Solar Pumps Market Report Scope & Overview:

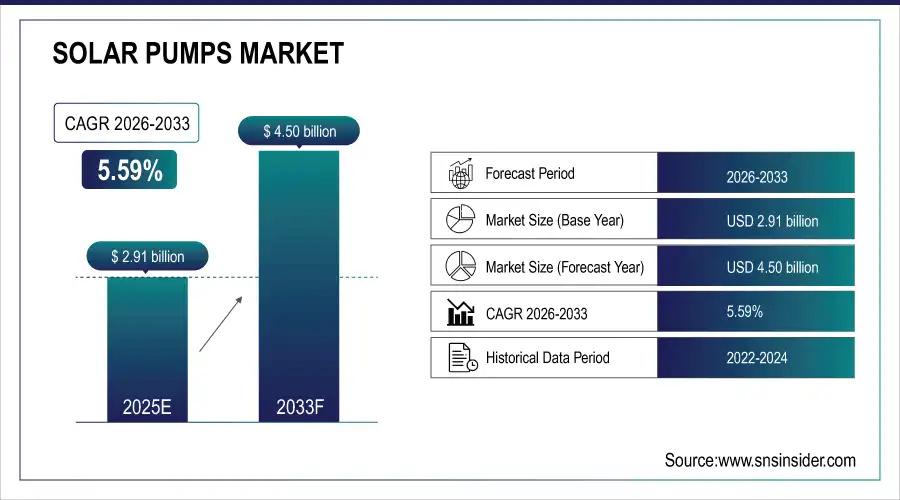

The Solar Pumps Market size was valued at USD 2.91 Billion in 2025E and is expected to reach USD 4.50 Billion by 2033, growing at a CAGR of 5.59% over 2026–2033.

The market is experiencing strong growth, propelled by surging demand for sustainable irrigation solutions, expanding rural electrification programs, and technological advancements in photovoltaic and pump systems. Adoption is widespread in agriculture, livestock watering, and rural potable water supply, delivering operational savings and improved accessibility where conventional power sources are unavailable. As costs decline and government incentives expand, solar pumps are set to revolutionize off-grid water management across key regions.

The Solar Pumps Market is witnessing robust growth fueled by rising demand for reliable and eco-friendly water pumping in agriculture and remote areas. Expanding applications in crop irrigation, community water supply, and livestock management are driving market expansion. Advances in solar technology, real-time monitoring, and government subsidy programs are enhancing efficiency and affordability, helping farmers and rural communities transition from diesel and grid-powered pumps to cost-effective solar solutions.

Solar Pumps Market Size and Forecast:

-

Market Size in 2025E: USD 2.91 Billion

-

Market Size by 2032: USD 4.50 Billion

-

CAGR: 5.59% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Solar Pumps Market - Request Free Sample Report

Key Solar Pumps Market Trends:

-

Adoption of solar-powered pumping systems in agriculture is rising as water scarcity, high diesel costs, and grid unreliability increase demand for decentralized solutions.

-

Government subsidy programs and rural electrification initiatives are boosting large-scale solar pump deployments in developing regions.

-

Efficiency improvements in PV modules and lower solar panel costs are making solar pumps more accessible for small farms and remote applications.

-

Integration of IoT and remote monitoring technologies enables predictive maintenance, water usage optimization, and enhanced operational efficiency.

-

Demand is growing for multi-functional solar pumps suited to livestock watering, drinking water supply, and micro-irrigation.

-

Expansion in commercial and community water supply projects is broadening the adoption of solar pumps beyond traditional farm usage.

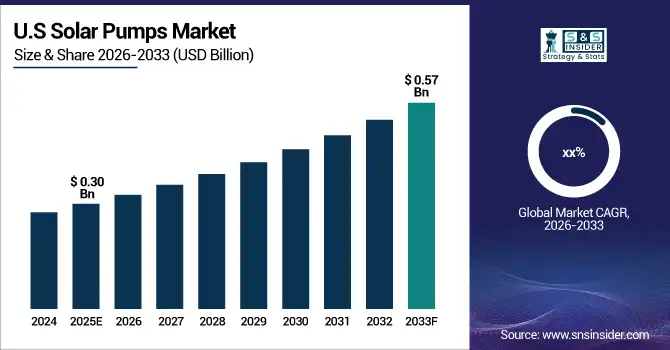

U.S. Solar Pumps Market Insights

The U.S. Solar Pumps Market size was USD 0.30 Billion in 2025E and is expected to reach USD 0.57 Billion by 2033. According to a study, intensifying drought conditions are driving farmers to invest in solar pumping systems that can reduce irrigation energy costs by up to 25%. This cause, persistent climate risks, effects accelerated adoption of energy-efficient solar pumps for agricultural and livestock needs. Integration of digital tracking and remote management tools supports sustainable, cost-effective operations, providing farmers with actionable insights and reliable water access in periods of grid instability.

Solar Pumps Market Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts Solar Pumps Market Growth

Governments worldwide expanded green energy incentives and promoted eco-friendly water management practices. This cause, rising awareness of climate change and increasing energy costs, effects widespread adoption of solar pumps across agricultural, industrial, and municipal sectors. Farmers and rural communities shift from diesel-powered pumps to solar alternatives for irrigation and potable water supply, curtailing carbon emissions and reducing dependency on fossil fuels. The strong policy backing and tangible operational savings stimulate investment in solar pump technologies. With environmental regulations growing stricter, businesses and end-users are incentivized to invest in sustainable pumping solutions.

For example, India’s National Solar Mission, updated in May 2025, unlocked new subsidies for solar agricultural pumps, resulting in a 22% year-over-year increase in installations and providing rural communities with affordable, emission-free water access.

Solar Pumps Market Restraints:

-

High Upfront Investment and Limited Technical Know-How Hinder Market Expansion for Solar Pumps

Farmer surveys revealed persistent barriers to solar pump adoption, including high initial setup costs and lack of hands-on training. This cause, limited financing options and technical expertise in rural regions, effects slow market penetration among smallholder farmers and low-income communities. Although solar pumps provide long-term savings, the heavy upfront investment is prohibitive for many without external support. Insufficient awareness, maintenance capabilities, and complexity in handling IoT-enabled systems further discourage wide-scale adoption, particularly in Latin America and Sub-Saharan Africa.

For instance, a survey conducted in Brazil in December 2024 found that nearly 45% of farmers cited installation costs as their main obstacle to converting from diesel to solar pumps, despite acknowledging potential fuel savings.

Solar Pumps Market Opportunities:

-

Rising IoT Integration and Cloud-Connected Farm Platforms Unlock Growth in Next-Generation Solar Pumps

Smart solar pumps with real-time IoT integration and cloud-based diagnostics entered large-scale agribusiness operations in North America. This cause, mounting adoption of precision agriculture and digital farm management tools, effects a new wave of connectivity-enabled solar pumps that empower predictive maintenance, energy optimization, and collaborative water management. Manufacturers are leveraging cloud solutions to enable multi-site data visualization, remote troubleshooting, and efficiency benchmarking, opening recurring revenue streams for bundled service offerings. The combination of AI-driven analytics and solar pumping advances elevates farm productivity and resource conservation.

For example, a U.S.-based agritech company launched cloud-integrated solar pumping systems in June 2025, which helped commercial farms cut water usage by 18% and reduce energy costs through remote control optimization.

Solar Pumps Market Segment Analysis:

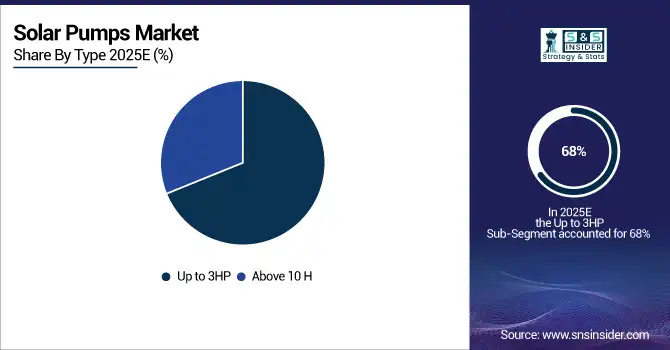

By Type, Up to 3HP Solar Pumps Dominate While Above 10HP Segment Registers Fastest Growth

The Up to 3HP segment accounts for a dominant 68% share of revenue in 2025E. This cause, growing preference for affordable, low-power pumps for small farms and rural potable water projects, effects widespread adoption in water-scarce and off-grid regions. Technological improvements, such as robust PV panel integration and simplified maintenance, further strengthen the segment’s performance, enabling cost savings for budget-focused end-users. Up to 3HP pumps are easy to install, operate, and maintain, positioning them as the preferred choice for small-scale irrigation and livestock watering applications, and securing their market leadership.

Above 10HP solar pumps are growing at the largest CAGR of 8.36% over the forecast period. This cause, increasing demand for high-capacity solutions in commercial agriculture, large dairy farms, and community water supply, effects accelerated investment in powerful pump models with advanced monitoring and hybrid grid integration. Manufacturers focus on improving efficiency and reliability for continuous operation, driving adoption among large landholders and agricultural cooperatives expanding irrigated acreage and scaling livestock production.

By Motor Type, AC Pumps Lead Market While DC Pumps Register Fastest Growth

AC Pump segments dominate with a largest share of 72% revenue in 2025E. This cause, traditional compatibility with agricultural infrastructure and high reliability, effects strong preference for AC-powered solar pump systems in existing farms and rural schemes. Advances in inverter technology and energy management have improved AC pump efficiency, supporting robust irrigation and livestock applications in diverse climates. Established supply chains and servicing further reinforce the segment’s sustained market lead.

DC solar pumps are growing at the largest CAGR of 9.70% over the forecast period. This cause, surging adoption of direct solar-powered solutions for portable, decentralized use, effects rapid uptake for off-grid irrigation, mobile watering units, and small-scale applications. DC pumps offer direct PV module integration, flexible deployment, and minimal maintenance, making them popular among tech-driven farms and rural communities seeking scalable, low-cost irrigation with IoT compatibility.

By Product, Submersible Pumps Dominate While Surface Suction Pumps Register Fastest Growth

The Submersible Pumps segment represents a commanding 68% revenue share in 2025E. This cause, rising need for efficient groundwater extraction in agriculture and rural development, effects strong performance in deep well applications and community water supply projects. Advances in waterproof motor design, higher flow rates, and remote monitoring ensure broad applicability, positioning submersible pumps as the backbone of the Solar Pumps Market.

Surface Suction pumps are growing at the largest rate over the forecast period. This cause, growing implementation in shallow water sourcing and open channel irrigation, effects rising deployments in smallholder farms, drip systems, and livestock watering. Recent developments in pump materials and modular electronics make surface suction pumps ideal for cost-effective, real-time water management in remote areas and fragmented agricultural holdings.

By Application, Agricultural Pumps Lead Market While Drinking Water Segment Registers Fastest Growth

Agricultural applications dominate with a 64% share in 2025E. This cause, increasing adoption of solar-powered pumps for crop irrigation, livestock watering, and precision farming operations, effects significant energy savings and improved agricultural productivity. Solar pumps help farmers mitigate drought risks, maximize yields, and ensure sustainable water management under variable climate conditions, reinforcing agriculture as the primary market driver.

The Drinking Water segment is growing fastest over the forecast period. This cause, expanding efforts to deliver reliable potable water supply to rural and remote communities, effects increasing installation of solar pumps in decentralized, off-grid locations. Product developments in ruggedized pump systems and hybrid power solutions support safe drinking water projects and community water kiosks, driving growth beyond traditional farm usage.

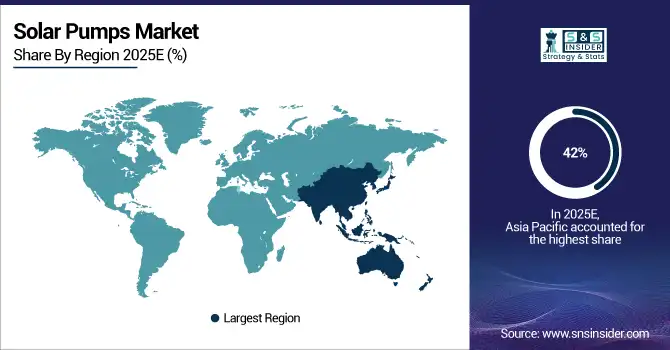

Solar Pumps Market Regional Analysis

Asia Pacific Dominates Solar Pumps Market in 2025E

Asia Pacific commands an estimated 42% share of the global solar pumps market in 2025E, driven by strong government-backed irrigation schemes, rising food demand, and ambitious rural electrification programs. The region benefits from large-scale agricultural modernization, particularly in developing economies, where solar pumps provide affordable and sustainable alternatives to diesel or grid-powered systems. Extensive subsidy programs and state-led projects ensure mass adoption, making Asia Pacific the largest revenue contributor and a trendsetter in global solar irrigation.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Leads Asia Pacific’s Solar Pumps Market

China dominates Asia Pacific with its aggressive renewable energy policies, large-scale rural modernization plans, and subsidized deployment of solar irrigation solutions. Backed by massive government funding and technological advancements in photovoltaic-pump integration, China is spearheading sustainable irrigation. Pilot projects, state partnerships, and innovative manufacturing ecosystems accelerate adoption across farms and rural communities. With its focus on increasing food security, improving water access, and reducing carbon emissions, China continues to be the region’s solar pump powerhouse, generating substantial market growth.

North America is the Fastest-Growing Region in Solar Pumps Market in 2025E

North America is expected to register the fastest growth with a projected CAGR of 8.76% in 2025E, fueled by the rapid adoption of precision agriculture technologies and climate adaptation programs. Widespread use of solar pumps for livestock watering, irrigation, and remote water supply is gaining traction across the U.S. and Canada. Supportive renewable energy incentives, technological R&D, and infrastructure modernization drive adoption. Growing awareness among farmers about cost savings and climate resilience further enhances North America’s leadership in solar pumps growth.

-

United States Leads North America’s Solar Pumps Market

The United States dominates North America’s solar pumps sector due to strong federal renewable energy incentives, investments in sustainable rural infrastructure, and advanced R&D in solar and pumping technologies. Drought-prone states, conservation programs, and water scarcity challenges have created significant demand for efficient, off-grid irrigation solutions. Climate adaptation measures, increasing farmer awareness, and government-backed subsidies continue to drive installations. With a thriving agricultural economy and large-scale adoption in livestock and crop irrigation, the U.S. leads the region’s solar pumps expansion.

Europe Solar Pumps Market Insights, 2025E

Europe holds a considerable market share in 2025E, supported by eco-centric farming practices, strict environmental regulations, and sustained research in water-efficient technologies. Solar pumps are increasingly adopted to reduce dependence on fossil fuels and ensure groundwater conservation. With active support from EU sustainability frameworks, adoption spans across both agricultural and municipal applications. Regional governments are incentivizing renewable water solutions, further boosting demand. Europe’s strong sustainability culture and advanced infrastructure ensure consistent market penetration and a continued shift toward green irrigation technologies.

-

Germany Leads Europe’s Solar Pumps Market

Germany dominates Europe’s solar pump adoption, supported by strict groundwater management regulations, a strong renewable energy grid, and advanced smart pump technologies. The nation’s sustainability-first approach drives substantial investments in solar-powered water management for both agricultural and municipal purposes. Government incentives and subsidies encourage smallholder adoption, while urban municipalities deploy solar solutions for water distribution efficiency. Germany’s role as a renewable energy leader ensures that solar pumps remain integral to its eco-centric strategies, securing ongoing growth and market leadership across Europe.

Middle East & Africa and Latin America Solar Pumps Market Insights, 2025E

In 2025E, both the Middle East & Africa (MEA) and Latin America demonstrate steady growth in solar pumps adoption, propelled by climate challenges, irrigation demands, and rural electrification initiatives. Governments in arid and semi-arid regions are promoting solar pumps to tackle water scarcity and reduce fossil fuel dependency. Subsidies and pilot projects play a major role in adoption. These regions leverage solar irrigation for food security, livestock, and municipal water supply, ensuring steady expansion in sustainable agricultural infrastructure and rural development.

-

Brazil and UAE Drive Regional Markets

Brazil leads Latin America’s solar pumps market, capitalizing on its vast agricultural exports, pasture-based farming, and demand for affordable irrigation solutions. Government policies, alongside private sector investment, support large-scale deployment of solar water systems. In MEA, the UAE dominates with desert farming projects, innovative water management technologies, and commitments to national food security. Heavy investment in agricultural modernization and renewable water systems drives rapid adoption. Both Brazil and UAE showcase how policy-driven initiatives and climate resilience strategies shape solar pump market growth.

Competitive Landscape for the Solar Pumps Market:

Alpex Solar Pumps

Alpex Solar Pumps is a global leader in solar-powered water pump solutions, offering reliable products for agriculture, drinking water, and industrial applications. Founded over two decades ago, Alpex enables efficient water management through advanced PV modules, durable motors, and scalable system configurations. Operating in more than 30 countries, Alpex actively partners with governments and NGOs to deploy subsidized solar pumps, supporting sustainable development in remote and water-scarce regions. Its role in the solar pumps market is vital, enabling farmers and communities to transition from diesel-driven to green energy-based water access.

-

In April 2025, Alpex launched a new portfolio of IoT-enabled submersible pumps, integrating cloud-based performance diagnostics for large farm operations.

Aqua Group

Aqua Group specializes in comprehensive solar pump systems for agricultural, livestock, and rural potable water needs. With a robust portfolio covering both AC and DC pump models, Aqua Group manufactures reliable products designed to withstand harsh environments. Operating from India, the company delivers scalable solutions through nationwide dealer networks, supporting mass deployment in regions undergoing solarization. Aqua’s commitment to research, durability, and aftersales service ensures enduring market presence and customer loyalty.

-

In March 2025, Aqua Group introduced modular solar surface pumps with improved energy efficiency and plug-and-play configuration for rapid rural installations.

Bright Solar Limited

Bright Solar Limited is a pioneering manufacturer of solar pumping systems with a focus on high-efficiency PV modules and innovative pump integration. Headquartered in India, the company serves demanding markets in agriculture, public water supply, and industrial segments. Bright Solar’s products are distinguished by robust build quality, extended warranties, and remote monitoring capabilities. By partnering with regional distributors, the company accelerates solar pump adoption, helping farmers optimize irrigation and minimize operational expenditures.

-

In May 2025, Bright Solar Limited debuted the next-generation DC pump series, featuring advanced telemetry for remote system performance tracking.

C.R.I. Pumps Private Limited

C.R.I. Pumps Private Limited stands as a leading supplier of solar and water pumping solutions across global markets. The firm is renowned for its wide-ranging portfolio from submersible and surface pumps to hybrid solar pump solutions. C.R.I. empowers farmers and rural communities with cost-effective, sustainable pumping systems backed by state-of-the-art engineering. The company actively invests in R&D to enhance solar pump efficiency, reliability, and lifecycle value, establishing itself as a key player for both small and large-scale agricultural water management.

-

In February 2025, C.R.I. Pumps Private Limited rolled out high-capacity solar submersible models tailored for commercial farm and municipal water projects, integrating advanced inverter technology for maximum efficiency.

Solar Pumps Market Key Players:

-

Alpex Solar Pumps

-

Aqua Group

-

Bright Solar Limited

-

C.R.I. Pumps Private Limited

-

Crompton

-

LORENTZ

-

Dankoff Solar

-

Duke Plasto Technique Private Limited

-

EcoSoach

-

Ecozen Solutions

-

Franklin Electric

-

Grundfos

-

Jackson Group

-

K.S.B.Limited

-

Novergy Energy Solutions Pvt. Ltd.

-

Shakti Pumps

-

SunEdison Infrastructure

-

Surya International

-

Tata Power Solar

-

Waaree Energies Ltd

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 2.91 Billion |

| Market Size by 2032 | US$ 4.50 Billion |

| CAGR | CAGR of 5.59 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Up to 3HP, Above 10HP) • By Motor Type (AC Pump, DC Pump) • By Product (Surface Suction, Submersible, Floating) • By Application (Agricultural, Drinking Water, Municipal Engineering) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Alpex Solar Pumps, Aqua Group, Bright Solar Limited, C.R.I. Pumps Private Limited, Crompton, LORENTZ, Dankoff Solar, Duke Plasto Technique Private Limited, EcoSoach, Ecozen Solutions, Franklin Electric, Grundfos, Jackson Group, K.S.B. Limited, Novergy Energy Solutions Pvt. Ltd., Shakti Pumps, SunEdison Infrastructure, Surya International, Tata Power Solar, Waaree Energies Ltd., and others. |