GCC Natural Gas Market Report Scope & Overview:

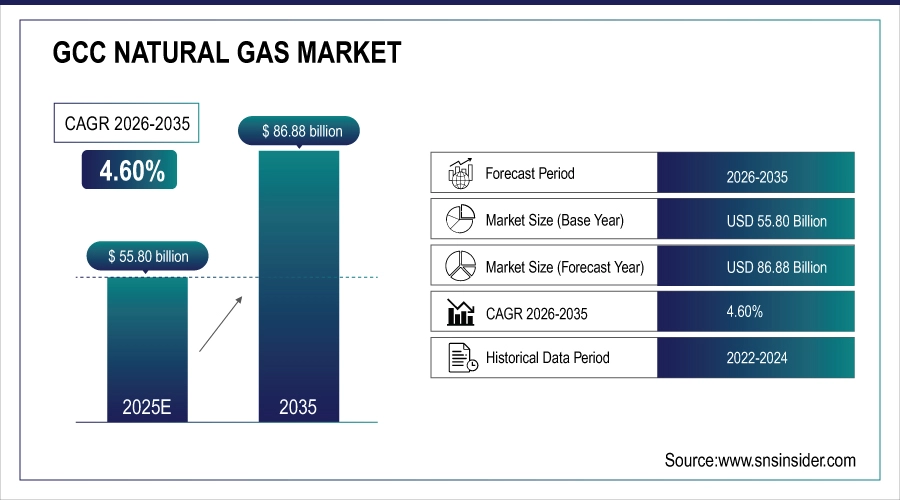

The GCC Natural Gas Market was valued at USD 55.80 billion in 2025 and is expected to reach USD 86.88 billion by 2035, growing at a CAGR of 4.60% from 2026-2035.

The GCC Natural Gas Market is growing due to rising electricity demand, industrial expansion, and population growth across the region. Investments in LNG infrastructure, pipelines, and gas processing facilities enhance supply and export capacity. Government initiatives promoting cleaner energy and the adoption of natural gas over oil for power generation and industrial use further drive demand. Technological advancements in extraction and distribution support efficient operations and sustained market growth.

-

Total investments in Qatar’s North Field LNG expansion have reached roughly USD 82.5 billion, with QatarEnergy itself funding USD 59 billion of that total. This includes infrastructure for new liquefaction trains, storage, and export capacity.

-

Larsen & Toubro (L&T) won a mega USD 4–5 billion contract from QatarEnergy LNG for the North Field Production Sustainability (NFPS) project one of the largest single orders in the company’s history.

GCC Natural Gas Market Size and Forecast

-

Market Size in 2025: USD 55.80 Billion

-

Market Size by 2035: USD 86.88 Billion

-

CAGR: 4.60% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on GCC Natural Gas Market - Request Free Sample Report

GCC Natural Gas Market Trends

-

Rising energy demand from power generation, industrial, and residential sectors is driving the GCC natural gas market.

-

Growing investment in LNG export infrastructure and pipeline networks is boosting market growth.

-

Expansion of petrochemical and fertilizer industries is fueling natural gas consumption.

-

Increasing focus on cleaner energy and lower carbon emissions is shaping market trends.

-

Advancements in exploration, drilling, and gas processing technologies are enhancing production efficiency.

-

Rising government initiatives and strategic partnerships for energy security are supporting market expansion.

-

Collaborations between national oil companies, international investors, and technology providers are accelerating innovation and global adoption.

GCC Natural Gas Production Insights by Country in 2025

|

Country |

Production (BCM) |

|

Qatar |

169.6 |

|

Saudi Arabia |

121.9 |

|

UAE |

56.7 |

|

Oman |

40.8 |

|

Kuwait |

19.3 |

|

Bahrain |

18.0 |

In 2025, Qatar dominated GCC natural gas production, generating the highest output primarily due to extensive reserves and its position as a global LNG leader. Saudi Arabia followed, leveraging both conventional and unconventional gas fields to achieve significant production. The UAE maintained moderate output supported by LNG and pipeline infrastructure, while Oman contributed steadily. Kuwait and Bahrain recorded lower outputs, reflecting smaller reserves and limited infrastructure. Overall, production is concentrated in Qatar and Saudi Arabia, highlighting their dominance in the GCC gas market.

GCC Natural Gas Market Growth Drivers:

-

Expanding liquefied natural gas infrastructure is enhancing export potential and boosting the GCC natural gas market growth

Significant investments in LNG terminals, pipelines, and storage across Qatar, UAE, and Oman are enabling large-scale exports to global markets. Expansion by QatarEnergy and state-owned firms increases production capacity, ensuring reliable supply and cost-efficient transit. Advanced liquefaction and shipping technologies optimize operations, while cross-border pipelines like Dolphin Energy enhance regional connectivity. This growing LNG infrastructure boosts export potential, strengthens long-term contracts, and positions the GCC as a key global natural gas supplier.

|

Country |

Cost, Capacity & Operational Details |

Project / Expansion |

|

Qatar |

32 MTPA (2026); USD 25B capex; heat raises liquefaction costs 25% |

North Field East (NFE) |

|

Qatar |

16 MTPA (2027+); adds 40 BCM supply; opex up due to desert corrosion |

North Field South (NFS) |

|

UAE |

9.6 MTPA (2028); USD 7.4B investment; 15% opex premium from harsh climate |

Ruwais LNG |

|

Saudi Arabia |

Phase 1: 2025+; USD 110B total; unconventional feedgas at USD 2–7/MMBtu |

Jafurah LNG support |

|

Oman |

Ongoing upgrades; USD 16B Khazzan-linked; environmental hardening costs |

Qalhat LNG expansion |

|

Kuwait |

2 MTPA import; USD 2–3B; mitigates domestic shortfall amid volatility |

Al-Zour import terminal |

GCC Natural Gas Market Restraints:

-

High infrastructure and operational costs limit rapid expansion and widespread adoption of natural gas in the GCC market

Developing pipelines, LNG terminals, and gas processing plants in the GCC demands massive capital investments and long-term financial commitments. High costs of drilling, liquefaction, storage, maintenance, and technological upgrades limit smaller market entrants. Price volatility in global energy markets further impacts returns, while harsh environmental conditions, including extreme heat and corrosive landscapes, increase operational challenges. These factors collectively slow natural gas project expansion, restrict market penetration, and moderate growth across the region.

High Capital and Operational Costs Limiting GCC Natural Gas Infrastructure Expansion

|

Item / Description |

Cost / Investment |

|

Saudi Arabia – Jafurah Gas Field: Total infrastructure costs for the Jafurah unconventional gas project covering gas processing plants, compression systems, and 1,500 km pipeline network. |

> USD 100 billion |

|

ADNOC Gas Capital Expenditure (UAE): Expansion of processing and pipeline infrastructure in Ruwais/Al Ruwais, including LNG infrastructure, compression facilities, and pipelines. |

55 billion AED (USD 15 billion) |

|

Kuwait LNG Infrastructure Spending: Investment in LNG and related gas infrastructure projects since 2014, showing sustained government commitment over years. |

USD 2.93 billion (6.15 % of GCC LNG spend) |

|

High Capital Intensity – Gas Piping & Utility Infrastructure: Initial capital required for gas piping and utility projects, plus regulatory compliance costs, restricting smaller players. |

> USD 25 million initial capital + USD 6 million compliance costs |

|

Operating Cost Pressures – Industrial Gas Production: High energy-intensive separation, storage, pipeline compression, and compliance costs; electricity alone is a major factor. |

Electricity 40–50 % of operating costs |

|

LNG Terminal Cost Benchmarks: Global capital expenditure and operating cost estimates per terminal, highlighting ongoing financial commitments. |

USD 180 million per million metric tons capacity; USD 90,000–USD 100,000 daily operating costs |

GCC Natural Gas Market Opportunities:

-

Technological advancements in gas extraction, storage, and transportation are driving new growth avenues for GCC natural gas market

Innovations in LNG liquefaction, pipeline monitoring, and gas compression technologies are enhancing operational efficiency and reducing costs. Advanced drilling methods and unconventional gas extraction techniques are increasing recoverable reserves, supporting higher production volumes. Smart infrastructure and real-time monitoring systems improve safety, reduce losses, and optimize supply chains. Additionally, investment in floating LNG units and cross-border pipelines expands market reach. The adoption of these technologies also attracts foreign investments and strengthens regional collaborations. These technological developments create opportunities for the GCC natural gas market to grow sustainably, improve efficiency, and expand its global footprint.

GCC Natural Gas Market Segment Highlights

-

By Product, Unconventional dominated the GCC Natural Gas Market with 56% share in 2025; Conventional fastest growing (CAGR).

-

By End Use, Transportation dominated the GCC Natural Gas Market with 41% share in 2025; Steam Generation fastest growing (CAGR).

-

By Distribution Channel, Pipeline Natural Gas dominated the GCC Natural Gas Market with 51% share in 2025; LNG (Liquefied Natural Gas) fastest growing (CAGR).

-

By Application, Industrial dominated the GCC Natural Gas Market with 46% share in 2025; Industrial fastest growing (CAGR).

GCC Natural Gas Market Segment Analysis

By Product, Unconventional Natural Gas segment dominates the Market, Conventional Natural Gas segment expected to grow fastest

Unconventional natural gas dominated the GCC market in 2025 due to abundant shale and tight gas reserves, advanced extraction technologies, and growing industrial demand. Investments in exploration and government support for unconventional gas projects increased production capacity, making it the primary revenue-generating segment across power, petrochemical, and industrial sectors throughout the region.

Conventional natural gas is expected to grow at the fastest CAGR from 2026 to 2035 as new pipeline expansions, discovery of gas fields, and improved extraction methods enhance supply. Increasing domestic consumption and LNG export projects drive demand, while stable infrastructure and lower production costs compared to unconventional gas attract investments, accelerating growth during the forecast period.

By End Use, Unconventional Natural Gas segment dominates the Market, Conventional Natural Gas segment expected to grow fastest

Transportation dominated the GCC natural gas market in 2025 owing to widespread adoption of compressed natural gas for vehicles, cost efficiency, and government initiatives promoting cleaner fuels. The extensive network of CNG stations and rising fleet conversions in commercial, public transport, and logistics sectors contributed significantly to high market revenue across the region.

Steam generation is expected to grow at the fastest CAGR from 2026 to 2035 due to expanding power plants and industrial facilities relying on natural gas for reliable, low-emission energy. Government projects supporting combined-cycle and hybrid power plants, alongside industrial modernization, further enhance demand, making steam generation a key growth driver in the GCC market.

By Distribution Channel, Pipeline Natural Gas segment dominates the Market, LNG segment expected to grow fastest

Pipeline natural gas dominated the GCC market in 2025 as the region has well-established infrastructure connecting production fields to industries and households. Efficient distribution, low transportation costs, and high reliability of pipelines for continuous gas supply support strong market revenue, making it the most widely used delivery method across residential, commercial, and industrial applications.

LNG is expected to grow at the fastest CAGR from 2026 to 2035 because of rising global demand for liquefied gas and expansion of export terminals in Qatar, UAE, and Oman. Technological improvements in liquefaction, storage, and shipping, along with government support for LNG projects and international trade agreements, drive adoption and market growth.

By Application, Industrial segment dominates the Market, Industrial segment expected to grow fastest

The industrial segment dominated the GCC natural gas market in 2025 due to extensive use in power generation, petrochemicals, cement, and metal industries. Reliable supply through pipelines and cost efficiency compared to alternative fuels supported high consumption. It is also expected to grow at the fastest CAGR from 2026 to 2035 as industrial expansion, modernization of manufacturing facilities, and increasing energy demand drive higher adoption of natural gas, while government initiatives and investments in infrastructure further boost market growth.

GCC Natural Gas Market Regional Analysis

Qatar GCC Natural Gas Market Insights

Qatar dominated the GCC Natural Gas Market in 2025 with the highest revenue share of about 41% due to its position as the world’s largest LNG exporter. Extensive production capacity, advanced liquefaction facilities, and well-established infrastructure enable consistent supply to international markets. Strategic investments by QatarEnergy and long-term export contracts with major importing countries further strengthen its dominance, while technological advancements and government support for gas exploration and processing ensure high revenue generation across domestic and global markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

Saudi Arabia GCC Natural Gas Market Insights

Saudi Arabia segment is expected to grow at the fastest CAGR of about 6.18% from 2026-2035 as the country expands its natural gas production and infrastructure. Investments in pipeline networks, LNG projects, and unconventional gas exploration drive growth. Increasing domestic energy demand, industrial expansion, and government initiatives for cleaner energy alternatives further boost consumption. Strategic collaborations with international oil companies and technology adoption accelerate development, positioning Saudi Arabia as the fastest-growing contributor to the GCC natural gas market during the forecast period.

United Arab Emirates (UAE) GCC Natural Gas Market Insights

United Arab Emirates (UAE) holds a significant position in the GCC Natural Gas Market due to substantial production and processing capabilities led by ADNOC. Expanding gas infrastructure, including pipelines and LNG facilities, supports both domestic consumption and exports. Growing industrialization, power generation, and government initiatives promoting cleaner energy further drive demand. Strategic investments in technology and cross-border collaborations enhance supply efficiency, making the UAE a key contributor to regional natural gas growth and market revenue.

Oman GCC Natural Gas Market Insights

Oman plays an important role in the GCC Natural Gas Market, driven by Oman LNG’s production and export activities. The country’s investments in gas processing plants, pipelines, and storage infrastructure support both domestic industries and international supply. Growing industrialization, power generation projects, and government initiatives to utilize cleaner energy sources are boosting natural gas demand. Strategic collaborations and technological upgrades further enhance efficiency, making Oman a key contributor to regional market growth.

GCC Natural Gas Market Competitive Landscape:

Saudi Aramco

Saudi Aramco is the world’s largest integrated energy and chemicals company, headquartered in Dhahran, Saudi Arabia. It leads global oil and gas production while developing domestic and international energy infrastructure, including upstream, midstream, and downstream operations. Aramco plays a central role in Saudi Arabia’s energy strategy, supplying natural gas, crude oil, and refined products, while investing in unconventional gas, LNG, and sustainability initiatives to meet domestic energy demand and secure long-term global energy supply.

-

2025: Aramco signed an USD 11 billion lease and leaseback deal for its Jafurah midstream gas assets, supporting natural gas scale-up and GCC gas infrastructure expansion.

-

2024: Aramco added 15 trillion scf to proven Jafurah unconventional gas reserves, boosting Saudi Arabia’s domestic gas supply and downstream energy security.

-

2023: Saudi Aramco reported 207.5 trillion scf of proved natural gas reserves and 10.7 bscfd production, highlighting its exclusive role in the Kingdom’s natural gas supply.

Abu Dhabi National Oil Company (ADNOC)

Abu Dhabi National Oil Company (ADNOC) is the UAE’s state-owned energy company, overseeing the full hydrocarbon value chain, including exploration, production, refining, and gas distribution. ADNOC plays a key role in expanding domestic and international natural gas and LNG supply, midstream infrastructure, and energy exports. The company pursues strategic partnerships, structured financing, and sustainable production technologies to support UAE energy security, net-zero ambitions, and long-term growth in global natural gas markets.

-

2025: ADNOC signed a 15‑year LNG supply agreement with Shell for the Ruwais LNG project, securing long-term global offtake.

-

2025: ADNOC secured USD 11 billion structured financing for Hail & Ghasha gas development, unlocking 1.8 bscfd midstream capacity with net-zero emissions goals.

-

2025: ADNOC announced Final Investment Decision (FID) for SARB Deep Gas Development, expanding offshore natural gas supply and UAE production.

-

2025: ADNOC Gas signed long-term LNG and natural gas export agreements, including 10- and 20-year deals, extending UAE’s global gas footprint.

Key Players

Some of the GCC Natural Gas Market Companies

-

Saudi Aramco

-

QatarEnergy (Qatar Petroleum)

-

Abu Dhabi National Oil Company (ADNOC)

-

Kuwait Petroleum Corporation (KPC)

-

Bahrain Petroleum Company (BAPCO)

-

BP (British Petroleum)

-

Royal Dutch Shell

-

ExxonMobil

-

Chevron

-

TotalEnergies

-

Eni S.p.A.

-

Equinor

-

Gazprom

-

Occidental Petroleum (Oxy)

-

Rosneft

-

Petrobras

-

ConocoPhillips

-

Lukoil

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 55.80 Billion |

| Market Size by 2035 | USD 86.88 Billion |

| CAGR | CAGR of 4.60% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Conventional, Unconventional) • By Application (Residential, Commercial, Industrial) • By End Use (Transportation, Steam Generation, Cooking, Space Heating, Others) • By Distribution Channel (Pipeline Natural Gas, LNG (Liquefied Natural Gas), CNG (Compressed Natural Gas)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Saudi Aramco, QatarEnergy (Qatar Petroleum), Abu Dhabi National Oil Company (ADNOC), Kuwait Petroleum Corporation (KPC), Oman LNG, Bahrain Petroleum Company (BAPCO), Dolphin Energy, BP (British Petroleum), Royal Dutch Shell, ExxonMobil, Chevron, TotalEnergies, Eni S.p.A., Equinor, Gazprom, Occidental Petroleum (Oxy), Rosneft, Petrobras, ConocoPhillips, Lukoil |