Transformer Market Report Scope & Overview:

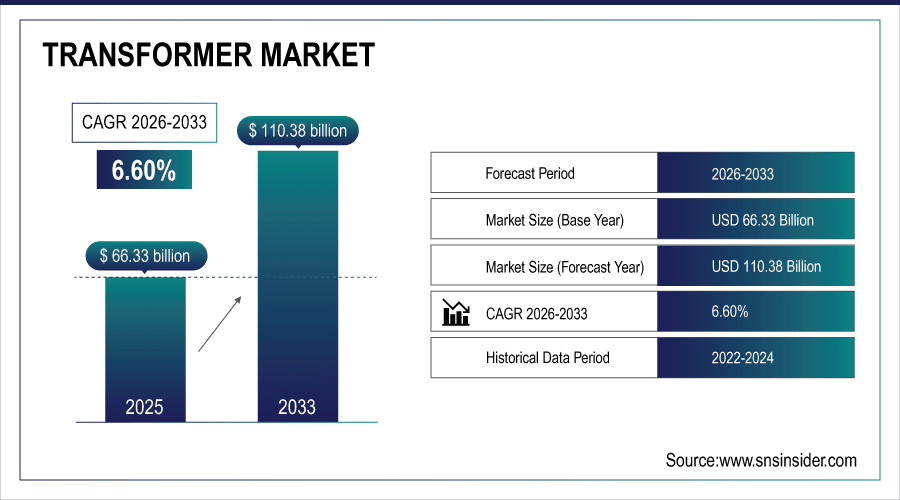

The Transformer Market Size was valued at USD 66.33 Billion in 2025E and is projected to reach USD 110.38 Billion by 2033, growing at a CAGR of 6.60% during the forecast period 2026–2033.

The Transformer Market provides an analysis of key trends and developments across products such as power, distribution, and instrument transformers, with varying capacities, cooling types, and installation methods. The market is segmented by application, distribution channels, and installation types including industrial, utilities, commercial, and residential sectors. Growing electricity demand, industrialization, renewable energy integration, and infrastructure expansion are driving global adoption, supporting market growth across major regions during the forecast period.

Power and distribution transformers accounted for nearly 60% of the Transformer Market in 2025, driven by rising electricity demand and industrial growth.

To Get More Information On Transformer Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 66.33 Billion

-

Market Size by 2033: USD 110.38 Billion

-

CAGR: 6.60% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Transformer Market Trends:

-

Rapid industrialization and urban electrification are driving demand for power and distribution transformers.

-

Energy-efficient and smart transformers with IoT and monitoring capabilities are gaining traction in modern grids.

-

Renewable energy integration, including solar and wind, is boosting the need for high-capacity, reliable transformers.

-

Government investments in grid modernization, especially in Asia-Pacific and North America, are accelerating market growth.

-

Rising focus on sustainability, low-loss transformers, and aftermarket services is shaping product development and adoption.

U.S. Transformer Market Insights:

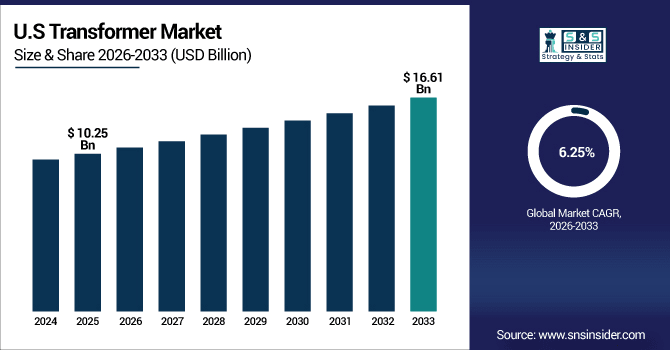

The U.S. Transformer Market is projected to grow from USD 10.25 billion in 2025E to USD 16.61 billion by 2033, at a CAGR of 6.25%. Growth is driven by industrialization, urban electrification, and renewable energy projects, alongside rising adoption of energy-efficient, low-loss, and smart transformers across utilities and commercial sectors.

Transformer Market Growth Drivers:

-

Surging global power demand and rapid renewable energy adoption are fueling dynamic growth in the transformer market.

The Transformer Market is witnessing robust growth due to surging global electricity demand and rapid renewable energy adoption. The global transformer installations are projected to surpass 25 million units by 2030, driven by industrialization, urban electrification, and infrastructure modernization. Expansion of solar and wind power projects, along with government-backed grid modernization programs, is accelerating demand. Innovations in energy-efficient and smart transformers are further supporting widespread adoption across utilities, commercial, and residential sectors.

Surging electricity demand and renewable energy adoption accounted for nearly 55% of global transformer installations in 2025.

Transformer Market Restraints:

-

High manufacturing costs and complex regulatory standards are constraining transformer market growth and slowing widespread adoption globally.

The Transformer Market faces significant challenges due to high manufacturing costs and stringent regulatory standards. Around 35% of manufacturers experience margin pressures from rising prices of steel, copper, and insulation materials, while supply chain disruptions delay timely deliveries. Compliance with complex certification and safety regulations further restrains market growth in several regions. Smaller regional players are most affected, and intense competition from advanced, energy-efficient, low-loss, and modular transformers continues to limit expansion and slow adoption globally.

Transformer Market Opportunities:

-

Expanding smart grid initiatives and rapid renewable energy adoption unlock lucrative, high-potential opportunities in the global transformer market.

Expanding investments in smart grids and renewable energy infrastructure are driving significant transformer market growth. In 2025, nearly 45% of new transformer installations focused on energy-efficient, IoT-enabled, and low-loss models to support modern power systems and renewable integration. Increasing electrification projects, industrial expansion, and government-backed infrastructure modernization are further enhancing market accessibility. Innovation in smart and modular transformers is expected to continue fueling global growth through 2033.

Adoption of energy-efficient and IoT-enabled transformers represented nearly 40% of new global transformer deployments in 2025.

Transformer Market Segmentation Analysis:

-

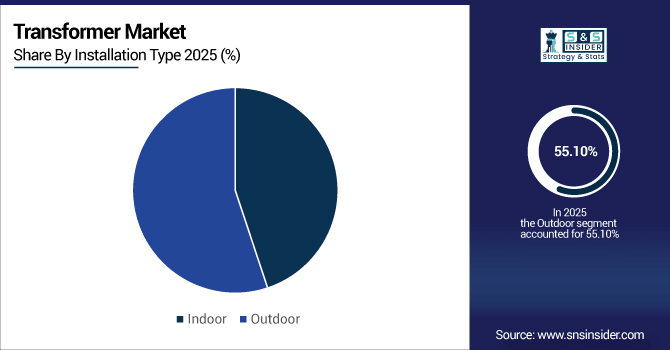

By Installation Type, Outdoor transformers held the largest share of 55.10% in 2025, while Indoor transformers are projected to grow at the fastest CAGR of 7.10%.

-

By Type, Power Transformers held the largest market share of 42.75% in 2025, while Instrument Transformers are expected to grow at the fastest CAGR of 7.20%.

-

By Application, Utilities dominated with a 38.90% share in 2025, while Industrial applications are projected to expand at the fastest CAGR of 7.05%.

-

By Cooling Type, Oil-Cooled transformers accounted for the highest market share of 51.30% in 2025, while Dry-Type transformers are expected to record the fastest CAGR of 6.85%.

-

By Capacity, High Voltage transformers held the largest share in 2025 with 44.20%, and Medium Voltage transformers are expected to grow at the fastest CAGR of 6.95%.

-

By Distribution Channel, Direct Sales held the largest share of 48.65% in 2025, while Online Retail is expected to grow at the fastest CAGR of 7.25%.

By Installation Type, Outdoor Transformers Lead While Indoor Expands Rapidly:

Outdoor transformers in 2025 dominated at nearly 12 million units, preferred for utilities and high-capacity industrial applications. Indoor transformers were fast-growing, reaching about 6.8 million units for commercial buildings, factories, and residential complexes. Urban infrastructure, industrial growth, and renewable energy projects are accelerating indoor transformer installations, while outdoor transformers continue to dominate utility and large-scale industrial networks.

By Type, Power Transformers Lead While Instrument Transformers Expand Rapidly:

Power transformers in 2025 dominated with over 10.5 million units installed globally, driven by high demand from utilities and industrial projects. Instrument transformers were fast-growing, totaling about 4.2 million units, reflecting rapid adoption for metering, protection, and smart grid applications. The growing need for reliable electricity distribution and monitoring in modern grids is driving expansion across Asia-Pacific, North America, and Europe, with instrument transformers showing particularly strong growth potential.

By Application, Utilities Dominate While Industrial Applications Grow Fast:

Utilities in 2025 dominated at roughly 9.8 million transformer installations globally, fueled by transmission and distribution network expansion. Industrial applications were fast-growing, totaling about 6.5 million units, reflecting electrification, factory automation, and manufacturing growth. Investments in energy infrastructure, renewable integration, and urban electrification are boosting demand, with industrial segments in Asia-Pacific and Europe experiencing accelerated adoption of advanced transformers.

By Cooling Type, Oil-Cooled Transformers Lead While Dry-Type Expands Rapidly:

Oil-cooled transformers in 2025 dominated at approximately 13 million units due to reliability in high-capacity applications. Dry-type transformers were fast-growing, reaching about 7.3 million units, reflecting preference for safer, low-maintenance, indoor installations in commercial and residential sectors. Urban infrastructure, renewable energy integration, and environmental regulations are driving dry-type adoption, while oil-cooled transformers continue to dominate industrial and utility networks.

By Capacity, High Voltage Transformers Lead While Medium Voltage Expands Rapidly:

High voltage transformers in 2025 dominated at roughly 8.9 million units, supporting long-distance transmission and large-scale power projects. Medium voltage transformers were fast-growing, totaling around 5.2 million units for distribution networks, commercial, and industrial facilities. Urbanization, rural electrification, and renewable integration drive medium voltage demand, while high voltage transformers maintain dominance for grid stability across Asia-Pacific, Europe, and North America.

By Distribution Channel, Direct Sales Lead While Online Retail Expands Rapidly:

Direct sales in 2025 dominated at around 11.2 million transformer units, driven by utility contracts, industrial agreements, and bulk orders. Online retail and B2B digital platforms were fast-growing, facilitating approximately 4.7 million units for faster procurement, wider accessibility, and adoption of advanced transformers. Expanding e-commerce, digital procurement platforms, and interest in smart transformers are boosting online sales, while direct sales continue to dominate large-scale utility and industrial purchases.

Transformer Market Regional Analysis:

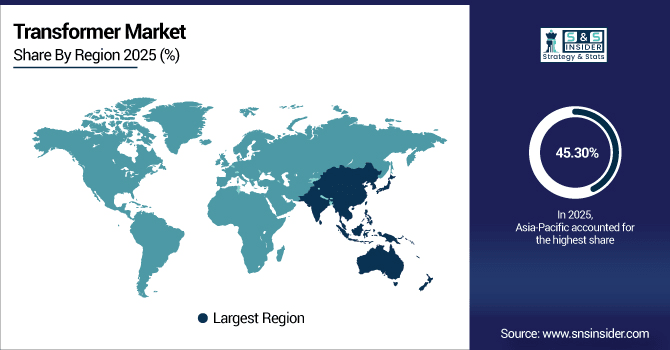

Asia-Pacific Transformer Market Insights:

The Asia-Pacific transformer market accounted for 45.30% of global installations in 2025, totaling over 11.5 million units, with China (5.2 million) and India (3.1 million) leading adoption. Power and distribution transformers dominated the region, while energy-efficient and IoT-enabled models are rapidly expanding. Strong industrialization, urban electrification, and government-backed renewable energy and grid modernization projects are accelerating transformer demand, making Asia-Pacific the largest and fastest-growing regional market globally.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Transformer Market Insights:

In 2025, China accounted for 5.2 million transformer installations, led by power and distribution transformers. Direct sales contributed to most orders, while online B2B platforms facilitated about 1.8 million units. Growth is driven by rapid industrialization, urban electrification, renewable energy projects, and government-backed grid modernization initiatives across the country.

North America Transformer Market Insights:

The North American transformer market installed 5.5 million units in 2025, with the US (3.2 million) and Canada (1.1 million) leading adoption. Growth is driven by industrial expansion, urban electrification, and renewable energy integration. Direct sales remain dominant, while digital procurement platforms facilitated around 1.5 million units. Increasing adoption of energy-efficient, low-loss, and smart transformers is further shaping the region’s market expansion and modernization initiatives.

U.S. Transformer Market Insights:

By 2025, the U.S. installed over 3.2 million transformers from 200+ manufacturers. Direct sales accounted for 2.1 million units, while digital B2B platforms handled 0.9 million. Growth is driven by industrialization, urban electrification, renewable energy projects, and rising adoption of energy-efficient, low-loss, and smart transformers across utilities, commercial, and residential sectors.

Europe Transformer Market Insights:

In 2025, Europe installed 3.7 million transformers, with Germany leading at 1.05 million units, followed by France (0.95 million) and the UK (0.85 million). Direct sales accounted for 2.1 million units, while digital B2B platforms facilitated 0.8 million. Growth is driven by industrial expansion, urban electrification, renewable energy integration, and rising adoption of energy-efficient, low-loss, and smart transformers across utilities, commercial, and residential sectors.

Germany Transformer Market Insights:

In 2025, Germany installed approximately 1.05 million transformers, with 600,000 units supplied through direct sales and 450,000 via digital B2B platforms. Power and distribution transformers dominated, while energy-efficient and smart models gained traction. Industrial growth, urban electrification, and renewable energy projects are driving demand across utilities, commercial, and residential sectors.

Middle East and Africa Transformer Market Insights:

In 2025, the Middle East & Africa installed approximately 1.25 million transformers, with 750,000 units supplied via direct sales and 500,000 through digital B2B platforms. Power and distribution transformers dominated, while energy-efficient and smart models are rapidly gaining traction. The market is driven by industrialization, urban electrification, and renewable energy projects, and is projected to grow at a CAGR of 7.94% through 2033.

Latin America Transformer Market Insights:

In 2025, Latin America installed 0.55 million transformers, with Brazil leading at 0.25 million units, followed by Mexico (0.18 million) and Argentina (0.12 million). Around 0.35 million units were supplied through direct sales, while 0.20 million were facilitated via digital B2B platforms. Industrial growth and renewable energy projects drive demand.

Transformer Market Competitive Landscape:

Siemens Energy AG dominates the transformer market with over 15,000 units installed globally in 2025, serving more than 80 countries. Its transformers range from low-voltage to ultra-high-voltage, supporting over 200 major industrial and utility projects. Siemens is recognized for integrating smart grid solutions, energy-efficient designs, and renewable energy-compatible transformers, enabling millions of consumers worldwide to access reliable and stable electricity infrastructure.

-

In June 2025, Siemens Energy expanded its Nuremberg transformer facility, increasing production capacity to meet rising global demand. The expansion also created 350 new jobs, supporting large transformers for grid modernization and renewable energy projects.

ABB Ltd. has supplied more than 12,500 transformers across 100+ countries as of 2025, powering industrial, commercial, and utility networks. Known for pioneering digital monitoring and low-loss transformer technology, ABB supports thousands of renewable energy projects worldwide. Its transformers are installed in over 150 smart grid initiatives, enabling efficient electricity distribution and reliability across multiple continents, making ABB a leading innovator and trusted provider in the global transformer market.

-

In March 2025, ABB inaugurated a new factory in Albuquerque, New Mexico, focused on manufacturing advanced transformers for power grids. The facility strengthens energy infrastructure and supports utilities and industrial sectors with efficient, reliable transformer solutions.

GE Vernova has delivered over 10,000 transformers globally by 2025, catering to utilities, industrial complexes, and renewable energy projects. Its solutions include high-capacity, energy-efficient, and IoT-enabled transformers, supporting thousands of winds, solar, and data center projects worldwide. GE Vernova’s transformers are integral to modern power grids across 70+ countries, ensuring reliable electricity supply while enabling advanced energy management and smart grid integration.

-

In May 2025, GE Vernova received an order to supply over 70 units of 765 kV transformers to POWERGRID in India. These units will support renewable power transmission and are manufactured at GE Vernova’s Vadodara facility for large-scale energy projects.

Transformer Market Key Players:

Some of the Transformer Market Companies are:

-

Siemens Energy AG

-

ABB Ltd.

-

General Electric Company (GE Vernova)

-

Mitsubishi Electric Corporation

-

Schneider Electric SE

-

Hitachi Energy Ltd.

-

Toshiba Energy Systems & Solutions Corporation

-

Hyundai Electric & Energy Systems Co., Ltd.

-

Eaton Corporation

-

CG Power and Industrial Solutions Ltd.

-

Bharat Heavy Electricals Limited (BHEL)

-

Hyosung Power & Industrial Systems Performance Group

-

Wilson Power Solutions

-

Prolec GE Waukesha

-

Wilson Transformer Company

-

Olsun Electrics

-

Elsco Transformers

-

Hammond Power Solutions

-

Eurogulf Transformers

-

JSHP Transformer

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 66.33 Billion |

| Market Size by 2033 | USD 110.38 Billion |

| CAGR | CAGR of 6.60% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Power Transformers, Distribution Transformers, Instrument Transformers, Others) • By Application (Industrial, Utilities, Commercial, Residential, Others) • By Cooling Type (Oil-Cooled, Dry-Type, Others) • By Capacity (Low Voltage, Medium Voltage, High Voltage) • By Installation Type (Indoor, Outdoor) • By Distribution Channel (Direct Sales, Distributors, Online, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Siemens Energy AG, ABB Ltd., General Electric Company (GE Vernova), Mitsubishi Electric Corporation, Schneider Electric SE, Hitachi Energy Ltd., Toshiba Energy Systems & Solutions Corporation, Hyundai Electric & Energy Systems Co., Ltd., Eaton Corporation, CG Power and Industrial Solutions Ltd., Bharat Heavy Electricals Limited (BHEL), Hyosung Power & Industrial Systems Performance Group, Wilson Power Solutions, Prolec GE Waukesha, Wilson Transformer Company, Olsun Electrics, Elsco Transformers, Hammond Power Solutions, Eurogulf Transformers, JSHP Transformer |