High Energy Lasers Market Size & Trends:

The High Energy Lasers Market size was valued at USD 12.49 billion in 2025 and is expected to grow at a CAGR of 9.12% to reach USD 29.90 billion by 2035.

High Energy Lasers Market trends include growing defense investments in directed energy weapons and increased integration of HEL systems on ground, naval, and airborne platforms for precision engagement and cost-effective operations.

Innovative beam control methods, thermal management systems, and compact power sources that can be hosted onto a mobile platform are propelling High Energy Lasers Market growth. Suggestion Increasing adoption-to-counter UAV and missile defense systems and growing geopolitical tensions and modernization of military arsenals are also stimulating adoption. Moreover, government funded R&D schemes are encouraging the development and testing of HEL prototypes.

-

In mid‑2025, Israel became the first country to use high-power laser weapons in live combat, intercepting enemy drones using Rafael’s Aerial Defense Array prototype.

-

KORD unveiled its mobile FIREFLY laser system (5–40 kW modular range), designed specifically for counter‑UAV tasks at forward positions tested over 34 months in harsh environments.

Market Size and Forecast:

-

Market Size in 2025 USD 12.49 Billion

-

Market Size by 2035 USD 29.90 Billion

-

CAGR of 9.12% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

To Get More Information On High Energy Lasers Market - Request Free Sample Report

High Energy Lasers Market Trends:

-

Rising adoption of High Energy Laser (HEL) systems for precision strikes against aerial threats such as drones, rockets, and missiles is driving market growth.

-

Defense modernization programs are expanding globally due to geopolitical instability and cross-border threats, increasing investment in HEL systems.

-

Technological advancements in power sources, beam control, and thermal management are enabling HEL deployment on mobile and unmanned platforms.

-

Miniaturized and modular HEL systems, such as the FIREFLY range (5–40 kW), are enhancing versatility for transport, mobile, and extreme environmental operations.

-

Successful naval trials, like USS Preble’s HELIOS tests in 2024, validate HEL engagement capabilities beyond drone interception and support future high-power platform initiatives.

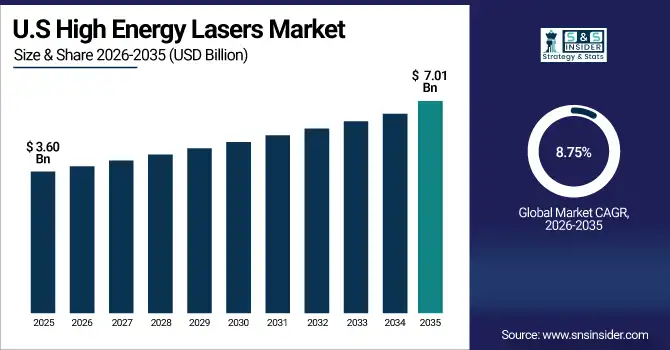

The U.S. High Energy Lasers Market size was valued at USD 3.60 billion in 2025 and is projected to grow at a CAGR of 8.75%, reaching USD 7.01 billion by 2035. The U.S. High Energy Lasers Market is growing with the backing of large defense budgets, increasing deployment of HEL systems across naval and ground platforms, and an extensive government-backed portfolio of research and development (R&D) for next-generation directed energy solutions.

High Energy Lasers Market Growth Drivers:

-

High Energy Lasers Gain Momentum for Precision Strike Capabilities Against Growing Aerial and Missile Threats

The rising ability to precision strike Aerial threats such as drones, rockets, and missiles are one of the main aspects fuelling the global High Energy Lasers Market. Due to the inherent challenges in the cost-effectiveness and rapidity of response from traditional kinetic weaponry, global defense organizations are gradually laying a greater financial stake on HEL systems as a solution with the advantage of virtually instantaneous strike abilities at the speed-of-light, low cost-per-shot, and versatile power scalability. Herein lies the increased defense modernization programs due to rising global geopolitical instability and cross border threat is supporting the defense modernization programs to propel the market growth.

-

In late 2024, the USS Preble conducted the first HELIOS tests against cruise missile–like targets, validating engagement capabilities beyond drone interceptions. These trials will inform the upcoming HELCAP initiative targeting 300 kW platforms.

High Energy Lasers Market Restraints:

-

Environmental Challenges and Beam Control Limitations Restrain High Energy Laser Performance Across Diverse Conditions

The fundamental technical complexities associated with beam quality control in both distant ranges or through unfavorable weather conditions like fog, rainfall, or dusty weather are likely to be one of the key restraining factors in the worldwide High Energy Laser (HEL) market. Such environmental conditions can cause the disruption of laser propagation, thereby complicating the targeting accuracy, which in-turn limits the repeatability of performance across a wide range of terrains and operational environments.

High Energy Lasers Market Opportunities:

-

Miniaturized High Energy Lasers Unlock New Defense Capabilities Across Mobile and Unmanned Combat Platforms

One of the new potentials is to miniaturize and integrate HEL systems onto some mobile and unmanned platform. Major improvements to power sources, beam control, and thermal management methods are allowing for deployment on a wider range of terrains. It generates a robust worldwide requirement from border security, homeland defense and future fight vehicle applications.

-

The FIREFLY modular HEL system ranges from 5–40 kW. It is palletized for transport, mobile platform deployment, and demonstrated robust performance in extreme environments including rain, snow, and sandstorms.

High Energy Lasers Market Segment Analysis:

By Laser Type

In 2025, fiber laser accounted for 33.7% share and is projected to provide the fastest CAGRs from 2026 to 2035. The expansion is attributed to its excellent beam quality, lightweight, small form factor, and high electrical efficiency, making it suitable for integration with a variety of defense platforms, including ground vehicles, naval ships, and other unmanned platforms. They also provide increased thermal management, less maintenance, and improved durability in different environmental setting. They can be set up in a modular style, enabling scalable power output to cater for everything from short-range drone defense to long-range missile interception. Fiber lasers are the largest segment in the High Energy Laser, which is emerging with increased R&D investments coupled with major defense organization field deployments.

By Application

In 2025, the Directed Energy Weapons had the largest share at 47.4%, due to their increasing use for aerial threat countermeasures, air defense systems for drones and missile interceptors. Due to their near light-speed engagement, high precision, and low collateral damage, they represent an attractive solution to modern battlefield needs. DEWs are primarily aimed at meeting various defense challenges and the armies of the U.S., Israel, India and the U.K. are making efforts to operationalize them on surface ships, armored vehicles and unmanned systems. Owing to the fact that nations are competing to improve beam control, thermal management and compact power systems, the segment of Research & Development is anticipated to expand at the highest CAGR from 2026 to 2035. Innovation is also propelled forward by government-backed initiatives, prototype testing, and industry collaborations to develop potent and flexible high-energy laser platforms that are entering the final phases of real-world deployment.

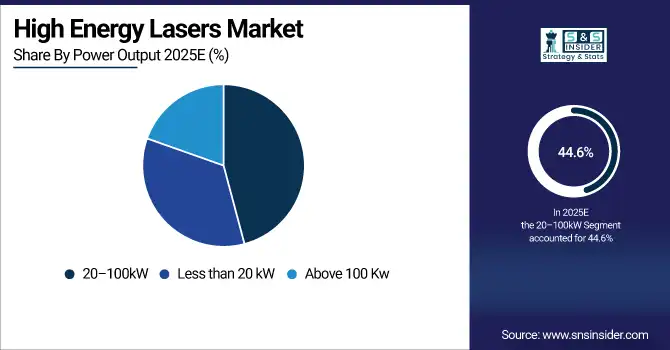

By Power Output

High Energy Lasers Market for 20–100kW power range accounted for 44.6% share in 2025, due to balance between mobility and lethality. This systems are being utilized for counter drone and also short to Mid-range Defense systems over a range of Land airborne and also naval platform. These are the best option for current tactical applications because they can be integrated into existing military vehicles and they have a relatively matured deployment from technology demonstrators to field-ready prototypes.

For the above 100kW segment, it is anticipated to experience the highest CAGR between 2026 and 2035, due to an increasing requirement for effective long-range high-power laser systems to neutralize cruise missiles, swarm drone attacks, and ballistic threats. Improvements in the areas of power scaling, combining, and cooling are allowing deployment on larger naval vessels and fixed defense installations.

By Platform

In 2025, land-based segment accounted for 43.4% share of High Energy Lasers Market, owing to the high adoption of HEL systems among ground combat vehicles, mobile platforms and land-based fixed installations. The counter UAV, mortar, and rocket systems are generally used in battlefield and border security applications. Land-based HEL solutions are the most prevalent among global armed forces due to their ease of integration and mobility, and lower deployment complexity. Due to its high-power laser integration for ship-based missile defense and anti-drone, naval segment is expected to grow at the highest CAGR from 2026 to 2035. HELs can help to ensure that maritime threats are neutralized with precision, and current advancements in various HEL technologies are making this capability deployable on destroyers, frigates, and other surface naval vessels to enhance maritime security.

High Energy Lasers Market Regional Analysis:

North America High Energy Lasers Market Insights

The High Energy Lasers Market in North America accounted for more than 41.5% of the total market share in 2025 owing to higher defense expenditure, rapid technological improvements and early deployment of directed energy weapons in land, airborne and naval applications. Through live field trials and also field deployment on naval ships, ground vehicles, and airborne platforms, the region has exhibited high operational readiness with regard to HEL systems. Next generation of laser weapons are being actively funded by advanced defense contractors and government agencies across the region, aided by favorable legislature and extensive R&D programs. These thrust areas in modernisation of military capabilities, counter drone solution and homeland security infrastructure creation will continue to generate strong momentum across the region, making it a hub in HEL system innovation designing and deployment in future. High Energy Lasers Market share in North America was led by the U.S. in 2025 due to the presence of large defense budgets, active HEL deployment programs, and robust R&D investments by its Army, Navy, and Air Force.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific High Energy Lasers Market Insights

Asia Pacific is likely to register the fastest CAGR over 2026-2035 owing to the increasing defense modernization programs, escalating border tensions, and increasing investments in advanced military technologies. There is a rapid pace of developing and testing high energy laser systems for counter-UAV systems, missile defense, and surveillance in the region. This demand is being propelled by rapid technological adoption, growing military budgets, and the development of domestic defense manufacturers to deliver scalable and mobile HEL platforms. The capabilities of the region towards directed energy weapon system is anticipated to expand over the forecast period due to government-led R&D programs and partnerships with defense players across the globe.

In 2025, the China was the leading market in the Asia Pacific High Energy Lasers Market, owing to significant defense R&D investments, speedy technology development in the field of directed energy and their large-scale deployment programmes on land, naval and airborne platforms.

Europe High Energy Lasers Market Insights

Europe is slowly emerging as the High Energy Lasers Market while accumulating defense modernization investments, which are aimed at bringing focus and improvements with regard to advanced threat detection and neutralization technologies. Regional defense companies are well into developing and testing HEL systems for integration into land and naval platforms. Innovation feels accelerated due to joint defense initiatives, cross-border collaborations, and government-backed R&D programs. Regional counter-drone, missile defense, and border security applications are being targeted to enhance operational preparedness and strategic deterrence capabilities.

Latin America (LATAM) and Middle East & Africa (MEA) High Energy Lasers Market Insights

High Energy Lasers Market Outlook for Middle East & Africa and Latin America is emerging as some of the countries in MEA and LATAM are leveraging high energy laser technology in defense systems on account of increasing security concerns, border surveillance, and the growing threat of UAVs and asymmetric warfare in the regions. Though there is far to go to deploy, national defense modernization efforts and international partnerships are already laying the groundwork for eventual implementation. Growing sensitivity of directed energy systems and interest from military will prompt regional government to consider pilot programs and research push, particularly for counter-drone and perimeter defence system

High Energy Lasers Market Key Players:

Key Players in Global High Energy Laser Market are Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Boeing Defense Space & Security, L3Harris Technologies Inc., BAE Systems plc, Rheinmetall AG, Leonardo SpA, MBDA, Thales Group, Elbit Systems Ltd., Hanwha Aerospace Co. Ltd., CACI International Inc., General Atomics, Directed Energy Solutions Inc., EOS Defense Systems, BlueHalo, QinetiQ Group plc, Israel Aerospace Industries Ltd., Textron Systems Corporation.

Competitive Landscape for High Energy Lasers Market:

Lockheed Martin is a leading global defense and aerospace company specializing in advanced weapon systems, including High Energy Laser (HEL) technologies. The company develops and integrates HEL solutions for precision strike, air defense, and mobile platforms, supporting naval, ground, and unmanned operations. Lockheed Martin’s innovations in beam control, power management, and modular systems strengthen defense modernization and high-performance laser capabilities worldwide.

-

In May 2025, Lockheed continues active testing of HELIOS under the Navy’s Directed Energy and Electric Weapon System programs, focusing on validating performance and preparing additional ships for future integration.

Northrop Grumman is a global aerospace and defense leader actively developing High Energy Laser (HEL) systems for military applications. The company focuses on precision strike, aerial threat defense, and integration on mobile and naval platforms. Northrop Grumman’s expertise in beam control, power management, and system miniaturization supports advanced HEL deployment, enhancing defense modernization and operational capabilities across global security and defense programs.

-

In April 2025, Northrop entered Phase 2 of DARPA's MELT initiative, fabricating full laser tile arrays capable of high beam quality. Future phases plan panel arrays combining multiple tiles for operational verification starting in 2027.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 12.49 Billion |

| Market Size by 2035 | USD 29.90 Billion |

| CAGR | CAGR of 9.12% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Laser Type (Fiber Laser, Solid-State Laser, Chemical Laser, Free Electron Laser, Gas Laser) • By Application (Directed Energy Weapons, Border Security, Industrial Processing, Communication and Research & Development) • By Power Output (Less than 20 kW, 20–100 kW and Above 100 kW) • By Platform (Land-Based, Airborne, Naval and Space-Based) • By End-User (Defense Forces, Homeland Security Agencies, Industrial Sector and Research Institutions) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Boeing Defense Space & Security, L3Harris Technologies Inc., BAE Systems plc, Rheinmetall AG, Leonardo SpA, MBDA, Thales Group, Elbit Systems Ltd., Hanwha Aerospace Co. Ltd., CACI International Inc., General Atomics, Directed Energy Solutions Inc., EOS Defense Systems, BlueHalo, QinetiQ Group plc, Israel Aerospace Industries Ltd., Textron Systems Corporation. |