Commercial Security System Market Size Analysis:

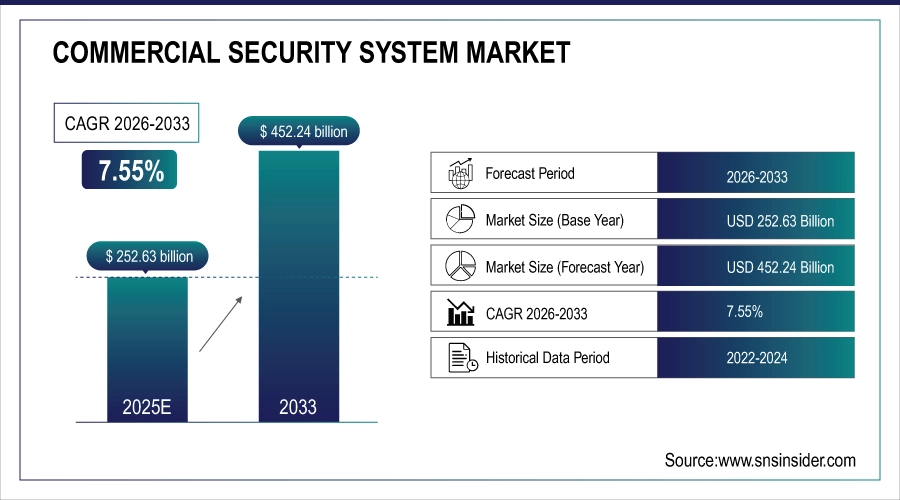

The Commercial Security System Market Size is estimated at USD 252.63 Billion in 2025 and is projected to reach USD 452.24 Billion by 2033, growing at a CAGR of 7.55% during the forecast period 2026–2033.

The Commercial Security System Market analysis report delivers a comprehensive overview of integrated security technologies, adoption trends across business operations, and the evolving risk landscape. Rising incidents of theft and unauthorized access, stringent regulatory compliance mandates, increasing adoption of IoT and AI-based smart solutions, and growing investments in protecting critical infrastructure are expected to drive market growth during the forecast period.

Commercial security system deployments are projected to protect over 85 million business sites globally by 2025, driven by rising security concerns and digital transformation of physical security.

Market Size and Growth Projection:

-

Market Size in 2025: USD 252.63 Billion

-

Market Size by 2033: USD 452.24 Billion

-

CAGR: 7.55% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Commercial Security System Market - Request Free Sample Report

Commercial Security System Market Trends:

-

Growing integration of AI and machine learning is driving intelligent threat detection, reducing false alarms by up to 40% and improving incident response times.

-

Rise of cloud-based security solutions is enabling remote monitoring and management, adopted by over 60% of new commercial installations for scalability.

-

Convergence of physical security and IT networks is increasing demand for cybersecurity-integrated systems to protect against data breaches.

-

Expansion of wireless and IoT-connected devices is boosting flexible system deployments, accounting for over 55% of new sensor and camera installations.

-

Increasing adoption of mobile access control and biometrics is enhancing user convenience and security, reducing reliance on traditional credentials.

-

Focus on data-driven insights and predictive analytics is transforming security from reactive to proactive, cutting security-related losses by an estimated 25-30%.

U.S. Commercial Security System Market Size Outlook:

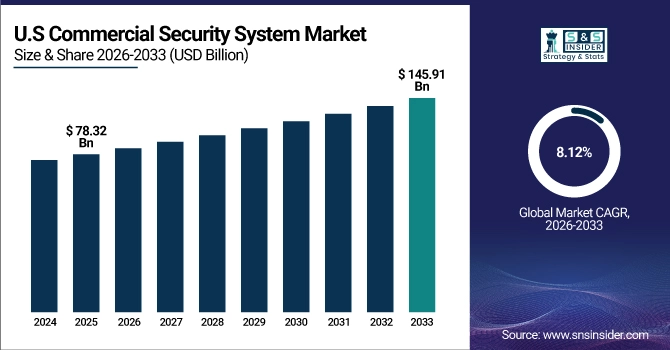

The U.S. Commercial Security System Market is projected to grow from USD 78.32 Billion in 2025 to USD 145.91 Billion by 2033, at a CAGR of 8.12%. High rates of crime in metropolitan areas, strict fire and life safety regulations, substantial insurance premium incentives for secured properties, the quick uptake of smart building technology, and large investments in safeguarding vital corporate, financial, and retail infrastructure are the main drivers of growth.

Commercial Security System Market Growth Drivers:

-

Increasing Security Breaches and Sophisticated Threats are Accelerating Commercial Security System Adoption to Protect Assets, Data, and People

One of the main factors propelling the growth of the commercial security system market is the rise in sophisticated threats and security breaches. Businesses across verticals are being forced to invest in sophisticated, multi-layered security due to an increase in terrorism, corporate espionage, organized retail crime, and illegal access. This comprises systems for fire safety, intruder detection, access control, and video surveillance. Investments are also driven by the need to lower insurance costs and compliance with strict industry rules. Modern systems are essential for risk reduction and business continuity due to the increased efficacy of the digital transformation of security brought about by AI and cloud management.

Investments in AI-powered commercial security are projected to grow by over 18% in 2025, driven by the need for real-time analytics and automated incident response.

Commercial Security System Market Restraints:

-

High Initial Installation Costs and Concerns Regarding Data Privacy and System Vulnerabilities are Restraining Market Expansion

Significant barriers to the commercial security system market include high upfront installation costs, worries about data privacy, and system weaknesses. For small and medium-sized businesses, comprehensive security solutions that involve significant capital expenditures for hardware, software, and integration may be unaffordable. Concerns regarding the security of security systems themselves are also raised by the fact that systems are becoming more and more connected, which leaves them vulnerable to cyberattacks. Adoption rates among cost-conscious and risk-averse end users are slowed by strict data protection laws and the possibility of liability from system malfunctions.

Commercial Security System Market Opportunities:

-

Proliferation of Smart City Initiatives and IoT Ecosystems Presents Significant Opportunities for Integrated and Data-Driven Commercial Security Solutions

The market for commercial security systems has a lot of potential due to the growth of smart city projects and IoT ecosystems. Security systems that seamlessly integrate with building management, energy systems, and public safety networks are becoming more and more necessary as urban infrastructure and commercial buildings become increasingly interconnected. This trend makes it possible to create comprehensive security platforms that use data from various sources for emergency response, crowd control, and predictive policing. In order to capitalize on long-term development in the changing scenario of connected urban areas, security firms might broaden their capabilities into managed services and analytics.

Integration with smart city platforms is expected to influence over 35% of new large-scale commercial security projects in 2025.

Commercial Security System Market Segmentation Analysis:

-

By Hardware, Video Surveillance System held the largest market share of 38.65% in 2025, while Access Control System is expected to grow at the fastest CAGR of 8.95% during 2026–2033.

-

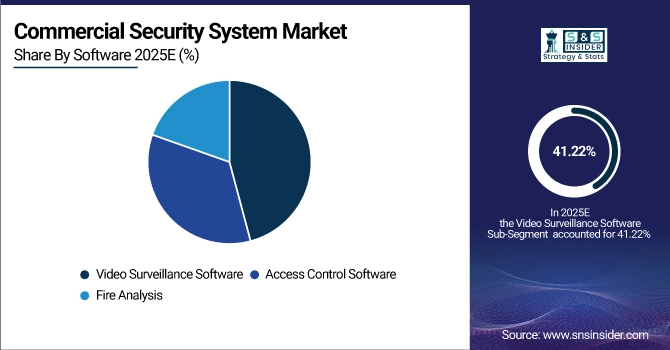

By Software, Video Surveillance Software accounted for the highest market share of 41.22% in 2025, while Access Control Software is projected to expand at the fastest CAGR of 9.45% during the forecast period.

-

By Vertical, Commercial (Corporate & Enterprise) dominated with a 28.50% share in 2025, while Healthcare is expected to grow at the fastest CAGR of 9.15% through 2026–2033.

By Software, Video Surveillance Software Dominates While Access Control Software Expands Rapidly

Video Surveillance Software segment dominated the market as it enables video management, advanced analytics, such as facial recognition and object detection, and system integration. Over 70% of new video surveillance deployments in 2025 included licensed or cloud-based VMS software to manage growing camera counts and data.

Access Control Software is the fastest-growing segment, driven by the need for centralized user management, integration with HR systems, and cloud-hosted solutions that enable remote administration. In 2025, cloud-based access control software subscriptions grew by over 22%, as businesses sought scalable and flexible security management platforms.

By Hardware, Video Surveillance Dominates While Access Control Expands Rapidly

Video Surveillance System segment dominated the market due to its critical role in continuous monitoring, evidence collection, and deterrence across all commercial verticals. Over 45 million surveillance cameras were deployed in U.S. commercial spaces alone in 2025, driven by demand for high-resolution, AI-analytics-ready IP cameras.

Access Control System is the fastest-growing segment, fueled by the shift from traditional locks and keys to electronic, biometric, and mobile-based systems that offer enhanced security and audit trails. In 2025, over 60% of new commercial construction projects integrated electronic access control as a standard, reflecting demand for secure and manageable entry solutions.

By Vertical, Commercial (Corporate & Enterprise) Dominates While Healthcare Expands Rapidly

Commercial (Corporate & Enterprise) segment dominated the market, encompassing office buildings, corporate campuses, and data centers, which require comprehensive security for assets, personnel, and intellectual property. This vertical accounted for security investments exceeding USD 70 billion globally in 2025.

Healthcare is the fastest-growing segment, fueled by stringent regulations (HIPAA), the need to protect sensitive patient data and pharmaceuticals, and rising violence in healthcare settings. Security spending in the global healthcare vertical increased by over 11% in 2025, focusing on integrated access control, video surveillance in sensitive areas, and emergency response systems.

Commercial Security System Market Regional Analysis:

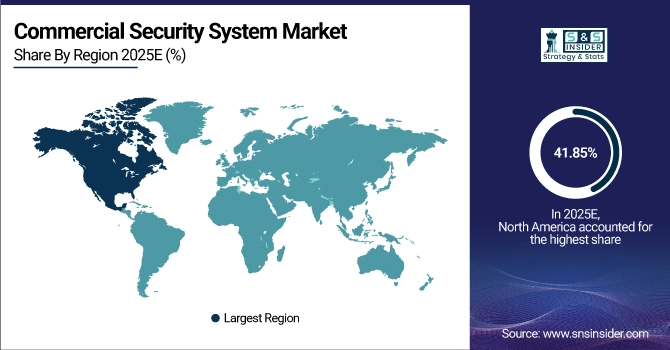

North America Commercial Security System Market Insights

North America dominated the Commercial Security System Market with 41.85% share in 2025, driven by the large number of Fortune 500 firms, important infrastructure, strict rules, and early use of new technology. Big investments in AI-based analytics, cloud security platforms, and integrated systems in the U.S. and Canada make the region a leader.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Commercial Security System Market Insights: The U.S. is the primary engine, accounting for nearly 86% of North American demand. Growth is driven by the largest commercial real estate sector globally, along with the high per-capita security spending, a strong competitive landscape of security providers, and recurring investments for the purpose of upgrading the legacy systems to IP-based and smart solutions.

Asia Pacific Commercial Security System Market Insights

Asia Pacific is the fastest-growing region, projected to expand at a CAGR of 8.85%. Rapid urbanization, huge smart city initiatives in China and India, more commercial construction, and businesses becoming more concerned of security are all driving growth. The growing use of video surveillance and access control in retail, banking, and transportation is driving growth in the region.

-

China Commercial Security System Market Insights: China dominates Asia-Pacific, contributing approximately 52% of regional revenue. Government-led public safety programs ("Skynet"), a lot of new commercial infrastructure, and a strong local manufacturing base for security hardware all help the economy grow, which makes it a vital hub for both supply and demand.

Europe Commercial Security System Market Insights:

Europe is the second-largest regional market. It has strong GDPR compliance that drives secure system design, high adoption in the retail and banking sectors, and enhanced integration of security with building automation. Germany, the UK, and France are the leaders in adoption, thanks to their large industrial and commercial sectors.

-

Germany Commercial Security System Market Insights: Germany leads Europe with nearly 25% regional demand, supported by its strong industrial sector (Industry 4.0), high-value manufacturing sites requiring protection, and rigorous standards for system quality and data protection, making it a market for advanced, reliable security solutions.

Commercial Security System Market Competitive Landscape:

Johnson Controls International plc

Johnson Controls is a global pioneer in building technology, providing integrated security, fire, and HVAC solutions. The company was founded in 1885 and is based in Cork, Ireland, with its operational headquarters in Milwaukee, USA. The OpenBlue platform from the company links security systems to larger building management systems. It works for businesses, factories, and government buildings all around the world.

-

In 2024, Johnson Controls launched enhanced AI-driven video analytics within its OpenBlue security suite, focusing on proactive threat detection for critical infrastructure sites.

Honeywell International Inc.

Honeywell is a leader in technology and manufacturing with a wide range of products. It was founded in 1906 and is based in Charlotte, North Carolina, USA. Its Building Technologies division offers a full range of commercial security, fire, access control, and building management systems that are known for being reliable and easy to integrate.

-

In 2023, Honeywell expanded its Pro-Watch access control platform with new mobile credential and cybersecurity features tailored for large enterprise and government campuses.

Robert Bosch GmbH

Bosch is a multinational technology and services company with its main office in Gerlingen, Germany. It was founded in 1886. The Security Systems branch delivers video surveillance, intrusion detection, access control, and management software to a wide range of businesses, with a strong focus on research and development and engineering.

-

In 2024, Bosch introduced a new series of intrusion detection panels with deep learning capabilities to reduce false alarms in retail and banking environments.

Carrier Global Corporation

Founded in 2020 and based in Palm Beach Gardens, Florida, this company offers smart solutions for climate, energy, fire, security, and cold chain issues around the world. Carrier, Kidde, Edwards, and LenelS2 are among of the names that the company uses. It sells modern HVAC, refrigeration, and building automation solutions to homes, businesses, and factories.

-

In October 2024, Carrier expanded its smart building portfolio by enhancing integrated fire and security solutions with AI-driven monitoring and energy-efficient systems to support sustainable, connected infrastructure.

Commercial Security System Companies are:

-

Honeywell International Inc.

-

Robert Bosch GmbH

-

Carrier Global Corporation

-

Hikvision Digital Technology Co., Ltd.

-

Dahua Technology Co., Ltd.

-

Axis Communications AB

-

Motorola Solutions, Inc.

-

Hanwha Vision Co., Ltd.

-

Allegion plc

-

Stanley Black & Decker, Inc.

-

SECOM CO., LTD.

-

ADT Inc.

-

Verizon Communications Inc.

-

Cisco Systems, Inc.

-

Genetec Inc.

-

Tyco International (Johnson Controls)

-

Panasonic Holdings Corporation

-

FLIR Systems, Inc. (Teledyne FLIR)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 252.63 Billion |

| Market Size by 2033 | USD 452.24 Billion |

| CAGR | CAGR of 7.55% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Hardware (Fire Protection System, Video Surveillance System, Access Control System, Entrance Control System) • By Software (Fire Analysis, Video Surveillance Software, Access Control Software) • By Vertical (Commercial, Government, Transportation, Retail, Banking & Finance, Education, Industrial, Energy & Utility, Sports & Leisure, Healthcare, Military & Defense) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Johnson Controls International plc, Honeywell International Inc., Robert Bosch GmbH, Carrier Global Corporation, Assa Abloy AB, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Axis Communications AB, Motorola Solutions, Inc., Hanwha Vision Co., Ltd., Allegion plc, Stanley Black & Decker, Inc., SECOM CO., LTD., ADT Inc., Verizon Communications Inc., Cisco Systems, Inc., Genetec Inc., Tyco International (Johnson Controls), Panasonic Holdings Corporation, FLIR Systems, Inc. (Teledyne FLIR). |