Global Dermal Fillers Market Size & Trends

To Get More Information on Dermal Fillers Market - Request Sample Report

The Dermal Fillers Market size was valued at USD 5.05 billion in 2023 and is expected to reach USD 10.26 billion by 2032 and grow at a CAGR of 8.2% over the forecast period of 2024-2032.

The dermal fillers market is experiencing rapid growth, driven by a surge in consumer demand for non-invasive cosmetic procedures. As people become more conscious of their appearance and seek ways to enhance their features, dermal fillers have emerged as a popular choice. Technological advancements, with increasing consumer acceptance and changing societal norms, have contributed significantly to market expansion.

The Aesthetics Society reports that 649,176 non-surgical dermal filler procedures were performed in the United States in 2022, accounting for 14% of the total non-surgical revenue in the country for that year.

The increasing prevalence of age-related concerns, such as wrinkles, fine lines, and volume loss, particularly among aging populations worldwide, has fueled demand for these treatments. According to the International Society of Aesthetic Plastic Surgery (ISAPS), dermal fillers were the second most popular non-surgical procedure in 2021, accounting for 30% of all non-surgical operations. This surge in demand can be attributed to factors such as increased awareness of aesthetic treatments, rising disposable income, and a growing desire for self-improvement.

On the supply side, manufacturers constantly innovate to develop new and improved dermal filler formulations. The introduction of hyaluronic acid-based fillers with varying degrees of cross-linking has revolutionized the market, providing practitioners with greater flexibility and control over treatment outcomes. Additionally, developing biodegradable and bioresorbable fillers addresses sustainability concerns and appeals to environmentally conscious consumers.

The growing acceptance of minimally invasive procedures is another factor driving demand. Dermal fillers offer a convenient and less invasive alternative to traditional surgical interventions, making them appealing to a broad demographic range. The desire for subtle, natural-looking results and the convenience of minimal downtime have contributed to the increased adoption of dermal fillers.

Technological innovations have also played a crucial role in market growth. The introduction of hyaluronic acid-based fillers has revolutionized the market, offering a temporary and reversible solution for facial rejuvenation. These fillers are biocompatible and naturally degrade over time, reducing the risk of long-term complications. Additionally, advancements in delivery methods have made procedures safer and more effective.

Governments globally have implemented various initiatives to ensure the safety and efficacy of dermal filler products. These measures include licensing and certification requirements for healthcare professionals, stringent product approval processes, quality control standards, and consumer education programs. The stringent government regulations in the U.S., European Union, and international markets for the development, branding, and production of HA-based products are imposing limitations on market growth. However, these strict regulations ensure that healthcare facilities and end-users have access to high-quality products. For example, according to a 2018 FDA report, Juvederm can only be purchased and administered by licensed healthcare providers. Additionally, the FDA has advised against the use of Juvederm Ultra 2, 3, and 4 due to their lack of approval, restricting the availability of certain products. Another example, in January 2022, RHA Redensity, a new dermal filler designed to reduce wrinkles, received FDA approval in the United States. RHA Redensity is a gel implant made from hyaluronic acid injected into specific facial tissue areas to smooth out lines and wrinkles.

The East Asian market for dermal fillers has seen a surge in popularity, with South Korea, Malaysia, and Thailand emerging as leading destinations. These countries offer several advanced medical technologies, competitive pricing, and a focus on aesthetic enhancement, attracting both domestic and international patients. South Korea, renowned for its medical tourism, provides a vast array of filler options and techniques. Malaysia, with its growing medical tourism sector, offers high-quality treatments at affordable prices. Thailand, a well-established medical tourism hub, boasts experienced practitioners and competitive costs.

However, market growth can be constrained by factors such as the high cost of dermal fillers and stringent government regulations. While the rise of minimally invasive techniques and advanced delivery methods can enhance treatment precision and safety, they may also increase costs. Nonetheless, the overall outlook for the dermal fillers market remains positive, with continued growth expected in the coming years.

Dermal Fillers Market Dynamics

Drivers

-

Rising Demand for Minimally Invasive Procedures

Consumers are increasingly seeking less invasive and less painful cosmetic procedures to achieve a youthful appearance. The risks associated with traditional surgeries and the desire for quicker recovery times have contributed to this shift.

-

Increasing Consumer Awareness

Growing awareness of aesthetic treatments and their benefits has led to a wider range of individuals considering dermal fillers as a viable option. This increased awareness is fueled by various factors, including social media, celebrity endorsements, and educational campaigns.

Restraints

-

High Costs

The cost of dermal filler procedures can be substantial, varying based on the practitioner's expertise, the time involved, and the complexity of the treatment. This can deter some individuals from pursuing these treatments.

-

Transient Effects

The temporary nature of dermal filler results may require repeated treatments, leading to increased costs over time.

-

Side Effects

While generally safe, dermal filler procedures can be associated with adverse effects such as pain, bruising, swelling, and in rare cases, more serious complications like vision loss or severe scarring. These risks may deter some individuals from considering these treatments.

Key Segmentation

Dermal Fillers Market By Material

The hyaluronic acid segment dominated the market in 2023 with 25.90%. This is primarily due to the introduction of new hyaluronic acid-based products and their associated benefits, such as safety and long-lasting effects. For instance, the launch of SEDY FILL by Maypharm in August 2023 and BELOTERO BALANCE (+) by Merz Aesthetics in February 2021 has contributed to the growth of this segment. The calcium hydroxyapatite segment is another significant player in the market, driven by the safety features of these products and the introduction of new offerings like HArmonyCa by Allergan Aesthetics.

The fat fillers segment is expected to experience the fastest growth, particularly in regions like North America, due to an increase in procedures involving fat fillers. While the PMMA segment has a limited market share due to the lack of biodegradability of its products, the relaunch of products containing polylactic acid is expected to drive growth in this segment.

Dermal Fillers Market By Product

The biodegradable segment dominated the market with a 56.7 % share in 2023 due to the wide availability and versatility of biodegradable products, which offer enhanced aesthetics and safety compared to non-biodegradable alternatives. Additionally, increased research and development efforts by both established and emerging players, with stringent regulations, are driving growth in this segment. For example, Hallura Ltd. announced positive results for their BiOLinkMatrix platform, a next-generation hyaluronic acid dermal filler, in March 2023. This product's safety and effectiveness in various applications, such as cheek enhancement, lip enhancement, and correction of nasolabial folds, have contributed to the growth of the biodegradable segment.

While the non-biodegradable segment held the lowest market share in 2023, it is expected to experience slower growth due to its non-temporary nature. The non-decomposable nature of these products may limit their appeal to some consumers.

Dermal Fillers Market By Application

The wrinkle correction treatment segment dominated the market with a 23.48% share in 2023, driven by a surge in demand for procedures to address facial lines and wrinkles. The introduction of new products, such as Teoxane's RHA Redensity, has further fueled growth in this segment.

While the lip enhancement segment also holds a significant market share, the wrinkle correction segment is expected to maintain its dominance. The growing demand for minimally invasive aesthetic improvements for the lips, coupled with the introduction of new products like Estyme facial fillers by Evolus, Inc., is likely to drive growth in the lip enhancement segment.

The restoration of volume/fullness segment is the third-largest segment, primarily due to the launch of new products by key players like Allergan's JUVEDERM VOLUX. However, the scar treatment segment is projected to have a relatively lower market share during the forecast period.

Dermal Fillers Market By End-user

The specialty & dermatology clinics segment dominated the market in 2023 with a 42.1% share. This is primarily due to the high volume of procedures performed in these specialized clinics and the increasing collaborations between clinics and stores, which enhances product availability. For example, the partnership between CAVENDISH CLINIC and John Lewis Plc in June 2023 to offer aesthetic treatments in stores across the U.K. has contributed to market growth.

While hospitals & clinics hold the second-largest market share, specialty & dermatology clinics are likely to maintain their dominance. The focus on specialized treatments and the convenience of offering procedures in retail settings provide a competitive advantage for these clinics.

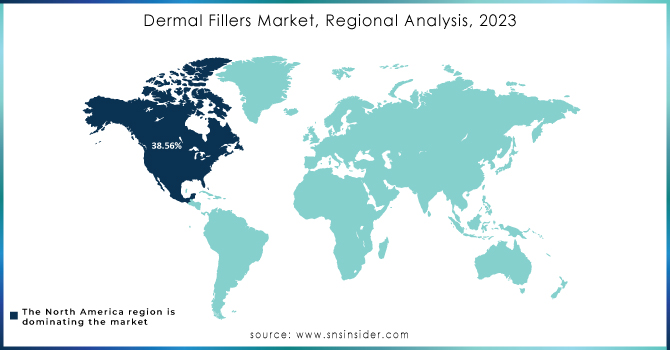

Dermal Fillers Market Regional Outlook

North America dominated the dermal filler market with a 38.56% share in 2023, driven by high awareness, increased disposable income, and several cosmetic procedures. The region's market share is expected to remain dominant in the coming years due to factors such as new product launches and robust regulatory approvals.

Europe holds the second-highest market share, primarily due to the increasing preference for dermal filler procedures among individuals in key European countries and greater investment in research and development.

The Asia Pacific region is anticipated to experience the fastest growth, driven by advancements in healthcare infrastructure, a growing aging population, and rising awareness of physical appearance. Companies focusing on research and development in this region contribute to its strong growth, as evidenced by Croma-Pharma's clinical trial for Princess Volume Plus Lidocaine in June 2023.

Latin America and the Middle East & Africa have relatively low market shares, but growth in these regions is expected to be driven by increasing healthcare expenditure and the entry of new players with innovative products. Turkey, for example, has witnessed a significant number of hyaluronic acid procedures in recent years.

Do You Need any Customization Research on Dermal Fillers Market - Enquire Now

Key Players

The Major Players are AbbVie Inc., Merz Pharma, Suneva Medical, Inc., Medytox Inc., Sinclair Pharma, Prollenium Medical Technologies, Galderma, Allergan, Inc., Revance Therapeutics Inc., Bioplus Co. Ltd., Bioaxis Pharmaceuticals, Teoxane Laboratories, Huadong Medicine Co., Ltd., Marllor Biomedical SR and others.

Recent Developments:

July 2024:

-

Galderma launched Restylane Lyft, a new dermal filler for treating moderate to severe facial wrinkles.

-

Allergan introduced Juvéderm Voluma XC, a new dermal filler for treating severe facial volume loss.

August 2024:

-

Teoxane launched RHA Redensity IV, a new dermal filler for treating mild to moderate facial wrinkles.

-

Merz Aesthetics introduced Belotero Balance + Lidocaine, a new hyaluronic acid-based dermal filler with lidocaine for reducing pain during injections.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.05 Bn |

| Market Size by 2032 | US$ 10.26 Bn |

| CAGR | CAGR of 8.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Hyaluronic Acid, Calcium Hydroxylapatite, Poly-L-lactic Acid, PMMA (Poly (Methyl Methacrylate)), Fat Fillers, Others)

• By Product (Biodegradable, Non-Biodegradable) • By Application (Scar Treatment, Wrinkle Correction Treatment, Lip Enhancement, Restoration of Volume/Fullness, Others) • By End-user (Specialty & Dermatology Clinics, Hospitals & Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AbbVie Inc., Merz Pharma, Suneva Medical, Inc., Medytox Inc., Sinclair Pharma, Prollenium Medical Technologies, Galderma, Allergan, Inc., Revance Therapeutics Inc., Bioplus Co. Ltd., Bioaxis Pharmaceuticals, Teoxane Laboratories, Huadong Medicine Co., Ltd., Marllor Biomedical SR |

| Key Drivers |

• Rising Demand for Minimally Invasive Procedures |

| Market Opportunities | • High Costs • Transient Effects • Side Effects |