Foot Ulcer Sensors Market Report Scope & Overview:

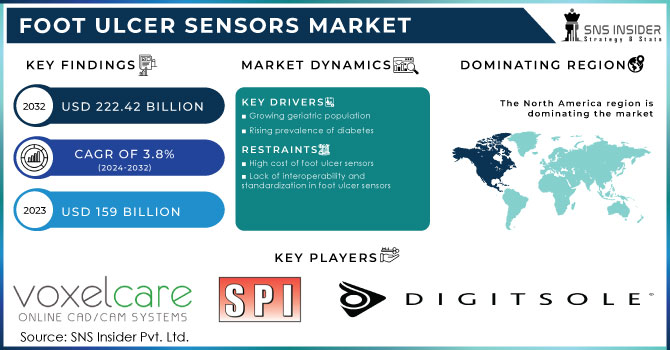

The Foot Ulcer Sensors Market size was valued at USD 163.03 Million in 2023 and expected to reach USD 224.46 Million by 2032 with a growing CAGR of 3.62% over the forecast period of 2024-2032.

Get more information on Foot Ulcer Sensors Market - Request Sample Report

The Foot Ulcer Sensors market is experiencing significant growth, primarily driven by the increasing prevalence of chronic wounds, particularly diabetic foot ulcers, which require effective monitoring and treatment solutions. Chronic wounds, including foot ulcers, are becoming a major global health concern, exacerbated by the rising number of diabetes cases and an aging population. In the United States, for instance, over 490,000 people suffer from tibial fractures annually, many of which lead to complications such as foot ulcers, necessitating extensive medical care. This contributes to more than 569,000 hospital stays and 800,000 physician office visits each year, highlighting the significant healthcare burden. The growing prevalence of diabetes is a major factor in this increase, as the condition is closely linked to foot ulcers. As a result, the market for foot ulcer sensors is expanding rapidly, driven by the need for effective management solutions. One of the key advancements fueling this growth is the development of pressure sensors , particularly wireless pressure sensors insoles, which enable continuous monitoring of foot pressure and gait. These wearable sensors provide real-time data, allowing for better management and early detection of potential foot ulcer formation. The adoption of such technologies aligns with the increasing trend of remote patient monitoring, reducing the need for frequent in-person visits and enhancing patient care. As healthcare, increasingly shifts towards more cost-effective and efficient solutions, these sensors are expected to play a crucial role in addressing the growing demand for chronic wound management. Consequently, the foot ulcer sensors market is poised for substantial growth, with advancements in sensors technology and the rising incidence of chronic conditions driving its expansion.

Market Dynamics

Drivers

-

Enhancing Foot Ulcer Care through Improved Reimbursement Policies and Smart Sensor Technology

Improved reimbursement policies are crucial in accelerating the growth of the Foot Ulcer Sensor Market, especially for patients with chronic conditions such as diabetic foot ulcers (DFUs). As the demand for advanced wound care technologies, like smart insoles and pressure sensors, grows, Medicare and other insurance frameworks have begun to adjust their coverage, making these devices more accessible and affordable for patients. Recent updates to Medicare's policies have streamlined reimbursement for DFU treatments, enhancing the adoption of smart insoles designed to prevent ulcer recurrence in diabetic patients proven to be cost-effective in the long term. The Centers for Medicare & Medicaid Services (CMS) has increasingly supported such innovations, including wireless pressure sensor insoles, which enable real-time monitoring of foot pressure. This shift toward covering new technologies aligns with clinical research and government initiatives aimed at reducing healthcare costs and improving patient outcomes. As these reimbursement policies evolve, healthcare providers are more inclined to adopt these technologies, further stimulating market demand. The evolving landscape not only improves patient care but also creates a favorable environment for the expansion of the Foot Ulcer Sensor Market, offering significant growth potential as the demand for wearable devices designed to manage chronic wounds and diabetic foot ulcers continues to rise.

Restraints

-

The durability and maintenance issues tied to wearable devices, particularly those equipped with foot ulcer sensors, create a significant market constraint.

These sensors, often embedded in smart insoles, are susceptible to wear and tear, requiring frequent upkeep, which raises the overall cost of ownership. Foot ulcer sensors are especially vulnerable to damage from prolonged exposure to moisture, heat, and pressure, which diminishes their long-term functionality and reliability. Moreover, the need for regular recalibration, battery changes, and ongoing maintenance increases operational expenses, making these devices less financially viable for both healthcare providers and patients. With frequent repairs or sensor replacements potentially needed, the cost-effectiveness of these technologies becomes a concern, hindering their adoption across the healthcare sector. As continuous maintenance remains a necessity, these challenges restrict the scalability and growth of foot ulcer sensor technologies, limiting their use in managing chronic wounds, particularly diabetic foot ulcers. As a result, the maintenance and durability requirements of these wearable devices present a substantial barrier to the broader adoption of foot ulcer sensors in healthcare settings.

Segment Analysis

By Product

In 2023, the in-sole sensors segment dominated the foot ulcer sensors market, accounting for approximately 45% of the market share. This dominance is driven by the increasing adoption of smart insole technologies for real-time monitoring of foot pressure, which is crucial for preventing and managing diabetic foot ulcers. In-sole sensors provide continuous and accurate data, allowing healthcare providers to track changes in foot health, detect early signs of pressure sores, and intervene promptly. The comfort and convenience of these sensors, which integrate seamlessly into patients' daily footwear, contribute to their growing popularity. The increasing focus on remote patient monitoring and personalized care further accelerates the demand for in-sole sensor solutions, making them a key driver of market growth in the foot ulcer sensors segment.

The in-shoe sensors segment is the fastest growing in the foot ulcer sensors market over the forecast period from 2024 to 2032. This rapid growth is driven by the increasing demand for advanced wearable technologies that provide real-time monitoring of foot pressure and gait. In-shoe sensors are gaining popularity due to their ability to seamlessly integrate into everyday footwear, making them non-intrusive and comfortable for patients. These sensors enable continuous monitoring, which is particularly valuable in managing diabetic foot ulcers and preventing recurrence. Furthermore, advancements in sensors technology, such as improved accuracy and miniaturization, are enhancing the performance and affordability of in-shoe sensors. As remote patient monitoring and personalized care become more prevalent, the in-shoe sensors segment is expected to see significant market expansion.

By Application

The diabetes management segment dominates the foot ulcer sensors market, accounting for approximately 49% of the market share in 2023. This is primarily driven by the high prevalence of diabetic foot ulcers (DFUs) among diabetic patients, making it a critical application area for foot ulcer sensors. These sensors are crucial in monitoring foot pressure, temperature, and gait, providing real-time data that helps in preventing ulcer formation and recurrence, which are common complications in diabetes. As the global diabetic population continues to rise, the demand for effective management tools to prevent foot-related complications is growing. Foot ulcer sensors help diabetic patients manage their condition more effectively, reduce hospital visits, and improve quality of life, thus driving the growth of this application segment. With advancements in sensor technology, the adoption of these devices is expected to increase further in the coming years.

The sports and athletics segment is poised to be the fastest-growing application in the foot ulcer sensors market over the forecast period from 2024 to 2032. Increasing awareness of foot health among athletes, combined with the rising focus on injury prevention and recovery, is driving demand for advanced sensor technologies. These sensors, integrated into footwear, help in monitoring foot pressure and identifying potential issues such as stress fractures or other injuries that may lead to ulcers or long-term complications. As athletes seek to enhance performance and minimize the risk of foot injuries, foot ulcer sensors provide valuable insights into their foot health, supporting quicker recovery and optimal training. The growing adoption of wearable technologies in sports and the ongoing innovations in sensor-based solutions are expected to accelerate the growth of this segment during the forecast period.

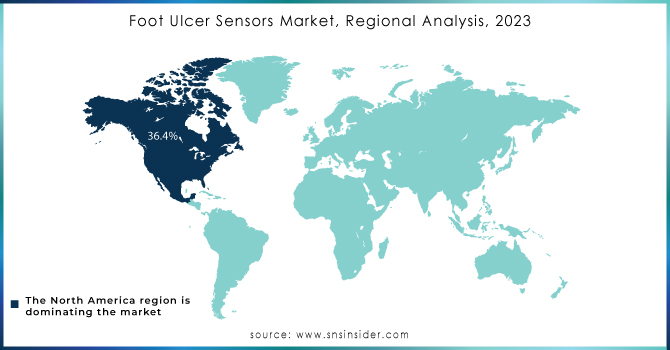

Regional Analysis

North America dominated the Foot Ulcer Sensors Market with the largest revenue share of approximately 40% in 2023, driven by strong healthcare infrastructure, high prevalence of diabetes, and increasing adoption of advanced medical technologies. The United States leads the region due to significant investments in diabetic foot ulcer (DFU) management, rising awareness of foot health, and favorable reimbursement policies that support sensor-based solutions. According to the CDC, over 37 million Americans have diabetes, with approximately 15% developing foot ulcers, necessitating advanced monitoring solutions. The presence of key industry players, ongoing R&D efforts, and government initiatives promoting digital healthcare have further fueled market growth. Additionally, Canada is witnessing growing adoption of foot ulcer sensors, supported by rising healthcare expenditure and a strong focus on preventive care, reinforcing North America’s dominance in the global Foot Ulcer Sensor Market.

Asia Pacific is the fastest-growing region in the foot ulcer sensor market over the forecast period 2024-2032, driven by a rising diabetic population, increasing healthcare expenditure, and growing awareness of advanced wound care solutions. Countries like China, India, and Japan are at the forefront of this growth due to the rapid expansion of healthcare infrastructure and technological advancements in medical devices. According to the International Diabetes Federation (IDF), Asia accounts for over 60% of the global diabetic population, with India and China having the highest number of cases. Governments in these countries are actively investing in digital healthcare solutions, boosting the adoption of smart insole sensors and wearable monitoring devices. Additionally, improving reimbursement frameworks and a growing demand for cost-effective, preventive healthcare measures are further accelerating the adoption of foot ulcer sensors across the region.

Need any customization research on Foot Ulcer SensorsMarket - Enquiry Now

Key Players

Some of the major players in Foot Ulcer Sensors Market:

-

Moticon ReGo AG (Germany)

-

Sensors Products Inc. (USA)

-

Voxelcare (USA)

-

Digitsole (France)

-

Linepro Controls Pvt Ltd. (India)

-

PI Bioelectronics Co., Ltd. (South Korea)

-

Sensors ia Health (USA)

-

XSENSORS (Canada)

-

Tekscan (USA)

-

Orpyx Medical Technologies Inc. (Canada

-

Nexstep (USA)

-

FeetMe (France)

-

Aetrex Worldwide, Inc. (USA)

List of Suppliers who provide raw material and component for the foot Ulcer Sensors Market:

-

Honeywell International Inc.

-

Analog Devices, Inc.

-

TE Connectivity

-

STMicroelectronics

-

Bosch Sensors tec

-

Semtech Corporation

-

Microchip Technology

-

Medtronic

-

Flex (Flex Ltd.)

-

Schneider Electric

Recent Development

-

January 2025, Moticon, in collaboration with Vanderbilt University, has secured a USD 2.7M NIH grant to develop a wearable system using wireless sensors insoles to monitor foot pressure and gait in real time, enhancing leg fracture recovery and rehabilitation

| Report Attributes | Details |

| Market Size in 2023 | USD 163.03 Million |

| Market Size by 2032 | USD 224.46 Million |

| CAGR | CAGR of 3.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (In-sole sensors , In-shoe sensors , Smart socks) • By Type (Pressure sensors , Temperature sensors , Humidity sensors ) • By Application (Diabetes management, Sports & athletics, others) • By Distribution Channel (Offline, Online, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Moticon ReGo AG (Germany), Sensors Products Inc. (USA), Voxelcare (USA), Digitsole (France), Linepro Controls Pvt Ltd. (India), PI Bioelectronics Co., Ltd. (South Korea), Sensors ia Health (USA), XSENSORS (Canada), Tekscan (USA), Orpyx Medical Technologies Inc. (Canada), Nexstep (USA), FeetMe (France), Aetrex Worldwide, Inc. (USA). |

| Key Drivers | • Enhancing Foot Ulcer Care through Improved Reimbursement Policies and Smart Sensor Technology |

| Restraints | • The durability and maintenance issues tied to wearable devices, particularly those equipped with foot ulcer sensors, create a significant market constraint. |