trillion, or USD 14,570 per individual, which creates an ideal environment for the physiotherapy equipment market. According to the National Health Expenditure Account (NHEA), the projected growth rate for health expenditure will be 5.4% annually from 2022 to 2031, which is higher than the growth of GDP and this represents a continued investment in healthcare technologies such as physiotherapy equipment.

On the other hand, Asia-Pacific is expected to grow at the highest CAGR, due to high urbanization rates along with increasing healthcare spending. According to World Bank, healthcare expenditure in East Asia and the Pacific has been increasing by 7.5% year on year which is above the global average. The National Bureau of Statistics of China reported that health expenditure increased to 7.1% of GDP in 2022 finally after years of commitment from the government to invest in healthcare infrastructure. Japan, which struggles with an aging population crisis, has raised its healthcare expenditure to the level of 11.1% of GDP, according to the Organisation for Economic Co-operation and Development (OECD), therefore, boosting the demand for physiotherapy equipment for age-related diseases.

Need any customization research on Physiotherapy Equipment Market - Enquiry Now

Physiotherapy Equipment Companies

Key Service Providers/Manufacturers

-

Enovis Corp. (US): DonJoy Defiance Knee Brace, LiteCure Medical Laser Therapy

-

BTL Industries (UK): BTL-6000 Series Electrotherapy, BTL-4000 Series Ultrasound

-

Performance Health (US): TheraBand Resistance Bands, Biofreeze Pain Relief Gel

-

ITO Co., Ltd. (Japan): US-101L Ultrasound Device, ES-160 Electrical Stimulator

-

Enraf-Nonius B.V. (Netherlands): Endomed 182 Ultrasound, Myomed 632 Biofeedback

-

Dynatronics Corporation (US): Dynatron Solaris Plus Series, 125B Portable Ultrasound

-

Zimmer MedizinSysteme GmbH (Germany): Soleoline Ultrasound Therapy, OptonPro Laser Therapy

-

Zynex Inc. (US): NexWave Electrotherapy Device, InWave Incontinence Therapy

-

Storz Medical AG (Germany): Duolith SD1 Shockwave Therapy, Masterpuls One

-

Mettler Electronics Corp (US): Sonicator 740 Ultrasound, Sys*Stim 240 Neuromuscular Stimulator

Users

-

Mayo Clinic

-

Cleveland Clinic

-

Charité – Universitätsmedizin Berlin

-

Singapore General Hospital

-

Apollo Hospitals

-

Fortis Healthcare

-

National Health Service

-

Mount Elizabeth Hospital

-

Toronto Rehabilitation Institute

-

Royal Melbourne Hospital

Recent Developments:

-

On 8 September 2024, JIPMER's Department of Physical Medicine and Rehabilitation (PMR) introduced a Standard Operating Procedure (SOP) manual for physiotherapy equipment, enhancing standardization and safety in physiotherapy practices.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 20.9 Billion |

|

Market Size by 2032 |

USD 38.2 Billion |

|

CAGR |

CAGR of 6.9% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Application (Neurology {Stroke, Spinal cord injuries, Parkinson’s disease, Multiple sclerosis, Cerebral palsy, Others}, Musculoskeletal, Cardiovascular & Pulmonary, Pediatric, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Enovis Corp., BTL Industries, Performance Health, ITO Co., Ltd., Enraf-Nonius B.V., Dynatronics Corporation, Zimmer MedizinSysteme GmbH, Zynex Inc., Storz Medical AG, Mettler Electronics Corp. |

|

Key Drivers |

• The increasing incidence of conditions like osteoarthritis and back pain necessitates physiotherapy interventions, boosting equipment demand. |

|

Restraints |

• The significant expense of sophisticated physiotherapy devices limits accessibility, especially in smaller clinics and developing regions. |