Geospatial Analytics Market Size & Overview:

Get more information on Geospatial Analytics Market - Request Free Sample Report

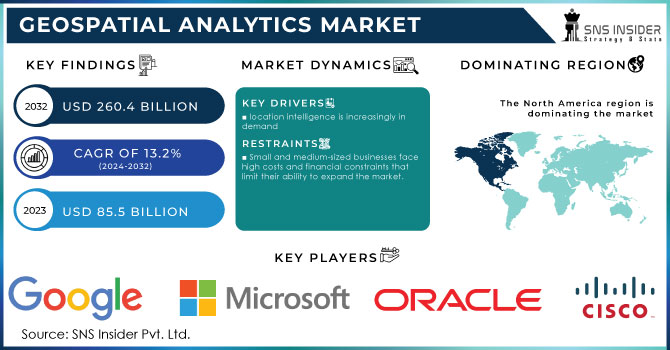

Geospatial Analytics Market Size was valued at USD 85.5 Billion in 2023 and is expected to reach USD 260.4 Billion by 2032, growing at a CAGR of 13.2% over the forecast period 2024-2032.

The global geospatial analytics market is gaining substantial growth due to increased government spending and the expanding application of geospatial technology in different sectors. The latest data from the United States Geological Survey (USGS) and the European Union’s Copernicus program suggest that government agencies throughout the world have been accelerating the use of geospatial data to benefit urban planning, disaster response, and environmental monitoring. The report from 2023 indicates that the U.S. federal government has spent close to $1.2 billion on geospatial data infrastructure as part of its smart city initiative. More specifically, the development and deployment of real-time data collection and analysis have permitted the city to enhance urban management efficiency. The Earth Observation Program of the EU’s Copernicus program established a 15% increase in the budget spent on satellite imagery and data to ensure the monitoring of environment and climate measures. This trend suggests that more sectors, both public and private, are increasingly relying on this technology to streamline their decision-making processes.

What is Geospatial Analytics?

Geospatial analytics entails analyzing patterns, relationships, and trends utilizing geospatial data. The term encompasses a vast variety of applications, given the possibility of usage of geographic information systems, as well as data provided by remote sensing, satellite imagery, Global Positioning Systems, and more.

Geospatial Analytics Market Dynamics

Drivers

-

location intelligence is increasingly in demand

Geospatial analytics are being developed in large part due to the rising demand for location intelligence. Organizations from a variety of industries are aware of the enormous benefits that spatial insights can have on their daily operations and decision-making. Location intelligence combines corporate data with geospatial data to provide a greater comprehension of spatial linkages, patterns, and trends. The knowledge that location is crucial for understanding customer behavior, market trends, and resource optimization is what drives this demand in numerous areas of business. Technological developments like cloud computing, big data analytics, and artificial intelligence have sped up demand by making it possible to process and analyze massive amounts of geographical data effectively.

Restrains

-

Small and medium-sized businesses face high costs and financial constraints that limit their ability to expand the market.

The public's concern regarding privacy has grown as GIS and related geospatial technologies have been used more often. In most scientific disciplines, as well as in organizations like governments and businesses, geospatial data creation and analysis are commonplace. However, because location data is inherently confidential, geospatial research and its societal applications face specific challenges. The collection of data, sharing of locations, use of location-based services, and storage of data are all governed by laws. Companies that gather location information from users are required to abide by several data privacy laws, including the Sensitive Personal Data or Information Act (SPDI) and the General Data Protection Regulation (GDPR). Due to the limited availability of user location data within organizations, the adoption of these analytics tools may be constrained.

Opportunities

-

Geospatial analytics enables businesses to analyze location data for a variety of key insights.

Challenges

-

Implementing geospatial analytics systems faces major obstacles due to cost and infrastructure requirements.

Segment analysis

By Type

In the geospatial analytics market, the largest share of revenue in 2023 was attributed to the surface & field analytics segment, which accounted for 57% share. The dominance of this segment can be driven by the fact that surface and field analytics are extensively used in agriculture, mining, and environmental management. Moreover, the use of geospatial analytics is accelerated by government initiatives. For instance, the U.S. Department of Agriculture’s precision agriculture program had its funding increased by 10% in 2023, accelerating the adoption of geospatial analytics to produce accurate land-use data and crop yield predictions. A similar initiative was undertaken by the European Space Agency in satellite-based environmental monitoring. This initiative made it possible to analyze surface changes in real time leading to more efficient environmental protection and disaster response. As for surface & field analytics, all the sectors relying on real-time spatial data for land use, adapting crop yield, resource extraction, and disaster planning are crucial. The use of the described products is backed up by government statistics and funding, and, therefore, the segment became the leading one in the geospatial analytics market

By Component

The software segment dominated the geospatial analytics market in 2023 and accounted for a 65% revenue share. As the demand for accurate and advanced geospatial software solutions continues to grow, this segment’s performance will likely remain strong. U.S. Census Bureau has introduced geospatial data software tools that allow local governments to enhance urban development and infrastructure planning. The European Commission’s Joint Research Centre has developed an open-source geospatial software platform, which the EU member states now use in 20% of cases of climate resilience as well as efficient management of soil, farming, and forests. Strong demand for geospatial software solutions is associated with their ability to handle ‘rapidly increasing volumes of spatial data from satellites, drones, and sensors’. At the same time, software solutions enable users to obtain meaningful insights. The software segment will continue leading the geospatial analytics market as the number of government-driven digital transformation projects, especially in such sectors as public safety, defense, and environment, is rapidly growing.

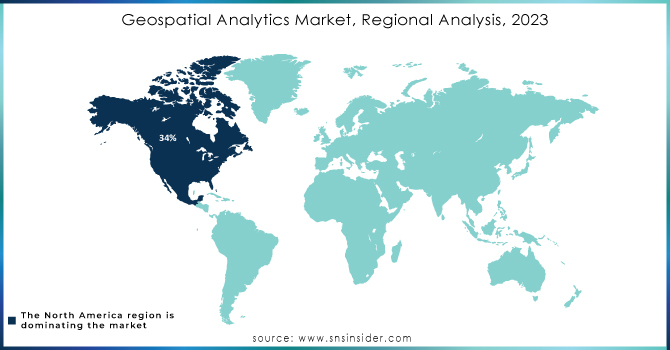

Regional Analysis

The global geospatial analytics market was dominated by North America in 2023, with a market share of 34%. This is mainly attributable to the region’s massive investment in geospatial technology and infrastructure. The U.S. Department of Homeland Security states that government expenditure on geospatial analytics for disaster response, border surveillance, and infrastructure monitoring grew by 12% in 2023 to exceed $3 billion. The U.S. government’s focus on improving national security and emergency preparedness has spurred the adoption of geospatial analytics in various federal and state agencies. Additionally, the Geospatial Data Strategy, which was launched in 2023, is set to boost the country’s geospatial infrastructure by expanding public access to real-time, high-quality data for urban planning, environmental surveillance, and resource management. Increased partnerships and collaborations between government agencies, research institutions, and private companies to develop new and innovative geospatial software, hardware, and data analytics services have also enabled North America to keep its dominant position in the global geospatial analytics market. For example, the United States National Mining Association combined GIS and location-based services to plan and collect geophysical, geological, and topographic data and information about natural resources. The North American market will benefit over the next few years as mobile GIS technology continues to grow, subsequently increasing demand for location-based services and real-time information.

The Asia Pacific market will experience the highest CAGR, however, because the growth of the region’s developing economies, notably India, China, and Indonesia, has led to more people living in cities. The demand for smart cities, integrated urban development plans, and smart infrastructure has consequently increased. In addition, China, India, and South Korea are leading the charge in building 5G infrastructure as well as IoT infrastructure. These factors will drive the market in APAC to grow at a higher CAGR than other regional markets over the forecast period.

Need any customization research on Geospatial Analytics Market - Enquiry Now

Key Players

-

IBM Corporation (IBM Watson OpenScale, IBM Cloud Pak for Security)

-

Microsoft Corporation (Microsoft Azure AI, Microsoft Responsible AI Toolkit)

-

Google LLC (Google AI Platform, Google Cloud AI Explainability)

-

Amazon Web Services (AWS) (AWS SageMaker Clarify, AWS Identity and Access Management)

-

Palantir Technologies (Palantir Foundry, Palantir Apollo)

-

Salesforce, Inc. (Einstein AI, Salesforce Shield)

-

SAP SE (SAP AI Core, SAP Business Technology Platform)

-

Oracle Corporation (Oracle AI, Oracle Identity Governance)

-

Accenture plc (Accenture Applied Intelligence, Accenture Cyber Intelligence Platform)

-

Hewlett Packard Enterprise (HPE) (HPE InfoSight, HPE GreenLake AI)

-

Cisco Systems, Inc. (Cisco SecureX, Cisco AI Network Analytics)

-

Darktrace plc (Darktrace Enterprise Immune System, Darktrace Antigena)

-

CrowdStrike Holdings, Inc. (CrowdStrike Falcon, CrowdStrike AI-Powered Threat Graph)

-

Fortinet, Inc. (FortiAI, FortiGuard AI-driven Security Services)

-

McAfee Corp. (McAfee MVISION Insights, McAfee Total Protection)

-

Splunk Inc. (Splunk AI, Splunk Enterprise Security)

-

SAS Institute Inc. (SAS Viya, SAS Model Risk Management)

-

FireEye, Inc. (FireEye Helix, FireEye Endpoint Security)

-

Bitdefender (Bitdefender GravityZone, Bitdefender AI Security Layer)

-

Zebra Technologies Corporation (Zebra Savanna, Reflexis AI Workforce Management) and others.

Recent Developments in the Geospatial Analytics Market

-

December 2023: Placer.ai and Esri signed a partnership deal that will help improve the use of geospatial information to analyze the target customers. The partnership will enable them to unlock new features through the partnership arrangement.

- February 2025: The United States Geological Survey signed a partnership with NASA to launch a new satellite under the Landsat program to improve the collection of high-resolution geospatial images for the use of environmental monitoring. This development will increase the market size of U.S. geospatial analytics. The satellite will provide a continuous collection of real-time satellite information for agriculture, forestry, and climate-related information. The collection of data will increase the geospatial database of the country.

- March 2023: CKS and Esri India Technologies Chain Management and Supply launched the ‘MMGEIS’ program to promote geospatial skills among students from 8th to undergraduates. The program has enabled India to become the worldwide leader in the use of geospatial technologies.

| Report Attributes | Details |

| Market Size in 2023 | USD 85.5 Billion |

| Market Size by 2032 | USD 260.4 Billion |

| CAGR | CAGR of 13.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Service) • By Deployment(On-Premises, Cloud) • By Type (Surface & Field Analytics, Network & Location Analytics, Geovisualization, Others) • By Application(Surveying, Medicine & Public Safety, Military Intelligence, Disaster Risk Reduction & Management, Marketing Management, Climate Change Adaption (CCA), Urban Planning, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services (AWS), Palantir Technologies, Salesforce, Inc., SAP SE, Oracle Corporation, Accenture plc, Hewlett Packard Enterprise (HPE), Cisco Systems, Inc., Darktrace plc, CrowdStrike Holdings, Inc. |

| Key Drivers | • location intelligence is increasingly in demand |

| Market Opportunities | • Geospatial analytics enables businesses to analyze location data for a variety of key insights. |