Hospital Outsourcing Market Size & Overview:

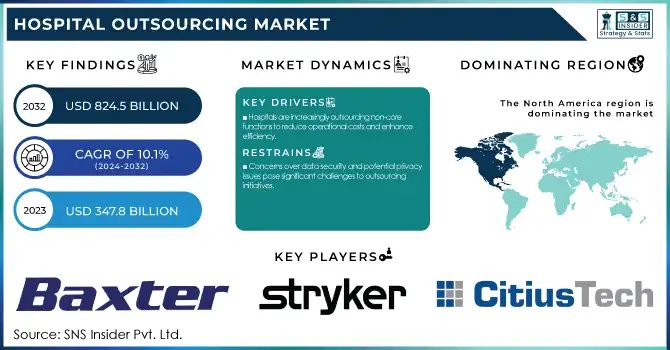

The Hospital Outsourcing Market Size was valued at USD 347.8 Billion in 2023 and is projected to grow to USD 824.5 Billion by 2032, with a CAGR of 10.1% during the forecast period from 2024 to 2032.

To get more information on Hospital Outsourcing Market - Request Free Sample Report

The report provides statistical information and the latest trends within the Hospital Outsourcing Market, covering key factors driving market growth. It examines market penetration and growth rates, highlighting the increasing adoption of outsourced services such as facility management, IT support, and revenue cycle management. It analyzes market penetration and growth rates, identifying the rise of outsourced services like facility management, IT support, and revenue cycle management. The report shows substantial cost savings from outsourcing and operational efficiency improvements, and how outsourcing helps reduce hospital overhead and operational costs. It also examines spending trends by region and compares expenditures of government-funded and private hospitals. Additionally, the study assesses regulatory compliance and vendor accreditation, focusing on adherence to healthcare laws. The study focuses on technology adoption in outsourced services, detailing how AI, automation, and cloud-based systems are being increasingly integrated into the strategic optimization of hospital operations. The hospital outsourcing market is experiencing significant growth driven by increasing healthcare costs, rising demand for specialized services, and the need for operational efficiency.

Hospital Outsourcing Market Dynamics

Drivers

-

Hospitals are increasingly outsourcing non-core functions to reduce operational costs and enhance efficiency.

Hospitals are increasingly outsourcing non-core functions to reduce operational costs and enhance efficiency. A survey of more than 500 hospitals and other inpatient organizations found that 90% of healthcare executives are pursuing cost savings via third-party vendors. This movement is propelled by the necessity to overcome financial hurdles, including escalating operational expenses and regulatory pressures. For instance, in South Australia, health officials have initiated plans to outsource entire episodes of care to the private sector to tackle extensive waiting lists for specialist consultations and elective surgeries. This is an effort to decrease wait times to see specialists, which in some specialties are up to six years. Similarly, the UK government has allocated £16 billion to reduce NHS waiting lists by outsourcing services to the private sector. The move responds to strong demand for private healthcare, as patients recoil at near-record NHS waiting lists forcing many at some point to consider going private for treatment.

Surging healthcare inflation and results for workforce shortages and clinician burnout have driven US healthcare organizations to explore outsourcing as a cost control strategy while maintaining quality of care. Contract labor expenses for hospitals increased by 258% from 2019 to 2022, highlighting the financial toll of staffing challenges. By outsourcing these non-core functions, hospitals can dedicate their time and resources to their main objective of curing patients while utilizing expert knowledge to increase operational productivity and reduce overall costs. Such a strategic approach allows the healthcare facilities to smartly adapt to face financial pressures and resource limitations.

Restraints:

-

Concerns over data security and potential privacy issues pose significant challenges to outsourcing initiatives.

Hospitals outsourcing market is heavily constrained by concerns related to data security and privacy risks. Recent events highlight how serious these challenges are. In June 2024, a ransomware attack on Synnovis, a laboratory services provider for several NHS hospitals in London, incurred costs of £32.7 million, vastly exceeding the company's 2023 profits of £4.3 million. This breach led to one of the largest recent NHS patient data breaches, causing delays or cancellations of thousands of operations and appointments. The UK has experienced a rise in severe cyber-attacks, tripling in 2024. In the United States, 2024 witnessed 567 data security breaches, exposing the health information of nearly 170 million individuals. These incidents have led regulators and lawmakers to push for stricter cybersecurity rules for healthcare providers in 2025, including new procedures and incident-response plans. However, smaller healthcare providers are worried about being able to afford compliance with these rules. Specifically, 61% said procedures and tests were delayed, resulting in bad outcomes, and 58% said patients had to stay for longer periods. According to research, 92% of firms faced at least two data loss incidents involving sensitive to the firm healthcare data over the last two years, and 50% of these instances also led to higher mortality rates.

Opportunities:

-

The adoption of advanced technologies like AI and blockchain offers potential for improved efficiency and accuracy in outsourced services.

The integration of advanced technologies like Artificial Intelligence (AI) and blockchain presents significant opportunities in the hospital outsourcing market, enhancing efficiency and accuracy in outsourced services. The power of AI has been used to combat serious shortages in healthcare personnel. For example, the Dublin-based medical tech company Deciphex has created AI-based diagnostic systems that have accelerated pathologist productivity by up to 40%. These platforms analyze around 150,000 clinical instances in a year, hastening the process of disease detection and enhancing the accuracy of diagnosis. In administrative functions, funding of $800 million in 2024 for AI-powered medical note-taking applications was up significantly from $390 million in 2023. For instance, Microsoft’s Nuance released DAX Copilot, which logs more than 1.3 million patient interactions each month and alleviates administrative workload for medical professionals in the process. Blockchain is finding its application in healthcare as well, especially in ensuring data security and transparency in the supply chain. In fact, 70% of healthcare organizations have AI-integrated blockchain solutions that help increase the security of patient data. These implementations have led to a 25% reduction in healthcare data breaches and a 40% improvement in the accuracy of medical record reconciliation. The growing dependence on blockchain for secure data management and streamlined operations in healthcare outsourcing. Together, these technologies transform operational efficiency and support quality improvements in patient services, making AI and blockchain two of the most important pillars in the hospitalization outsourcing services evolution.

Challenges:

-

Integrating outsourced services with existing hospital operations can be complex, requiring effective communication and data sharing.

Integrating outsourced services into existing hospital operations presents significant challenges, primarily due to the complexity of merging disparate IT systems, and enabling seamless communication between in-house and third-party teams. A recent Deloitte report highlights that consolidation often leads to substantial technical debt, as organizations struggle to unify various IT infrastructures. With continued convergence in the industry, this complexity is only expected to grow. Furthermore, the increasing financial pressure on medical systems makes all of this harder. NHS trusts in England have more than doubled their collective deficit in just a year to £1.2 billion, according to the Nuffield Trust. This financial strain frequently has to entail more outsourcing to help, adding extra layers of difficulties to integration efforts. Workforce shortages also are a major challenge. More than half (57%) of health system executives said talent shortages would affect their organization's strategy in 2024, according to Deloitte. This shortage affects both the internal staff and the availability of skilled personnel from outsourcing partners, making effective integration more challenging. To address these issues, healthcare organizations must invest in robust integration strategies, prioritize clear communication channels, and ensure that both in-house and outsourced teams are aligned in their objectives and workflows.

Hospital Outsourcing Market Segmentation Insights

By Service

In 2023, clinical services held the largest revenue share of 22% in the hospital outsourcing market. Some key factors contributing to this significant market share include the growing need for healthcare delivery efficiency, a lack of healthcare providers, and the increasing demand for specialty care. Government statistics and trends in health care provided additional support for competitive outsourcing of clinical services. According to the Association of American Medical Colleges (AAMC), the United States could face a shortage of between 54,100 and 139,000 physicians by 2033. This shortage is especially pronounced in specialized areas, leading hospitals to outsource clinical services to maintain quality patient care. Chronic diseases are the leading causes of death and disability in the United States, according to the Centers for Disease Control and Prevention (CDC), which estimates that 7 of 10 deaths each year are a result of these illnesses. The growing number of chronic conditions requires specialized care best done that many hospitals are finding more efficient to outsource. That means many of these new models require expertise not customarily found in traditional providers and plans,” the U.S. Department of Health and Human Services has already noted. Outsourcing clinical services allows hospitals to access this expertise without the need for long-term commitments or extensive training programs.

By Hospital Type

In 2023, Private hospitals dominated the hospital outsourcing market with a share of 71%. This large market share is due to several factors that have always shaped decision-making processes and operational strategies in private hospitals. The profit-driven motives and operational efficiency incentives of private hospitals have made them more amenable to outsourcing strategies. In 2022, the American Hospital Association (AHA) recorded 3,007 private hospitals within the U.S., contributing to a significant part of the healthcare environment. Many of these private institutions have often led the pack in implementing new management practices, including outsourcing, to improve their efficiency and financial performance.

According to CMS, spending for private health insurance in 2021, grew by 5.8% to $1,236.2 billion 28.5% of National Health Expenditure. This growth in private health insurance spending has put pressure on private hospitals to manage costs effectively, leading to increased outsourcing of non-core functions. Larger workforces meant more complicated management structures, and outsourcing seemed a way to simplify. MedPAC data have historically shown that private hospitals earn higher all-payer profit margins than public hospitals. These investments would enable private hospitals to negotiate long-term contracts with suppliers, paving the way for potential cost savings and streamlined operations.

Hospital Outsourcing Market Regional Analysis

In 2023, North America held the highest hospital outsourcing market share of 68%. The development in the region is largely credited to a well-developed healthcare infrastructure, high healthcare spending capacity, and accessibility of novel healthcare management practices. According to the Centers for Medicare & Medicaid Services (CMS), U.S. healthcare spending reached $4.3 trillion in 2021, representing 18.3% of the country's Gross Domestic Product (GDP). The U.S. Department of Health and Human Services has estimated that there were 6,093 hospitals across the country in 2021, creating a giant customer base for third-party services to outsource. The complexity of the U.S. healthcare system, with its combination of public and private payers, has also fueled outsourcing, especially in areas like revenue cycle management.

Asia-Pacific is expected to grow at the highest CAGR during the forecast period. These factors include rising healthcare spending, a growing population, and government efforts to develop healthcare infrastructure, which contribute to this explosive growth. For instance, the National Health Policy 2017 (NHPolicy) of India is an initiative that has set the target to increase the public health expenditure to 2.5% of GDP by 2025 thereby creating opportunities in the delivery of healthcare, including outsourcing. Likewise, China's Health China 2030 plan prioritizes healthcare reform and modernization, which will drive demand for outsourced hospital services. The World Health Organization (WHO) projects that the proportion of the population aged 60 years and older in the Western Pacific Region, which includes many Asia-Pacific countries, will increase from 17.1% in 2020 to 28.2% by 2050. The growing aging population is anticipated to lead to increased healthcare demand, which will continue to fuel growth in hospital outsourcing in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Key Service Providers/Manufacturers

-

Baxter International (Intravenous therapy solutions, Artificial kidney devices)

-

Stryker Corporation (Orthopedic implants, Surgical navigation systems)

-

CitiusTech (Healthcare data analytics, Health information technology solutions)

-

Hill-Rom Holdings, Inc. (Hospital smart beds, Patient monitoring systems)

-

Greenway Health (Electronic health records (EHR) systems, Practice management solutions)

-

Medtronic (Cardiac devices, Minimally invasive surgical instruments)

-

Philips Healthcare (Medical imaging systems, Patient monitoring equipment)

-

GE Healthcare (Diagnostic imaging equipment, Healthcare IT services)

-

Siemens Healthineers (Laboratory diagnostics, Advanced therapy solutions)

-

Cerner Corporation (Health information technologies, Electronic health record systems)

-

Allscripts Healthcare Solutions (Practice management software, Revenue cycle management)

-

McKesson Corporation (Pharmaceutical distribution services, Healthcare management software)

-

Cardinal Health (Medical supply distribution, Inventory management solutions)

-

Fresenius Medical Care (Dialysis equipment, Renal care services)

-

DaVita Inc. (Kidney care services, Dialysis center management)

-

HCA Healthcare (Hospital management services, Outpatient care facilities)

-

Tenet Healthcare (Ambulatory surgery centers, Diagnostic imaging services)

-

Aramark Healthcare (Clinical support services, Facilities management)

-

Sodexo Healthcare (Patient nutrition services, Environmental services)

Recent Developments

-

In January 2025, the United States Department of Health and Human Services announced a new initiative to promote value-based care models in hospitals. This has created an opportunity for specialized outsourcing services to aid hospitals in effectively entering these new care models, driving an increase in demand for this initiative.

-

The Centers for Medicare & Medicaid Services (CMS) released new rules in November 2024 that officials said would drive enhanced healthcare data interoperability. Such regulations threaten new compliance requirements that hospitals must implement new standards resulting in increased demand for healthcare IT services.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 347.8 Billion |

| Market Size by 2032 | USD 824.5 Billion |

| CAGR | CAGR of 10.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Healthcare IT, Transportation Services, Clinical Services, Business Services, Others) • By Hospital Type (Public, Private) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Baxter International, Stryker Corporation, CitiusTech, Hill-Rom Holdings Inc., Greenway Health, Medtronic, Philips Healthcare, GE Healthcare, Siemens Healthineers, Cerner Corporation, Allscripts Healthcare Solutions, McKesson Corporation, Cardinal Health, Fresenius Medical Care, DaVita Inc., HCA Healthcare, Tenet Healthcare, Aramark Healthcare, Sodexo Healthcare |