Hydrogen Electrolyzer Market Report Scope & Overview:

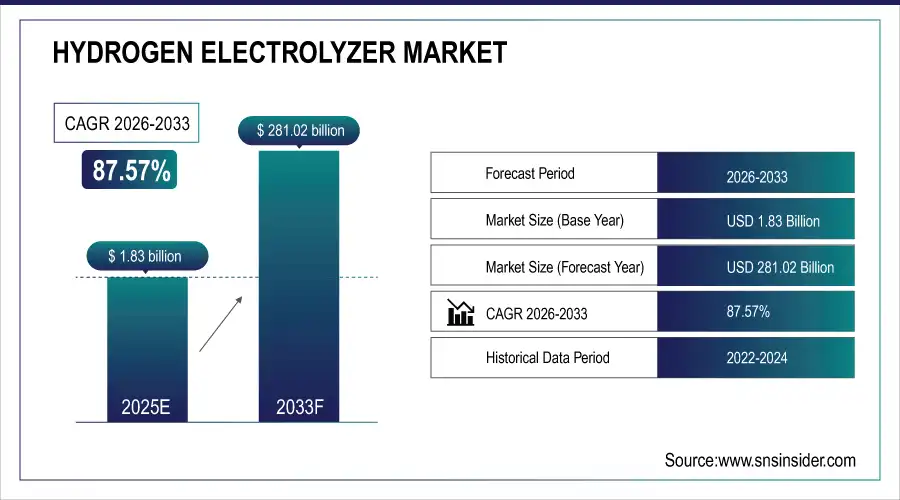

The Hydrogen Electrolyzer Market Size was valued at USD 1.83 billion in 2025E and is expected to reach USD 281.02 billion by 2033, growing at a CAGR of 87.57% over the forecast period of 2026-2033.

To Get more information On Hydrogen Electrolyzer Market - Request Free Sample Report

The Hydrogen Electrolyzer Market is experiencing robust growth due to a convergence of technological, regulatory, and industrial factors. A major driver is the rapid global transition toward green hydrogen, fueled by net-zero commitments and stringent carbon reduction targets in regions such as Europe, North America, and Asia-Pacific. Governments are actively supporting electrolyzer deployment through subsidies, tax incentives, and hydrogen roadmap initiatives, which de-risk investments and encourage large-scale project development. Technological innovation is also a key factor, with advancements in PEM and AEM electrolyzers improving efficiency, reducing reliance on scarce catalysts, and enabling modular, scalable solutions for industrial and mobility applications.

For instance, under the National Green Hydrogen Mission (NHM), the Indian government has allocated approximately USD 2.1 billion to incentivize the domestic manufacturing of electrolysers and the production of green hydrogen. This initiative aims to bolster the country's capabilities in producing 15 GW of electrolyzer capacity by 2030.

Market Size and Forecast:

-

Hydrogen Electrolyzer Market Size in 2025E: USD 1.83 Billion

-

Hydrogen Electrolyzer Market Size by 2033: USD 281.02 Billion

-

CAGR: 87.57% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

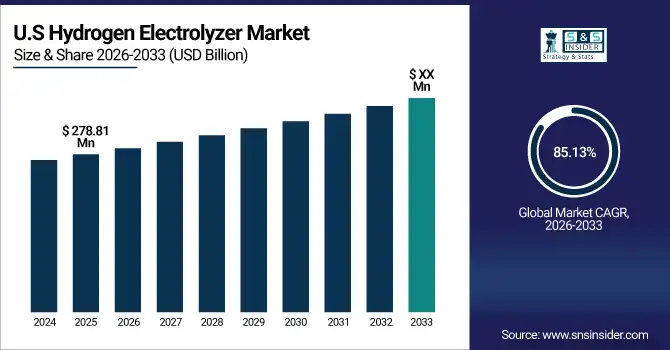

U.S. Hydrogen Electrolyzer Market Insights

The U.S. market is valued at USD 278.81 Million in 2025 and is projected to grow at a CAGR of 85.13% through 2033. Federal funding, tax incentives, and grants support large-scale electrolyzer deployment in industrial and mobility sectors. Major projects include green hydrogen production for fuel cell vehicles, industrial decarbonization in steel and chemicals, and integration with utility-scale renewable energy. Expansion of hydrogen hubs, such as in California and Texas, and private investments in electrolyzer manufacturing capacity further strengthen the market. Companies are increasingly adopting PEM and AEM electrolyzers due to their efficiency and modular design.

Key Hydrogen Electrolyzer Market Trends

-

Rising adoption of green hydrogen and renewable-based electrolyzers, driven by global decarbonization initiatives and net-zero targets.

-

Growth in deployment of large-scale industrial and mobility electrolyzer projects, including steel, ammonia, chemical production, and hydrogen fuel cell transportation.

-

Increasing government incentives, subsidies, and funding for domestic electrolyzer manufacturing, particularly in Europe, North America, and Asia-Pacific, to promote local production and technology development.

-

Expansion of advanced electrolyzer technologies, such as PEM, AEM, and SOE, with improved efficiency, durability, and modularity for both distributed and utility-scale applications.

-

Rising collaboration between electrolyzer manufacturers, industrial end-users, and renewable power producers to develop integrated hydrogen production ecosystems and hydrogen hubs.

-

Integration of digital monitoring, predictive maintenance, and IoT-enabled solutions to optimize electrolyzer performance, reduce downtime, and ensure operational safety.

Hydrogen Electrolyzer Market Growth Driver

-

Government Incentives and Policy Support Drive the Market Growth.

Governments across regions are actively driving the adoption of electrolyzer technologies through policies, grants, and subsidies aimed at reducing carbon emissions. In Europe, the European Commission allocated over €3.4 billion under the “Important Projects of Common European Interest” (IPCEI) for hydrogen, which includes funding for electrolyzer manufacturing and large-scale deployment. In North America, the U.S. Inflation Reduction Act provides up to $3 per kg of clean hydrogen, incentivizing private companies to invest in electrolyzer production and green hydrogen projects. In Asia-Pacific, India’s National Green Hydrogen Mission has committed ₹17,490 crore (~$2.1 billion) to develop 15 GW of domestic electrolyzer capacity by 2030. These combined measures stimulate market expansion, encourage technology innovation, and lower adoption barriers for industrial, mobility, and energy applications.

Hydrogen Electrolyzer Market Restraint

High Capital and Operational Costs May Hamper the Market Growth.

Electrolyzers require substantial initial investments in equipment, renewable electricity integration, and specialized infrastructure, limiting adoption for smaller players. In Europe, a mid-sized PEM electrolyzer company delayed a large-scale expansion due to high upfront costs despite EU funding support. In North America, green hydrogen projects often face high installation and operational costs, particularly for large-scale electrolyzers connected to intermittent renewable energy sources. Similarly, in Asia, while subsidies exist, the cost of imported components and skilled labor can increase project expenses. These high capital requirements and ongoing operational costs remain a key challenge for widespread deployment, especially in emerging markets.

Hydrogen Electrolyzer Market Opportunity

Expansion into Emerging Markets and Industrial Applications Create the Opportunity for the Market

Emerging economies offer tremendous potential due to rising industrial demand, renewable energy capacity, and government support. In India, Reliance Industries announced a $10 billion investment in 2025 to build a 300 MW electrolyzer manufacturing facility, supported by the National Green Hydrogen Mission. In Europe, Germany and Spain are developing “hydrogen valleys,” where renewable energy and electrolyzer production are integrated to supply industrial clusters, supported by multi-billion euro government grants. In North America, companies like Plug Power are expanding electrolyzer production to supply hydrogen for mobility and industrial applications. These initiatives highlight opportunities for both regional expansion and the creation of integrated hydrogen ecosystems, enabling electrolyzers to penetrate energy, industrial, and transport sectors globally.

Hydrogen Electrolyzer Market Segment Highlights:

-

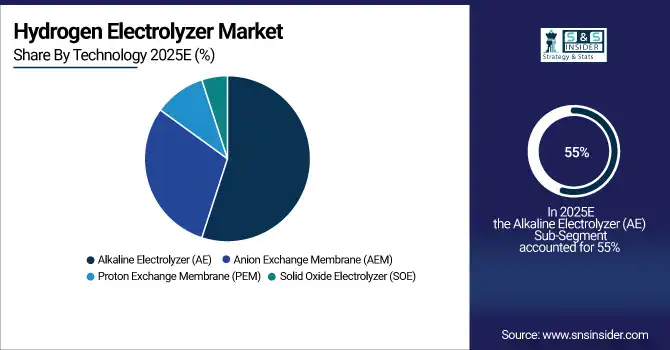

By Technology: Alkaline Electrolyzer (AE) – 55% share (largest); PEM fastest-growing at 92% CAGR, driven by high-efficiency and modular deployments.

-

By Application: Energy – Power Generation – 38% share (largest); Mobility fastest-growing at 95% CAGR, supported by fuel cell vehicle adoption and refueling infrastructure.

-

By Power Generation Capacity: >2,000 kW – 45% share (largest); 500–2,000 kW fastest-growing at 88% CAGR due to industrial-scale projects.

Hydrogen Electrolyzer Market Segment Analysis

By Technology

Alkaline Electrolyzer (AE) continues to dominate the market with a 55% share in 2025, owing to its mature technology, cost-effectiveness, and widespread adoption in large-scale industrial and energy projects. Proton Exchange Membrane (PEM) is the fastest-growing segment, projected at a CAGR of 92%, driven by high efficiency, modular design, and suitability for mobility applications like hydrogen fuel cell vehicles. Growth is further supported by ongoing R&D, improved stack durability, and increasing investment in PEM electrolyzer manufacturing facilities across Europe, North America, and Asia-Pacific. SOE and AEM technologies are emerging segments, gaining traction for specialized high-temperature applications and cost-efficient green hydrogen production.

By Application

Energy – Power Generation leads the market with a 38% share in 2025, driven by integration of electrolyzers with renewable energy projects, grid balancing, and large-scale green hydrogen production for industrial and municipal use. Mobility is the fastest-growing sub-segment, with a CAGR of 95%, fueled by the rising adoption of hydrogen fuel cell buses, trucks, and trains. Growth is also supported by public-private investments in hydrogen refueling infrastructure, especially in Europe and North America, and increasing government targets for zero-emission transport. Industrial applications, including chemical, steel, and ammonia production, are showing steady adoption due to the push for low-carbon feedstocks.

By Power Generation Capacity

Electrolyzers with >2,000 kW capacity held the largest share at 45% in 2025, reflecting demand for utility-scale and industrial hydrogen production. The 500–2,000 kW segment is the fastest-growing, with a CAGR of 88%, driven by flexible, medium-scale industrial applications and integration with large renewable energy projects. Small-scale electrolyzers (<500 kW) are increasingly adopted for distributed energy and mobility refueling projects, supporting regional and local green hydrogen ecosystems. Growth in this segment is further fueled by declining renewable electricity costs and modular system designs.

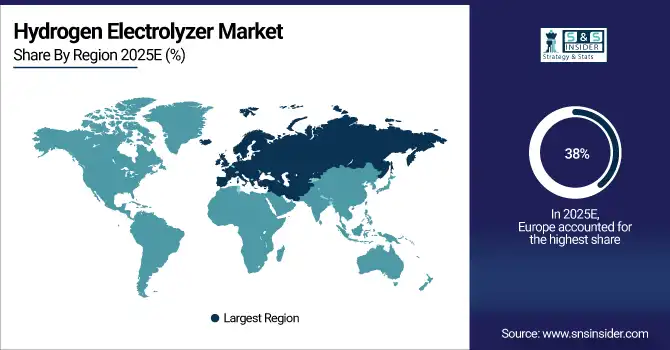

Hydrogen Electrolyzer Market Regional Analysis

Europe Hydrogen Electrolyzer Market Insights

Europe dominates the global market with 38% share in 2025, supported by strong government policy frameworks like the EU Green Deal and IPCEI (Important Projects of Common European Interest), which fund electrolyzer manufacturing and large-scale green hydrogen deployment. Germany, France, and the Netherlands are leading the region, investing in industrial-scale PEM and alkaline electrolyzers for chemical, steel, and mobility applications. Well-established renewable energy infrastructure, supportive regulations, and industrial decarbonization targets drive adoption. Partnerships between governments and private companies, as well as strategic investments in hydrogen refuelling stations, reinforce Europe’s leadership in the electrolyzer market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific Hydrogen Electrolyzer Market Insights

Asia-Pacific holds 30% of the global market in 2025 and is the fastest-growing region due to rapid industrialization, renewable energy adoption, and government initiatives promoting green hydrogen. Countries such as China, Japan, and South Korea are investing heavily in electrolyzer manufacturing, building hydrogen hubs, and integrating renewable energy sources with electrolysis projects. Government programs, subsidies, and grants encourage domestic production and private-sector investment in mobility and industrial applications. For instance, China is targeting 5 GW of electrolyzer capacity by 2030, with multiple PEM and alkaline electrolyzer facilities under construction. The region’s growth is further boosted by industrial decarbonization mandates and private investments in hydrogen-powered transport solutions.

North America Hydrogen Electrolyzer Market Insights

North America accounts for 20% of the market in 2025, with the U.S. leading growth. Government policies such as the Inflation Reduction Act provide tax credits and incentives for green hydrogen projects, significantly lowering investment risk for large-scale PEM and alkaline electrolyzers. Companies like Plug Power, Bloom Energy, and Cummins are expanding electrolyzer production capacity and developing mobility hydrogen refueling networks. Industrial adoption in chemical, steel, and ammonia production, combined with renewable energy integration, drives regional growth. The market is also supported by federal R&D programs and state-level green hydrogen initiatives, making North America a key player in global electrolyzer expansion.

Latin America (LATAM) and Middle East & Africa (MEA) Hydrogen Electrolyzer Market Insights

LATAM (5% share) and MEA (7% share) are emerging regions, showing significant growth potential. Brazil leads LATAM, investing in industrial hydrogen applications and electrolyzer production. Chile and Argentina are developing renewable-linked hydrogen projects and pilot electrolyzer facilities. In MEA, countries such as UAE and Saudi Arabia are investing in large-scale green hydrogen plants, hydrogen mobility projects, and industrial decarbonization initiatives. Government policies promoting renewable energy and hydrogen exports, along with rising industrial demand, make these regions strategically important for market expansion. Private-sector investments and international collaborations further accelerate growth.

Competitive Landscape for Hydrogen Electrolyzer Market:

Plug Power Inc.

Plug Power specializes in providing alternative energy technology, focusing on hydrogen fuel cell systems and electrolyzers.

-

In July 2025, Plug Power Inc. commissioned a 100 MW PEM electrolyzer plant in New York, capable of producing up to 45 tons of green hydrogen daily, supporting heavy transport and industrial decarbonization.

Air Liquide & TotalEnergies

Air Liquide is a global leader in gases, technologies, and services for industry and health, while TotalEnergies is a multinational integrated energy company.

-

In February 2025, Air Liquide & TotalEnergies announced a joint investment of over €1 billion to develop two large-scale, low-carbon hydrogen production plants in the Netherlands, including a 200 MW electrolyzer in Rotterdam and a 250 MW electrolyzer in Zeeland.

Bosch Group

Bosch is a multinational engineering and technology company, known for its innovations in various sectors, including mobility solutions and energy technologies.

-

In March 2025, Bosch Group commenced production of components for electrolysers, aiming to generate billions in hydrogen revenue by 2030.

Woodside Energy

Woodside Energy is an Australian oil and gas company, focusing on energy production and the development of sustainable energy solutions.

-

In September 2025, Woodside Energy, formed a partnership with Japan Suiso Energy and Kansai Electric Power Co to establish a liquid hydrogen supply chain between Australia and Japan, with a proposed production capacity of up to 100 tonnes of liquid hydrogen per day.

Hydrogen Electrolyzer Market Key Players

Some of the Hydrogen Electrolyzer Companies

-

Nel Hydrogen

-

Siemens Energy

-

Thyssenkrupp Nucera

-

John Cockerill

-

Plug Power Inc.

-

Enapter

-

HydrogenPro

-

ITM Power

-

Sunfire GmbH

-

McPhy Energy

-

LONGi Green Energy

-

Bloom Energy

-

Cummins Inc.

-

Asahi Kasei Corporation

-

PERIC Hydrogen Technologies

-

Beijing SinoHy Energy Co., Ltd.

-

Green Hydrogen Systems

-

Giner Inc.

-

H-TEC Systems GmbH

-

Ohmium International

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD1.83 Billion |

| Market Size by 2033 | USD 281.02 Billion |

| CAGR | CAGR of87.57% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Alkaline Electrolyzer (AE), Proton Exchange Membrane (PEM), Solid Oxide Electrolyzer (SOE), Anion Exchange Membrane (AEM)) • By Application (Energy – Power Generation, CHP, Mobility, Industrial – Chemical, Industries, Grid Injection) • By Power Generation (<500 kW, 500–2,000 kW, >2,000 kW) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Nel Hydrogen, Siemens Energy, Thyssenkrupp Nucera, John Cockerill, Plug Power Inc., Enapter, HydrogenPro, ITM Power, Sunfire GmbH, McPhy Energy, LONGi Green Energy, Bloom Energy, Cummins Inc., Asahi Kasei Corporation, PERIC Hydrogen Technologies, Beijing SinoHy Energy Co., Ltd., Green Hydrogen Systems, Giner Inc., H-TEC Systems GmbH, Ohmium International |