Healthcare Revenue Cycle Management Market Size & Trends:

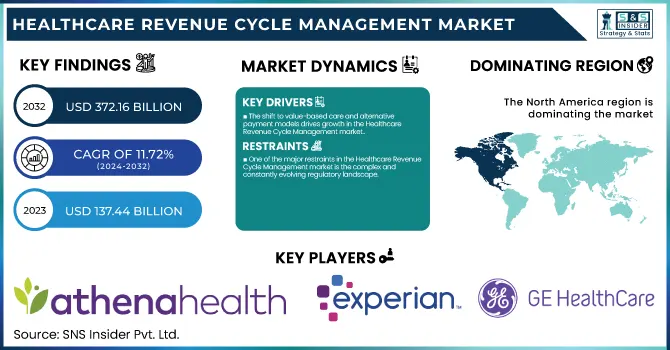

The Healthcare Revenue Cycle Management Market size was estimated at USD 137.44 billion in 2023 and is projected to reach USD 372.16 billion by 2032 at a CAGR of 11.72% during the forecast period of 2024-2032.

To Get more information on Healthcare Revenue Cycle Management Market - Request Free Sample Report

The Healthcare Revenue Cycle Management market is witnessing significant growth, fueled by the increasing need for cost-effective solutions amid rising healthcare expenses and regulatory pressures. According to the Healthcare Financial Management Association, hospitals in the U.S. spend about USD 1.2 billion annually on administrative costs related to billing and collections. This underscores the growing demand for efficient RCM solutions that streamline processes and reduce overhead costs. Healthcare organizations are turning to RCM systems to improve billing accuracy, ensure timely reimbursement, and reduce claim denials.

A key driver of the market's expansion is the shift from fee-for-service to value-based care. In 2020, 30% of Medicare payments were tied to value-based care models, a figure expected to rise in the coming years. These models require healthcare providers to adopt more complex billing and coding practices. For example, the implementation of ICD-10 coding has made coding more detailed and precise, requiring RCM systems to ensure compliance and avoid costly errors. Additionally, AI and automation are revolutionizing the industry by automating claim submissions and reducing manual errors. For instance, AI-driven RCM solutions can increase claims accuracy by 25% and reduce claim rejections by up to 10%.

Patient responsibility for healthcare costs has also risen significantly. A report by the American Hospital Association indicated that 40% of Americans with employer-sponsored insurance were enrolled in high-deductible health plans in 2022, up from 20% a decade ago. As a result, healthcare providers are implementing RCM solutions with integrated patient engagement features, such as online bill pay and payment plans, to facilitate easier transactions and improve collections. Systems that help transparent billing and real-time payment options improve patient satisfaction while ensuring that healthcare providers maintain cash flow.

Outsourcing is another trend driving RCM market growth. In a recent survey by HFMA, 44% of healthcare organizations reported outsourcing some or all of their RCM functions. Outsourcing allows providers to focus on patient care while leveraging specialized expertise in managing complex billing and coding tasks, which can lead to better financial outcomes.

Healthcare Revenue Cycle Management Market Dynamics

Drivers

-

The increasing shift toward value-based care and alternative payment models has significantly contributed to the growth of the Healthcare Revenue Cycle Management market.

Traditional fee-for-service models are being replaced with more complex structures such as bundled payments, accountable care organizations, and pay-for-performance systems. These models require more detailed financial documentation and sophisticated billing processes, as healthcare providers must track and report on patient outcomes and the effectiveness of care. RCM solutions are crucial in helping healthcare organizations navigate this complexity by streamlining the billing and reimbursement process. Automated coding and billing systems integrated with clinical data ensure accuracy, compliance, and faster claim submissions. Moreover, the ability to process claims according to these new payment models allows healthcare providers to receive timely reimbursements and optimize revenue, thus supporting the ongoing transition to value-based care.

-

The healthcare industry’s rapid adoption of Artificial Intelligence, machine learning, and robotic process automation is driving innovation and efficiency in the RCM market.

AI-powered systems can automate repetitive tasks such as coding, claims verification, and payment posting, significantly reducing the administrative burden on healthcare providers. By using predictive analytics, these technologies can also identify patterns in claims denials, track payer behavior, and detect potential fraud, enabling healthcare organizations to address issues before they affect revenue. For example, AI-driven systems can instantly flag errors in claims submissions, minimizing the chances of rejections and reducing manual labor. As healthcare organizations strive to streamline operations and improve financial outcomes, these technologies play a pivotal role in optimizing the revenue cycle, accelerating reimbursements, and ensuring accurate payments, all of which are essential for maintaining financial sustainability.

-

The growing trend of high-deductible health plans has shifted more financial responsibility to patients, driving demand for transparent and efficient billing solutions.

With more patients facing higher out-of-pocket costs, healthcare organizations are increasingly focusing on improving patient engagement through the billing process. RCM systems that provide user-friendly online payment options, customized payment plans, and clear, itemized billing statements are crucial for addressing these challenges. These features enhance the patient experience by providing greater financial transparency and reducing confusion about medical bills. Moreover, RCM solutions that integrate payment processing with patient portals can streamline collections and improve cash flow for healthcare providers. By making it easier for patients to pay and communicate about their financial obligations, RCM systems not only boost patient satisfaction but also improve revenue collection rates, ensuring healthcare organizations remain financially viable amidst changing insurance dynamics.

Restraints

-

One of the major restraints in the Healthcare Revenue Cycle Management market is the complex and constantly evolving regulatory landscape.

Healthcare providers must comply with numerous regulations, including the Health Insurance Portability and Accountability Act, the Affordable Care Act, and other country-specific billing requirements. Keeping up with these regulatory changes requires continuous updates to RCM systems, which can be costly and time-consuming. Additionally, the handling of sensitive patient data and ensuring its security poses a significant challenge. Non-compliance with data privacy laws can lead to substantial penalties and loss of patient trust, further complicating RCM operations. Healthcare organizations must invest in robust security systems and regularly update their RCM software to ensure compliance with new regulations and mitigate the risk of data breaches. The cost and complexity associated with maintaining compliance act as a key restraint for many healthcare providers looking to optimize their RCM processes.

Healthcare Revenue Cycle Management Market Segmentation Insights

By Type

Integrated solutions dominated the Healthcare Revenue Cycle Management (RCM) market in 2023, accounting for 56.2% of the market share. The preference for integrated solutions is driven by their ability to streamline end-to-end revenue cycle processes, ensuring seamless interoperability between clinical and administrative systems. These solutions offer a unified platform for billing, coding, claims management, and patient engagement, reducing manual errors and administrative burdens. The growing demand for value-based care models and the need for accurate, real-time financial data further contribute to the dominance of integrated solutions. Healthcare providers increasingly opt for integrated RCM to enhance efficiency, improve compliance, and optimize reimbursement cycles.

Standalone solutions are expected to register the fastest growth during the forecast period due to their affordability and specialized functionality. Small- and medium-sized healthcare providers, particularly clinics and independent practices, prefer standalone solutions tailored to specific RCM functions like billing or claims management. Their modular design allows organizations to implement targeted solutions without overhauling their entire IT infrastructure, making them an attractive option for cost-conscious providers.

By Deployment

Cloud-based Revenue Cycle Management (RCM) solutions dominated the market in 2023, accounting for 65% of the market share. The dominance of cloud-based systems is attributed to their scalability, cost-efficiency, and ease of deployment. These solutions provide healthcare organizations with seamless accessibility to RCM functionalities, enabling operations to continue uninterrupted across multiple locations. The flexibility of cloud systems to adapt to changing organizational needs makes them particularly attractive for small- and medium-sized practices. Furthermore, cloud-based platforms often incorporate cutting-edge technologies such as AI and machine learning, enabling providers to optimize claim submissions, minimize denials, and streamline overall revenue cycles.

On-premise RCM solutions are anticipated to grow rapidly, fueled by increasing demand from large healthcare institutions prioritizing data security and compliance. While on-premise solutions accounted for a smaller share in 2023, their growth trajectory is driven by their robust security infrastructure, which appeals to organizations handling sensitive patient data. These systems provide complete control over data storage and processes, enabling providers to comply with stringent regulatory frameworks such as HIPAA. The customization capabilities of on-premise RCM systems allow organizations to tailor functionalities to their specific operational needs.

Healthcare Revenue Cycle Management Market Regional Analysis

North America held the largest share of the Healthcare Revenue Cycle Management (RCM) market in 2023 with 33.2%, driven by its advanced healthcare infrastructure, extensive adoption of digital health technologies, and supportive government policies. The United States emerged as the key contributor, propelled by substantial healthcare spending, a strong emphasis on optimizing billing processes, and the widespread implementation of value-based care models. Additionally, the region’s stringent regulatory framework, including HIPAA compliance, underscores the need for efficient RCM systems to ensure data security and operational accuracy.

Europe secured the second-largest market share, with notable adoption of RCM solutions in countries such as Germany, the UK, and France. The region’s efforts to enhance operational efficiency in healthcare facilities, coupled with significant investments in e-health initiatives, have been pivotal in driving growth.

The Asia-Pacific region is poised for the fastest growth, fueled by the rapid digital transformation of healthcare systems in emerging economies like India and China. Government initiatives aimed at improving healthcare accessibility, coupled with the growing medical tourism industry and the rising burden of chronic diseases, are creating significant demand for advanced RCM solutions. Furthermore, the adoption of cloud-based technologies and artificial intelligence in healthcare management is accelerating market expansion in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Top Healthcare Revenue Cycle Management Companies

Key Players and Their Products

-

Athenahealth – AthenaCollector, Claims Management, Patient Pay Advisor

-

Experian Health – Revenue Cycle Management Platform, Eligibility Verification, Claims Scrubber

-

Cerner – Cerner RevWorks, PowerChart Revenue Cycle, Cerner Millennium

-

GE HealthCare – Centricity Practice Solution, Financial Management Solutions, Denials Management

-

Coronis Health – Billing and Coding Services, Revenue Cycle Optimization, Patient Access Services

-

Epic Systems – Resolute Professional Billing, Resolute Hospital Billing, MyChart RCM Integration

-

Conifer Health Solutions – Patient Access Services, Revenue Integrity Solutions, Value-Based Care Models

-

eClinicalWorks – Revenue Cycle Management Services, Billing Optimization Solutions, Denial Management Tools

-

Change Healthcare – Revenue Performance Advisor, Intelligent Healthcare Network, Claims Management Solutions

-

Optum – Optum360 Revenue Cycle Solutions, Claims Edit System, Denial Management Tools

-

Waystar – Claims Management Platform, Patient Financial Clearance, Denial Management Suite

-

McKesson Corporation – RelayHealth Financial, Revenue Management Solutions, Claims and Denials Services

-

R1 RCM – Revenue Cycle Services, Patient Scheduling and Billing Solutions, Front-End RCM Technology

-

Veradigm LLC – Practice Fusion Revenue Cycle Services, Intergy Practice Management Solutions

-

CareCloud Corporation – Central PM/RCM Platform, CareCloud Concierge, Denial Prevention Solutions

-

Access Healthcare – Revenue Cycle Outsourcing Services, Billing Optimization Tools, AR Follow-Up Services

-

AdvantEdge Healthcare Solutions – Practice Management and Billing, Analytics for Revenue Cycle Performance, Denial Resolution Services

Recent Developments

In Jan 2025, InTandem Capital Partners, a private equity firm specializing in healthcare services, announced its strategic equity investment in Healthfuse, a leader in revenue cycle vendor management. This investment supports Healthfuse's ongoing mission to enhance hospital operations and the communities they serve.

In Jan 2025, Knack RCM expanded its global presence and enhanced its expertise in the durable medical equipment (DME) sector by acquiring HealthyBOS, a leading RCM provider based in the U.S. and the Philippines. This acquisition strengthens Knack RCM’s tech-enabled revenue cycle management services.

In Jan 2025, Forte Healthcare unveiled its upgraded Revenue Cycle Management (RCM) services, specifically designed to meet the dynamic needs of hospitals and clinics in Dubai. These advanced services aim to optimize financial operations, minimize claim rejections, and ensure compliance with Dubai Health Authority (DHA) regulations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 137.44 Billion |

| Market Size by 2032 | USD 372.16 Billion |

| CAGR | CAGR of 11.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Standalone, Integrated] • By Deployment [Cloud, On-Premise] • By Component [Software, Service] • By Function [Appointment Scheduling, Claims & Denial Management, Medical Coding & Billing, Network Management, Others] • By End User [Hospitals, Clinics, Ambulatory Surgical Centres, Diagnostics & Imaging Centres, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Athenahealth, Experian Health, Cerner, GE HealthCare, Coronis Health, Epic Systems, Conifer Health Solutions, eClinicalWorks, Change Healthcare, Optum, Waystar, McKesson Corporation, R1 RCM, Veradigm LLC, CareCloud Corporation, Access Healthcare, AdvantEdge Healthcare Solutions. |