Hydrogen Fueling Station Market Report Scope & Overview:

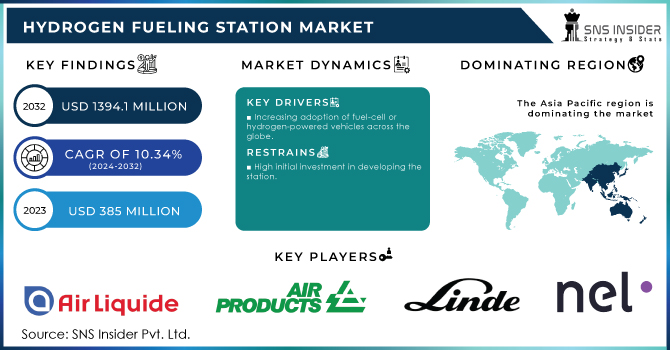

The Hydrogen Fueling Station Market size was valued at USD 385 million in 2023 and is expected to grow to USD 1394.1 million by 2032 and grow at a CAGR of 15.37% over the forecast period of 2024-2032.

To Get More Information on Hydrogen Fueling Station Market - Request Sample Report

The hydrogen fueling station market is similar to a conventional petrol station in layout but there are some additional components present in the hydrogen fueling station that are needed to deal with the unique characteristics of hydrogen and fuel-cell-powered vehicles. The hydrogen fueling station market contains Hydrogen source storage, compressor, High-pressure buffer storage, refrigeration unit, and dispenser.

There is no such difference between the process of fueling at a hydrogen station and a conventional petrol station. But in the case of a hydrogen fueling station, hydrogen is supplied at high pressure and as it is an extremely volatile gas, the connection between the connection point of the vehicle and the pump must be watertight. The hydrogen is pumped into the vehicle's fuel tank, which powers the fuel cell that generates the electricity needed to drive the vehicle. The only waste product produced is water vapor, which is expelled through the exhaust pipe.

Market Dynamics

Drivers

-

Rising pressure of decreasing carbon emission.

-

Increasing adoption of fuel-cell or hydrogen-powered vehicles across the globe

-

Shifting of focus toward the adoption of low-carbon technologies

-

growing consumer awareness of the need to reduce Greenhouse Gas (GHG) emissions and focus on the sustainable energy source

-

Stringent government action to reduce pollution

Restrain

-

High initial investment in developing the station

-

Underdeveloped hydrogen infrastructure

Opportunities

-

Increase in the safety of hydrogen technology is likely to propel the market.

-

Increase in the investment in R&D activities of hydrogen fueling technologies.

Challenges

-

Risk assessment and safety precautions for fueling station.

Impact of COVID-19:

The outbreak of COVID-19 largely affected the operation of the automotive industry and because of the economic crisis caused a reduction in the expenditure on next-generation technologies. That’s why hydrogen-powered vehicles have affected the hydrogen fueling station market. Moreover, a decreased demand and sale of fuel-cell electric vehicles impacted the hydrogen fueling station market globally. But the increase in the government initiative to curb carbon emissions and increase decarbonization technology driving the market post-COVID-19 pandemic.

Impact of Russia-Ukraine War:

The hydrogen fueling technique has become a major point for the government's efforts to reduce carbon emissions, especially in light of record-high temperatures and the disruption caused by Russia's invasion of Ukraine, a major oil and gas producer. In the wake of the conflict, the economics of green hydrogen has become increasingly attractive, as it offers a solution to the energy trilemma of security, affordability, and sustainability.

According to Michael Strusch, CEO of H2 Industries Inc, the global economy has been significantly impacted by the war in Ukraine, leading to a surge in demand for green hydrogen in the Middle East and North Africa region. As the world shifts towards cleaner and more sustainable sources of energy to combat climate change, green hydrogen is emerging as a crucial energy source for the future.

Impact of Recession:

The hydrogen fueling station market is responsible for providing fueling stations for hydrogen-powered vehicles, has experienced a decline in growth due to the economic downturn. The recession has led to a decrease in consumer spending, which has affected the demand for hydrogen-powered vehicles. As a result, the need for hydrogen fueling stations has also decreased. This has caused a slowdown in the growth of the hydrogen fueling station market. Furthermore, the recession has also affected the investment in the development of new hydrogen fueling stations. Many investors have become hesitant to invest in this market due to the economic uncertainty. This has resulted in a lack of funding for the development of new hydrogen fueling stations, which has further slowed down the growth of the market.

Key Market Segmentation

By Station Size

-

Small Station

-

Medium Station

-

Large Station

By Station Type

-

Fixed Hydrogen Station

-

Mobile Hydrogen Station

By Pressure

-

Low Pressure

-

High Pressure

By Solution

-

EPC

-

Component

By Supply Type

-

On-Site

-

Off-Site

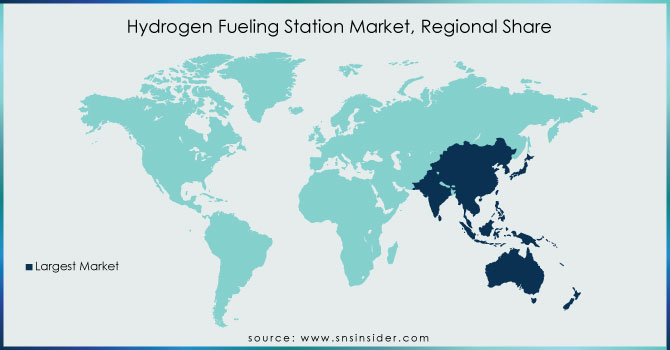

Regional Analysis

Asia Pacific region dominated the market in 2021 with an approximate market share of 213 USD million and is expected to grow at a significant CAGR in the coming years. Various countries of this economy are planning to develop electrolyze-based hydrogen fueling stations. Due to this planning, there is an increase in investment toward pilot projects, new deployment of hydrogen fueling, and feasibility studies in the Asia Pacific region, especially in Japan and South Korea. All of these factors are helping to grow exponentially in this market. Moreover, the rapid adoption of heavy-duty and light-duty vehicles containing hydrogen-powered fuel has accelerated the growth hydrogen fueling station market across the globe.

Europe region is also anticipated to show visible growth during the forecast period owing to the application of carbon emission policies by the European Union and an increase investment in hydrogen fuel technologies.

Do You Need any Customization Research on Hydrogen Fueling Station Market - Enquire Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Air Liquide, Air Products and Chemicals, Inc., Linde plc, Nel ASA, McPhy Energy S.A., Ballard Power System, First Element Fuel, Inc., hydrogenics, Praxair, Fuel Cell Energy, Nuvera Fuel Cell, and other key players will be included in the final report.

Recent Developments:

-

Matthieu Giard, Vice President and Executive Committee Member of the Air Liquide Group is a pioneer in the hydrogen industry. He firmly believes that hydrogen will play a crucial role in the energy transition, and Air Liquide is committed to achieving carbon neutrality by 2050. Hydrogen is the key to meeting this goal, as it can decarbonize heavy industry and revolutionize clean mobility.

-

In February 2023, Air Liquide and Total Energies announced their joint venture to develop a network of hydrogen stations for heavy-duty vehicles on major European road corridors. This initiative will facilitate access to hydrogen and strengthen the hydrogen sector, enabling the development of its use for goods transportation.

-

Linde plc is also making strides in the hydrogen industry, announcing the launch of an industrial-scale electrolyzer that will use hydroelectric power to produce green liquid hydrogen. This plant is set to begin operation by 2025 and will expand Linde's existing infrastructure and liquefier to supply both old and new customers. This project is the first of its kind in the U.S. and will fulfill the growing demand for green liquid hydrogen.

-

Overall, these developments in the hydrogen industry are exciting and promising. As more companies invest in hydrogen technology, we can expect to see significant progress in achieving a more sustainable future.

| Report Attributes | Details |

| Market Size in 2023 | US$ 385 Mn |

| Market Size by 2032 | US$ 1394.1 Mn |

| CAGR | CAGR of 15.37% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Station Size (Small station, Medium Station, Large Station) • By Station Type (Fixed Hydrogen Station, Mobile Hydrogen Station) • By Pressure (Low Pressure, High Pressure) • By Solution (EPC, Component) • By Supply Type (On-Site, Off-Site) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Air Liquide, Air Products and Chemicals, Inc., Linde plc, Nel ASA, McPhy Energy S.A., Ballard Power System, First Element Fuel,Inc., hydrogenics, Praxair, Fuel Cell Energy, Nuvera Fuel Cell |

| Key Drivers | • Rising pressure of decreasing carbon emission. • Increasing adoption of fuel-cell or hydrogen-powered vehicles across the globe |

| Market Opportunities | • Increase in the safety of hydrogen technology is likely to propel the market. • Increase in the investment in R&D activities of hydrogen fueling technologies. |