Hydraulic Equipment Market Report Scope & Overview:

To Get More Information on Hydraulic Equipment Market - Request Sample Report

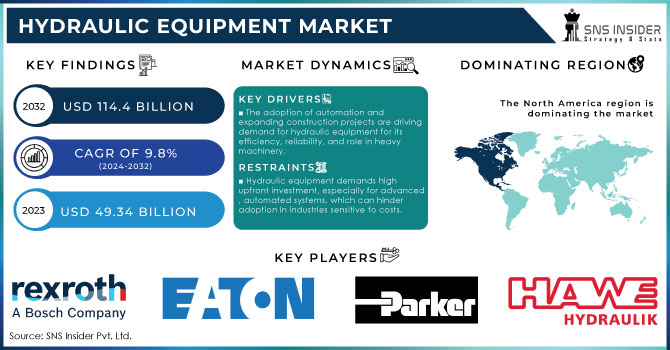

The Hydraulic Equipment Market Size was valued at USD 49.34 Billion in 2023 and is now anticipated to grow to USD 114.4 Billion by 2032, displaying a compound annual growth rate (CAGR) of 9.8% during the forecast Period 2024-2032.

The hydraulic equipment industry is expanding rapidly as a result of the technological advances in this field combined with practical high power & efficient machinery demand in various industrial sectors. Industries that depend heavily on hydraulic cushioning means include construction, manufacturing, agriculture and oil & gas just to name a few. The demand for hydraulic systems is steadily increasing owing to the requirement of high-performance equipment capable of loading excessive weights and providing accurate control. Hydraulic Equipment market has also seen some of the recent dynamic trends that have been evolving in the market such as great shift towards automation and integration of IoT (Internet of Things) Technologies. With the use of these new advancements remote monitoring and control of hydraulic systems in real time has been made possible, which resulted into higher efficiency and lower downtime. Owing to this, manufacturers are concentrating on building smart hydraulic systems that can cater to different operating conditions as well as improve performance and energy efficiency.

In addition, sustainability is growing importance in the market expansion. More and more focus is on developing green hydraulic equipment that uses less energy and make a lesser impact on the environment. Such tendencies are pushing the producers to compel production and design hydraulic structures that use bio-degradable fluids and that also combine energy recovery systems. Moreover, increase in adoption of mobile hydraulic equipment is observed in industries such as agriculture and construction wherein both mobility and versatility are required. A transition to electric and hybrid hydraulic systems is already underway, providing cleaner and more sustainable solutions.

MARKET DYNAMICS

DRIVERS

- The growing adoption of automation technologies in industrial processes, along with expanding construction projects, is driving demand for hydraulic equipment due to its efficiency, reliability, and essential role in heavy machinery.

The increasing adoption of automation technologies across various industries is a key driver in the hydraulic equipment market. As manufacturing and industrial processes evolve towards greater efficiency and precision, hydraulic systems play a crucial role in powering automated machinery. In sectors like automotive, aerospace, and industrial production, hydraulic equipment is widely used for its superior reliability and precision control, particularly in tasks requiring heavy lifting, repetitive motions, or force application. This growing reliance on automation has led to a surge in demand for hydraulic systems, particularly in robotic applications where they offer smooth, consistent operation under high load conditions.

In addition to manufacturing, the construction and infrastructure sectors are also fueling demand for hydraulic equipment. Expanding construction projects, particularly in emerging markets, require heavy machinery such as excavators, loaders, bulldozers, and cranes. These machines rely on hydraulic systems to operate efficiently under challenging conditions, enabling large-scale construction projects, including urban development, transportation networks, and energy infrastructure. Hydraulic equipment’s ability to support industrial automation and power construction machinery highlights its importance in modernizing industries and improving operational efficiencies. As global infrastructure development continues, and industries increasingly adopt automated processes, the demand for hydraulic systems will further accelerate, making them a cornerstone of industrial modernization and growth.

- Energy-efficient hydraulic systems reduce fuel consumption and emissions, while smart hydraulics with IoT integration enable real-time monitoring and predictive maintenance, enhancing productivity.

Energy efficiency and technological advancements are key drivers in the hydraulic equipment market. Modern hydraulic systems are being designed to consume less energy, reducing fuel usage and lowering emissions. These innovations align with stricter global environmental regulations, enabling industries to adopt more sustainable solutions. Energy-efficient hydraulics not only help cut operational costs but also contribute to greener practices across sectors such as construction, manufacturing, and agriculture.

Another significant advancement is the integration of smart hydraulics with IoT sensors. These systems allow real-time monitoring of equipment performance, providing data for predictive maintenance and enabling quick detection of potential issues. This reduces downtime and increases overall productivity. The ability to monitor hydraulic systems remotely, adjust parameters, and schedule maintenance efficiently has made smart hydraulic systems attractive for industries looking to optimize operational efficiency while reducing costs. These advancements continue to revolutionize the hydraulic equipment market.

RESTRAIN

- Hydraulic equipment demands high upfront investment, especially for advanced, automated systems, which can hinder adoption in industries sensitive to costs.

Hydraulic equipment often involves a substantial initial investment, particularly when dealing with advanced systems that incorporate automation and smart technologies. These capital-intensive machines, while offering enhanced efficiency, precision, and durability, come with higher costs due to the complex design, robust components, and specialized manufacturing processes. For industries that are highly cost-sensitive, such as small-scale manufacturing or construction firms, this significant upfront expense can be a deterrent.

Moreover, advanced hydraulic systems that integrate IoT sensors and energy-efficient designs may have higher maintenance and training requirements, adding to operational costs. While large corporations in sectors like mining, oil & gas, or large-scale infrastructure projects can often absorb these costs, smaller players might delay or avoid upgrading their equipment, affecting the overall market adoption rate. This cost barrier can also lead companies to explore alternative, less expensive technologies like electric or pneumatic systems.

KEY SEGMENTATION ANALYSIS

By Application

The industrial segment is dominated market share over 62.04% in 2023, mainly due to its widespread use in industries like manufacturing, oil and gas, mining, and material processing. These industries require heavy-duty, high-power hydraulic systems for various functions like lifting, pressing, and clamping.

The mobile hydraulic equipment market is projected to grow rapidly, driven by the increasing demand in sectors like construction, agriculture, and material handling. The expansion of infrastructure projects, rising urbanization, and an increase in agricultural mechanization are key factors pushing growth in this segment.

REGIONAL ANALYSIS

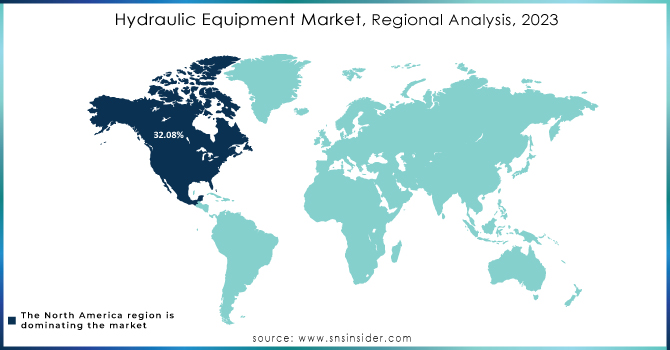

The North American region is dominated market share over 32.08% in 2023. Over the past few years, North America's food and beverage, pharmaceutical, and FMCG businesses have all experienced rapid growth. The demand for hydraulic-operated filling and packing equipment has increased as a result of the rise in FMCG product demand, new manufacturing facilities, and the expansion of existing factories. When filling containers like bags and sacks, the food and beverage industry use conveyors powered by hydraulic motors.

Do You Need any Customization Research on Hydraulic EquipmentMarket - Inquire Now

KEY PLAYERS

Some of the major key players of Hydraulic Equipment Market

- Bosch Rexroth (Germany): (Hydraulic pumps, motors, cylinders, and control systems)

- Eaton Corporation Plc (Ireland): (Hydraulic power units, valves, pumps, and fluid conveyance products)

- Parker Hannifin (US): (Hydraulic actuators, motors, pumps, and valves)

- Kawasaki (Japan): (Hydraulic pumps, motors, and control valves)

- HAWE Hydraulik (Germany): (Hydraulic valves, pumps, and controls)

- Hydac (Germany): (Hydraulic filters, accumulators, coolers, and control systems)

- Moog, Inc. (US): (Electrohydraulic actuators, servo valves, and hydraulic control systems)

- Bucher Hydraulics (Germany):(Hydraulic power units, motors, pumps, and valves)

- Daikin Industries Ltd. (Japan): (Hydraulic equipment for industrial machinery and systems)

- Concentric AB (Sweden): (Hydraulic gear pumps and motors)

- Casappa (Italy): (Hydraulic gear pumps, motors, and filters)

- Nachi-Fujikoshi Corp. (Japan): (Hydraulic pumps, motors, and control valves)

- Dantal Hydraulics (India): (Hydraulic cylinders, power packs, and filters)

- Fluitronics GmbH (Germany): (Hydraulic systems, valves, and control units)

- Linde Hydraulics (Germany): (Hydraulic pumps, motors, and drive systems)

- Danfoss Power Solutions (Denmark): (Hydraulic motors, pumps, and steering systems)

- Komatsu Ltd. (Japan): (Hydraulic equipment for construction and industrial machinery)

- Hydreco Hydraulics (UK): (Hydraulic pumps, valves, and motors)

- Sauer-Danfoss (US/Denmark): (Hydraulic pumps, motors, and steering systems)

- Yuken Kogyo Co., Ltd. (Japan): (Hydraulic pumps, valves, and actuators)

RECENT DEVELOPMENTS

In June 2023: KTI Hydraulics Inc. unveiled a submerged DC hydraulic power unit (HPU) to enhance the dependability of recycling equipment. The business provides a waterproof HPU equipped with a 1.8-kilowatt, 12-volt, and 24-volt DC motor that has excellent ingress protection ratings. The Hydraulic Power Unit (HPU) consists of a gear pump under pressure, a sealed solenoid, and a reservoir holding five quarts of usable liquid volume.

In April 2023: Bosch Rexroth introduced the Hägglunds Quantum series of hydraulic motors, aimed at improving torque and speed abilities while maintaining efficiency for direct drive use in heavy-duty machinery. Furthermore, these motors can reach speeds exceeding 150 rpm and have a maximum torque of over 350 kNm. Modifications in the design and materials resulted in increased speed and torque, as well as a prolonged lifespan, all while maintaining efficient performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 49.34 Billion |

| Market Size by 2032 | USD 114.4 Billion |

| CAGR | CAGR of 9.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Pumps, Motors, Valves, Cylinder and Accessories) • By Application (Industrial and Mobile) • By End User (Mining & Construction, Agriculture & Forestry, Packaging, Material Handling, Aerospace & defense, Machine Tool, Oil & Gas, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bosch Rexroth, Eaton Corporation Plc, Parker Hannifin, Kawasaki, HAWE Hydraulik, Hydac, Moog, Inc., Bucher Hydraulics, Daikin Industries Ltd., Concentric AB, Casappa, Nachi-Fujikoshi Corp., Dantal Hydraulics, Fluitronics GmbH, Linde Hydraulics, Danfoss Power Solutions, Komatsu Ltd., Hydreco Hydraulics, Sauer-Danfoss, and Yuken Kogyo Co., Ltd. |

| Key Drivers | •The growing adoption of automation technologies in industrial processes, along with expanding construction projects, is driving demand for hydraulic equipment due to its efficiency, reliability, and essential role in heavy machinery. • Energy-efficient hydraulic systems reduce fuel consumption and emissions, while smart hydraulics with IoT integration enable real-time monitoring and predictive maintenance, enhancing productivity. |

| RESTRAINTS | • Hydraulic equipment demands high upfront investment, especially for advanced, automated systems, which can hinder adoption in industries sensitive to costs. |