Incinerator Market Report Scope & Overview:

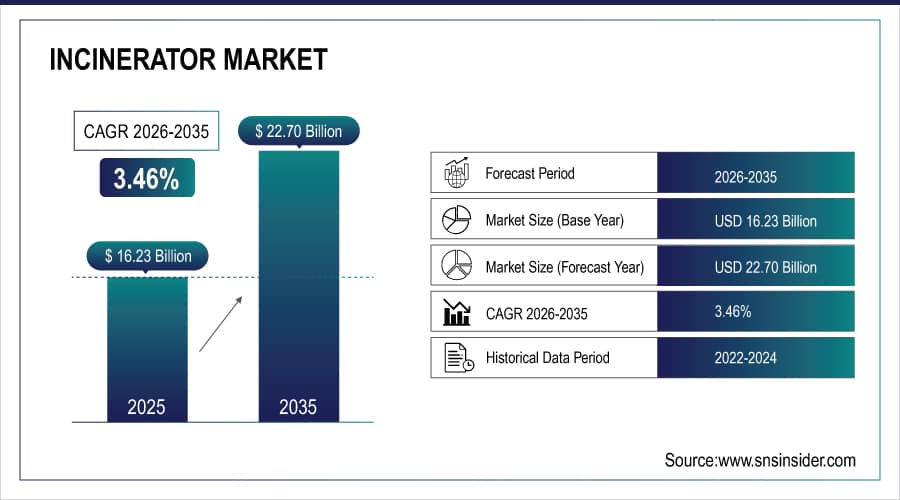

The Incinerator Market was valued at USD 16.23 billion in 2025 and is expected to reach USD 22.70 billion by 2035, growing at a CAGR of 3.46% from 2026-2035.

Incinerator Market is growing due to increasing municipal, industrial, and biomedical waste generation, rising focus on sustainable waste management, and adoption of energy recovery solutions. Stringent environmental regulations, government incentives, and advancements in emission control and flue gas treatment technologies are driving investments. Growing urbanization and industrialization further boost demand for efficient, large-scale incineration systems globally.

For instance, ANDRITZ secured a contract in July 2024 to install four TurboSorp flue gas cleaning systems with catalytic denitrification at Hamm waste incineration plant in Germany, ensuring emissions below 17th BImSchV limits.

Additionally, Mitsubishi Heavy Industries Environmental & Chemical Engineering (MHIEC) completed a 4-year refurbishment in April 2025 of Eco Clean Plaza Miyazaki in Japan, upgrading combustion, gas cooling, waste gas treatment, and controls for stable low-air-ratio operation.

Incinerator Market Size and Forecast

-

Incinerator Market Size in 2025: USD 16.23 Billion

-

Incinerator Market Size by 2035: USD 22.70 Billion

-

CAGR: 3.46% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get More Information On Incinerator Market - Request Free Sample Report

Incinerator Market Trends

-

Rising volumes of municipal, industrial, and medical waste are driving demand for incinerator systems.

-

Increasing focus on waste-to-energy solutions is boosting adoption across urban and industrial regions.

-

Stricter environmental regulations are accelerating upgrades to advanced emission-control incinerators.

-

Growing healthcare and pharmaceutical activities are fueling demand for biomedical waste incineration.

-

Advancements in flue gas treatment, heat recovery, and automation are improving efficiency and compliance.

-

Limited landfill availability is supporting incinerator deployment in dense cities.

-

Public–private partnerships and government investments are aiding market expansion.

The U.S. Incinerator Market was valued at USD 3.40 billion in 2025 and is expected to reach USD 4.60 billion by 2035, growing at a CAGR of 3.09% from 2026-2035.

The U.S. Incinerator Market is growing due to increasing municipal and industrial waste, stringent environmental regulations, rising adoption of energy recovery technologies, and government initiatives promoting sustainable waste management and advanced incineration solutions across healthcare, industrial, and municipal sectors.

In January 2025, the U.S. DOE's Bioenergy Technologies Office and Vehicle Technologies Office announced USD 6.9 million for nine projects across six states to convert local organic waste into low-carbon biofuels via waste-to-energy solutions, helping reduce landfilling and vehicle emissions.

Incinerator Market Growth Drivers:

-

Rising need for efficient municipal solid waste management and sustainable disposal methods drives the growth of incinerator adoption globally

Increasing urbanization and population growth have led to massive waste generation, creating a pressing need for efficient waste management solutions. Incinerators provide a reliable method to reduce landfill dependency while simultaneously recovering energy, making them increasingly attractive for municipalities. Governments worldwide are enforcing strict waste management policies, incentivizing the installation of modern incineration technologies. Moreover, industrial and biomedical sectors generate hazardous waste that must be treated safely, boosting demand for advanced incinerators.

For instance, New Zealand reduced landfilling by 423 kg per capita per year by redirecting waste to incineration and other methods to manage urban growth pressures.

In the U.S., the EPA’s June 2025 OSWI rule amendments set subcategory emission limits for small municipal waste combustors (≤10 TPD or 10–35 TPD), promoting compliant modern incinerators over outdated landfills.

Incinerator Market Restraints:

-

Stringent environmental regulations and emission control compliance restrict rapid deployment of incineration technologies in certain regions

Government bodies enforce strict regulations on pollutant emissions, including dioxins, NOx, and particulate matter, which necessitate expensive flue gas treatment and monitoring systems. Non-compliance can lead to penalties, legal actions, and project shutdowns, creating hesitation among potential investors. Regional variations in environmental standards make it difficult for manufacturers to offer standardized solutions globally. Moreover, public opposition to incineration due to perceived air pollution concerns further slows adoption. These regulatory challenges, combined with increasing scrutiny over operational safety and environmental sustainability, act as a restraint, slowing the pace of market growth despite rising demand for waste management solutions.

Incinerator Market Opportunities:

-

Expansion of waste-to-energy initiatives and increasing adoption in emerging economies presents lucrative growth opportunities

Emerging markets in Asia-Pacific, Latin America, and Africa are witnessing rapid urbanization and industrialization, generating significant waste volumes. Governments are promoting waste-to-energy programs to address energy shortages while managing waste sustainably. Incentives, public-private partnerships, and infrastructure development create opportunities for incinerator manufacturers to enter these untapped markets. Technological advancements, such as modular and small-scale incinerators, make solutions accessible to municipalities with limited budgets. Integration with renewable energy projects further enhances market potential.

For example, Singapore’s Tuas Nexus facility, operational by 2025, will generate 120 MW from solid waste incineration, powering 300,000 households while advancing sustainable disposal.

Similarly, Palm Beach County, Florida Solid Waste Authority approved a $1.5 billion mass-burn incinerator in October 2025 to handle up to 3,000 tons/day of municipal solid waste, countering landfill exhaustion from population growth.

Incinerator Market Segment Highlights

-

By Waste Type, Municipal Solid Waste dominated the Incinerator Market with ~44% share in 2025; Biomedical Waste fastest growing (CAGR).

-

By Application, Energy Recovery dominated the Incinerator Market with ~37% share in 2025; Environmental Protection fastest growing (CAGR).

-

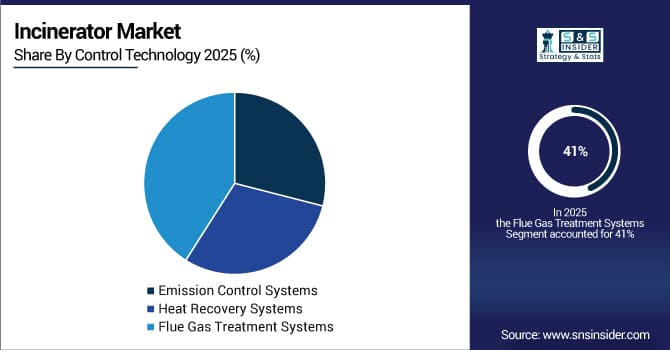

By Control Technology, Flue Gas Treatment Systems dominated the Incinerator Market with ~41% share in 2025; Heat Recovery Systems fastest growing (CAGR).

-

By Operating Capacity, Large Scale (Over 200 tons/day) dominated the Incinerator Market with ~45% share in 2025; Medium Scale (51–200 tons/day) fastest growing (CAGR).

-

By Technology, Mass Burn Incineration dominated the Incinerator Market with ~36% share in 2025; Fluidized Bed Incineration fastest growing (CAGR).

Incinerator Market Segment Analysis

By Control Technology, Flue Gas Treatment Systems segment dominates the Market, Heat Recovery Systems segment expected to grow fastest

Flue Gas Treatment Systems segment dominated the Incinerator Market in 2025 as strict emission regulations required efficient control of dioxins, NOx, and particulate matter. Advanced treatment systems ensured regulatory compliance and environmental safety, making them essential for large-scale incineration projects and contributing the highest revenue share in the market during this year.

Heat Recovery Systems segment is expected to grow at the fastest CAGR from 2026 to 2035 because industries and municipalities aim to maximize energy efficiency by reusing heat from incineration processes. Integration of heat recovery improved cost-effectiveness and sustainability, driving adoption of modern systems across industrial, municipal, and healthcare applications over the forecast period.

By Waste Type, Municipal Solid Waste segment dominates the Market, Biomedical Waste segment expected to grow fastest

Municipal Solid Waste segment dominated the Incinerator Market in 2025 due to increasing urbanization, rapid population growth, and rising household waste generation, which created a continuous demand for efficient disposal methods. Governments and municipalities preferred incinerators for reducing landfill dependency while recovering energy, making it the largest revenue contributor during this period.

Biomedical Waste segment is expected to grow at the fastest CAGR from 2026 to 2035 as hospitals, clinics, and laboratories generate increasing volumes of infectious and hazardous waste. Stringent regulations for safe disposal, rising healthcare infrastructure, and public health awareness are driving demand for specialized incinerators, fueling rapid growth in this segment over the forecast period.

By Application, Energy Recovery segment dominates the Market, Environmental Protection segment expected to grow fastest

Energy Recovery segment dominated the Incinerator Market in 2025 because of its ability to convert waste into electricity and heat, reducing landfill usage and dependence on fossil fuels. Organizations prioritized sustainable energy recovery solutions, combining environmental compliance and cost savings, which made this application segment the largest revenue contributor in incineration technologies during the year.

Environmental Protection segment is expected to grow at the fastest CAGR from 2026 to 2035 due to increasing awareness of air and soil pollution. Industries and municipalities are adopting advanced incinerators with emission control and flue gas treatment systems to meet environmental standards, creating rising demand for solutions focused on safeguarding ecosystems in the forecast period.

By Operating Capacity, Large Scale (Over 200 tons/day) segment dominates the Market, Medium Scale (51–200 tons/day) segment expected to grow fastest

Large Scale (Over 200 tons/day) segment dominated the Incinerator Market in 2025 due to the growing requirement for high-capacity waste disposal in urban centers and industrial zones. Large-scale facilities efficiently handled massive municipal, industrial, and hazardous waste volumes while generating energy, making them the primary choice for high-revenue projects during this year.

Medium Scale (51–200 tons/day) segment is expected to grow at the fastest CAGR from 2026 to 2035 as emerging municipalities and small industries seek scalable and cost-effective incineration solutions. Medium-capacity systems provide flexibility, lower capital investment, and sufficient energy recovery, attracting new installations and driving rapid growth in developing regions over the forecast period.

By Technology, Mass Burn Incineration segment dominates the Market, Fluidized Bed Incineration segment expected to grow fastest

Mass Burn Incineration segment dominated the Incinerator Market in 2025 because it could handle large volumes of unsegregated municipal waste efficiently. Its simplicity, reliability, and ability to integrate with energy recovery systems made it the preferred choice for municipalities, contributing the largest revenue share in the market during this year.

Fluidized Bed Incineration segment is expected to grow at the fastest CAGR from 2026 to 2035 due to its efficiency in burning diverse waste types at lower temperatures. The technology offers higher combustion efficiency, reduced emissions, and suitability for hazardous and biomedical waste, making it increasingly adopted in industrial and healthcare facilities during the forecast period.

Incinerator Market Regional Analysis

North America Incinerator Market Insights

North America held a significant position in the Incinerator Market in 2025 due to advanced waste management infrastructure, strict environmental regulations, and high adoption of energy recovery technologies. Growing industrial and biomedical waste generation, combined with government incentives for sustainable waste disposal, encouraged investments in modern incinerators. Technological advancements, efficient emission control systems, and strong focus on reducing landfill dependency further strengthened market growth, making the region a key contributor during this period.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Incinerator Market Insights

Asia Pacific dominated the Incinerator Market in 2025 with the highest revenue share of about 39% due to rapid urbanization, industrial growth, and increasing municipal waste generation across countries like China, India, and Japan. Rising population and industrial activities created substantial waste management challenges, prompting governments to invest in modern incineration technologies. Supportive policies, stringent environmental regulations, and growing focus on energy recovery from waste further accelerated adoption, contributing to the region’s largest revenue share during this period.

Europe Incinerator Market Insights

Europe accounted for a prominent share in the Incinerator Market in 2025 due to stringent environmental regulations, advanced waste-to-energy initiatives, and strong government support for sustainable waste management. High industrialization and growing municipal and hazardous waste generation encouraged the adoption of modern incineration technologies. Investments in emission control systems, energy recovery solutions, and advanced flue gas treatment strengthened the market, positioning Europe as a key region contributing significantly to global revenue.

Middle East & Africa and Latin America Incinerator Market Insights

Middle East & Africa and Latin America held a growing share in the Incinerator Market in 2025 due to increasing urbanization, industrial expansion, and rising municipal and hazardous waste generation. Governments in these regions are focusing on sustainable waste management and energy recovery initiatives. Investments in modern incineration technologies, coupled with supportive policies and growing environmental awareness, are driving market adoption, creating significant opportunities for regional growth during the forecast period.

Incinerator Market Competitive Landscape:

Veolia Environnement S.A.

Veolia Environnement is a global leader in environmental solutions, including hazardous waste management, water treatment, and energy recovery. The company focuses on sustainable technologies, emission reduction, and operational efficiency across municipal and industrial applications. Its waste-to-energy initiatives integrate advanced incineration, resource recovery, and emission controls, supporting clients’ regulatory compliance and environmental sustainability goals while maintaining high operational standards across global facilities.

-

2024: Veolia began a $300M hazardous waste incinerator project in Gum Springs, Arkansas, with enhanced capacity and emissions control, set to operate by 2025.

-

2025: Veolia partnered with Hitachi Zosen to co-develop next-generation waste-to-energy facilities across Southeast Asia with advanced incineration technology.

Clean Harbors, Inc.

Clean Harbors is a North American leader in environmental, energy, and industrial services, offering hazardous waste disposal, emergency response, and waste-to-energy solutions. The company emphasizes advanced incineration technologies, regulatory compliance, and operational efficiency. Clean Harbors serves industrial, healthcare, and municipal clients, integrating emission control innovations and capacity expansion to optimize hazardous waste destruction while contributing to energy recovery and sustainable environmental management initiatives.

-

2024: Clean Harbors announced a USD 180M expansion of its El Dorado, Arkansas incineration facility, adding advanced emissions control and boosting capacity by ~30%.

Babcock & Wilcox Enterprises, Inc.

Babcock & Wilcox Enterprises designs and operates industrial-scale energy and environmental systems, including modular and large-scale waste-to-energy and hazardous waste incineration solutions. The company focuses on innovative combustion technologies, sustainability, and emission reduction. Its portfolio serves municipal, pharmaceutical, and industrial sectors, emphasizing modular design, efficiency, and environmental compliance while supporting energy recovery from waste streams across North America and global markets.

-

2024: Babcock & Wilcox launched a modular hazardous waste incineration system for pharmaceutical facilities with enhanced destruction capabilities.

-

2025: Babcock & Wilcox acquired EnerTech’s small-scale waste-to-energy business to accelerate municipal waste incineration projects.

SUEZ Group

SUEZ Group provides comprehensive environmental management solutions, including hazardous waste treatment, energy recovery, and water management. The company develops advanced incineration technologies for pharmaceutical and industrial wastes, combining complete destruction of hazardous compounds with energy recovery. SUEZ emphasizes sustainable operations, regulatory compliance, and innovation, supporting clients globally in minimizing environmental impact while maximizing operational efficiency in waste management and resource recovery initiatives.

-

2024: SUEZ launched THERMYLIS pharmaceutical waste incineration technology, ensuring complete active compound destruction while recovering usable energy.

Keppel Seghers

Keppel Seghers specializes in environmental infrastructure and waste-to-energy solutions, including advanced hazardous waste incineration. The company delivers high-capacity, energy-efficient incineration systems with integrated emission controls, supporting municipal and industrial clients. Its focus on sustainable energy recovery, innovative moving-grate technology, and operational reliability allows Keppel Seghers to enhance resource efficiency and environmental compliance, while contributing to energy generation and global waste management infrastructure development.

-

2024: Keppel Seghers secured Singapore Integrated Waste Management Facility Phase 2 contract with moving-grate incineration and 120 MW net energy export capacity.

Hitachi Zosen Corporation

Hitachi Zosen is a global engineering company providing advanced waste-to-energy and industrial incineration systems. Its focus includes rotary kiln technology, AI-assisted combustion control, and emission reduction. Hitachi Zosen delivers sustainable, high-efficiency incineration solutions for municipal and industrial waste management, integrating energy recovery and environmental compliance. Its innovations support global demand for efficient waste disposal with minimized environmental impact and optimized operational performance.

-

2025: Hitachi Zosen introduced next-generation rotary kiln incinerators using AI-enhanced combustion control, boosting efficiency while reducing emissions up to 15%.

Covanta Holding Corporation / Reworld Holding

Covanta, now Reworld, operates waste-to-energy facilities, focusing on municipal and industrial waste incineration with energy recovery. The company emphasizes regulatory compliance, operational efficiency, and environmental sustainability, delivering scalable solutions for waste destruction. Covanta integrates advanced emissions control and energy conversion technologies to generate electricity while reducing landfill dependence, serving public and private clients with innovative, environmentally conscious waste-to-energy projects.

-

2025: Covanta (Reworld) announced a major U.S. contract to design and build a municipal waste-to-energy incineration plant with advanced processing and energy recovery.

Incinerator Market Key Players

Some of the Incinerator Market Companies are:

-

SUEZ Group

-

Mitsubishi Heavy Industries (Environmental & Chemical Engineering)

-

Inciner8 Ltd.

-

Veolia Environnement S.A.

-

Covanta Holding Corporation

-

Hitachi Zosen Corporation

-

Keppel Seghers

-

Martin GmbH

-

Wheelabrator Technologies Inc.

-

China Everbright Environment Group Limited

-

Constructions Industrielles de la Méditerranée (CNIM)

-

Doosan Lentjes GmbH

-

JFE Engineering Corporation

-

Ebara Corporation

-

Clean Harbors, Inc.

-

Waste Management, Inc.

-

Atlas Incinerators

-

ECO Concepts

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 16.23 Billion |

| Market Size by 2035 | USD 22.70 Billion |

| CAGR | CAGR of 3.46% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Waste Type (Municipal Solid Waste, Hazardous Waste, Industrial Waste, Biomedical Waste) • By Application (Energy Recovery, Waste-to-Energy, Volume Reduction, Environmental Protection) • By Control Technology (Emission Control Systems, Heat Recovery Systems, Flue Gas Treatment Systems) • By Operating Capacity (Small Scale [Up to 50 tons/day], Medium Scale [51 to 200 tons/day], Large Scale [Over 200 tons/day]) • By Technology (Mass Burn Incineration, Modular Incineration, Fluidized Bed Incineration, Open Hearth Incineration) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Babcock & Wilcox Enterprises, Inc., SUEZ Group, Mitsubishi Heavy Industries (Environmental & Chemical Engineering), Inciner8 Ltd., Thermax Ltd., Veolia Environnement S.A., Covanta Holding Corporation, Hitachi Zosen Corporation, Keppel Seghers, Martin GmbH, Wheelabrator Technologies Inc., China Everbright Environment Group Limited, Constructions Industrielles de la Méditerranée (CNIM), Doosan Lentjes GmbH, JFE Engineering Corporation, Ebara Corporation, Clean Harbors, Inc., Waste Management, Inc., Atlas Incinerators, ECO Concepts |