Hybrid Cloud Market Report Scope & Overview:

The Hybrid Cloud Market was valued at USD 96.78 billion in 2023 and is expected to reach USD 405.62 billion by 2032, growing at a CAGR of 17.31% from 2024-2032.

To Get more information on Hybrid Cloud Market - Request Free Sample Report

The Hybrid Cloud market is experiencing significant growth as organizations increasingly seek flexible IT solutions that integrate the benefits of both private and public cloud infrastructures. 73% of the enterprises had a hybrid cloud strategy in 2024, and 82% of the IT leaders reported that they have a hybrid cloud model in place. This is because there is a demand to optimize the operation of a business, yet maintain control over sensitive data in private clouds while leveraging public clouds for scalable and efficient workloads that are not sensitive. With the ever-changing landscape of cloud-native applications, the hybrid model has become the preferred solution in addressing performance and security together with cost-effectiveness. In November 2024, Nutanix deepened its cooperation with AWS as the company helped make hybrid cloud adoption easier to embrace by introducing a more unified and efficient solution that further boosted the acceleration of hybrid cloud strategies across industries.

With digital transformation driving change across industries, the demand for hybrid cloud solutions continues to escalate, especially as organizations aim to enhance security, compliance, and operational flexibility. The surge in remote work, alongside the growing need for real-time data access, further accelerates the adoption of hybrid clouds, as businesses look for ways to maintain agility while securing critical data. In June 2024, Oracle and Google Cloud announced a groundbreaking multi cloud partnership, enabling customers to leverage Oracle Cloud Infrastructure and Google Cloud services together for easier migration and management of applications. This heightened interest is supported by a broader range of cloud service providers offering tailored hybrid cloud solutions, simplifying integration and facilitating seamless management of multi-cloud environments.

Looking ahead, the future of the Hybrid Cloud market is filled with untapped potential as emerging technologies like artificial intelligence, machine learning, and edge computing begin to shape its capabilities. In October 2024, SAP introduced advanced AI-assisted capabilities in the SAP S/4HANA Cloud Private Edition 2023 FPS02, including AI-driven sales order fulfillment, transportation planning, and maintenance order recommendations, demonstrating the growing role of AI in enhancing hybrid cloud solutions. These innovations will enable organizations to optimize IT resources and improve the efficiency of hybrid platforms. The advent of 5G networks will further accelerate hybrid cloud growth, providing faster, more reliable connectivity for real-time data processing, reinforcing the strategic importance of hybrid cloud solutions.

Hybrid Cloud Market Dynamics

Drivers

-

Technological Advancements Fueling the Demand for Hybrid Cloud Solutions

Innovations in artificial intelligence, machine learning, and automation are transforming how businesses manage and process vast amounts of data. These advanced technologies require significant computing power and real-time data processing capabilities. Hybrid cloud infrastructures offer the scalability and flexibility needed to handle complex workloads, allowing organizations to store, analyze, and process data seamlessly across both private and public clouds. In November 2024, Lenovo launched hybrid cloud platforms and services designed to accelerate AI integration across industries, further driving the demand for hybrid cloud solutions. The integration of AI and ML with hybrid cloud platforms enables automation, predictive analytics, and better decision-making. As enterprises increasingly rely on these technologies to drive efficiency, innovation, and insights, the demand for hybrid cloud solutions continues to grow, empowering businesses to optimize resource allocation, reduce costs, and enhance operational performance.

-

Growing Volume of IoT Data and Big Data Analytics Boosting Hybrid Cloud Demand

The rapid expansion of the Internet of Things and the surge in big data analytics are creating an overwhelming amount of data that organizations must efficiently manage. IoT devices generate vast volumes of real-time data, while big data analytics require the ability to process and analyze this information quickly and accurately. Hybrid cloud solutions offer the necessary scalability to handle this influx of data, allowing businesses to store and analyze data both on private infrastructure and in the public cloud. By leveraging hybrid cloud platforms, companies can ensure timely data processing, optimize storage costs, and maintain high performance across diverse workloads. This flexibility is crucial for organizations looking to extract insights from large data sets, enabling more informed decision-making and enhancing overall operational efficiency.

Restraints

-

High Initial Investment Restricting Hybrid Cloud Adoption for Smaller Businesses

The adoption of hybrid cloud solutions often requires a substantial upfront investment in infrastructure, software, and specialized expertise. Businesses must set up both private and public cloud environments, which involves costs related to hardware, software licenses, and integration efforts. Additionally, skilled professionals are needed to design, implement, and maintain these complex environments, contributing to the overall financial burden. While hybrid clouds can deliver long-term cost savings by optimizing resource usage, the initial capital outlay can be a significant barrier, particularly for smaller businesses with limited budgets. This high initial investment may deter many from exploring hybrid cloud solutions, as the costs involved could outweigh perceived immediate benefits, limiting access to advanced technologies for smaller or resource-constrained organizations.

-

Security and Privacy Challenges of Storing Data Across Hybrid Cloud Environments

Storing data across both private and public clouds introduces significant security risks, which can pose a challenge for organizations adopting hybrid cloud solutions. The distribution of data across multiple environments creates potential vulnerabilities, particularly regarding data breaches, unauthorized access, and the loss of sensitive information. Businesses must carefully manage access controls and encryption protocols to protect their data. Additionally, adhering to strict privacy regulations, such as the General Data Protection Regulation , becomes more complex when data is stored across various cloud platforms. Ensuring compliance across both private and public clouds can be difficult, requiring ongoing monitoring and adjustment of security policies. These concerns around data security and privacy can deter organizations from fully embracing hybrid cloud solutions, as they seek to mitigate the risks associated with potential breaches and regulatory violations.

Hybrid Cloud Market Segment Analysis

By Component

In 2023, the Solution segment dominated the hybrid cloud market with the highest revenue share of approximately 73%. This dominance can be attributed to the increasing demand for robust cloud infrastructure and tailored solutions that integrate private and public clouds. Organizations prioritize comprehensive, secure, and scalable solutions to optimize workloads, enhance data management, and maintain business continuity. The ability to customize cloud solutions to meet specific needs across various industries has driven this segment's substantial market share.

The Services segment is expected to grow at the fastest CAGR of about 19.55% from 2024 to 2032, driven by the growing need for expert guidance in hybrid cloud adoption and management. As businesses increasingly migrate to hybrid cloud environments, the demand for consulting, integration, and managed services rises. This trend is fueled by the complexity of cloud integration, security concerns, and the need for continuous optimization, making specialized services crucial for organizations seeking to maximize the benefits of their hybrid cloud investments.

By Organization Size

In 2023, the Large Enterprises segment dominated the hybrid cloud market with the highest revenue share of 60%. This is primarily due to the extensive IT infrastructure and complex operational needs of large organizations, which require scalable, secure, and flexible cloud solutions. Large enterprises are leveraging hybrid cloud to enhance their data management, improve business continuity, and optimize costs across diverse business units. Their ability to invest in customized hybrid cloud solutions and the growing complexity of their operations further contribute to their dominant market position.

The Small and Medium-sized Enterprises segment is expected to grow at the fastest CAGR of about 18.66% from 2024 to 2032. This growth is driven by the increasing affordability and accessibility of hybrid cloud solutions, which now offer scalable, cost-effective options for SMEs. As these businesses look to expand their digital capabilities, hybrid cloud solutions provide the flexibility, enhanced security, and cost efficiency needed to support rapid growth while minimizing the challenges associated with traditional IT infrastructures.

By Vertical

In 2023, the BFSI segment led the hybrid cloud market with the highest revenue share of about 24%. This dominance is driven by the sector's need for secure, scalable, and compliant cloud solutions to handle vast amounts of sensitive financial data. Hybrid cloud models enable BFSI companies to enhance data security, ensure business continuity, and meet regulatory requirements, all while optimizing operational costs. The sector’s ongoing digital transformation and reliance on innovative cloud-based technologies have further bolstered its market leadership.

The Healthcare segment is expected to grow at the fastest CAGR of about 20.68% from 2024 to 2032. This rapid growth can be attributed to the increasing demand for secure, accessible, and scalable cloud solutions to manage patient data, improve care delivery, and comply with strict privacy regulations. Hybrid cloud enables healthcare organizations to maintain sensitive medical records securely while leveraging the flexibility of cloud computing for data analysis, telemedicine, and collaboration, driving its accelerated adoption across the sector.

By Service Type

In 2023, the Hybrid Hosting segment dominated the hybrid cloud market, with the highest revenue share of about 51%. This leadership is driven by the growing demand for flexible and cost-efficient hosting solutions that combine the benefits of both private and public cloud environments. Hybrid hosting allows businesses to maintain sensitive data on private infrastructure while taking advantage of the scalability and resource optimization offered by public clouds. This combination provides enhanced security, greater flexibility, and reduced operational costs, making it the preferred solution for many enterprises.

The Cloud Management and Orchestration segment is expected to grow at the fastest CAGR of about 18.92% from 2024 to 2032. As organizations increasingly adopt hybrid cloud environments, the need for effective management, automation, and orchestration of workloads across multiple cloud platforms becomes critical. Cloud management solutions ensure smooth operation, better resource allocation, and enhanced security, helping businesses optimize their hybrid cloud investments. The rapid shift toward multi-cloud strategies and the growing complexity of cloud environments are driving the demand for advanced management tools, fueling the segment’s rapid growth.

By Service Model

In 2023, the Software-as-a-Service segment dominated the hybrid cloud market, capturing the highest revenue share of about 44%. This dominance can be attributed to the widespread adoption of cloud-based applications across industries, offering businesses cost-effective, scalable, and flexible solutions. SaaS enables organizations to access a wide range of software tools on-demand, reducing the need for on-premises infrastructure and simplifying maintenance. The increasing reliance on SaaS for enterprise applications, such as customer relationship management, finance, and human resources, has solidified its leading position in the market.

The Platform-as-a-Service segment is expected to grow at the fastest CAGR of 19.54% from 2024 to 2032. This rapid growth is driven by the rising demand for agile development and deployment platforms, which allow businesses to build, test, and scale applications without managing underlying infrastructure. PaaS enables faster time-to-market for new products and services while offering flexibility, cost efficiency, and seamless integration with hybrid cloud environments. As companies increasingly focus on innovation and digital transformation, PaaS is becoming a vital enabler for accelerating application development and improving operational efficiency.

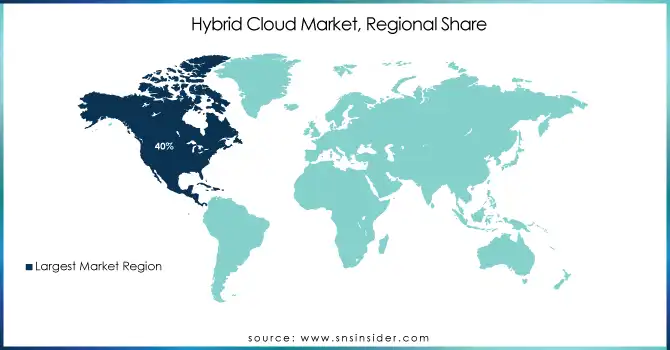

Regional Analysis

In 2023, North America dominated the hybrid cloud market, with the highest revenue share of about 40%. This dominance is largely driven by the region’s well-established technology infrastructure, high adoption of cloud solutions, and the presence of major cloud service providers. North American enterprises, particularly in sectors like BFSI, healthcare, and technology, increasingly rely on hybrid cloud models to enhance scalability, security, and operational efficiency. The robust digital transformation initiatives and innovation in cloud technologies further solidify the region’s leadership in the hybrid cloud market.

Asia Pacific is expected to grow at the fastest CAGR of about 20.12% from 2024 to 2032, driven by rapid industrialization, increasing internet penetration, and a growing emphasis on digital transformation across emerging economies. Businesses in Asia Pacific are increasingly adopting hybrid cloud solutions to address their specific data privacy, scalability, and cost-efficiency needs. The region’s expanding tech ecosystem, coupled with a rise in cloud-native startups, is fostering a strong demand for hybrid cloud services, positioning Asia Pacific as the fastest-growing market in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

IBM (IBM Cloud, Watson)

-

Microsoft (Azure, Office 365)

-

Cisco Systems (Cisco Cloud, Cisco Meraki)

-

AWS (Amazon EC2, Amazon S3)

-

Oracle (Oracle Cloud, Oracle Autonomous Database)

-

Google (Google Cloud Platform, Google Kubernetes Engine)

-

VMware (VMware Cloud, vSphere)

-

Alibaba (Alibaba Cloud, Elastic Compute Service)

-

Equinix (Equinix Cloud Exchange, Equinix Metal)

-

Rackspace (Rackspace Cloud, Rackspace Managed Hosting)

-

NetApp (NetApp Cloud Volumes, NetApp ONTAP)

-

Atos (Atos Cloud, Atos MyCloud)

-

Fujitsu (Fujitsu Cloud Service, Fujitsu K5)

-

CenturyLink (CenturyLink Cloud, CenturyLink Hybrid IT)

-

HPE (HPE GreenLake, HPE Ezmeral)

-

DXC (DXC Cloud, DXC Managed Services)

-

RightScale (Flexera Cloud Management, Cloud Management Platform)

-

Micro Focus (Micro Focus Hybrid Cloud, Operations Bridge)

-

NTT Communications (Enterprise Cloud, Cloudn)

-

Dell EMC (Dell VxRail, Dell EMC Cloud)

-

Citrix (Citrix Cloud, Citrix Workspace)

-

Pure Storage (Pure Storage Cloud Block Store, FlashArray)

-

Unitas Global (Unitas Cloud, Network as a Service)

-

Quest Software (Quest Cloud Management, Quest Backup Solutions)

-

T-Systems (T-Systems Cloud, T-Systems Hybrid Cloud)

-

Huawei (Huawei Cloud, Huawei CloudStack)

-

Broadcom (Broadcom Cloud, Broadcom Enterprise Solution

Recent Developments:

-

In November 2024, IBM announced its collaboration with AMD to deploy AMD Instinct MI300X accelerators as a service on IBM Cloud. This partnership aims to enhance performance for generative AI and HPC applications, supporting enterprise clients with greater scalability, cost-efficiency, and security

-

In November 2024, Microsoft introduced Azure Local, enabling hybrid cloud and edge solutions. It allows businesses to run Azure services on-premises while maintaining centralized management via Azure Arc.

-

In August 2024, Hitachi Vantara and Broadcom introduced an advanced private and hybrid cloud solution featuring VMware Cloud Foundation. This co-engineered solution enhances data management, sustainability, and performance, helping organizations scale while reducing energy consumption and operational complexity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 96.78 Billion |

| Market Size by 2032 | USD 405.62 Billion |

| CAGR | CAGR of 17.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Service Type (Cloud management and orchestration, Disaster recovery, Hybrid hosting) • By Service Model (Infrastructure-as-a-Service, Platform-as-a-Service, Software-as-a-Service) • By Organization Size (Large enterprises, Small and medium-sized enterprises) • By Vertical (BFSI, IT and Telecommunications, Healthcare, Retail, Media and entertainment, Manufacturing, Government, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Microsoft, Cisco Systems, AWS, Oracle, Google, VMware, Alibaba, Equinix, Rackspace, NetApp, Atos, Fujitsu, CenturyLink, HPE, DXC, RightScale, Micro Focus, NTT Communications, Dell EMC, Citrix, Pure Storage, Unitas Global, Quest Software, T-Systems, Huawei, Broadcom. |

| Key Drivers | • Technological Advancements Fueling the Demand for Hybrid Cloud Solutions • Growing Volume of IoT Data and Big Data Analytics Boosting Hybrid Cloud Demand |

| RESTRAINTS | • High Initial Investment Restricting Hybrid Cloud Adoption for Smaller Businesses • Security and Privacy Challenges of Storing Data Across Hybrid Cloud Environments |