Small Modular Reactor Market Report Scope & Overview:

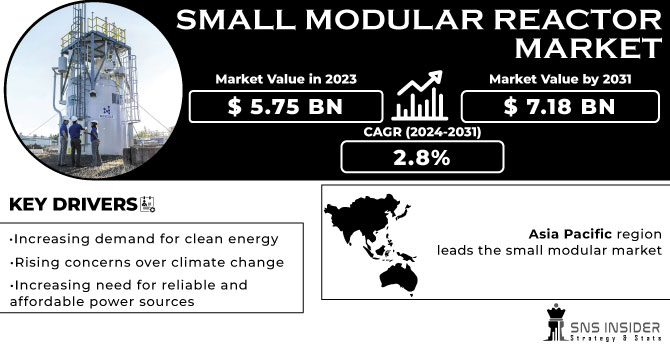

The Small Modular Reactor Market size was valued at USD 5.75 billion in 2023 and is expected to grow to USD 7.37 billion by 2032 and grow at a CAGR of 2.8% over the forecast period of 2024-2032.

The Small Modular Reactor (SMR) market is a rapidly growing industry that is gaining traction in the energy sector. SMRs are a type of nuclear reactor that is smaller in size and has a lower power output than traditional nuclear reactors. SMRs are typically less than 300 megawatts in capacity, which makes them easier to transport and install in remote locations. They are designed to be more flexible and cost-effective, making them an attractive option for countries and companies looking to diversify their energy portfolios. They use advanced technologies such as passive cooling systems and advanced fuel designs to reduce the risk of accidents and improve overall performance.

Get More Information on Small Modular Reactor Market - Request Sample Report

One of the main advantages of SMRs is their flexibility. They can be used to power small communities, remote industrial sites, or even military bases. They can also be used to supplement existing power grids during peak demand periods. One of the key advantages of SMRs is their ability to be deployed in remote locations, providing power to areas that may not have access to traditional energy sources. They are also designed to be safer and more secure than traditional nuclear reactors, with advanced safety features and built-in security measures. As the demand for clean energy continues to grow, the SMR market is poised to play a significant role in meeting this demand. With their smaller size, flexibility, and cost-effectiveness, SMRs offer a promising solution for countries and companies looking to transition to a more sustainable energy future. Despite their many advantages, SMRs are still a relatively new technology and there are some challenges that need to be addressed. These include regulatory hurdles, high upfront costs, and public perception issues. However, as the demand for clean, reliable energy continues to grow, SMRs are likely to play an increasingly important role in the global energy mix.

Market Dynamics

Drivers

-

Increasing demand for clean energy

-

Rising concerns over climate change

-

Increasing need for reliable and affordable power sources

The small modular reactor market is experiencing growth due to the increasing demand for reliable and affordable power sources. This trend is driven by the need for sustainable energy solutions that can meet the growing energy demands of modern society. As a result, the market for small modular reactors is expanding rapidly, with many companies investing in research and development to create innovative and efficient solutions. This growth is expected to continue in the coming years, as more countries and industries recognize the benefits of small modular reactors for meeting their energy needs.

Restrain

-

Regulatory hurdles associated with the small modular reactor market

-

High capital costs are required for the

Opportunities

-

Expansion of the small modular reactor market into new regions

-

Emergence of new applications for small modular reactors

The innovative applications are expanding the potential uses for small modular reactors beyond traditional power generation. As the demand for clean energy continues to grow, small modular reactors are becoming an increasingly attractive option due to their flexibility, scalability, and cost-effectiveness. These reactors can be used in a variety of settings, including remote locations, industrial processes, and even for desalination. Furthermore, the modular design of these reactors allows for easier construction and maintenance, making them a more practical option for many organizations. This, in turn, is driving the growth of the small modular market and creating new opportunities for businesses and investors alike.

Challenges

-

Competition from other energy sources

-

Need for greater investment in research and development

-

Lack of public awareness and acceptance

Many people are not familiar with the concept of small modular reactors and may not fully understand their benefits. As a result, there may be a reluctance to invest in or support this technology. This factor is expected to hinder the growth of this market in the future. To address this challenge, it is important to educate the public about the advantages of small modular reactors. These reactors are more flexible and cost-effective than traditional nuclear power plants, and they can be used in a variety of settings, including remote locations and areas with limited infrastructure. Additionally, small modular reactors are safer and more secure than older nuclear technologies, which can help to alleviate concerns about nuclear accidents and terrorism.

Impact of COVID-19

The modular reactor market has faced a significant challenge in the form of supply chain disruptions. The COVID-19 pandemic has caused a ripple effect, leading to delays in the transportation of goods and materials, ultimately resulting in project delays and increased costs for manufacturers. This has been a major setback for the industry, which has been striving to meet the growing demand for modular reactors. Moreover, the pandemic has also led to reduced demand for energy. With the decrease in economic activity, there has been a decline in energy consumption, which has affected the demand for modular reactors and other forms of energy. The economic slowdown during the pandemic has also resulted in decreased investment in the small modular reactor market. This has created a threat of slow growth for the industry in the future.

Impact of Russia-Ukraine War:

The Russian invasion of Ukraine affected various industries including the small modular reactor market. This market, which is focused on the development and deployment of small, modular nuclear reactors, has been affected by the political and economic instability in the region. The Russia-Ukraine war has led to a decrease in investment in the small modular reactor market, as investors are hesitant to invest in a market that is affected by political instability. Additionally, the conflict has led to a decrease in demand for small modular reactors in the region, as many countries are focused on other priorities, such as national security and economic stability.

Impact of Recession:

SMRs are a promising technology that offers a more flexible and cost-effective alternative to traditional nuclear power plants. However, the recession has slowed down the growth of this market, as many countries have cut back on their investments in nuclear energy. One of the main challenges facing the SMR market is the lack of funding. The recession has made it difficult for companies to secure the necessary capital to develop and commercialize their SMR technologies. This has resulted in delays in the deployment of SMRs, as well as a slowdown in research and development activities. Another factor that has affected the SMR market is the decline in demand for energy. The recession has led to a decrease in industrial activity and a reduction in consumer spending, which has resulted in lower demand for electricity. This has made it difficult for SMR companies to find customers for their products, as there is less demand for energy overall.

Key Market Segmentation

By Reactor Type

-

Heavy Water Reactor (HWR)

-

Light Water Reactor (LWR)

-

High-Temperature Reactor (HTR)

-

Molten Salt Reactor (MSR)

-

Fast Neutron Reactor (FNR)

By Coolant

-

Water

-

Gases

-

Molten Salt

-

Heavy liquid Metals

By Connectivity

-

Off-Grid

-

Grid-Connected

By Deployment

-

Single-Module Power Plant

-

Multi-Module Power Plant

By Location

-

Marine

-

Land

By Application

-

Desalination

-

Power Generation

-

Process Heat

-

Industrial

-

Hydrogen Production

Regional Analysis

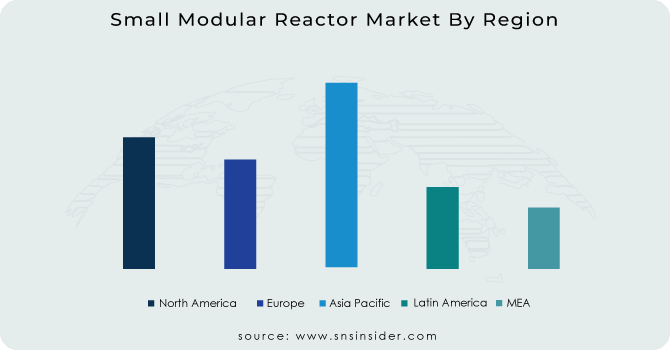

The Asia Pacific region leads the small modular market reactor and is expected to dominate the small modular reactor (SMR) owing to the region’s high demand for energy, and SMRs offer a reliable and cost-effective solution to meet this demand. Additionally, the region has a growing population and economy, which further increases the need for energy. Moreover, the Asia Pacific region has a strong focus on reducing carbon emissions and transitioning to clean energy sources. SMRs are a promising technology that can help achieve these goals, as they produce significantly less carbon emissions compared to traditional power plants. Furthermore, several countries in the region, such as China, South Korea, and Japan, have already invested heavily in SMR research and development. This has led to the creation of advanced SMR designs and technologies, giving the region a competitive advantage in the market.

Europe is projected to experience the highest CAGR during the forecast period in the small modular reactor market. Increasing demand for clean energy sources and the implementation of favorable government policies are the driving factors for the region’s growth. Additionally, the region's advanced technological infrastructure and skilled workforce provide a conducive environment for the development and deployment of small modular reactors. As a result, Europe is expected to remain a key player in the global small modular reactor market, driving innovation and growth in the industry.

Need any customization research on Small Modular Reactor Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are NuScale Power LLC., GE Hitachi Nuclear Energy, Moltex Energy, X-energy, Rolls-Royce, Ultra-safe Nuclear, Westinghouse Electric Corporation, Terristrial Energy Inc., Toshiba Energy Systems and Solutions, General Atomics, and other players

NuScale Power LLC-Company Financial Analysis

Recent Developments:

-

In May of 2023, NuScale Power released new research that highlights the advanced capabilities of their small modular reactors (SMRs) in reducing emissions in industrial sectors. This is a crucial step in meeting global climate goals and demonstrates the potential for SMRs to revolutionize the energy industry.

-

In March of 2021, Moltex Energy received a substantial investment of $50.5 million from the Government of Canada’s Strategic Innovation Fund and Atlantic Canada Opportunities Agency. This funding helped in advancing their project to design and commercialize a molten salt reactor and spent fuel recycling facility, which has the potential to transform the nuclear energy industry.

-

In March of 2023, Rolls-Royce secured funding of $3.18 million from the UK Space Agency for the development of a modular nuclear reactor for the UK’s lunar mission. This exciting project demonstrates the versatility of nuclear energy and its potential to power space exploration.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.75 Bn |

| Market Size by 2032 | US$ 7.37 Bn |

| CAGR | CAGR of 2.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Reactor Type (Heavy Water Reactor (HWR), Light Water Reactor (LWR), High-Temperature Reactor (HTR), Molten Salt Reactor (MSR), and Fast Neutron Reactor (FNR)) • By Coolant (Water, Gases, Molten Salt, and Heavy liquid Metals) • By Connectivity (Off-Grid and Grid-Connected) • By Deployment (Single-Module Power Plant and Multi-Module Power Plant) • By Location (Marine and land) • By Application (Desalination, Power Generation, Process Heat, Industrial, and Hydrogen Production) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | NuScale Power LLC., GE Hitachi Nuclear Energy, Moltex Energy, X-energy, Rolls-Royce, Ultra-safe Nuclear, Westinghouse Electric Corporation, Terristrial Energy Inc., Toshiba Energy Systems and Solutions, General Atomics |

| Key Drivers | • Increasing demand for clean energy • Rising concerns over climate change |

| Market Opportunities | • Expansion of the small modular reactor market into new regions • Emergence of new applications for small modular reactors |