Hydrogen Truck Market Report Scope & Overview:

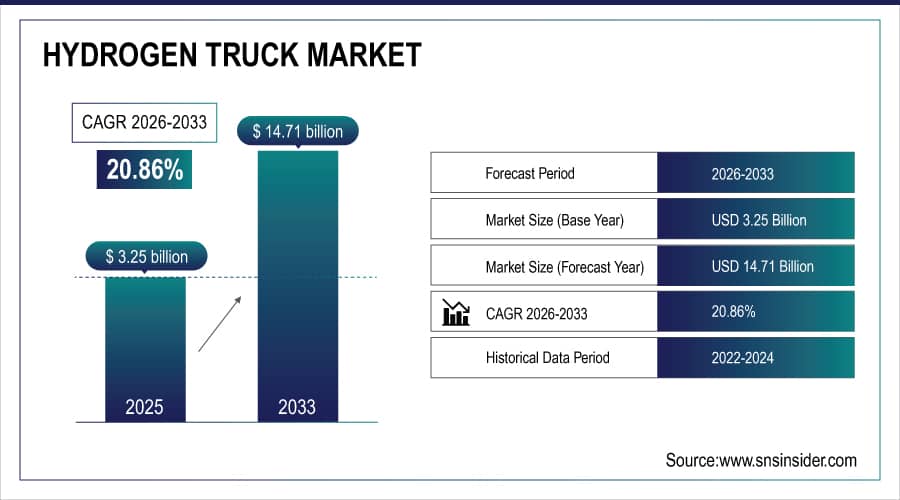

The Hydrogen Truck Market is valued at USD 3.25 billion in 2025E and is expected to reach USD 14.71 billion by 2033, growing at a CAGR of 20.86 % from 2026-2033.

Hydrogen Truck Market is growing rapidly due to increasing environmental regulations, rising demand for zero-emission transportation, and the push toward sustainable logistics solutions. Advances in fuel cell technology, expanding hydrogen refueling infrastructure, and government incentives for clean energy adoption are driving market growth. Additionally, fleet operators are increasingly investing in hydrogen-powered trucks to reduce carbon footprints, improve operational efficiency, and comply with emission standards, further fueling the adoption of hydrogen trucks globally.

In 2024, global hydrogen truck deployments surged by 60%, with over 8,000 units ordered primarily by logistics and freight operators supported by a 40% expansion in refueling infrastructure and USD4.5 billion in government clean-transport incentives worldwide.

To Get More Information On Hydrogen Truck Market - Request Free Sample Report

Hydrogen Truck Market Size and Forecast

-

Market Size in 2025E: USD 3.25 Billion

-

Market Size by 2033: USD 14.71 Billion

-

CAGR: 20.86% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Hydrogen Truck Market Trends

-

Accelerating fleet transition toward zero-emission logistics as governments tighten carbon regulations and incentivize hydrogen-powered commercial vehicles

-

Rising investments in hydrogen refueling infrastructure to support long-haul trucking and enable large-scale fleet deployments across regions

-

Growing collaboration between truck OEMs, fuel-cell manufacturers, and energy companies to advance commercialization and reduce total operating costs

-

Increasing focus on heavy-duty applications where battery-electric trucks face limitations in payload capacity, range, and charging downtime

-

Expansion of green hydrogen production to support sustainable transportation and reduce lifecycle emissions across logistics supply chains

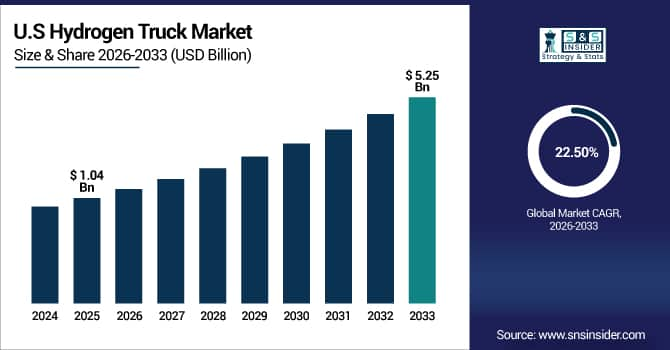

The U.S. Hydrogen Truck Market is valued at USD 1.04 billion in 2025E and is expected to reach USD 5.25 billion by 2033, growing at a CAGR of 22.50 % from 2026-2033.

Growth in the U.S. Hydrogen Truck Market is driven by increasing demand for zero-emission vehicles, supportive government incentives, and expanding hydrogen refueling infrastructure. Advances in fuel cell technology and rising adoption by logistics and transportation fleets for sustainable operations are further accelerating market growth.

Hydrogen Truck Market Growth Drivers:

-

Growing focus on zero-emission transportation and government incentives for hydrogen fuel technologies are accelerating adoption of hydrogen trucks across logistics and freight sectors

Governments worldwide are implementing stringent emission regulations and promoting zero-emission vehicles to reduce greenhouse gas emissions and combat climate change. Hydrogen trucks, powered by fuel cells, produce only water as a byproduct, making them an attractive alternative to conventional diesel trucks. Incentives such as tax credits, subsidies, and grants for fleet operators encourage early adoption. Logistics and freight companies are increasingly integrating hydrogen trucks into their operations to meet sustainability targets, improve environmental compliance, and enhance corporate social responsibility, driving growth in the global hydrogen truck market.

In 2024, government incentives including tax credits, grants, and low-emission zone access drove a 50% year-over-year increase in hydrogen truck orders, with logistics and freight companies accounting for over 70% of new deployments globally.

-

Advancements in hydrogen refueling infrastructure and fuel cell efficiency are boosting operational reliability, making hydrogen trucks more viable for long-distance heavy-duty transportation

The development of hydrogen refueling stations along key transportation corridors is reducing range anxiety and operational limitations for fleet operators. Improvements in fuel cell efficiency increase driving range, reduce refueling frequency, and lower overall operational costs. Longer vehicle lifespans and better performance make hydrogen trucks increasingly competitive with diesel alternatives. These advancements provide greater reliability for long-haul and heavy-duty applications, encouraging fleet operators to transition. As infrastructure continues to expand and technology matures, hydrogen trucks are becoming a practical, environmentally friendly solution for sustainable logistics and freight transportation globally.

In 2024, hydrogen refueling infrastructure expanded by 35%, while fuel cell efficiency improvements extended truck range to over 800 km, enhancing reliability and making hydrogen a competitive zero-emission solution for long-haul freight.

Hydrogen Truck Market Restraints:

-

High vehicle purchase costs and limited hydrogen refueling stations restrict large-scale deployment of hydrogen trucks, especially in developing regions and cost-sensitive fleets

Hydrogen trucks currently have higher upfront costs compared to traditional diesel and battery-electric trucks, primarily due to expensive fuel cell systems and storage technology. Limited refueling infrastructure, particularly in developing regions, constrains operational flexibility and prevents widespread adoption. Small and medium-sized fleet operators often lack the financial resources to invest in hydrogen vehicles. Additionally, installation of private refueling stations involves significant capital expenditure. These factors collectively hinder large-scale deployment, slow market penetration, and limit growth in cost-sensitive regions, making it challenging for hydrogen truck adoption to achieve critical mass across the global logistics industry.

In 2024, hydrogen truck purchase prices remained 2–3 times higher than diesel equivalents, and with fewer than 1,000 public refueling stations globally—70% concentrated in Europe, China, and North America—large-scale adoption in developing regions remained limited.

-

Competition from battery-electric trucks and uncertainties around hydrogen production sustainability slow investment decisions and adoption rates in the transportation sector

Battery-electric trucks are increasingly being adopted due to declining battery costs, mature charging infrastructure, and favorable policies. Investors and fleet operators may hesitate to commit to hydrogen trucks until infrastructure and technology are more widespread. Additionally, hydrogen production methods vary in environmental impact, and green hydrogen remains expensive compared to fossil-fuel-based alternatives. Concerns regarding sustainability, energy efficiency, and long-term operational costs contribute to cautious investment strategies. These competitive and technical uncertainties slow adoption rates and may delay large-scale hydrogen truck commercialization, particularly in regions where electric vehicle infrastructure is well-established.

In 2024, 60% of fleet operators delayed hydrogen truck investments due to competition from battery-electric alternatives and concerns over green hydrogen supply, slowing adoption despite supportive pilot programs.

Hydrogen Truck Market Opportunities:

-

Rapid expansion of green hydrogen production and declining renewable energy costs create opportunities to scale hydrogen truck adoption for sustainable freight operations globally

The global push for decarbonization and the falling costs of renewable energy make green hydrogen production more viable and affordable. Hydrogen produced from renewable sources offers a truly zero-emission alternative for heavy-duty transportation. Increasing investment in electro lyzers, production facilities, and supply chains provides opportunities to scale hydrogen truck adoption. Companies in logistics and freight sectors can leverage these developments to reduce emissions, comply with environmental regulations, and achieve sustainability goals. As green hydrogen becomes more cost-competitive, the market for hydrogen trucks is expected to expand rapidly, especially for long-haul and heavy-duty applications.

In 2024, global green hydrogen production capacity grew by 45%, with renewable energy costs falling below USD30/MWh in key regions—enabling hydrogen truck operating costs to drop by 20% and accelerating fleet adoption in sustainable freight corridors.

-

Increasing interest from logistics, mining, and long-haul transport industries enables commercialization of hydrogen trucks through partnerships, pilot projects, and large fleet procurement programs

Key industries with high energy demands, such as logistics, mining, and freight, are exploring hydrogen trucks to reduce emissions and operating costs. Pilot programs, public-private partnerships, and collaborations with truck manufacturers facilitate technology testing, infrastructure planning, and fleet integration. Large-scale fleet procurement initiatives allow operators to achieve economies of scale, reduce operational risk, and demonstrate commitment to sustainability. These strategic collaborations accelerate market adoption, provide critical insights for commercialization, and create opportunities for hydrogen truck manufacturers to expand their presence in global markets while meeting increasing demand for zero-emission freight solutions.

In 2024, over 40 major fleet operators in logistics and mining launched hydrogen truck pilot programs, with combined pre-orders exceeding 5,000 units and industry partnerships driving USD2.3 billion in infrastructure and vehicle investments globally.

Hydrogen Truck Market Segment Highlights

-

By Vehicle: Heavy-duty trucks led with 57.3% share, while Medium-duty trucks is the fastest-growing segment with CAGR of 25.84%.

-

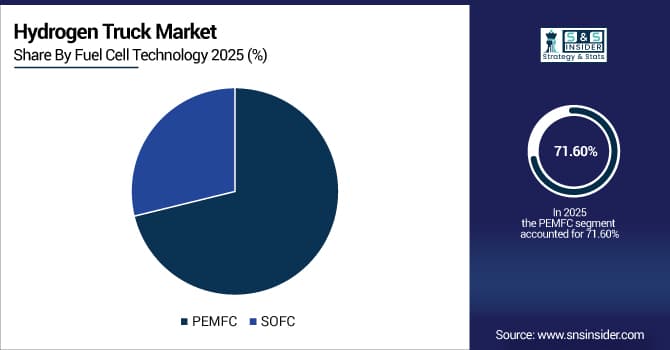

By Fuel Cell Technology: PEMFC led with 71.6% share, while SOFC is the fastest-growing segment with CAGR of 24.92%.

-

By Range: 300–500 miles led with 46.8% share, while Above 500 miles is the fastest-growing segment with CAGR of 27.41%

-

By Motor Power: 200–400 kW led with 51.2% share, while Above 400 kW is the fastest-growing segment with CAGR of 26.55%.

-

By Application: Logistics and Transport led with 58.9% share, while Construction is the fastest-growing segment with CAGR of 23.87%.

Hydrogen Truck Market Segment Analysis

By Vehicle: Heavy-duty Trucks segment dominates the Hydrogen Truck Market, while the Medium-duty Trucks segment is projected to grow at the fastest pace.

Heavy-duty trucks dominate the hydrogen truck market due to their extensive usage in long-haul logistics and freight transport, where zero-emission solutions are increasingly mandated. Governments and fleet operators prefer hydrogen-powered trucks for their high payload capacity, long range, and quick refueling advantages over battery electric alternatives. The adoption is further fueled by incentives, stricter emission norms, and rising fuel costs, making hydrogen trucks a preferred choice for heavy-duty applications across developed and emerging markets.

Medium-duty trucks represent the fastest-growing segment as fleets modernize urban and regional delivery vehicles to meet emission reduction targets. These trucks balance payload efficiency with operational flexibility, making them suitable for last-mile deliveries. Rising e-commerce demand, combined with expanding hydrogen refueling infrastructure, accelerates adoption. Manufacturers are increasingly offering medium-duty models with optimized fuel cell systems, driving rapid market growth. The segment benefits from supportive government policies, fleet electrification initiatives, and technological improvements in compact fuel cell modules.

By Fuel Cell Technology: PEMFC technology holds the largest market share, whereas SOFC technology is expected to expand at the highest CAGR.

Proton Exchange Membrane Fuel Cells (PEMFC) dominate the hydrogen truck market due to their high efficiency, quick startup, and suitability for vehicular applications. PEMFC systems offer lower operating temperatures and easier integration with vehicle powertrains, making them ideal for both heavy- and medium-duty trucks. Widespread R&D investments and proven commercial deployment reinforce their dominance. OEMs prefer PEMFC for reliability, reduced maintenance costs, and scalability across truck platforms, securing strong market share in both long-haul and regional applications.

Solid Oxide Fuel Cells (SOFC) are the fastest-growing technology segment, driven by innovations in high-temperature operation and fuel flexibility. SOFC systems can utilize hydrogen and other alternative fuels, providing extended range and efficiency advantages for long-distance and specialized applications. Growing interest from fleet operators and industrial logistics players in high-performance, durable fuel cell systems fuels adoption. Technological advancements reducing SOFC startup time and improving durability are accelerating market penetration, positioning the segment for rapid growth in the coming years.

By Range: 300–500 Miles range segment leads the market, while the Above 500 Miles segment is anticipated to record the fastest growth.

The 300–500 miles range segment dominates due to its balance of operational feasibility and fleet efficiency. This range meets the typical needs of regional transport, allowing trucks to complete daily routes without frequent refueling. Hydrogen trucks in this range address both urban and intercity logistics requirements, making them highly attractive for fleet operators. The segment benefits from existing hydrogen refueling infrastructure development and optimized fuel cell systems, ensuring consistent adoption and significant market share globally.

Hydrogen trucks with a range above 500 miles are the fastest-growing segment, driven by demand for long-haul operations. Extended-range trucks reduce downtime and improve fleet productivity, making them ideal for cross-country transport. Technological advances in high-capacity hydrogen storage and fuel cell efficiency support adoption. Strong government incentives and partnerships between OEMs and logistics companies accelerate market penetration. Increasing infrastructure investments along major highways further enable the deployment of ultra-long-range hydrogen trucks.

By Motor Power: 200–400 kW motor power category remains dominant, while the Above 400 kW category showcases the strongest growth potential.

The 200–400 kW motor power segment dominates as it aligns with most regional and long-haul truck requirements, delivering sufficient torque and performance while maintaining energy efficiency. Fleet operators favor this range for a balance between power output and fuel consumption. OEMs standardize hydrogen fuel cell modules in this range to optimize cost-effectiveness and operational reliability. The segment’s dominance is reinforced by widespread deployment in medium- and heavy-duty trucks, ensuring consistent adoption across commercial transportation fleets.

Trucks with motor power above 400 kW are the fastest-growing segment due to rising demand for high-performance vehicles in construction, mining, and long-haul logistics. High-powered trucks require robust fuel cell systems and advanced energy management solutions, driving rapid technological innovation. Adoption is propelled by fleets seeking greater payload capability and speed without compromising zero-emission objectives. Increasing infrastructure readiness and OEM focus on high-capacity fuel cells accelerate growth, particularly in industrial applications where high-power hydrogen trucks are strategically advantageous.

By Application: Logistics and Transport is the leading application segment, while the Construction segment emerges as the fastest-growing area.

Logistics and transport applications dominate the hydrogen truck market, driven by the urgent need to decarbonize urban delivery, regional freight, and long-haul operations. Fleet operators prioritize hydrogen trucks for zero-emission compliance, operational efficiency, and reduced environmental impact. Government incentives and low-carbon policies further strengthen adoption. High route predictability and centralized refueling infrastructure make this application ideal for hydrogen technology deployment. The segment consistently accounts for the largest market share due to widespread industry adoption.

The construction segment is the fastest-growing application, as hydrogen trucks gain traction in heavy-duty off-road operations and materials transport. Hydrogen fuel cells provide high torque, zero emissions, and longer operational hours compared to batteries, making them suitable for construction sites. Infrastructure projects, including road and urban development, drive demand for high-performance trucks capable of handling rugged terrain and payloads. Technological improvements, coupled with sustainability mandates in construction projects, fuel rapid adoption of hydrogen-powered vehicles in this application segment.

Hydrogen Truck Market Regional Analysis

North America Hydrogen Truck Market Insights:

North America dominated the Hydrogen Truck Market with a 35.59% revenue share in 2025 and is also projected to grow at the fastest CAGR of about 22.50% from 2026–2033 due to strong adoption of clean transportation technologies, heavy investments in hydrogen fueling infrastructure, and supportive government policies promoting zero-emission commercial fleets. The region’s presence of leading automotive OEMs, rising demand for sustainable logistics, and rapid fleet electrification trends continue to accelerate hydrogen truck deployment across long-haul and heavy-duty transport applications.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Hydrogen Truck Market Insights

Asia accounted for a considerable share of the Hydrogen Truck Market in 2025 and continues to show strong growth momentum driven by government initiatives toward carbon-neutral transportation, rapid industrialization, and increasing adoption of fuel-cell trucks for logistics and heavy-duty operations. Major participation from China, Japan, and South Korea, along with expanding hydrogen production capacity and infrastructure development, is accelerating regional market expansion.

Europe Hydrogen Truck Market Insights

Europe demonstrated strong demand in the Hydrogen Truck Market in 2025, supported by stringent emission regulations, the EU’s decarbonization roadmap, and rising adoption of fuel-cell commercial vehicles for long-distance freight. Major automotive manufacturers and logistics providers are investing heavily in hydrogen mobility, while significant funding for hydrogen refueling corridors across key transport routes continues to boost market penetration.

Middle East & Africa and Latin America Hydrogen Truck Market Insights

Middle East & Africa and Latin America (combined) recorded steady progress in the Hydrogen Truck Market in 2025, driven by increasing interest in alternative fuels, infrastructure modernization, and government efforts to diversify energy portfolios. Growing investments in green hydrogen production, adoption of sustainable mobility initiatives, and early pilot projects in commercial and logistics sectors are gradually enhancing market opportunities across both regions.

Hydrogen Truck Market Competitive Landscape:

Hyundai Motor Company:

Hyundai Motor Company, headquartered in South Korea, is a global leader in automotive manufacturing and innovation. The company focuses on developing eco-friendly vehicles, including hydrogen fuel cell trucks, electric vehicles, and hybrid models. Hyundai emphasizes advanced technologies in autonomous driving, connectivity, and smart mobility solutions. With a strong presence in Asia, Europe, and North America, the company continuously expands its global footprint while investing heavily in research and development to provide sustainable and high-performance transportation solutions.

-

2024, Hyundai launched “HTWO Grid”, a global infrastructure and service platform supporting its XCIENT Fuel Cell hydrogen trucks

Daimler Truck AG:

Daimler Truck AG, based in Germany, is one of the world’s leading commercial vehicle manufacturers, producing trucks, buses, and vans under brands like Mercedes-Benz and Freightliner. The company is at the forefront of hydrogen fuel cell and electric truck development, promoting sustainable logistics and reducing carbon emissions. Daimler Truck AG combines innovative engineering, safety technologies, and digital solutions to enhance fleet efficiency. Its global operations span Europe, North America, and Asia, focusing on long-term mobility solutions and market leadership.

-

2025, Daimler Truck introduced “TruckForce”, an AI-powered digital repair platform for its Freightliner, Mercedes-Benz Trucks, and Thomas Built Buses.

Volvo Group:

Volvo Group, headquartered in Sweden, is a multinational company specializing in trucks, buses, construction equipment, and marine and industrial engines. The company is a pioneer in clean transport solutions, including hydrogen fuel cell, electric, and hybrid trucks. Volvo Group emphasizes innovation, safety, and sustainability, offering advanced digital solutions for fleet management and efficiency. With a strong international presence, particularly in Europe and North America, the company continues to invest in research and development to meet global demand for environmentally friendly and high-performance commercial vehicles.

-

2024, Volvo Group launched “Volvo Dynamic Maintenance”, an AI-driven predictive maintenance and repair optimization platform for its Volvo Trucks, Renault Trucks, and Mack Trucks fleets.

Hydrogen Truck Market Key Players

Some of the Hydrogen Truck Market Companies are:

-

Hyundai Motor Company

-

Daimler Truck AG

-

Volvo Group

-

TRATON Group

-

PACCAR

-

Dongfeng Motor Corporation

-

Foton

-

Yutong International Holding Co., Ltd.

-

Nikola Corporation

-

Hyzon Motors

-

Toyota

-

Renault Trucks

-

Iveco

-

MAN Truck & Bus

-

Scania

-

Cummins

-

Bosch

-

Navistar

-

Xiamen King Long International

-

Solaris Bus & Coach

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.25 Billion |

| Market Size by 2033 | USD 14.71 Billion |

| CAGR | CAGR of 20.86% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle (Heavy-duty trucks, Medium-duty trucks, Small-duty trucks) • By Fuel Cell Technology (PEMFC, SOFC) • By Range (Upto 300 miles, 300–500 miles, Above 500 miles) • By Motor Power (Upto 200 kW, 200–400 kW, Above 400 kW) • By Application (Logistics and Transport, Municipal, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Hyundai Motor Company, Daimler Truck AG (Mercedes-Benz / GENH2), Volvo Group, TRATON Group (MAN / Scania / IVECO / others), PACCAR, Dongfeng Motor Corporation, Foton (Beiqi Foton Motor Co., Ltd.), Yutong International Holding Co., Ltd., Nikola Corporation, Hyzon Motors, Toyota (and related Hino / fuel-cell efforts), Renault Trucks, Iveco, MAN Truck & Bus, Scania (within TRATON), Cummins (as engine / fuel-cell partner), Bosch (fuel-cell systems supplier), Navistar, Xiamen King Long International, Solaris Bus & Coach (heavy-duty / commercial vehicles). |