Intelligent Process Automation Market Report Scope & Overview:

Get more information on Intelligent Process Automation Market - Request Free Sample Report

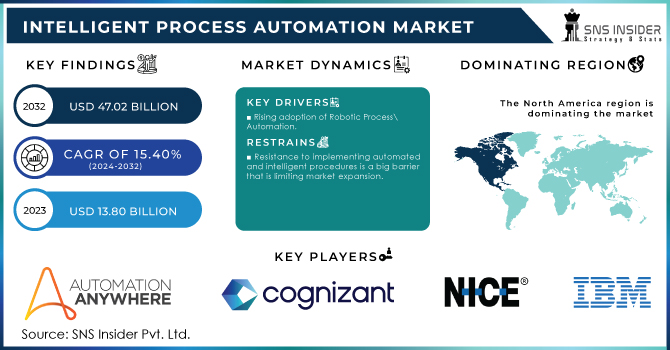

The Intelligent Process Automation Market Size was valued at USD 15.05 Billion in 2023, and is expected to reach USD 47.85 Billion by 2032, and grow at a CAGR of 13.72% over the forecast period 2024-2032. The Intelligent Process Automation market is experiencing rapid growth as businesses seek innovative ways to reduce operational costs and improve efficiency. Driven by the integration of Artificial Intelligence (AI) and Machine Learning (ML), IPA platforms are transforming how companies automate processes and enhance productivity. By automating repetitive tasks and optimizing workflows, IPA significantly reduces costs and frees up valuable human resources for more strategic work. Underscoring the widespread adoption of AI-driven solutions. In fact, companies leveraging AI-powered automation tools can reduce operational costs by up to 40-60%, as AI optimizes decision-making and improves process efficiency. 33% of businesses are already using generative AI to cut costs, while 12% use it to create new income streams. This growing adoption is particularly evident in industries such as healthcare, finance, and manufacturing, where AI and IPA are helping businesses stay competitive and agile in a rapidly evolving marketplace. For instance, the Associated Press uses generative AI to streamline news reporting reducing time spent on research and automating repetitive tasks. By embracing Intelligent Process Automation, businesses can achieve significant ROI, with 82% of early AI adopters reporting tangible financial benefits. Furthermore, AI applications in IPA are projected to yield substantial savings, particularly in sectors like healthcare, where AI integration could lead to USD200-USD 360 billion in potential cost reductions annually. As AI continues to evolve, its ability to streamline operations, improve accuracy, and enhance customer experiences will drive even greater demand for Intelligent Process Automation. Companies looking to stay ahead in the market must continue to innovate and integrate AI solutions to remain competitive and optimize their operations, ensuring long-term growth and profitability.

Intelligent Process Automation Market Dynamics

Drivers

-

Driving Digital Transformation with the Role of Intelligent Process Automation (IPA) in Business Efficiency

As organizations strive to stay competitive and enhance customer experiences, the demand for digital transformation is rapidly growing. Intelligent Process Automation (IPA) plays a crucial role in this transformation, enabling businesses to streamline operations, reduce costs, and create more agile models. By automating complex tasks, Intelligent Process Automation accelerates time-to-market and fosters innovation. BMW, for instance, has used IPA to optimize decision-making and improve operational efficiency. Additionally, industries such as government and healthcare are turning to IPA to modernize services, with SAP’s solutions helping governments enhance service delivery through automation. The rise of AI and machine learning further fuels the adoption of IPA, providing advanced tools for data analysis, process optimization, and decision-making. As noted by Forbes, AI is reshaping workplaces by enabling businesses to redefine workflows and stay ahead in a competitive landscape. In sectors like finance and healthcare, AI-driven automation is improving productivity by streamlining data analysis and automating administrative tasks, which enhances overall efficiency and patient care. For example, MindStudio’s AI tools saved one hour per 8,000 hiring managers at HM Revenue & Customs, while Affinityx reported significant improvements in employee output. 75% of employees fear AI will make their jobs obsolete.

Restraints

-

Data Security and Privacy Issues Impacting the Growth of the Intelligent Process Automation Market

As businesses adopt Intelligent Process Automation (IPA) to streamline operations, one of the key challenges is the increased risk of data breaches and privacy violations. Automating processes often involves handling sensitive business and customer data, which exposes organizations to potential security threats. The reliance on AI and machine learning for data processing further amplifies the risk of cyberattacks. Protecting this sensitive information requires companies to implement robust data security protocols, which can be both costly and complex to execute. As organizations scale their use of Intelligent Process Automation, they must also ensure compliance with privacy regulations like GDPR and CCPA. The growing role of AI in data collection and analysis makes safeguarding personal data more critical than ever. According to Security Intelligence, there is an urgent need for automation to support privacy initiatives, as breaches are becoming more prevalent in the AI era. Implementing automated systems for tasks ranging from customer interactions to financial management introduces significant challenges related to data integrity, breach prevention, and privacy maintenance. Stanford HAI highlights the increasing difficulty of protecting personal information as AI becomes more integrated into business processes. Maintaining transparency in AI decision-making processes is another challenge. Without clear guidelines and accountability, automated systems may expose organizations to legal risks. With 75% of employees concerned about AI-induced job displacement, a lack of trust in how data is handled further complicates IPA adoption. These concerns emphasize the need for companies to invest in cybersecurity and ensure compliance with evolving privacy standards, as data security remains a significant barrier to the widespread implementation of Intelligent Process Automation.

Intelligent Process Automation Market Segments Analysis

By Component

In 2023, the solution segment captured the largest share of the revenue in the Intelligent Process Automation (IPA) market, accounting for approximately 68%. This dominance can be attributed to the growing adoption of end-to-end automation solutions that streamline business processes across industries. Solutions in IPA typically include software platforms, AI-driven tools, robotic process automation (RPA), and analytics, which enable businesses to automate tasks, improve decision-making, and optimize workflows. By integrating various functions such as data extraction, process automation, and real-time analytics, IPA solutions provide organizations with a comprehensive approach to improving operational efficiency and reducing manual intervention. The increasing demand for digital transformation and the need for businesses to stay competitive are driving the adoption of these solutions. As companies seek to modernize their processes, the solution segment’s share is expected to continue growing, with businesses investing heavily in automation platforms to enhance productivity and reduce costs.

By Deployment

In 2023, the cloud-based segment captured the largest share of the Intelligent Process Automation (IPA) market, of around 61% of the revenue. This growth is driven by the increasing preference for scalable, cost-effective, and flexible solutions offered by cloud technology. Cloud-based IPA platforms allow businesses to deploy automation tools quickly without the need for significant upfront investments in infrastructure. Additionally, cloud-based solutions provide real-time access to data and analytics, facilitate easier updates, and enable seamless integration with existing systems. As organizations seek to optimize their processes and reduce operational costs, the cloud-based deployment model offers compelling benefits, making it the dominant choice for enterprises adopting Intelligent Process Automation solutions in 2023.

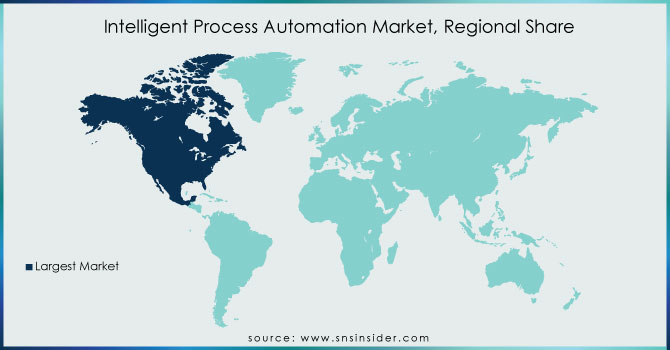

Intelligent Process Automation Market Regional Overview

In 2023, North America led the Intelligent Process Automation (IPA) market, capturing around 41% of total revenue. This dominance is driven by the United States and Canada, where advanced technological infrastructure and widespread digital transformation initiatives are reshaping industries. The U.S. is a key driver, with companies across finance, healthcare, retail, and manufacturing adopting IPA to improve efficiency and reduce costs. The integration of AI and machine learning technologies further accelerates IPA adoption. Canada also contributes with smart city projects, government automation, and business modernization. Supportive government policies, strong infrastructure, and investments in R&D foster an environment for continued growth, ensuring North America's leadership in the global IPA market.

In 2023, the Asia-Pacific region emerged as the fastest-growing market for Intelligent Process Automation (IPA), driven by rapid industrialization, technological progress, and a strong push for digital transformation. Key countries like China, India, Japan, and South Korea are leading this growth, with industries such as manufacturing, finance, healthcare, and retail adopting Intelligent Process Automation to improve efficiency, streamline operations, and enhance customer experiences. The widespread integration of AI, machine learning, and cloud computing in the region has accelerated IPA adoption. Large-scale digital initiatives and government support in China and India are major contributors. The growing demand for cost-effective solutions, especially in manufacturing and supply chain sectors, fuels this expansion. Additionally, investments in smart technologies and a thriving startup ecosystem further bolster Asia-Pacific's role as a leader in the global Intelligent Process Automation market.

Need any customization research on Intelligent Process Automation Market - Enquiry Now

Key Players in Intelligent Process Automation Market

Some of the major players in Intelligent Process Automation Market with their product:

-

UiPath (UiPath Automation Platform)

-

Automation Anywhere (Automation Anywhere Enterprise)

-

Blue Prism (Blue Prism RPA)

-

Microsoft (Power Automate)

-

WorkFusion (WorkFusion Intelligent Automation Cloud)

-

Pegasystems (Pega Intelligent Automation)

-

Kofax (Kofax RPA and Kofax TotalAgility)

-

AntWorks (AntWorks Intelligent Automation Platform)

-

NICE Systems (NICE Advanced Process Automation)

-

IBM (IBM Robotic Process Automation)

-

Thoughtonomy (Blue Prism) (Thoughtonomy Virtual Workforce)

-

AutomationEdge (AutomationEdge RPA)

-

Softomotive (Microsoft) (WinAutomation)

-

Delmia (Dassault Systèmes) (Delmia Robotics)

-

Cognizant (Cognizant Intelligent Automation)

-

Tata Consultancy Services (TCS) (TCS Ignio)

-

HCL Technologies (HCL Automation Platform)

-

Capgemini (Capgemini RPA)

-

Accenture (Accenture Intelligent Automation)

-

Oracle (Oracle Intelligent Process Automation)

-

Celonis (Celonis Intelligent Business Cloud)

-

Fortra, LLC (Fortra Automation Solutions)

-

Tungsten Automation Corporation (Kofax) (Tungsten Automation Platform)

-

Nintex UK Ltd (Nintex RPA)

-

ThoughtSpot Inc. (ThoughtSpot Analytics and Automation Platform)

List of 20 potential customers for the Intelligent Process Automation (IPA) market across various industries:

-

Bank of America (Financial Services)

-

JPMorgan Chase (Financial Services)

-

Wells Fargo (Financial Services)

-

HSBC (Financial Services)

-

Citigroup (Financial Services)

-

Walmart (Retail)

-

Target (Retail)

-

Amazon (E-commerce & Logistics)

-

Coca-Cola (Manufacturing & FMCG)

-

PepsiCo (Manufacturing & FMCG)

-

Siemens (Manufacturing & Industrial)

-

General Electric (Manufacturing & Industrial)

-

Shell (Energy & Utilities)

-

ExxonMobil (Energy & Utilities)

-

Accenture (Consulting & Professional Services)

-

IBM (Technology & Consulting)

-

Microsoft (Technology)

-

Tata Consultancy Services (TCS) (Technology & Consulting)

-

AIG (American International Group) (Insurance)

-

Allianz (Insurance)

Recent Development

-

September 25, 2024 – SS&C Blue Prism recently enhanced its intelligent automation capabilities with Blue Prism Process Intelligence, enabling businesses to identify automation opportunities more effectively and optimize task orchestration for improved operational efficiency. This development aims to augment the workforce by automating repetitive tasks and allowing employees to focus on high-value activities.

-

January 19, 2024 – Kofax has rebranded as Tungsten Automation, reflecting its evolution into a global provider of AI-powered workflow automation solutions. This transformation emphasizes the company’s commitment to innovation, particularly in intelligent document processing and automating accounts payable processes.

-

September 2, 2024 – Primark and Tata Consultancy Services (TCS) have extended their partnership to transform Primark's technology operations, with a focus on intelligent automation and DevOps technologies. This collaboration will support Primark’s global expansion and help transition to a more agile, product-based operating model through 2029.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 15.05 Billion |

|

Market Size by 2032 |

USD 47.85 Billion |

|

CAGR |

CAGR of 13.72% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solution, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

UiPath, Automation Anywhere, Blue Prism, Microsoft, WorkFusion, Pegasystems, Kofax, and Others |

|

Key Drivers |

• Driving Digital Transformation with the Role of Intelligent Process Automation (IPA) in Business Efficiency |

|

Restraints |

• Data Security and Privacy Issues Impacting the Growth of the Intelligent Process Automation Market |