Hotel Furniture, Fixtures, and Equipment (FF&E) Market Report Scope & Overview:

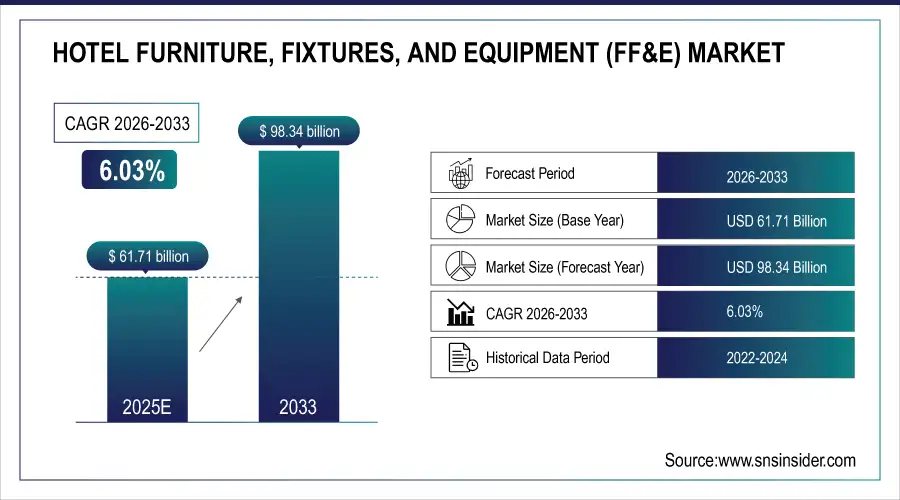

The Hotel Furniture, Fixtures, and Equipment (FF&E) Market Size is valued at USD 61.71 Billion in 2025E and is projected to reach USD 98.34 Billion by 2033, growing at a CAGR of 6.03% during the forecast period 2026–2033.

The Hotel Furniture, Fixtures, and Equipment (FF&E) Market analysis report provides a detailed assessment of procurement trends, design innovations, material advancements, and refurbishment cycles. Increasing new hotel developments, renovation projects, guest experience improvement and expansion in the hospitality industry are anticipated to considerably boost market growth over the forecast period.

Hotel FF&E installations exceeded 820 million units in 2025, supported by accelerating hotel construction and rising refurbishment cycles.

Market Size and Forecast:

-

Market Size in 2025: USD 61.71 Billion

-

Market Size by 2033: USD 98.34 Billion

-

CAGR: 6.03% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Hotel Furniture, Fixtures, and Equipment (FF&E) Market - Request Free Sample Report

Hotel Furniture, Fixtures, and Equipment (FF&E) Market Trends:

-

Rising focus on experience design is creating interest in bespoke FF&E that boosts brand and guest comfort.

-

Rapid hotel turnover and asset repositioning tactics increase the replacement discuss across all hotel chains.

-

The increasing use of smart, tech-integrated furniture and energy-efficient fixtures is reshaping contemporary hotel interiors.

-

Sustainable construction materials, such as recycled wood, eco-fabrics and low-emission composites are influencing procurement choices.

-

Luxury and boutique and lifestyle hotel growth is driving demand for premium, design-centric FF&E.

-

Greater use of e-procurement platforms and a shift toward centralized sourcing are enhancing transparency and efficiency in the supply chain.

-

Expanding deployment prospects within hospitality resort, serviced apartment and mixed-use projects are broadening the range of applications for FF&E suppliers.

U.S. Hotel Furniture, Fixtures, and Equipment (FF&E) Market Insights:

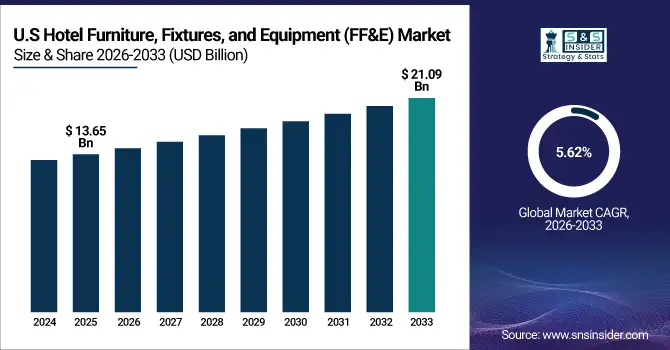

The U.S. Hotel FF&E Market is projected to grow from USD 13.65 Billion in 2025E to USD 21.09 Billion by 2033, at a CAGR of 5.62%. Growth is mainly attributed to the increasing hotel construction and renovation activities, growing demand for a green and smart FF&E, and increasing consumer spending in the hospitality industry.

Hotel Furniture, Fixtures, and Equipment (FF&E) Market Growth Drivers:

-

Accelerating hotel construction pipelines and frequent renovation cycles significantly boosting demand for modern, customizable FF&E solutions.

Accelerating hotel construction pipelines and frequent renovation cycles are major drivers of the Hotel FF&E Market growth. Rapid increase of luxury, boutique and mid-scale hotel infrastructure alongside with increased renovations demanded to fulfil the evolving guest preferences continue driving demand for modern and customizable FF&E solutions. Hotels regularly refurbish their interiors as part of refreshes to establish brand identity, reduce energy consumption and compete with new properties. These ongoing development and refresh cycles help to further solidify FF&E purchasing and market expansion.

Hotel FF&E spending increased 6.4% in 2025, driven by rapid hotel construction growth and accelerated renovation cycles across hospitality markets.

Hotel Furniture, Fixtures, and Equipment (FF&E) Market Restraints:

-

Volatile raw material prices and prolonged supply-chain disruptions are significantly restricting timely FF&E production and delivery.

Volatile raw material prices and prolonged supply-chain disruptions are major restraints for the Hotel FF&E Market. Regular changes in the pricing of lumber, metal, fabrics and composites result in added manufacturing costs and pricing volatility for manufacturers. Logistics limitations, delays at ports and capacity scarcity are another drag on delivery times that impact hotel construction or renovation schedules. Collectively, these challenges are prohibitive for large-scale FF&E purchasing, reduce supplier integrity and produce project volatility especially in emerging or budget-sensitive hospitality markets.

Hotel Furniture, Fixtures, and Equipment (FF&E) Market Opportunities:

-

Rising demand for sustainable, smart, and modular FF&E solutions presents opportunities for innovative hospitality interior offerings.

Rising demand for sustainable, smart, and modular FF&E solutions presents a significant opportunity for the Hotel FF&E Market. However, environmentally friendly products and refined technology can help hotels improve guest experiences as also cut down on operation costs. Makers are manufacturing products that can be customized, deconstructed and web-enabled so they’re easier to set up and rebuild. This move toward new, flexible and sustainable interior solutions enables hotels to satisfy ever changing guest demands, regulations and targets to reduce its environmental footprint, driving the market.

Sustainable and smart FF&E accounted for 18% of new hotel installations in 2025, driven by rising demand for eco-friendly and tech-integrated interiors.

Hotel Furniture, Fixtures, and Equipment (FF&E) Market Segmentation Analysis:

-

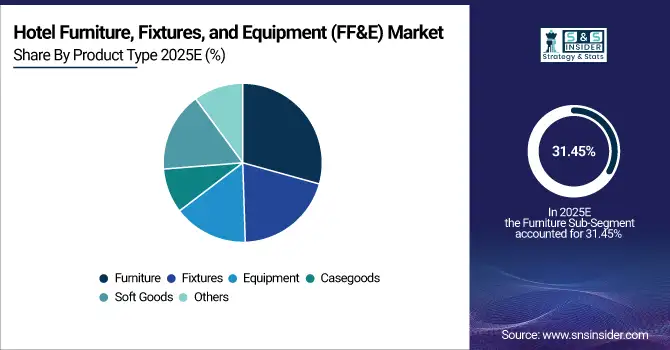

By Product Type, Furniture held the largest market share of 31.45% in 2025, while Equipment is expected to grow at the fastest CAGR of 7.12% during 2026–2033.

-

By Material, Wood accounted for the highest market share of 34.27% in 2025, while Composite Materials are projected to expand at the fastest CAGR of 6.85% during the forecast period.

-

By Application, Guest Rooms dominated with a 38.56% share in 2025, while Outdoor Areas are anticipated to record the fastest CAGR of 7.05% through 2026–2033.

-

By Hotel Category, Luxury hotels held the largest share of 36.72% in 2025, while Boutique hotels are expected to grow at the fastest CAGR of 6.92% during 2026–2033.

-

By Procurement Type, Renovation accounted for the largest share of 55.31% in 2025, while New Construction is forecasted to register the fastest CAGR of 6.47% during 2026–2033.

-

By Distribution Channel, Direct Sales held the largest share of 42.19% in 2025, while Online is expected to grow at the fastest CAGR of 7.28% during 2026–2033.

By Product Type, Furniture Dominates While Equipment Expands Rapidly:

Furniture segment dominated the market as it is an integral part of hotel interiors, including beds, seating, tables and storage solutions. The universal demand across guest rooms, lobbies and restaurants together with signature designs and ergonomic trends make it an ideal choice for hotel developers. In 2025, furniture installations surpassed 255 million units.

Equipment is the fastest-growing segment, shaped by increasing use of smart appliances and energy-efficient kitchen systems and housekeeping tools that integrate technology. Hotels are investing more and more in high tech equipment that improves their operations and the experience of their customers. In 2025, equipment installations reached 87 million units.

By Material, Wood Dominates While Composite Materials Expand Rapidly:

Wood segment dominated the market due to their appearance, strength and can be used in various furniture, fixtures casegoods. Hotels lust after it for high-end finishes and luxury interiors. In 2025, wood-based FF&E units surpassed 198 million.

Composite Materials are the fastest-growing segment, driven by developments in lightweight, green and modular construction. These materials are increasingly popular in furniture and fixtures due to lower costs and environmental benefits. In 2025, composite material installations reached 62 million units.

By Application, Guest Rooms Dominate While Outdoor Areas Expand Rapidly:

Guest Rooms dominated the market by guest contributing also helped with a complete FF&E package needed for comfort, luxury and good operation. Strong occupancy levels and ongoing upgrade cycles underpin repeat demand. In 2025, FF&E installations in guest rooms surpassed 310 million units.

Outdoor Areas are the fastest-growing segment, fueled by increasing spend in hotel gardens, pools and terraces and recreational spaces. Growth is being driven by the trend toward more durable, weather resistant and attractive furniture and fixtures. In 2025, outdoor FF&E installations reached 85 million units.

By Hotel Category, Luxury Dominates While Boutique Expands Rapidly:

Luxury segment dominated the market due to high spending on premium, designer FF&E reflecting guest experience, brand image and comfort. Luxurious furniture, lighting and equipment renovations have made these portfolios the heaviest FF&E users. In 2025, luxury hotel FF&E units surpassed 145 million.

Boutique are the fastest-growing segment, in part fueled by unique, design-driven interiors, personalized guest stays and a smaller property footprint that lends itself to modular and creative FF&E. In 2025, boutique hotel FF&E installations reached 48 million units.

By Procurement Type, Renovation Dominates While New Construction Expands Rapidly:

Renovation segment dominated the market, owing to frequent changes in interiors by hotels to remain competitive, make sure that they are up to standard and replace old-out-of-date sets and establish a modern facility. Maintenance high turnovers result in on-going FF&E purchase. In 2025, renovation-related installations exceeded 320 million units.

New construction is the fastest-growing segment, driven by the increasing scope of hotel constructions in emerging markets and luxury resorts. New builds benefit from rising tourism-related infrastructure and urbanization driving FF&E needs. In 2025, new construction FF&E installations reached 90 million units.

By Distribution Channel, Direct Sales Dominates While Online Expands Rapidly:

Direct Sales dominated the market as hotels prefer procuring FF&E directly from manufacturers in order to customize designs, negotiate pricing and assure quality. In 2025, direct sales accounted for 200 million units.

Online are the fastest-growing segment, with digital procurement platforms and acceptance of e-commerce and remote sourcing. Hotels look more and more into the online world for ease, variety and price. In 2025, online FF&E units reached 72 million units.

Hotel Furniture, Fixtures, and Equipment (FF&E) Market Regional Analysis:

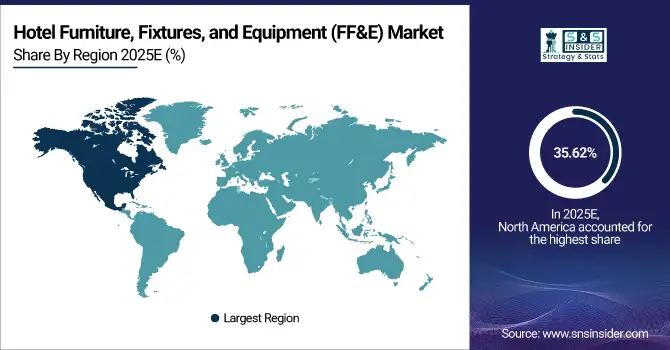

North America Hotel Furniture, Fixtures, and Equipment (FF&E) Market Insights:

North America dominated the Hotel FF&E Market, accounting for a 35.62% market share in 2025. Increasing number consumers spending overnights on vacation, supported by robust hospitality infrastructure and high hotel renovation rates further bolster demand. The earlier the adoption of smart, sustainable and design-led FF&E solutions is also a testament to how the market becomes more robust. Historic emphasis on the overall guest journey, determining points of difference and operational efficiency has meant that North America has long been one of the most mature sectors in terms of concept rollout and FF&E sourcing.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Hotel Furniture, Fixtures, and Equipment (FF&E) Market Insights:

The U.S. Hotel FF&E Market is propelled by large hotel renovation projects, robust hospitality infrastructure and growing investments in luxury and boutique hotels. Growing use of smart, modular and eco-friendly furniture as well fixtures with emphasis of guest experience and brand differentiation further endorse the country's lead in FF&E procurement and innovation.

Asia-Pacific Hotel Furniture, Fixtures, and Equipment (FF&E) Market Insights:

The Asia-Pacific Hotel FF&E Market is the fastest-growing globally, projected to register a CAGR of 7.08% during 2026–2033. Growth is being fueled by aggressive hotel development, growing tourism infrastructure and increasing demand for luxury, boutique and mid-scale establishments across China, India, Japan and Southeast Asia. The adoption of smart, modular and sustainable FF&E solutions along with the lifecycle refurbishment coupled with increased hospitality investments is making Asia Pacific tied up as the fastest growing market.

China Hotel Furniture, Fixtures, and Equipment (FF&E) Market Insights:

China’s Hotel FF&E Market is driven by burgeoning hotel industry, growing tourism sector and rising hospitality investments. Service of government encouraging sustainable and smart interiors, increasing renovation work, and the growing use of modern, modular and design-rich FF&E solutions are some vital factors that drive China as a dominant growth contributor in Asia-Pacific FF&E.

Europe Hotel Furniture, Fixtures, and Equipment (FF&E) Market Insights:

The Europe Hotel FF&E Market is bolstered by robust hospitality infrastructure, a rise in hotel remodeling and emphasis on guest experience and operational efficiency. Local request is led by increased use of sustainable, intelligent and design-oriented FF&E products. Germany, the UK, France and Italy continue to be key stakeholders with extensive hotel networks, high refurbishment levels, exacting quality standards and investment in modernizing interiors for a variety of property sectors.

Germany Hotel Furniture, Fixtures, and Equipment (FF&E) Market Insights:

Germany is one of the largest Hotel FF&E markets in Europe with high rate of hotel refurbishment and significant investments in guest experience. Introducing sustainable, smart and design-led FF&E solutions with stringent quality standards further confirms Germany’s role as a leader in modernizing hospitality interior projects throughout the region.

Latin America Hotel Furniture, Fixtures, and Equipment (FF&E) Market Insights:

The Latin America Hotel FF&E Market is propelled by the rising demand for new hotel builds, surge in tourism and hospitality investments across Brazil, Argentina and Mexico. Growing demand for contemporary, eco-friendly and design-oriented interior spaces, along with renovation activities and installation of smart, modular FF&E solutions, proliferates the regional market landscape.

Middle East and Africa Hotel Furniture, Fixtures, and Equipment (FF&E) Market Insights:

The Middle East & Africa Hotel FF&E Market is rising along with the rising number of hotel infrastructure projects, growing tourism volumes and increasing hospitality investment in Saudi Arabia, UAE and South Africa. Regional market demand is led by procurement of sustainable, modular and tech-enabled FF&E, refurbishment programmes and government-sponsored infrastructure projects.

Hotel Furniture, Fixtures, and Equipment (FF&E) Market Competitive Landscape:

Kimball International, headquartered in the U.S., is a leading manufacturer of furniture for hospitality and commercial markets. The company has a commanding presence in the Hotel FF&E market through its many years of experience, superior craftmanship and delivery of both custom and high-volume solutions. Through its commitment to innovative design, quality and project support, Kimball has been able to furnish thousands of rooms in hotels for some of the leading hospitality chains.

-

In March 2025, Kimball International launched the “Fringe 2.0” and “Connolly 2.0” hospitality furniture lines, featuring modular seating, enhanced durability and easy-to-clean surfaces. Their updated web platform improved customization tools for hotel clients.

Consolidated Hospitality Supplies (CHS) is a major distributor and supplier of furniture, fixtures and equipment to the hospitality industry. The company is able to maintain its dominance through the use of comprehensive products, complete supply chain capabilities, and national distribution network. Providing diversified selections to luxury, midscale and economy hotels, CHS ensures on-time delivery, quality control with supply chain efficiency with its procurement transparency for the hotel owners’ and its developers’.

-

In August 2025, CHS implemented a new SAP Cloud ERP system to streamline inventory, procurement and logistics. AI-enabled supply-chain tools enhance efficiency, reduce costs and support timely FF&E distribution across hotels.

Benjamin West, a U.S.-based furniture manufacturer, specializes in high-quality wood furniture and casegoods for the hospitality sector. The company has been able to captivate the market through its craftsmanship, resilience and producing classic evergreen designs that suit hotel interiors. Known for its dependable supply chains, quality finishes and custom solutions, Benjamin West is a preferred vendor to those within the hospitality sector looking for appealing furniture that is both operationally sound and in tune with their design direction.

-

In June 2025, Benjamin West secured a major FF&E contract for renovating 69 hotels, supplying comprehensive furniture, fixtures, and equipment, showcasing its strength in custom solutions and premium hospitality interiors.

Hotel Furniture, Fixtures, and Equipment (FF&E) Market Key Players:

Some of the Hotel Furniture, Fixtures, and Equipment (FF&E) Market Companies are:

-

Kimball International

-

Consolidated Hospitality Supplies (CHS)

-

Benjamin West

-

Milliken & Company

-

Hotel Spec International, Inc.

-

Carroll Adams

-

Innvision Hospitality, Inc.

-

Beyer Brown

-

Avendra, LLC

-

Andreu World

-

MINGSUN

-

Bernhardt Hospitality

-

Hooker Hospitality

-

Century Furniture

-

Flexsteel Industries, Inc.

-

JTB Furniture

-

The Parker Company

-

Hospitality Furnishings & Design Inc.

-

Global Furniture Group

-

Curve Hospitality

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 61.71 Billion |

| Market Size by 2033 | USD 98.34 Billion |

| CAGR | CAGR of 6.03% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Furniture, Fixtures, Equipment, Casegoods, Soft Goods, Others) • By Material (Wood, Metal, Glass, Plastic, Upholstery, Composite Materials) • By Application (Guest Rooms, Lobbies & Reception, Restaurants & Bars, Outdoor Areas, Back-of-House, Others) • By Hotel Category (Luxury, Premium, Mid-Scale, Budget, Boutique, Resorts) • By Procurement Type (New Construction, Renovation) • By Distribution Channel (Direct Sales, Distributors, OEMs, Online) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Kimball International, Consolidated Hospitality Supplies (CHS), Benjamin West, Milliken & Company, Hotel Spec International, Inc., Carroll Adams, Innvision Hospitality, Inc., Beyer Brown, Avendra, LLC, Andreu World, MINGSUN, Bernhardt Hospitality, Hooker Hospitality, Century Furniture, Flexsteel Industries, Inc., JTB Furniture, The Parker Company, Hospitality Furnishings & Design Inc., Global Furniture Group, Curve Hospitality |