Horizontal Directional Drilling Market Report Scope & Overview:

To get more information on Horizontal Directional Drilling Market - Request Free Sample Report

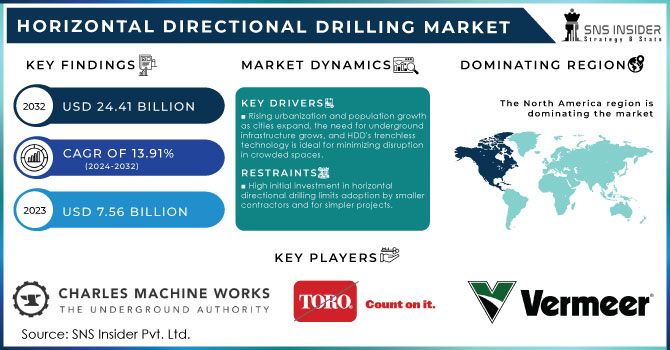

The Horizontal directional drilling Market size was valued at USD 7.56 Bn in 2023. It is anticipated to be valued at USD 24.41 Bn by the year 2032 and shows a growth rate of 13.91% CAGR during the forecasting period 2024-2032.

Tunneling creates the main passage, while HDD would likely be used to lay cables and pipelines alongside it. Asia's tunnel boom caters to large-scale projects like the massive 14.15 km Zojila tunnel, creating highways, railways, and water channels. In contrast, horizontal directional drilling (HDD) tackles smaller tasks, installing utilities and telecom lines typically ranging from centimeters to a few meters. Both sectors benefit from the region's infrastructure push. China alone is expected to invest $31-$38 billion annually between 2025-2028. Tunnelling addresses large-scale transportation needs, while HDD ensures these projects have the underground utility and communication networks they rely on. The North-South Commuter Railway-Metro Manila Subway tunnel exemplifies this.

The horizontal directional drilling market is also challenged in various ways. Some of these ways include the incurring of high costs, especially in the acquisition of HDD equipment. Other additional costs incurred may include permits and licenses which are quite costly since it is a form of regulation. Although horizontal directional drilling is less invasive than other approaches, there are still environmental risks involved, as it could accidentally spill drilling fluid or contaminate groundwater. Key drivers of the horizontal directional drilling market include increasing urban sprawl and the need for sustainable solution-based infrastructure. Developed countries are rapidly aging, and much of their Infrastructure is due for replacement or updates, resulting in a high need for this solution. Sliding technical enhancements in horizontal directional drilling technology due to technological achievements boost the need for such solutions and solutions. Finally, the elevated need for infrastructure and connectivity initiatives across the globe boosts the require for horizontal directional drilling.

In January 2024: SLB committed in association with Nabors Industries to provide its clients with automated drilling solutions across Opulence oil & gas operators and their contracting driller.

The commitment was designed to make it simpler for customers whose drilling automation application driller presently employs Nabors to access SLB’s vast array of automated drilling solutions or to contemplate integrating their current and remaining drilling automation technologies based on rig operating system restrictions.

MARKET DYNAMICS:

Drivers

Rising urbanization and population growth as cities expand, the need for underground infrastructure grows, and HDD's trenchless technology is ideal for minimizing disruption in crowded spaces.

The expanding urban areas and growing population, the demand for today’s efficient infrastructure solutions, which are minimally disruptive, increases constantly. Traditional methods of installing underground utilities such as pipelines, conduits, and cables usually entail significant earthworks that cause traffic jams and a cacophony of noise as well as pollutes the environment. In densely populated cities, these interruptions may seriously affect ordinary people's lives and local commerce. Horizontal directional drilling (HDD) has ranched less qualities that reduce the degree of surface damage. It involves drilling a pilot hole along a chronologically planned route and then widening this so as to take what are basically Conduits in drilling mud or slurry Bentonite, or other stabilizing solutions that do not pollute the environment below ground level as drilling ground-water recirculated well can. This method is especially suitable for the intricate city landscape where open-cut troughing would be either impractical or impossible. By minimizing the extent of earthworks, Horizontal directional drilling maintains the integrity of the city environment and existing infrastructure, which makes it a highly desirable choice for municipal planners and construction projects of future intent when looking to expand or upgrade the subterranean utility networks that lie beneath our feet. Moreover, its precision and efficiency ensure that this project can be done more quickly and at less cost than before, addressing the urban infrastructure requirements that are proliferating with mainstream methods.

Growing Demand for Efficient Utility Distribution to HDD supports efficient electricity, water, and gas transmission by facilitating the laying of cables and pipelines, driven by rising energy demands in urban and industrial areas.

Demand for efficient utility distribution systems in urban, and industrial areas is growing in concert with the increased use of energy. As cities grow and as industries develop, facilities for electricity transmission, water and gas all have to expand. Laying underground cables and pipelines, Horizontal directional drilling is pivotal for meeting this need. Horizontal directional drilling technology allows utilities to be installed underneath surfaces with minimal disruption to those surfaces. This is particularly important in densely-populated or developed areas where traditional trenching methods would cause considerable inconvenience and expense. Making it possible to add new utility lines to existing infrastructure in a smooth and seamless manner, Horizontal directional drilling bears that much more significance. This capability is crucial as cities seek to enhance their energy efficiency and assure a stable supply of indispensable services to their expanding populations. The literature review was performed on the Utility of Horizontal directional drilling in Meeting the Distribution of Urban and Industrial Energy Demand.

Restrain

High initial investment costs in horizontal directional drilling equipment and project setup can be expensive, limiting adoption by smaller contractors or for less complex projects.

Horizontal drilling (HDD) has a great deal of uses than traditional methods but requires large initial investment levels that may impede adoption. The equipment necessary for horizontal directional drilling, drilling rigs, drill pipes and fluid systems entail large economic input from anyone wishing to move into this field. In addition, horizontal directional drilling project layout requires special planning to bridge the gap between theory and reality, and it also calls for skilled workers and advanced technology which contribute a further amount to total costs. Smaller contractors or companies that perform simplified projects may think this is too costly a new approach for them, so will not be able to make use of it. The high up-front expense has been known to drive customers away even from horizontal directional drilling a technology which can be justified in tests by such things as its lower ground crater volume and quicker completion times. However, for any organization with limited funds and working on a project in which these benefits are not a matter of life or death, investing in horizontal directional drilling technology would be impossible. This kind of barrier to entry slows the uptake of horizontal directional drilling across a wide area and particularly in places lacking development resources as well as small emerging markets. When the technology continues to improve and hopefully lower in cost, those high initial costs may one day be reduced.

Limited application in hard rock land horizontal directional drilling is less effective in very hard rock formations, where traditional drilling methods might be better suited.

Horizontal directional drilling is known for handling a range of geologic conditions with success. But when it comes to hard rock formations, Horizontal directional drilling confronts significant challenges. The technology's effectiveness in such terrains is reduced because the standard horizontal directional drilling equipment for easily penetrating hard rock is less capable than of cutting through softer soils or mixed ground conditions. Traditional drilling methods such as rotary or percussion drilling are often better suited for these severe terrains because they can take more force and are abrasion-resistant during the grinding process in hard rock. Horizontal directional drilling thus requires special drill bits and improved drilling fluid systems to cope with its significantly increased rate of wear--which in turn only increases expense and complexity. Furthermore, the slower pace of expensive hard rock drilling can extend project schedules while at the same time causing labor costs to surge upward. All of these limitations serve to make Horizontal directional drilling less attractive for predominantly hard rock projects, where traditional drilling methods might offer a more practical and cost-effective solution. In spite of these hurdles, breakthroughs in Horizontal directional drilling technology are gradually improving the performance of this technology in hard rock conditions. But as long as such developments remain the preserve of a few and hence very costly, their application to such terrains will remain limited.

KEY MARKET SEGMENTATION

By Technique

-

Conventional

-

Rotary Steerable System

The Rotary Steerable Systems (RSS) segment held the largest share of about 64% in 2023. With real-time steering capabilities provided by RSS, drilling contractors can accurately follow a designated borehole passage even under challenging conditions. As a result, problems encountered by hitting objects or running over time and budget can be avoided entirely in many instances. This means that drilling companies have lower operating costs and higher profits.

Conventional is the easier to manage and do not require as skilfully crew. So, they are attractive to those less professional crews. They are also cheaper to purchase than RSS rigs, making them a more attractive option for small projects and budget-conscious operators. However, using conventional methods of drilling increases the risk of getting off-course from the planned path, which could potentially impact nearby infrastructure.

By Parts

-

Rigs

-

Pipes

-

Bits

-

Reamers

The rigs segment accounted for the largest share of approx. 34% in 2023 owing to the application of underground utility installation to install pipelines, cables, and conduits without disturbing the surface in industries like construction and telecommunication for infrastructural development.

Reamers came in at the second place in the part types section mainly because of the extensive usage of reamers in horizontal drilling. Reamers are often used in HDD operations in the oil and gas industry.

By Machine

- Mini

- Midi

- Maxi

By Application

-

On-shore

-

Off-shore

In 2023, the offshore segment had the largest proportion approx. to 69.5%. This occurs largely as a result of more offshore hydrocarbon exploration and production projects is driving demand for the use of horizontal directional drilling in the future.

It is anticipated that the second important field for horizontal directional drilling machines in oil and gas exploration & production will be the drilling of onshore fields, because there are more E&P activities being carried out in onshore parties than off parties.

By Machine Type

- Utility vibratory plow

- Utility tractor

- Pile driver

- Foundation machines

- Boring machines

- Others

This is found in utility vibratory plow, utility tractor, and pile driver as well as in foundation machines boring machines and others. In 2023, the utility vibratory plow segment accounted for about 32% of the HDD market, largest Toshiba. This machine is mainly used for creating pipelines and installing cable conduits underground.

Pile drivers are pulled through this conduit to form a pipeline. These machines are used in the telecommunication industry for laying fiber cable and in the petroleum sector. The prospects for growth in these industries are expected to help demand for utility vibrator plough horizontal directional drilling machine over the next few years. In the telecommunication and oil/gas sectors, the pile driver takes second largest share of the market because pipeline and cable installations are in demand. STARKE and others are engaged in producing pile drivers that offer tremendous strength, automatic anchoring and so forth.

By Tooling

-

Transition Rods

-

HDD Drill Rods

-

HDD Paddle Bits

-

HDD Drive Collars, Chucks, and Subs

-

HDD Swivels & Pulling Equipment

-

Others

By End User

-

Oil and Gas Excavation

-

Utility

-

Telecommunication

-

Others

In 2023, the oil and gas extraction segment accounted dominating share of the market, with approximately 36% of global revenues coming through that channel. The well-developed infrastructure creates a large demand for drilling rigs, contributing to the oil and gas extraction segment's fine market share. Furthermore, the segment's dominance is likely to be enhanced by the need to address escalating oil exploration and production costs on new sites.

The telecommunication segment is expected to grow at a significant CAGR. With the increasing demand for higher-speed broadband, telecom operators are choosing to make greater use of new and more reliable drilling services like horizontal directional drilling in order to extend fiber optic networks.

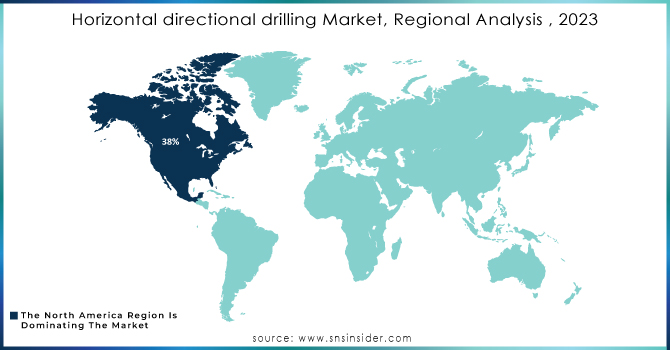

REGIONAL ANALYSIS:

North America is a dominant region in the horizontal directional drilling market with around 38% market share. The U.S. Energy Information Administration pointed to extensive liquid fuel utilization, underscoring the requirement of reliable drilling technologies (US EIA). Growing count of infrastructure and utility projects across North America is further supporting the demand for HDD equipment & services.

The Asia-Pacific region is expected to experience rapid growth, with China making its national energy infrastructure revolve around renewable sources of energy. The area is sprawling in terms of investments in telecommunications the market for 4G and 5G networks is increasing rapidly, this implies that demanding opportunities might be on the rise as far as employing better drilling equipment is concerned.

Need any customization research on Horizontal Directional Drilling Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The Major Players are Charles Machines Works, Inc. (Ditch Witch), Barbco, Inc., Toro Company, Vermeer Corporation, Vmt Gmbh Gesellschaft Für Vermessungstechnik, Laney Directional Drilling Co., Inrock Drilling Systems Ellingson Companies, Laney Directional Drilling Co., Mclaughlin Group, Inc., American Augers, Inc., Schlumberger Limited and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.56 Billion |

| Market Size by 2032 | US$ 24.41 Billion |

| CAGR | CAGR of 13.91% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Conventional, Rotary Steerable System) • By Machine Type (Utility vibratory plow, Utility tractor, Pile driver, Foundation machines, Boring machines, Others) • By Application (Onshore, Offshore) • By Machine (Mini, Midi, maxi) • By Parts Type (Rigs, Pipes, Bits, Reamers) • By Tooling (Transition Rods, HDD Drill Rods, HDD Paddle Bits, HDD Drive Collars, Chucks, and Subs, HDD Swivels & Pulling Equipment, Others) • By End-use (Oil & Gas Extraction, Utility, Telecommunication, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | American Augers, Inc., Ditch Witch, Ellingson Companies, Vermeer Corporation, The Toro Company, Baker Hughes Incorporate, Halliburton Company, Schlumberger Limited, Weatherford International National Oilwell Varco, Inc., Nabors Industries, Ltd. |

| Key Drivers | • Rising urbanization and population growth as cities expand, the need for underground infrastructure grows, and HDD's trenchless technology is ideal for minimizing disruption in crowded spaces. • Growing Demand for Efficient Utility Distribution to HDD supports efficient electricity, water, and gas transmission by facilitating the laying of cables and pipelines, driven by rising energy demands in urban and industrial areas. |

| RESTRAINTS | • High initial investment costs in horizontal directional drilling equipment and project setup can be expensive, limiting adoption by smaller contractors or for less complex projects. • Limited application in hard rock land horizontal directional drilling is less effective in very hard rock formations, where traditional drilling methods might be better suited. |