Hyaluronic Acid-Based Dermal Fillers Market Size:

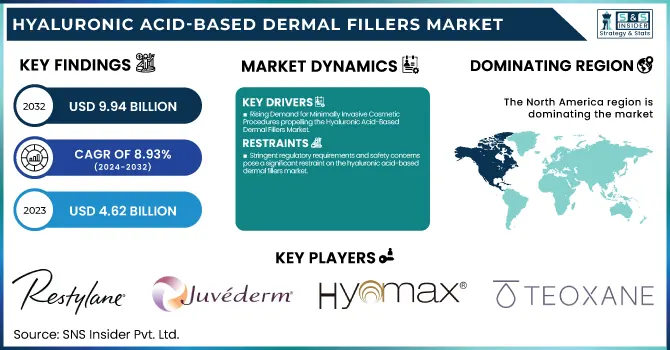

The Hyaluronic Acid-Based Dermal Fillers Market was valued at USD 4.62 billion in 2023 and is expected to reach USD 9.94 billion by 2032, growing at a CAGR of 8.93% from 2024 to 2032.

To Get more information on Hyaluronic Acid-Based Dermal Fillers Market - Request Free Sample Report

The global hyaluronic acid-based dermal fillers Market Report provides unique insights into procedure volume trends, regional treatment preferences, and product adoption rates between 2020 and 2032. We give a detailed breakdown of HA filler procedures by region, with age-group and gender-based preferences for aesthetic treatments. The report further explores adoption patterns of single-phase versus biphasic fillers, as well as an extensive evaluation of aesthetic expenditure habits for government, commercial, private, and out-of-pocket spending in core markets. With region-by-region information on price, consumer trends, and market dynamics, this report is a data-backed guide to strategic decision-making.

Hyaluronic Acid-Based Dermal Fillers Market Dynamics

Drivers

-

Rising Demand for Minimally Invasive Cosmetic Procedures propelling the Hyaluronic Acid-Based Dermal Fillers Market.

Growing demand for minimally invasive cosmetic procedures is a major growth driver for the hyaluronic acid-based dermal fillers market. Patients are increasingly choosing procedures that provide aesthetic benefits with minimal recovery time and fewer risks associated with them in comparison to conventional surgical procedures. Hyaluronic acid (HA) fillers, being safe and effective, have become a widely sought-after option for treating wrinkles, fine lines, and loss of volume. Based on data from the American Society of Plastic Surgeons, treatments with HA fillers rose by 8% between 2022 and 2023, reflecting an increasing trend towards non-invasive facial rejuvenation. This trend is also complemented by advances in HA filler technology, providing longer-lasting and natural appearance outcomes, which in turn enhance patient confidence and market expansion. Also, regulatory clearances and product launches, including Galderma's Restylane SHAYPE in 2024, support market growth and innovation.

-

Influence of social media and Celebrity Endorsements accelerating the market growth.

Celebrity endorsements and social media platforms heavily influence purchasing decisions in the aesthetic market. Celebrity endorsements of cosmetic procedures have de-mystified treatments such as HA dermal fillers to the point where these treatments are now increasingly acceptable and desired among the masses. For example, even though some celebrities choose to dissolve their fillers, the overall trend indicates a rise in HA filler procedures, which is a result of a complex influence where celebrities create both the uptake and change of beauty standards. This trend combined with social media's culture of aspirationalism inspires users to pursue similar modifications, thus fuelling demand for HA-based dermal fillers. In addition, digital marketing campaigns by major players, such as influencer collaborations and virtual consultations, have played a crucial role in elevating consumer consciousness and procedure adoption among multiple age groups.

Restraint

-

Stringent regulatory requirements and safety concerns pose a significant restraint on the hyaluronic acid-based dermal fillers market.

Stringent regulatory guidelines and safety issues are a major constraint on the market for hyaluronic acid-based dermal fillers. As these fillers are regulated as medical devices or drugs in different parts of the world, companies have to adhere to stringent approval procedures established by regulatory agencies such as the U.S. FDA, European Medicines Agency (EMA), and other health Committees. These rules tend to increase product launch delays and R&D expenses for corporations, capping market expansion. Secondly, even though HA fillers are generally safe, complications like swelling, lumps, vascular occlusion, and allergic reactions have become concerning for both practitioners and consumers. The increasing popularity of unregulated practices by non-qualified professionals only adds to the risk, leading authorities to impose tighter regulations. This regulatory complexity can serve to dampen market growth, rendering compliance a major challenge for industry stakeholders.

Opportunities

-

The growing demand for aesthetic treatments in emerging markets presents a lucrative opportunity for the hyaluronic acid-based dermal fillers market.

The increasing demand for cosmetic treatments in emerging markets offers a promising business opportunity for the industry of hyaluronic acid-based dermal fillers. Asian-Pacific, Latin American, and Middle Eastern countries are experiencing a rise in disposable incomes, rising beauty awareness, and higher levels of acceptance of cosmetic procedures. Furthermore, the development of medical tourism in countries such as South Korea, Thailand, and Brazil has increased the availability of high-quality but affordable aesthetic treatments. Major market players are investing in such regions through inorganic collaborations, product approvals, and localized campaigns to address divergent consumer demand. In addition, the surge in minimally invasive treatments for men and young populations offers an added growth area, as individuals increasingly opt for non-surgical treatments for facial rejuvenation, contouring, and anti-aging treatments.

Challenges

-

High Cost of Treatments challenging the market growth.

The expense of hyaluronic acid-based dermal fillers is still a major issue, deterring market penetration, particularly in price-sensitive markets. HA filler therapy usually necessitates multiple visits for maximum benefit, with maintenance injections every 6 to 12 months, resulting in considerable recurring expenditure. The cost per syringe is between USD 500 and USD 1,500, depending on brand and locale. While high-end products provide more sophisticated formulations and longer-lasting results, the cost may discourage middle-income individuals from seeking treatments. Moreover, the majority of health insurance companies do not cover cosmetic procedures, which further makes affordability a significant issue. Though the market is experiencing greater competition and technological innovations that could reduce prices in the future, the cost factor is still a significant limitation for mass adoption, especially in developing countries.

Hyaluronic Acid-Based Dermal Fillers Market Segmentation Insights

By Product

The Single-Phase Products segment dominated the Hyaluronic Acid (HA) Based Dermal Fillers Market with around 58.14% market share in 2023, based on its superior consistency, injection ease, and longevity relative to biphasic fillers. Single-phase HA fillers possess a smooth, uniform gel texture that suits integration within the skin easily, leading to more natural results. This characteristic makes them especially in demand for lip augmentation, facial reshaping, and wrinkle removal, which are some of the most popular cosmetic treatments worldwide. In addition, single-phase fillers are more hydrating and elastic because they have a homogeneous composition, which minimizes the risk of lumping or asymmetrical distribution after injection. Market leaders such as Juvéderm (Allergan) and Belotero (Merz Aesthetics) mainly market single-phase fillers, which adds to this category's market share.

Moreover, increases in cross-linking technologies have made single-phase fillers more durable than before, with results lasting 12 to 18 months, longer than most biphasic fillers. In addition, the increasing use of non-surgical cosmetic procedures, especially in North America and Europe, has further driven the uptake of single-phase fillers. As patients become more inclined to pursue minimally invasive procedures with guaranteed results, single-phase HA fillers continue to be the first choice among dermatologists and aesthetic professionals, cementing their top spot in 2023.

By Application

The Wrinkle Removal segment dominated the Hyaluronic Acid (HA) Based Dermal Fillers Market with a 32.14% market share in 2023 because of the elevated demand for anti-aging procedures and the swelling aging population worldwide. HA fillers are highly recommended for minimizing fine lines, deep wrinkles, and facial folds, especially in regions like the nasolabial folds, marionette lines, and forehead wrinkles. As consumers looked for non-surgical facelift alternatives, HA fillers have emerged as a favored option because of their short procedure time, low downtime, and natural results. Based on the American Society of Plastic Surgeons (ASPS), HA-based treatments of wrinkles continue to be among the most frequently performed aesthetic procedures. Moreover, increasing social acceptance of cosmetic treatments and the proliferation of medical spas and aesthetic clinics across the globe have also contributed to the dominance of this segment.

The Lip Augmentation segment is anticipated to grow at the fastest rate in forecast years as a result of increasing beauty trends, social media pressure, and rising demand among youth populations. Fuller lips have emerged as a leading aesthetic desire, fueled by celebrity culture, influencers, and online beauty culture. Hyaluronic acid fillers, including Juvéderm VOLBELLA and Restylane Kysse, are used extensively to augment lip volume, sculpt contours, and treat asymmetry. HA fillers' non-permanent status is also beneficial, as consumers can try out new appearances without opting for permanent changes. Further, the creation of sophisticated, long-duration HA formulations with enhanced flexibility and natural motion has increased the credibility among consumers for lip augmentation treatments. The growing availability of low-cost treatments in medical tourism destinations such as South Korea, Thailand, and Brazil is also driving growth in this segment.

By End Use

The Specialty & Dermatology Clinics segment dominated the Hyaluronic Acid (HA) Based Dermal Fillers Market with around 62.14% market share in 2023 as a result of increasing demand for specialized, bespoke aesthetic treatments. Non-surgical facial rejuvenation and contouring treatments are often left to skilled dermatologists and aesthetic practitioners because these individuals receive extensive training in facial anatomy, injection methods, and filler product selection. These clinics offer customized treatment plans, providing safer procedures, improved aesthetic results, and fewer risks of complications, thus making them the first choice compared to general hospitals or medspas. In addition, dermatology clinics are well-equipped with advanced technologies and have a greater range of HA filler brands and formulations to suit various patient requirements. In addition, the growth in the number of dermatology and aesthetic clinics globally, especially in North America, Europe, and Asia-Pacific, has enhanced the segment's market position. Most prominent HA filler brands, including Juvéderm (Allergan), Restylane (Galderma), and Belotero (Merz Aesthetics), collaborate with dermatology clinics to offer specialized training, premium products, and loyalty schemes, enhancing their stronghold even further. Increasing interest in minimally invasive treatments from the middle-aged and younger patients, coupled with improving affordability and availability of aesthetic procedures, have continued to boost patient visits to dermatology offices, sustaining the dominance of this segment in 2023.

Regional Analysis

North America dominated the hyaluronic acid based dermal fillers market with a 40% market share in 2023, as a result of its strong demand for cosmetic procedures, well-established presence of dominant market players, and sophisticated healthcare infrastructure. The region, the United States specifically, has an established cosmetic dermatology market with a high prevalence of certified physicians and medical spas that provide HA filler procedures. As per the American Society of Plastic Surgeons (ASPS), dermal filler treatments have continued to increase, fueled by growing awareness, social media promotion, and increased demand for less invasive aesthetic treatments. Moreover, regular product launches, regulatory clearances, and technological innovations by prominent players such as Allergan Aesthetics (AbbVie), Revance, and Galderma support market growth. The area's disposable income and spending on premium cosmetic enhancement only add to its leading market share.

Asia-Pacific is becoming the fastest-growing market for HA-based dermal fillers with a 10.05% CAGR throughout the forecast period, driven by growing beauty awareness, higher disposable income, and the growth of medical tourism. Markets such as South Korea, China, and Japan are leaders in aesthetic innovation, with South Korea commonly being termed the "plastic surgery capital of the world." The region has seen an upsurge in non-surgical facial contouring procedures among young consumers for subtle results. Further, increasing social media power, celebrity endorsement, and the growing male population seeking cosmetic procedures are driving demand. The presence of domestic manufacturers providing affordable HA fillers has also increased accessibility for treatments. Additionally, government policies encouraging medical tourism—particularly in India and Thailand—have drawn foreign patients, contributing to further market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Hyaluronic Acid-Based Dermal Fillers Market

-

Restylane (Restylane-L, Restylane Silk)

-

JUVÉDERM (JUVÉDERM Ultra XC, JUVÉDERM Voluma XC)

-

Hyamax (Hyamax Skin Booster, Hyamax Pure)

-

Singderm (Singderm Dermal Filler, Singderm Plus)

-

Teoxane (Teosyal RHA 2, Teosyal Ultra Deep)

-

Volomis (Volomis Deep, Volomis Volume)

-

Bloomage (BioHyalux Fine, BioHyalux Derm)

-

Techderm (Sofiderm Fine Line, Sofiderm Derm)

-

Beufiller (Beufiller Derm, Beufiller Deep)

-

NovaCutis (NovaCutis HA Filler Fine, NovaCutis HA Filler Deep)

-

Hafiller (Hafiller Fine Line, Hafiller Subskin)

-

DermoAroma (DermoAroma HA Filler Soft, DermoAroma HA Filler Volume)

-

Allergan (JUVÉDERM Ultra Plus XC, JUVÉDERM Volbella XC)

-

Galderma (Restylane Lyft, Restylane Defyne)

-

Merz Pharmaceuticals (Belotero Balance, Belotero Volume)

-

Prollenium Medical Technologies (Revanesse Ultra, Revanesse Kiss)

-

LG Chem (YVOIRE Classic, YVOIRE Volume)

-

Hugel Pharma (The Chaeum Pure, The Chaeum Premium)

-

Medytox (Neuramis Deep, Neuramis Volume)

-

BioPlus Co., Ltd. (Hyafilia Grand, Hyafilia Petit)

Suppliers in Hyaluronic Acid Based Dermal Fillers Market

-

Allergan (AbbVie Inc.)

-

Galderma S.A.

-

LG Chem Ltd.

-

Merz Pharmaceuticals

-

Relevance Aesthetics

-

Sinclair Pharma

-

Teoxane Laboratories

-

Prollenium Medical Technologies

-

Bloomage Biotechnology

-

Hugel Pharma

Recent Developments

-

January 2024 – Galderma has released regulatory approval for Restylane SHAYPE, a next-generation hyaluronic acid (HA) injectable specifically created for augmentation of the chin. Formulated in close collaboration with top experts, Restylane SHAYPE features increased strength and structural support, duplicating the bone to create a more defined and natural-looking lower face profile. The groundbreaking gel formulation lasts long, with its effect lasting up to 12 months without retreatment.

-

October 2, 2024 – Allergan Aesthetics, an AbbVie company, announced today the national launch of JUVÉDERM VOLUMA XC for the correction of temple hollowing. Recently approved by the U.S. FDA in March 2024, JUVÉDERM VOLUMA XC is the first and sole hyaluronic acid (HA) filler approved for moderate to severe temple hollowing in adults aged 21 and older.

Hyaluronic Acid-Based Dermal Fillers Market Report Scope

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.62 billion |

| Market Size by 2032 | US$ 9.94 billion |

| CAGR | CAGR of 8.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Single Phase Products, Duplex Products) • By Application (Wrinkle Removal, Lip Augmentation, Rhinoplasty, Others) • By End Use (Specialty & Dermatology Clinics, Hospitals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Restylane, JUVÉDERM, Hyamax, Singderm, Teoxane, Volomis, Bloomage, Techderm, Beufiller, NovaCutis, Hafiller, DermoAroma, Allergan, Galderma, Merz Pharmaceuticals, Prollenium Medical Technologies, LG Chem, Hugel Pharma, Medytox, BioPlus Co., Ltd., and other players. |