HVAC Sensors Market Size & Trends:

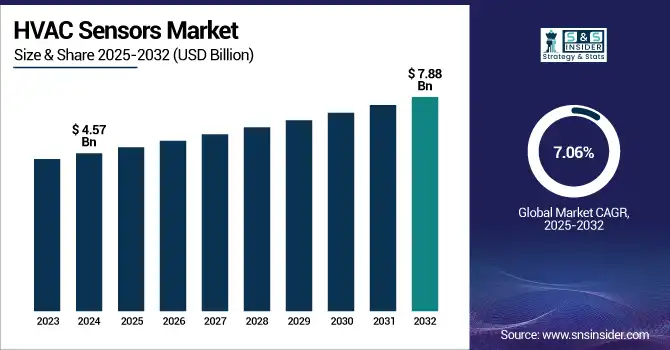

The HVAC Sensors Market Size was valued at USD 4.57 billion in 2024 and is expected to reach USD 7.88 billion by 2032 and grow at a CAGR of 7.06 % over the forecast period of 2025-2032.

To Get more information on HVAC Sensors Market - Request Free Sample Report

The global market for HVAC Sensors is robustly increasing over time owing to rise in demand for energy-efficient systems, integration of smart buildings, and with the increasing government regulations to improve indoor air quality. The residential, commercial, and industrial sector demand is increasing significantly, as companies have started focusing on maximizing the HVAC system performance and minimizing energy usage. In addition, the development of sensor technologies such as IoT and real-time monitoring contributed to the development of improved systems and expanded applications, resulting in a rise in the overall market trend in the world.

According to research, more than 60% of new commercial buildings globally are now integrating smart HVAC and sensor-based systems.

The U.S. HVAC Sensors Market size was USD 0.79 billion in 2024 and is expected to reach USD 1.50 billion by 2032, growing at a CAGR of 8.31 % over the forecast period of 2025–2032.

The U.S. HVAC sensors market growth due to the surge in demand for smart HVAC systems, government incentives for energy-efficient buildings, and rising concerns regarding indoor air quality. In the U.S., the need for advanced sensor integration with respect to building management systems is increasing rapidly, companies are striving to reduce their carbon footprints and meet new sustainability standards.

According to research, 72% of the U.S. corporations have committed to net-zero or science-based targets, driving increased investment in energy-optimizing HVAC sensor technologies.

HVAC Sensors Market Dynamics:

Key Drivers:

-

Rising Demand for Smart HVAC Systems Integrated with IoT Technologies Accelerates HVAC Sensors Market Expansion

Rapid growth in smart HVAC systems is the major factor driving the growth of HVAC sensors market. These systems utilize IoT solutions and data-enabled controls to enable advanced energy management, predictive maintenance and better occupant comfort. HVAC sensors have a significant impact on generation of precise information related to temperature, humidity, airflow, and indoor air quality. Increasing demand for automation among the consumers and accompanied with advancements in sensors technology and easy connectivity will place industries and building owners under pressure to install advanced sensors thus fueling the global HVAC sensors market growth.

According to research, 55% of global HVAC equipment shipped in 2024 contained embedded sensors and IoT connectivity.

Restraints:

-

Lack of Standardization and Interoperability Challenges Limit Seamless Integration of HVAC Sensors in Existing Systems

The absence of a universal protocol and problems of compatibility are impeding the straightforward interconnection of HVAC sensors with building automation systems. With different kinds of sensors, communication standards and proprietary solutions, this is a challenge for control systems manufacturers as the complexity is increased together with the higher integration costs. Building owners/operators often struggle to achieve seamless performance within multi-vendor HVAC environments. There are also integration barriers that can slow down the adoption process, leading to diminished perceived value to invest in new sensor technologies, especially in retrofit cases. Solving these standardization challenges is essential to capturing a larger market and to get this technology widely adopted.

Opportunities:

-

Expansion of Green Building Certifications and Sustainability Regulations Fosters Demand for High-Performance HVAC Sensors

Rising global penetration of the green building certifications including LEED and BREEAM and increasingly strict sustainability regulations is stimulating demand for high-performance HVAC sensors. Owner/operators of a facility want next-generation sensor technology in order to make compliance with energy efficiency and indoor air quality laws and regulations achievable. HVAC sensors have an essential role in providing data for the optimal system performance and certification targets fulfilment. This regulatory-driven momentum for sustainable buildings is predicted to drive strong demand for smart sensors, especially in markets with stringent climate policies and building environmental awareness.

According to research, over 80% of LEED v4/v4.1 credits for indoor environmental quality require HVAC systems equipped with precise sensors for CO₂, humidity, and particulate matter.

Challenges:

-

Complexity in retrofitting legacy HVAC systems with advanced sensor technologies hampers market scalability

The advanced sensor technology is not suitable for the majority of existing HVAC systems of old buildings, this constrains the market expand dimensions. Legacy buildings often feature obsolete infrastructures that are not compatible with modern sensor networks and IoT ecosystems. Integration is buried deep within the system and therefore involves significant modification, upgrade or replacing of the entire system, which is often associated with higher projects costs and difficulty. These are the types of barriers that dissuade many building owners from embracing new sensor technology, especially in older commercial and industrial buildings. Solving these compatibilities and retrofit issues is critical in order to drive wider adoption and market expansion in the HVAC sensors market.

HVAC Sensors Market Segmentation Analysis:

By Sensor Type

Temperature sensors dominated the HVAC Sensors Market share with a 39.03% in 2024, as they play such a vital role controlling the temperature inside. Devices of this type now are the key for accurate temperature measurements, besides its energy saving and comfort reasons, and therefore are found in homes, work places and factory buildings. Siemens AG, as a market leader in building technologies, has designed accurate temperature sensors that clear their job excellently. Increasing requirement of energy efficient smart buildings is further escalating the domination of temperature sensors globally.

Gas sensors are projected to witness the fastest CAGR of 8.72% over 2025-2032, driven by growing concern about indoor air pollution and stringent environmental norms. Growing demand for harmful gas and volatile organic compounds detection is driving the demand in various end use industries. Sensirion AG provides innovative gas sensors with high sensitivity and small form factors for modern HVAC systems. This technology aids in addressing public health and regulatory issues and stands as an accusation for faster market expansion.

By Application

Commercial HVAC systems dominated the market with a 45.25% revenue share in 2024. In offices, shopping malls, hospitals, and schools, all with their large installations, advanced climate control is a requirement for energy efficiency and comfort of the occupants. HVAC Sensors Companies, such as Johnson Controls International PLC offers a variety of premium high-efficiency HVAC sensors for commercial buildings. Their seamless integration with building automation systems allows for the effective control of spaces, vital for high traffic areas that demand both energy efficiency and environmental quality.

Industrial HVAC systems are anticipated to grow at the fastest CAGR of 8.07% over 2025-2032, due to the increased use of temperature-controlled settings in the manufacturing, data center, and pharmaceutical sectors. Allan Tucker Bundy argues that industrial standards are demanding rigorous monitoring. Honeywell International Inc. provides industrial-grade HVAC sensors that are durable and precise enough. These elements allow companies to keep the process conditions best suited for the task and realize energy savings and compliance, driving the segment’s growth.

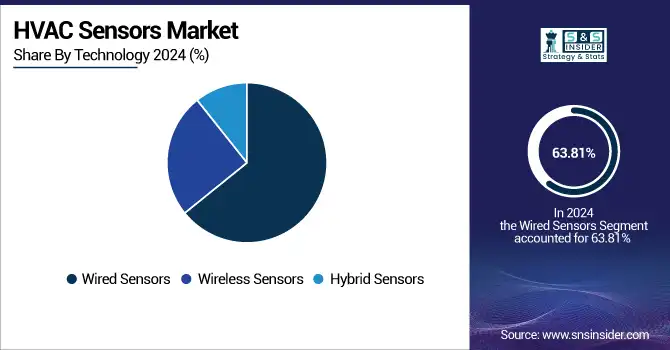

By Technology

Wired sensors dominated the HVAC Sensors Market with a 63.81% revenue share in 2024, due to their excellent reliability, accuracy and compatibility with central HVAC control systems. Cabled systems Cabled business ultrasonic sensor solutions are designed for larger commercial and industrial installations where reliable data needs to be transmitted over longer ranges. Schneider Electric SE has a wide array of wired sensors through which can provide complex HVAC systems. Their reliability and ease of integration with other building systems makes them a perfect fit for permanent and mission critical installations.

Wireless sensors are forecast to grow at the fastest CAGR of 8.76% over 2025-2032, due to the convenience of installation and flexibility, and the compatibility with IoT-based smart building systems. Older building systems and new construction efforts are also requiring more wireless infrastructure. Emerson Electric Co. unveiled its smart wireless HVAC sensors for easy installation and system monitoring. The market for these sensors is ramping up as building managers look for affordable, scalable, and smart sensor technologies to optimize systems.

By End-User

Building Management Systems (BMS) dominated the HVAC Sensors Market with a 43.10% revenue share in 2024, as integrated platforms heavily depend on HVAC systems for achieving the best balance between energy consumption and indoor environmental quality. BMS allow organizations to centralize monitoring and control their facilities. ABB Ltd. also offers advanced HVAC sensors which easily integrate into BMS systems. These offerings increase system efficiency, provide predictive maintenance, and help companies achieve sustainability objectives, rendering BMS the foundation of smart building operations in the new normal, and accentuating sustained market leadership.

Energy Management Companies are projected to achieve the fastest CAGR of 7.97% over 2025-2032, driven by the growing international attention on energy saving and decarbonization. HVAC sensors advanced to offer actionable data on building performance. Delta Electronics, Inc. provides sensor solutions to enable energy management companies to operate more efficiently and enhance energy productivity. Increasing focus on net-zero buildings and more stringent energy codes is driving demand for advanced HVAC sensor solutions developed for energy optimization applications.

By Functionality

Control sensors dominated the HVAC Sensors Market with a 39.14% revenue share in 2024, owing to their vital role for on-the-fly control of the HVAC system. These sensory controls automatically regulate the temperature, humidity, and airflow for ideal operation. Belimo Holding AG is the world market leader in the development, production and marketing of actuator solutions for controlling heating, ventilation, and air conditioning systems. After all these years, the ability of control sensors to improve comfort and slash operating costs means that they are here to stay in all types of buildings.

Smart sensors are expected to grow at the fastest CAGR of 8.60% during 2025-2032, as they enable predictive maintenance, integration to IoT and advanced system analytics. Real-time monitoring and cloud computing are changing everything about the HVAC industry. About Bosch Sensortec introduces the high-end smart HVAC sensors, which enable the compact solutions for AI-based building automation. Worldwide momentum towards smart cities and intelligent infrastructure is also driving strong demand for advanced smart sensors in HVAC.

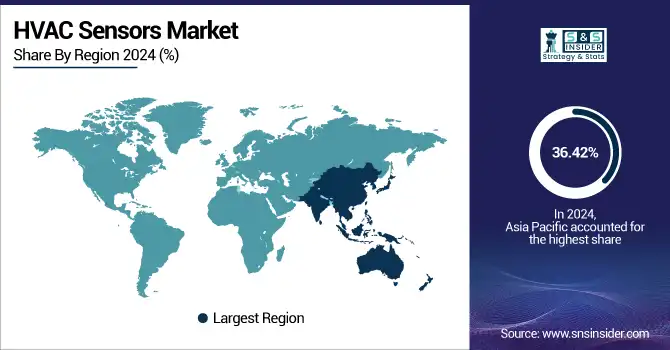

HVAC Sensors Market Regional Outlook:

Asia Pacific dominated the HVAC Sensors Market with a 36.42% revenue share in 2024, fueled by rapidly expanding urban centres, new commercial and residential building construction and an increase in energy efficient HVAC installations. Encouragement of green building standards by the government and smart city initiatives also contribute to the expansion of the market. Moreover, growing disposable incomes and increasing concern about indoor air quality will further stimulate demand for advanced HVAC technologies. Asia Pacific remains at the forefront, due to the hefty population and rapid industrial expansion.

-

China dominates the market due to the large construction boom with urbanization, the heavy focus of the government on energy, and efficiency. Widespread use of smart building technologies and strict environmental laws continue to boost the demand for advanced HVAC sensor solutions in the country.

North America is projected to grow at the fastest CAGR of 8.80% over 2025-2032, driven by increasing penetration of smart building infrastructure and stringent demand of power efficiency. The need for older buildings to be retrofitted with more advanced HVAC solutions is growing stronger, with the emphasis on businesses and home owners taking greater control over their energy usage and indoor air quality. Growing sustainability concerns and advancement in sensor and IoT technology across the region has significantly contributed to the rapid growth of the market in North America.

-

The U.S. is the leading market for HVAC Sensors due to high market penetration for monitoring and control systems which use high-density capacity HVAC sensors, and smart building projects to beat energy efficiency guidelines. Focus on sustainability, indoor air quality, and integration of technologically advanced HVAC systems also drive the market growth.

HVAC Sensor Market in Europe is anticipated to grow on account of increasing number of regulations to enhance energy efficiency and rising implementation of smart building systems. Dense urban population and growing emphasis of the region on lowering carbon emissions and enhanced indoor air quality are driving the demand for high tech HVAC equipment. Further, ongoing retrofitting and renovation activities in old buildings and ambitious government policies, induce continuous new demand for the European market.

-

Germany leads the European market due to an upsurge in the production sector and its strict energy efficiency directives along with its commitment to smart buildings systems and services. Add these to the country's head start in automation and penetration of IoT-ready HVAC systems, and the market is barely beginning to show signs of slowing.

The Middle East & Africa and Latin America markets are also growing steadily owing to increasing consolidation and growing demand from urbanized regions, smart cities and increasing energy efficiency requirements. Saudi Arabia and Brazil rule their respective regions, driven by infrastructure spending levels and a growing demand for sophisticated HVAC equipment in new and replacement applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

HVAC Sensors Companies are:

Major Key Players in the HVAC Sensors Market are Honeywell International Inc., Siemens AG, Johnson Controls, Schneider Electric SE, Emerson Electric Co., Sensirion AG, ABB Ltd., TE Connectivity Ltd., Carrier Global Corporation, and Delta Controls Inc and others.

Recent Developments:

-

In April 2025, Delta Controls started their ENTEL-R room and ENTEL-D duct sensors have featured prominently in Canadian commercial BMS pilot programs targeting EnOcean wireless and zero‑wiring strategies.

-

April 2025, Siemens’ QAA/QPA sensor series has been gaining traction with their Desigo CC ecosystem supporting BACnet MS/TP and IP for smart BMS.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.57 Billion |

| Market Size by 2032 | USD 7.88 Billion |

| CAGR | CAGR of 7.06% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Temperature Sensors, Pressure Sensors, Humidity Sensors, Gas Sensors, Proximity Sensors) • By Application (Residential HVAC Systems, Commercial HVAC Systems, Industrial HVAC Systems) • By Technology (Wired Sensors, Wireless Sensors, Hybrid Sensors) • By End-User (Building Management Systems, OEMs (Original Equipment Manufacturers), Energy Management Companies) • By Functionality (Monitoring Sensors, Control Sensors, Smart Sensors, Multi-function Sensors) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., Siemens AG, Johnson Controls International PLC, Schneider Electric SE, Emerson Electric Co., Sensirion AG, ABB Ltd., TE Connectivity Ltd., Carrier Global Corporation, Delta Controls Inc. |