High-Density Polyethylene Bottles (HDPE) Market Report Scope & Overview:

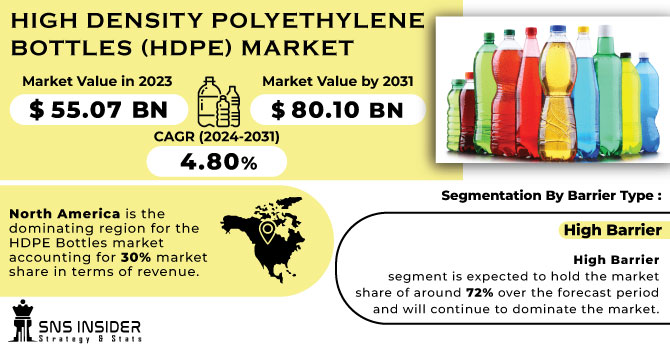

The High Density Polyethylene Bottles (HDPE) Market size was USD 55.07 billion in 2023 and is expected to Reach USD 80.10 billion by 2031 and grow at a CAGR of 4.80% over the forecast period of 2024-2031.

HDPE is characterized by its high density to strength ratio. The density of HDPE is between 930 and 970 kg per mm3. Due to which the recyclability of HDPE Bottles is more than the other polymers.

Get More Information on High-Density Polyethylene Bottles (HDPE) Market - Request Sample Report

HDPE colored bottles are typically more durable than other types of bottles. HDPE is suitable for packaging household cleansers, as it has an excellent barrier against moisture. HDPE bottles are usually back to the same shape after being broken or damaged because they have a recollection in their cool and stable condition. These characteristics make it suitable for use in a variety of unique liquid detergents as press bottles.

MARKET DYNAMICS

KEY DRIVERS:

-

Due to different properties, demand is increasing

High Density Polyethylene (HDPE) is a perfect material for the manufacture of bottles because it is resistant to mildew, mold and rot. It is possible to sterilise HDPE bottles by boiling, which makes it a suitable material for the packaging of foodstuffs and beverages. Because of these properties, a growing demand for high density polyethylene bottles is predicted to be the driving force behind market growth.

-

The demand for environmentally friendly bottles is growing

RESTRAIN:

-

The market is hindered by the presence of alternatives

Due to their numerous characteristics, including light weight and resistance to liquids and gases, good transparency and a wide choice of colours, polyethylene terephthalic PET bottles are restricting market shares in the HDPE bottle sector. different. Furthermore, there is a relatively small gap in the cost of plastic bottle versus HDPE and their recycling rates are comparable to that of HDPE bottles. These factors are holding back the growth of this market.

OPPORTUNITY:

-

Strict rules and regulations on the manufacture of glass bottles

The increasing growth of the polyethylene HDPE bottles market is also due to strict regulations and prohibitions put in place by the government on use of toxic plastics and release of poisonous chemicals and gases into the production of HDPE.

CHALLENGES:

-

Environmental challenges and sustainability requirements

Due to their environmental impact, HDPE bottles have become increasingly scrutinised as well as all plastic packaging. The demand for a reduction in plastic usage, better recyclability, and the need to provide more ecofriendly packaging solutions has been brought about by increasing awareness of plastic pollution and efforts towards sustainable alternatives.

IMPACT OF RUSSIAN UKRAINE WAR

In Hungary, Slovakia, the Czech Republic, Poland and the former East Germany, the imposition of sanctions against Russia in the event of an invasion of Ukraine would threaten the supply of crude oil through the pipeline and the operation of oil refineries and petrochemical plants. ICIS data predicts that by 2022, 2.79 million tons of ethylene (11% of total European capacity) and 2.34 million tons of propylene (12% of total European capacity) will be at the disposal of oil refinery located along the Druzhba pipeline. Although some alternative sources of oil may be available, normal production levels are unlikely to be maintained. Europe imports 40% of its natural gas from Russia. But it is helping to mitigate the pressure by shipping record volumes of LNG to Europe in 2022.

IMPACT OF ONGOING RECESSION

Looking at historical data, the €1,500/ton FD for PPH and PE films is significant as prices have only touched this level a few times. However, for about a year and a half, starting in 2021 and continuing through 2022, prices remained above this threshold due to problems caused by the pandemic. In contrast to H1 2021, which saw markets surge due to supply chain disruption, prices in 2022 set new highs mainly on account of cost pressures. In April, as in the rest of the polymers, polyolefin markets experienced a sharp increase due to significant increases in monomer prices and rising energy costs. Prices reached around €2,100 to €2,200 FD/ton depending on quality and peaked at that time.

The most affected by the cost of living crisis over the period from 2022 was the main PP application areas, including automotive and other durable applications. Demand for PE has to a certain extent been supported by ongoing support from the packaging industry, particularly in relation to food packaging, pharmaceuticals and hygiene products. While the US is expected to have only a mild recession from 2023 onwards, it is assumed that the euro area will also be falling into recession. In the case of China, which is seen as unprepared to cope with an influenza wave, a surge in infections known as COVID 19 suppresses market expectations even though they ease some restrictions. Therefore, the uncertainties which can put businesses in a state of paralysis that could slow down or reduce growth continue to haunt the world's 2nd largest economy.

KEY MARKET SEGMENTS

By Cap Type

-

Snap Closures

-

Disc Top Closures

-

Dispensers

-

Screw Closures

-

Dropper

-

Push-Pull Closures

-

Spray Closures

By Neck Type

-

Wide Mouth Bottles

-

Narrow Mouth Bottles

By Bottle Capacity

-

Less than 30 ml

-

31-100 ml

-

101-500 ml

-

501-1 ltr

-

Above 1 ltr

By Visibility

-

Opaque

-

Translucent

By Barrier Type

-

Low-Barrier

-

High Barrier

By Barrier type, high barrier segment is expected to hold the market share of around 72% over the forecast period and will continue to dominate the market.

By Application

-

Food & Beverages

-

Speciality Chemicals

-

Personal Care & Cosmetics

-

Homecare & Toiletries

-

Chemicals

Personal care & cosmetics segment is dominating application segment. This segment is expected to hold the market share of around 32%. Whereas, food & beverages and chemical segment is expected to hold the market share of 18% and 16% respectively.

REGIONAL ANALYSIS

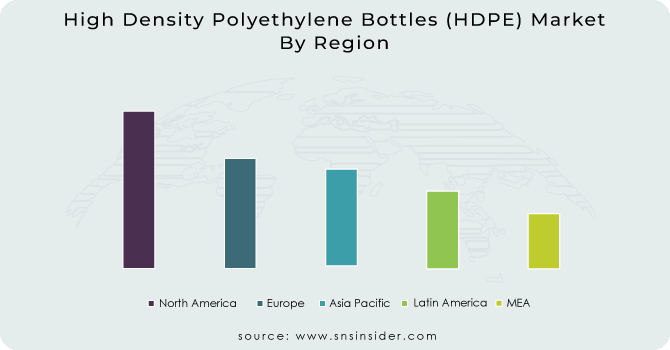

North America is the dominating region for the HDPE Bottles market accounting for 30% market share in terms of revenue. The North America is dominating due to the stringent regulations and rules for using high quality of plastic bottles. US fruit juice, milk and other products which require bottles for packaging is gaining huge demand which is driving the growth of the market.

Europe is the second largest market for the HDPE Bottles accounting for 25% market share. There is huge demand for the plastic drinking bottles in the region. The consumer shifting towards healthier lifestyles is also giving demand to the fresh milk. Many European manufacturers are shifting towards recycled HDPE bottles for packaging of ready to drink beverages.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the High-Density Polyethylene market are ALPLA Group, Avery Dennison, Nampac Limited, RPC Group Plc, Graham Packaging, O Berk Company LLC, Berry Global Group Inc, Gerreshemier AG, CL Smith, Silgan Plastics Closure Solutions and other players.

Avery Dennison-Company Financial Analysis

RECENT DEVELOPMENT

-

A new HDPE plastic recycling plant has been set up by the ALPLA Group in Toluca, Mexico. In addition, the company announced that from the second half of 2022, it will double its annual production capacity for regrind material to 30,000 tonnes.

-

For HDPE bottles, Avery Dennison introduces AD CleanFlake technology.

| Report Attributes | Details |

| Market Size in 2023 | US$ 55.07 Bn |

| Market Size by 2031 | US$ 80.10 Bn |

| CAGR | CAGR of 4.80% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Cap Type (Snap Closures, Disc Top Closures, Dispensers, Screw Closures, Dropper, Push-Pull Closures, Spray Closures) • by Neck Type (Wide Mouth Bottles, Narrow Mouth Bottles) • by Bottle Capacity (Less than 30 ml, 31-100 ml, 101-500 ml, 501-1 ltr, Above 1 ltr) • by Visibility (Opaque, Translucent) • by Barrier Type (Low-Barrier, High Barrier) • by Application (Food & Beverages, Speciality Chemicals, Personal Care & Cosmetics, Homecare & Toiletries, Chemicals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | O Berk Company LLC, Graham Packaging Company, Amcor Plc, Gerresheimer AG, Alpha Packaging Inc, CL Smith, Clarke Container Inc, Maynard & Harris Plastics, Comar LLC, United States Plastic Corporation |

| Key Drivers | • Due to different properties, demand is increasing • The demand for environmentally friendly bottles is growing. |

| Key Restraints | • The market is hindered by the presence of alternatives |