Digital Battlefield Market Report Scope & Overview:

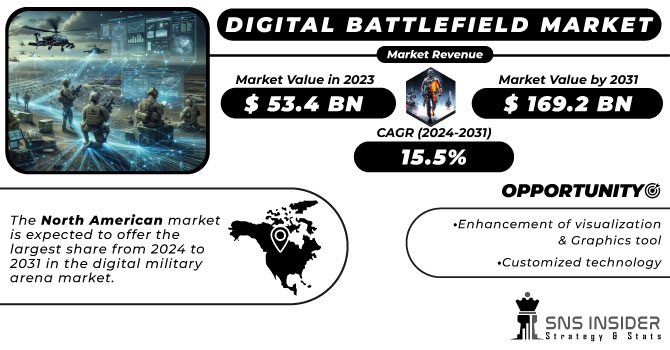

The Digital Battlefield Market Size was valued at USD 53.4 billion in 2023 and is expected to reach USD 169.2 billion by 2031 with a growing CAGR of 15.5% over the forecast period 2024-2031.

The changing geopolitical realities in economies across North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa are attributed to the quickly evolving dynamics of the digital combat market. The increasing frequency of border disputes and terrorism in these regions increases demand for digital battlefield products, services, and solutions. Globally, defence organizations and governments are implementing next-generation digital battlefield goods in order to improve surveillance and situational awareness during conflict scenarios. A digital war arena is a network of connected aircraft, weapons systems, and surveillance and communications systems.

To get more information on Digital Battlefield Market - Request Free Sample Report

Continued military development to meet the support needs of electronic systems and equipment drives the need for digital battlefields around the world.

Digital battlefield systems are used in a space that allows you to create a real-time map, which helps defense leaders make real-time decisions, especially during war-like situations. The great demand for devices that support 5G technology and the introduction of advanced technology to establish an efficient and reliable military sector is expected to further market growth during forecasting.

The development of new systems, devices, and software by key vendors also creates the need for digital battlefields. The global digital military market is expected to grow rapidly at the time of forecasting, due to the recent rise of the defense industry coupled with the development of new skills in digital battlefield products worldwide.

MARKET DYNAMICS

KEY DRIVERS

-

Growing demand

-

High speed internet connectivity

RESTRAINTS

-

High maintenance

-

High development cost

-

Fully AI system’s

OPPORTUNITIES

-

Enhancement of visualization & Graphics tool

-

Customized technology

CHALLENGES

-

Improvement of database management

-

Cyberattacks

-

Data breaches

IMPACT OF COVID-19

The COVID-19 pandemic has wreaked damage on the economies of countries all over the world. The production of digital battlefield products, like as systems, subsystems, and components, has also been hampered. Although next-generation digital battlefield items for defence applications are critical, supply chain problems have temporarily halted their manufacturing processes. The level of COVID-19 exposure, the level at which industrial operations are functioning, and import-export rules, among other considerations, all influence the resumption of manufacturing activity.

The onset of the COVID-19 epidemic has brought a series of supply chain disruptions and operational disruptions to the North American region. According to a study published by the National Association of Manufacturers, about 80% of manufacturers expect the epidemic to have a financial impact on their business. Some large companies have closed their facilities and are still considering retrenchment. The manufacturing sector, which employs about 13 million workers in the US, is expected to contribute to the outbreak, mainly for two reasons: first, most production activities are in place and cannot be done remotely. Second, slower economic performance has reduced the demand for industrial products in the US and around the world. Industry experts, however, have said that the COVID-19 epidemic did not affect the demand for digital military products in the U.S. defense sector. The Department of Defense has asked manufacturers to continue production activities related to defense equipment.

The following significant developments demonstrate the surge in demand for digital battlefield in the defence sector during the COVID-19 crisis in the European region. The COVID-19 epidemic has hampered delivery of critical platforms in India, including HAL's supply of Tejas combat aircraft and Dhruv helicopters to the Indian Armed Forces. Other platforms' release dates are also likely to be pushed back, especially if lockdowns are extended. Due to the COVID-19 outbreak, the Indian Ministry of Defence has delayed procurement deadlines, which would have an impact on the growth of digital battlefield products used in such aircrafts and helicopters.

Depending on the platform, the market is divided into air space, land, naval and space. Based on the CAGR, part of the space is expected to prove the highest CAGR from 2024 to 2031. The digital warfare systems deployed on the space platform enable real-time mapping of objects around the world and facilitate satellite communication networks. This will greatly support the growth of part of the space. Based on the platform, the aerial component is expected to lead the digital military arena market from 2022 to 2028. The growth of the aerial component is due to the growing tendency of the defense forces in the products and systems of the battlefield.

Based on the installation, a new procurement component is expected to lead the digital battlefield market from 2024 to 2031. The growth of the new procurement phase is due to the growing introduction of advanced defense systems and the increasing purchase of digital military products. The development component will register significant growth due to the increase in transformation activities and modernization of the old electronic military systems by defense forces to gain a foothold over incoming threats and enemy attacks.

The growing focus of the global defense force in modernizing their military equipment, including digital military field products, will boost market growth. This may be due to growing tensions between countries, leading to efforts to strengthen their defense forces. In recent years, more than nine major international conflicts have occurred, including the Syrian Civil War, the Saudi Arabia-Yemen conflict, the US-Iran conflict, and the India-China conflict. Such conflicts can lead to higher purchases of AI-enabled military products as well as the inclusion of advanced technology in existing military systems to make them more efficient and reliable.

Several governments set up specialized departments or agencies to integrate AI capabilities into existing machines and to focus on developing new skills in the digital war arena.

KEY MARKET SEGMENTATION

By Platform

-

Airborne

-

Naval

-

Land

-

Space

By Technology

-

IOT

-

Big Data

-

5G

-

Master Data Management

By Application

-

Warfare Platform

-

Logistics & Transportation

-

Surveillance & Situational Awareness

-

Command & Control

-

Communication

-

Health Monitoring

-

Simulation & Training

-

Combat Simulation and Training

-

Command and Control Training

-

Design and Manufacturing

-

Predictive Maintenance

-

Threat Monitoring

-

Real-Time Fleet Management

-

Others

By Solution

-

Hardware

-

Software

-

Service

REGIONAL ANALYSIS

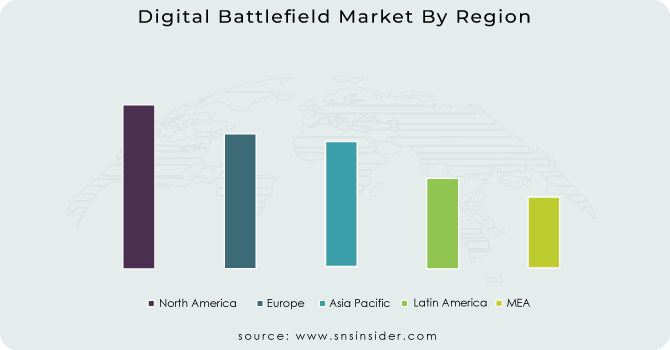

The North American market is expected to offer the largest share from 2024 to 2031 in the digital military arena market. The US and Canada are key countries considered for market analysis in the North American region. The region is expected to lead the market from 2024 to 2031, due to increased investment in digital warfare technology by countries around the region. The US, with its strong economy and security policies, is regarded as one of the key users and receivers of digital in the defense sector. Key manufacturers and developers of digital battlefield components and services in the US include Amazon, Google, Microsoft, IBM, Cisco, Raytheon, and Palantir. The US has long relied on its technological superiority and high levels of training and efficiency to reduce the low number of numbers. This limit is slowly declining as international competitors such as China invest heavily to improve their skills. This has forced the US to be aggressive in expanding its capabilities. This will greatly support market growth in the North American region.

Need any customization research on Digital Battlefield Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are BAE Systems Plc., Northrop Grumman Corporation, Israel Aerospace Industries, Elbit Systems Ltd., General Dynamics Corporation, Lockheed Martin Corporation, Thales Group, Raytheon Technologies Corporation, L3Harris Technologies, Inc., FLIR Systems Inc. and Other Players

Northrop Grumman Corporation-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 53.4 Billion |

| Market Size by 2031 | US$ 169.2 Billion |

| CAGR | CAGR of 15.5% From 2023 to 2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Airborne, Naval, Land, Space) • By Technology (Artificial Intelligence, IOT, Big Data, 5G, Cloud Computing, Master Data Management) • By Application (Warfare Platform, Cyber Security, Logistics & Transportation, Surveillance & Situational Awareness, Others) • By Solution (Hardware, Software, Service) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BAE Systems Plc., Northrop Grumman Corporation, Israel Aerospace Industries, Elbit Systems Ltd., General Dynamics Corporation, Lockheed Martin Corporation, Thales Group, Raytheon Technologies Corporation, L3Harris Technologies, Inc., FLIR Systems Inc. |

| DRIVERS | • Growing demand • High speed internet connectivity |

| RESTRAINTS | • High maintenance • High development cost • Fully AI system’s |